- Signing of a strategic partnership with Furui, a leading

Chinese healthcare player and Theraclion’s long-term partner

- Launch of a global financing of up to 15M€

- Appointment of Martin Deterre as CEO

Regulatory News:

THERACLION (ISIN: FR0010120402; Mnemo: ALTHE), an innovative

company developing a scalable robotic platform for non-invasive

ultrasound therapy, announced today the signing of a strategic

agreement with its long-term partner Furui, the launch of a

financing with various investors for a total amount of up to 15M€,

which would allow it to finance the deployment of its strategy over

3 years, and the appointment of its new CEO, Martin Deterre.

Accelerated strategy execution

Theraclion is focusing on the treatment of varicose veins

through 3 strategic axes, with regular deliverables, starting this

year:

- US market clearance by the FDA via the launch in the coming

months of a pivotal multi-center study

- Rapid access to the high-potential Chinese market and the

development of industrial capacities in China, in close partnership

with Furui

- Artificial Intelligence and further advances in technology and

robotics, to shorten and simplify treatments

The new CEO will have the funding to execute this strategy,

which should contribute to rapid value creation for Theraclion, the

world leader in non-invasive focused ultrasound therapy,

approaching 2,000 varicose veins treatments to date.

Strategic partnership with Furui

Furui has been a shareholder of Theraclion SA since 2016 and the

co-shareholder in Theraclion China. Furui will invest through its

subsidiary Furui Paris €7 million, including €6 million in the €11

million capital increase decided by Theraclion's Board of Directors

on May 24th, 2023, and €1 million, through the exercise of

warrants, conditional on the achievement of milestones. Furui

brings its know-how in supporting innovative medical companies in

their international expansion with particular expertise in the

Chinese market. Theraclion and Furui will develop a production

capacity for Echopulse® and SONOVEIN® in China. Theraclion will

license its technologies and trademarks in China to Theraclion

China, for €3 million based on the achievement of milestones.

An immediate capital increase of 11M€, which can be increased

to a maximum of 12.7M€

The funds will be raised through a capital increase, decided by

the Board of Directors at its meeting on May 24th, 2023, by issuing

19,064,124 shares with warrants attached (the "ABSAs") for a

total amount of €11 million. The subscription price per share is

€0.577, i.e. a discount of 20% compared to the weighted average of

the market prices of the last five trading sessions preceding the

issue. This amount may be increased to a maximum of 21,923,742

ABSAs for an amount of €12.7 million. In addition, six new shares

will give the right to subscribe to one new share at a price of

€0.577.

Appointment of a CEO

On May 24th, the Board of Directors appointed Martin Deterre as

CEO of Theraclion, previously Director of Engineering and

Development of Theraclion since 2020. He has successfully led the

development of the new generations of SONOVEIN® and demonstrated

his ability to achieve ambitious goals in a short timeframe with

dynamism and pragmatism. "I am honored and grateful to have been

promoted to lead Theraclion in executing our strategy to commercial

success," concluded Martin Deterre.

ANNEXES

Furui-Theraclion Partnership

The objective of this transaction is to more actively and

effectively introduce Theraclion's advanced high-intensity focused

ultrasound (HIFU) therapy technology and products to the Chinese

market, particularly the non-invasive treatment of varicose veins,

thyroid tumors and breast fibroadenomas. This partnership will

create medical products suitable for the Chinese market with

advanced international medical devices combined with local

industrial manufacturing capabilities and will encourage medical

institutions to create new models of corresponding medical

services. At the same time, the resources provided by Furui will

help Theraclion to better promote its products worldwide.

In the long term, this transaction will expand the company's

business scope, strengthen its competitiveness, and improve its

sustainability and business performance, in line with the company's

development strategy and shareholders' interests.

Terms and conditions of the fundraising

The fundraising will be carried out in two distinct but

concomitant parts:

- a capital increase through the issuance of ABSAs with

cancellation of the preferential subscription right to the benefit

of categories of beneficiaries (investment companies and investment

funds under French or foreign law investing in a sector similar or

complementary to that of the Company as well as strategic partners

of the Company) (in accordance with the 10th resolution of the

Ordinary and Extraordinary General Meeting of June 30th, 2022) (the

"Offering to Categories of Persons"); and

- a capital increase by way of issuance of ABSAs with

cancellation of preferential subscription rights within the

framework of a public offering addressed exclusively to a limited

circle of investors acting on their own behalf and/or to qualified

investors as referred to in article L. 411-2 of the French Monetary

and Financial Code (in accordance with the 9th resolution of the

Ordinary and Extraordinary Shareholders' Meeting of June 30th,

2022) (the "Private Placement").

Each ABSA will have attached to it a warrant to subscribe for

shares (the "BSA") on the basis of one BSA for six shares.

