RELX Backs 2018 View After Nine-Month Underlying Revenue Rose 4%

October 25 2018 - 2:40AM

Dow Jones News

By Adria Calatayud

RELX PLC (REL.LN) confirmed Thursday its full-year guidance

after posting a 4% increase in underlying revenue for the first

nine months.

The Anglo-Dutch professional-information and events group said

it continues to anticipate 2018 to be a year of underlying growth

in revenue and in adjusted operating profit, together with growth

in adjusted earnings per share on a constant-currency basis.

The company behind medical journal the Lancet and the London

Book Fair said it invested 943 million pounds ($1.22 billion) in

seven acquisitions in 2018 to date and sold four assets worth GBP28

million.

For the first nine months, underlying revenue grew 2% at RELX's

scientific, technical and medical division--the company's largest

segment--as well as 8% in risk and business analytics, 2% in legal

and 6% in its exhibitions unit.

RELX said that to date, it has completed share buybacks worth

GBP650 million of the previously announced GBP700 million and plans

to deploy the remainder by year end.

The company's simplification of its corporate structure into a

single parent company was completed on Sept. 8, RELX said.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

October 25, 2018 02:25 ET (06:25 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

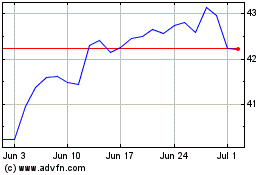

RELX (EU:REN)

Historical Stock Chart

From Mar 2024 to Apr 2024

RELX (EU:REN)

Historical Stock Chart

From Apr 2023 to Apr 2024