Australian Dollar Falls After Retail Sales Miss Forecasts

November 02 2017 - 10:59PM

RTTF2

The Australian dollar slipped against its key counterparts in

the Asian session on Friday, as the nation's retail sales missed

forecasts in September, triggering hopes that the Reserve Bank of

Australia would keep rate on hold in the coming months.

Data from the Australian Bureau of Statistics showed that

Australia's retail sales remained flat in September, defying

economists' forecast for an increase.

The seasonally adjusted retail trade turnover showed no

variations in September, following a 0.5 percent fall in August.

Meanwhile, it was expected to rise by 0.4 percent.

Survey from the Australian Industry Group showed that

Australia's services sector continued to expand in October, but the

rate of growth eased slightly since September.

The Performance of Service Index, dropped to 51.4 in October

from 52.1 in September. However, any reading above 50 indicates

expansion in the sector.

Asian shares are mixed as traders digested details of the House

Republican tax reform bill as well as the announcement of President

Donald Trump to nominate Federal Reserve Governor Jerome Powell as

the successor to current Fed Chair Janet Yellen.

The currency was higher on Thursday, buoyed by impressive data

on Australia's building approvals and trade surplus in

September.

The aussie declined to a 3-day low of 0.9840 against the loonie,

compared to 0.9879 hit late New York Thursday. If the aussie slides

further, 0.97 is possibly seen as its next support level.

The aussie that ended yesterday's trading at 1.5114 against the

euro fell to a 2-day low of 1.5186. Continuation of the aussie's

downtrend may see it challenging support around the 1.53 mark.

The aussie slipped to 1.1063 against the kiwi, its lowest since

October 19. Further weakness may take the aussie to a support

around the 1.08 area.

The aussie fell to a 2-day low of 87.50 against the Japanese

yen, down from Thursday's closing quote of 87.99. The next possible

support for the aussie-yen pair is seen around the 86.00 level.

The aussie edged down to 0.7676 against the greenback from

Thursday's closing value of 0.7713. On the downside, the aussie may

challenge support around the 0.75 mark.

Looking ahead, U.K. services PMI for October are due in the

European session.

In the New York session, U.S. jobs data and ISM

non-manufacturing index for October and trade report and factory

orders for September, as well as Canada jobs data for October and

trade report for September are set for release.

At 12:15 pm ET, Minneapolis Fed President Neel Kashkari speaks

about monetary policy and the 2018 outlook at the Women in Housing

and Finance luncheon, in Washington DC.

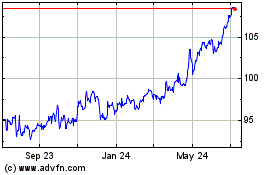

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

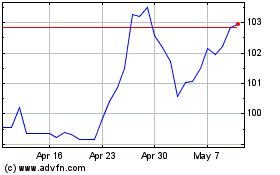

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024