The BSAs will be detached from the shares immediately upon issue.

They will be exercisable until December 31st, 2025.

The issue price of the ABSAs, set by the Board of Directors, is

€0.577 per new share, representing a 20% discount to the weighted

average of the Theraclion share price over the last five trading

days preceding the setting of the issue price, in accordance with

the 9th and 10th resolutions of the Ordinary and Extraordinary

General Meeting of June 30th, 2022. The subscription price of the

ABSAs is identical for the Offering and the Private Placement.

The subscription period for the ABSAs starts on Thursday, May

25th, 2023, from the close of trading, until June 15th, 2023.

Pursuant to Article 1.4 of Regulation (EU) 2017/1129 of the

European Parliament and of the Council of June 14, 2017, the

Fundraising will not give rise to the preparation of a prospectus

subject to the approval of the Autorité des marchés financiers

("AMF").

This press release does not constitute a prospectus under

Regulation (EU) 2017/1129 of the European Parliament and of the

Council of 14 June 2017, as amended, or an offer to the public.

Undertaking to abstain

None.

Commitment to subscribe

Under the terms of the agreement entered into on May 24th, 2023,

Furui has undertaken, subject to certain conditions, to subscribe

via Furui Paris for 10,398,614 ABSAs, i.e. a subscription of €6M to

the Classified Offering.

Subject to the achievement of certain operational performance

indicators, Furui has also committed to exercise the BSAs through

its French subsidiary, representing a potential additional

contribution of €1M.

In addition, upon completion of the capital raising, two

representatives of Furui will be appointed to the Board of

Directors, in accordance with the agreement entered into on May

24th, 2023.

Impact of the issuance of the ABSA on the shareholders'

participation

The impact of the ABSA issue described above on shareholders'

equity interests (calculated on the basis of 29,618,027 shares

making up the share capital and 30,764,005 shares on a fully

diluted basis prior to the ABSA issue) would be as follows:

Shareholder's participation in

%

On a non-diluted basis

On a diluted basis

Before issue of new shares

1,00%

0,96%

In the event of the issue of 19,064,124

new shares

0,61%

0,59%

In the event of the issue of 19,064,124

new shares and 3,177,354 shares on exercise of all the warrants

0,57%

0,56%

Impact of the issuance of the ABSAs on shareholders'

equity

The impact of the issuance of the ABSAs described above on the

share of equity (calculated on the basis of the 29,618,027 shares

making up the share capital and the 30,764,005 shares on a fully

diluted basis before the issuance of the ABSAs) would be as

follows:

Shareholders' equity at

December 31, 2022

On a non-diluted basis

On a diluted basis

Before issue of new shares

0,025€

0,024€

In the event of the issue of 19,064,124

new shares

0,241€

0,236€

In the event of the issue of 19,064,124

new shares and 3,177,354 shares on exercise of all the warrants

0,262€

0,256€

Potential cash inflow from operations (excluding

over-allotment option)

Cash contribution

Including Furui

Royalties from licensing agreement with

Furui

3M€

3M€

Capital increase

11M€

6M€

Additional funds raised in the event of

exercise of the warrants attached to the ABSAs (assuming 100%

greenshoe option exercised)

1.8 M€

1M€

Total

15,8 M€

(including 9M€ from Furui)

About Martin Deterre

Martin Deterre received an Engineer degree from the Ecole

Polytechnique, a Master of Science from M.I.T. and a Ph.D. in

Physics from the University of Paris Sud. His professional career

in the medical device industry, and more particularly in disruptive

technology start-ups, has led him to work on various technical,

regulatory and operational issues, from pacemakers (Sorin Group) to

retinal implants (Pixium Vision). His technical knowledge of

Theraclion's products, strong customer orientation and proven

managerial skills are the basis of his legitimacy to lead the

company's teams today.

Risk Factors

Detailed information about Theraclion, including its business,

results and risk factors, is presented in the annual financial

report for the year ended December 31st, 2022. It is available,

together with other regulated information and press releases, on

the company's website www.theraclion.com.

The occurrence of some or all of these risks could have an

adverse effect on the Company's business, financial condition,

results, development or prospects. The risk factors presented in

the annual financial report remain unchanged as of the date of this

press release.

About Theraclion

Theraclion is a French MedTech company committed to developing a

non-invasive alternative to surgery through the innovative use of

focused ultrasound.

High Intensity Focused Ultrasound (HIFU) does not require

incisions nor an operating room, leaves no scars, and allows

patients an immediate return to their daily activities.

Echotherapy, as the HIFU treatment method is called, concentrates

therapeutic ultrasounds to an internal focal point from outside of

the body.

Theraclion has developed two CE-marked robotic platforms

delivering echotherapy: SONOVEIN® for varicose veins and ECHOPULSE®

for breast fibroadenoma and thyroid nodules. Each representing the

potential to replace millions of surgical procedures every

year.

