Airbus Focuses on Cash in Crisis, But Positions to Out Distance Boeing

April 29 2020 - 7:11AM

Dow Jones News

By Benjamin Katz

Airbus SE said it expects to come out of the coronavirus

pandemic in a stronger competitive position than its rival Boeing

Co., as it balances navigating a sharp drop in jetliner demand with

positioning itself to go on the offensive once the crisis

eases.

Airbus, which eclipsed Boeing last year as the world's biggest

plane maker by deliveries, said its focus now is cash preservation,

as airline customers defer and cancel orders. The company's ability

to deliver planes is also complicated by global travel restrictions

enacted to curb the pandemic. Airlines typically pay most of the

purchase price for new jets when they are delivered.

Airbus said it burned through EUR4.4 billion ($4.78 billion) in

free cash flow in the first quarter. That excludes a separate,

EUR3.6 billion fine Airbus paid in the first quarter after it

settled U.S., French and British allegations of corruption.

Airbus posted a net loss of EUR481 million in the period,

compared with net income of EUR40 million in the year-ago quarter.

Revenue fell 15% to EUR10.6 billion

Despite the large cash drain, Airbus slightly beat analysts'

expectations. Shares were up about 1% in midday European

trading.

Airbus' cash situation will get worse in the current quarter,

Chief Executive Guillaume Faury said. Deliveries are likely to only

start recovering after the summer. Airbus said it would reassess

its production rates in June after already slashing output by about

a third. The company said any further reductions would be to a

lesser extent than those already undertaken.

Airbus is also using the crisis to "right size" the business,

Mr. Faury said. In the short-term, that includes plans to scrap all

nonessential activities and furlough more staff in Germany and

France. It is also undergoing a wider-ranging review of its fixed

costs to position itself for a post-pandemic era.

Airbus said it likely won't require a bail out from European

governments and pointed to a number of factors that could boost it

against Boeing when airlines begin to see a recovery.

"We think our capacity to compete and be strong on the long term

is intact, if not improved, as the impact of Covid-19 on our main

competitor, on top of the previous difficult situations they had to

manage is probably making us stronger," Mr. Faury said. "I want to

remain very prudent on this."

First among Airbus' potential advantages is its A320 family of

jets -- a single-aisle rival to the Boeing 737 MAX. The two jets

once competed fiercely for orders from airlines, which prized their

fuel efficiency and flexible range.

Boeing grounded the 737 MAX last year after two fatal accidents

blamed on problems with its flight control system. The

recertification of the aircraft isn't expected until at least late

summer, The Wall Street Journal previously reported.

Mr. Faury said he expects sales of narrow-body aircraft to

rebound first, with domestic and short-haul routes recovering

before longer connections. Airline executives are also leaning

toward smaller planes, which they can more easily fill in a time of

depressed demand, he said.

Airbus is also now able to offer an even smaller plane, the

A220, after it bought out the program from Bombardier Inc. in

February, just before the coronavirus outbreak hammered Europe and

started shutting down travel across the Western world.

Airbus' original joint venture with Bombardier set in motion a

similar proposed tie up between Boeing and Brazilian jet maker

Embraer SA. Embraer produces a rival to the A220. But Boeing walked

away from completing that deal over the weekend.

Mr. Faury said Airbus has established a task force to monitor

its supply chain to track companies that may fall into bankruptcy.

He added that the main risks are for those manufacturers that

"entered the crisis in a weak position," particularly those already

suffering from the MAX grounding.

"Suppliers that were already impacted by the 737 MAX grounding

and stop of production are obviously high on our screen," Mr. Faury

said.

Write to Benjamin Katz at ben.katz@wsj.com

(END) Dow Jones Newswires

April 29, 2020 06:56 ET (10:56 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

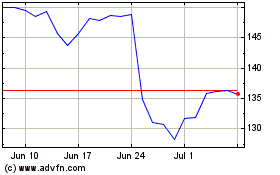

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

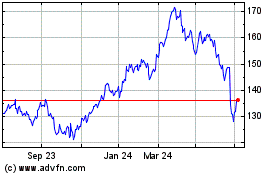

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024