Theradiag Announces Its Results for the First Half of 2022: Breaking-Even and Confirming Its Ability to Be Structurally Profitable From Early 2023

September 19 2022 - 1:30AM

Business Wire

Regulatory News:

THERADIAG (ISIN: FR0004197747, Ticker: ALTER), a company

specializing in in vitro diagnostics and Theranostics, today

announces its half-year results to June 30, 2022, as approved by

the Board of Directors on September 15, 2022.

2022 half-year results

In thousands of euros

H1 2022

H1 2021

% change

Revenue

6,264

5,482

+14%

of which: Theranostics

3,024

2,766

+9 %

of which: IVD

3,240

2,716

+19 %

Operating profit/(loss)

(129)

(178)

+28 %

Recurring profit/(loss) before tax

(173)

(206)

+16 %

Net profit/(loss) before non-recurring

items

(56)

(23)

-138%

Non-recurring items

0

(68)

NA

Net profit/(loss)

(56)

(92)

+38%

Bertrand de Castelnau, Theradiag’s CEO, commented: “In

the first half of 2022, Theradiag was able to deploy solid

commercial momentum within a healthier cost structure. The

financial indicators on our traditional scope of activity thus

substantially improved over the semester. Indeed, we increased our

net result by 38% despite the fact that this figure had benefited

from an exceptional contribution of €150 thousand from Covid

activity in the first half of 2021. Over the period, we also

continued our investments in all strategic domains to drive future

profitable growth. Buoyed by this very positive trend, we will

continue to apply our strategic plan with a view to achieving a

structurally positive margin from 2023.”

“Thanks to the concerted efforts of all its teams and to the

strategic reorientation initiated in recent semesters, Theradiag is

continuing its progress towards profitability, which should be

achieved by early 2023 at the latest. Furthermore, Theradiag has

amazing development potential, given the size of the biotherapy

monitoring market and its regular growth. Theradiag will thus

continue to deploy all of its strategic tools to ensure its

successes on this fast-growing market,” added Pierre Morgon,

Chairman of Theradiag’s Board of Directors.

Solid growth in activity thanks to the recurring dynamism of

Theranostics and to market opportunities in In Vitro

Diagnostics

Over the six months to June 30, 2022, Theradiag generated

revenue of €6.3 million, compared with €5.5 million in the same

period of 2021, giving growth of 14.3%.

Theranostics activity recorded another semester of solid

growth, with revenue increasing by 9.3% to more than €3.0 million

at June 30, 2022. This activity keeps on growing thanks to dynamic

sales of the automated i-Track10 driven by an expanding range of

i-Tracker® tests adapted to this analyzer that thus allows the

development of individualized therapeutic monitoring of even more

biotherapies.

IVD (In Vitro Diagnostics) activity recorded strong sales

growth of 19.3% to over €3.2 million at June 30, 2022. This

performance is the result of non-recurring commercial

opportunities. Indeed, during the first half of this year,

Theradiag recorded some opportunistic sales of diagnostic

instruments, notably to the veterinary sector, and logged a

temporary boost in sales of genetic tests, prior to stopping this

distribution line at the end of 2023.

Financial indicators closing in on profitability and

maintaining of investments to drive future growth

Over the first half of 2022, Theradiag continued its substantial

progress towards profitability. Indeed, the operating loss shrank

by 28% compared to the same period of 2021, despite a high basis

for comparison due to Covid activity having contributed €150

thousand in the first half of 2021. As previously reported,

Theradiag decided to end its antigen activities in the second

semester of 2021. As well as significantly improving its

profitability on its traditional markets, Theradiag has maintained

its strategic investments in several fields that will drive the

Company’s future growth: Marketing and Market access, Research

& Development and Quality (compliance with the European Union’s

directive on in vitro diagnostic medical devices (IVDR)).

Furthermore, without impacting the strategic penetration of

markets, in particular key markets, Theradiag’s Management will

continue to optimize its commercial organization in its strategic

countries to accelerate the return to strong profitability in the

coming months.

The net loss before non-recurring items is slightly down this

semester with a decrease of €33 thousand compared with the same

period of 2021 due to lower Research Tax Credit.

The overall net result improved by 38% to -€56 thousand at June

30, 2022 versus -€92 thousand at June 30, 2021. It is now close to

breakeven and represents -0.9% of revenue.

Cash position and Financial structure

Theradiag had a net cash position of €6.0 million on June 30,

2022, versus €7.1 million on December 31, 2021. This level is in

line with the Company’s roadmap outlined at the time of the rights

issue carried out in October 2021.

Reminder of the main H1 2022 highlights

- January 2022: Signing of a distribution agreement with BIOSYNEX

regarding their AMPLIQUICK SARS-CoV-2 PCR test

- May 2022: Launch of two new i-Tracker® kits: i-Tracker®

Certolizumab and i-Tracker® Anti-Certolizumab

- May 2022: Launch of ez-Track, a diagnostic Point-of-Care

Testing solution

- June 2022: Partnership with Quotient Limited to advance

autoimmune disease diagnostics

About Theradiag

Theradiag is the market leader in biotherapy monitoring.

Capitalizing on its expertise in the diagnostics market, the

Company has been developing, manufacturing and marketing innovative

in vitro diagnostic (IVD) tests for over 30 years.

Theradiag pioneered “theranostics” testing (combining therapy

with diagnosis), which measures the efficacy of biotherapy in the

treatment of chronic inflammatory diseases. Going beyond mere

diagnosis, Theranostics aims to help clinicians set up “customized

treatment” for each patient. This method favors the

individualization of treatment, evaluation of its efficacy and the

prevention of drug resistance. In response to this challenge,

Theradiag develops and markets the CE-marked TRACKER® range, a

comprehensive solution of inestimable medical value.

The Company is based in Marne-la-Vallée, near Paris, has

operations in over 70 countries and employs over 60 people. In

2021, the Company posted revenue of €11.1 million. The Theradiag

share is listed on Euronext Growth Paris (ISIN: FR0004197747) and

is eligible for the French PEA-PME personal equity plan. For more

information about Theradiag, please visit our website:

https://www.theradiag.com/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220918005021/en/

Theradiag Bertrand de Castelnau CEO/Managing

Director +33 (0)1 64 62 10 12 contact@theradiag.com

NewCap Financial Communications & Investor Relations

Pierre Laurent / Quentin Massé +33 (0)1 44 71 94 94

theradiag@newcap.eu

NewCap Media Relations Arthur Rouillé +33 (0)1 44

71 94 98 nmerigeau@newcap.fr

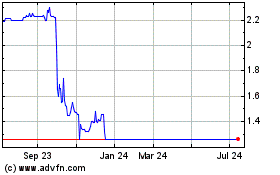

Theradiag (EU:ALTER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Theradiag (EU:ALTER)

Historical Stock Chart

From Apr 2023 to Apr 2024