Based in Malakoff (Paris), the Theraclion team is made up of 30

people, mainly in technological and clinical development.

For more information, please visit www.theraclion.com or

www.echotherapy.com and follow the account on LinkedIn.

About Furui

Furui is a Chinese medical group specializing in the manufacture

and marketing of drugs, as well as the R&D and distribution of

medical devices, mainly in pediatric and liver indications. Furui

has extensive resources in the field of medical devices and has

achieved significant commercial success, contributing to its

reputation in China and France. The company has been listed on the

Shenzhen Stock Exchange since 2010.

Theraclion is listed on Euronext Growth Paris Eligible for the

PEA-PME scheme Mnemonic: ALTHE - ISIN code: FR0010120402 LEI:

9695007X7HA7A1GCYD29

Disclaimer

This press release, and the information it contains, does not

constitute an offer to sell or subscribe, or the solicitation of an

order to buy or subscribe, shares in Theraclion in any country.

This press release constitutes a promotional communication and

not a prospectus within the meaning of Regulation (EU) n°2017/1129

of the European Parliament and of the Council of June 14, 2017 (the

"Prospectus Regulation").

With respect to Member States of the European Economic Area

other than France (the "Member States"), no action has been

taken or will be taken to permit a public offering of the

securities making it necessary to publish a prospectus in any of

these Member States. Consequently, the securities cannot and will

not be offered in any Member State (other than France), except in

accordance with the exemptions provided for in article 1(4) of the

Prospectus Regulation, or in other cases not requiring the

publication by Theraclion of a prospectus under article 3 of the

Prospectus Regulation and/or the regulations applicable in those

Member States.

This press release does not constitute an offer to sell

securities or the solicitation of an offer to buy or subscribe for

securities in the United States of America. The shares, or any

other securities, of Theraclion may not be offered or sold in the

United States of America except pursuant to registration under the

U.S. Securities Act of 1933, as amended (the "Securities

Act"), or pursuant to an exemption from the registration

requirements, except that the shares of Theraclion have not been

and will not be registered under the Securities Act. Theraclion

does not intend to register the offering in whole or in part in the

United States of America or to conduct a public offering in the

United States of America.

With respect to the United Kingdom, the announcement is directed

only at persons located (x) outside the United Kingdom or (y) in

the United Kingdom, who are "qualified investors" (as that term is

defined in the Prospectus Regulations which form part of domestic

law pursuant to the European Union (Withdrawal) Act 2018) and who

(i) are investment professionals within the meaning of Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005, as amended (the "Financial Promotion

Order"), (ii) fall within Article 49(2) (a) to (d) ("high net

worth companies, unincorporated associations etc. "of the Financial

Promotion Order, or (iii) are persons to whom an invitation or

inducement to take part in investment activities (within the

meaning of section 21 of the Financial Services and Markets Act

2000) may lawfully be communicated or passed on (the persons

referred to in paragraphs (y)(i), (y)(ii) and (y)(iii) together

being referred to as "Relevant Persons"). This press release is

intended for Authorized Persons only and may not be used by anyone

other than an Authorized Person.

This press release contains information about Theraclion's

objectives and forward-looking statements. This information is not

historical data and should not be construed as a guarantee that the

facts and data stated will occur. This information is based on

data, assumptions and estimates considered reasonable by

Theraclion. Theraclion operates in a competitive and fast-changing

environment. It is therefore not in a position to anticipate all

the risks, uncertainties or other factors that might affect its

business, their potential impact on its business, or the extent to

which the materialization of a risk or combination of risks could

have results materially different from those mentioned in any

forward-looking information. This information is given only as of

the date of this press release. Theraclion undertakes no obligation

to publicly update this information or the assumptions on which it

is based, except as may be required by law or regulation.

The distribution of this press release may be subject to

specific regulations in certain countries. Consequently, persons

physically present in such countries and in which the press release

is circulated, published or distributed must inform themselves of

and comply with such laws and regulations.

The information contained in this press release does not

constitute an offer of securities in the United States, Australia,

Canada, Japan or any other country. This press release may not be

published, transmitted or distributed, directly or indirectly, in

the United States of America, Australia, Canada or Japan.

This document may not be distributed,

directly or indirectly, in the United States, Canada, Australia or

Japan.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230525005805/en/

Theraclion Martin Deterre CEO

martin.deterre@theraclion.com

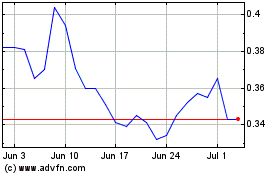

Theraclion (EU:ALTHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Theraclion (EU:ALTHE)

Historical Stock Chart

From Apr 2023 to Apr 2024