Air France-KLM to Expand Low-Cost Carrier Businesses

August 20 2015 - 1:00PM

Dow Jones News

AMSTERDAM—Air France-KLM SA is set to spur its European foothold

in the low cost market by growing its existing French and Dutch

budget carriers to counter rising low cost competition in Europe,

after a costly pilot strike last year derailed plans to launch a

European low cost airline.

To enable European growth, a new round of investments to buy up

to 20 aircraft is expected to be announced in the coming weeks,

coming on top of a €1 billion ($1.11 billion) investment announced

year. That has largely been reserved for 17 aircraft, Air

France-KLM's low-cost airline Transavia's chief executive, Matthijs

ten Brink, said Thursday in an interview with The Wall Street

Journal.

Europe's largest airline by traffic said it strongly feels the

urge to quickly move forward with its expansion in the low-cost

segment by opening operational bases outside France and the

Netherlands, as stronger European competitors continue to

expand.

The Franco-Dutch airline group currently has two separate budget

carriers, Transavia France and Transavia Netherlands, and initially

had plans to launch a Transavia Europe brand. Last year, those

plans were abandoned after a pilots' strike that cost the company

€425 million.

A year later, the need for the creation of a new airline, which

should have enabled a simplified structure and lower cost base, has

evaporated.

"Now we have been given an additional year to fix things

internally, there is no need to create a new airline," Mr. Ten

Brink said.

"Basically, the argument to launch a new airline was to not

suffer from the legacy we carried in the Netherlands and partly in

France. We weren't ready to take on the competition battle in

Europa," he added.

Meanwhile, Transavia Netherlands in July reached a deal on new

labor agreements with its pilots, meant to push down costs, and has

booked significant progress with streamlining and simplifying the

overall Transavia brand, and enhancing the IT infrastructure,

investing "tens of millions," Mr. Ten Brink said.

Air France-KLM Chief Executive Alexandre de Juniac said in

mid-July the airline aims to open its first operational base

outside its home markets in the first half of 2016. Without

providing further details while he emphasized that the pilots'

unions in France had expressed willingness to reopen

discussions.

A deal is likely to be signed in the coming weeks by Transavia

executives, the chief executive of Transavia Netherlands said,

adding that deals with French trade unions still need to be reached

first.

The expansion doesn't come without risk for the Transavia

airlines, as both are loss making and are expected to return to

profitability by 2017. Europe's largest budget carriers, easyJet

PLC and Ryanair Holdings PLC, currently do manage to post a profit

out of their low-cost airline businesses.

"The growth we add must contribute to our profitability target,"

Mr. Ten Brink said. The operational base expansion requires a fleet

expansion. Earlier this year the company announced the purchase of

17 Boeing 737-800 airplanes meant for growth within its home

markets. New aircraft for bases in Europe could be bought from

Boeing Co., but could also come from "befriended airlines," Mr. Ten

Brink added.

After the airline moved away from creating a European low-cost

unit, it has rapidly increased its French budget unit. Because of

this fast expanding growth and intensive competition in France,

revenue has come under pressure, Mr. Ten Brink said.

Air France-KLM faces fierce competition from low-cost carriers,

which are expanding rapidly across Europe. Boosting its own

low-cost activities is one of the measures it is taking to address

competition within Europe. A strong European network could

furthermore stimulate traffic for Air France-KLM's long-haul

flights, addressing competition from carriers from Gulf states on

intercontinental flights.

The Franco-Dutch airline is in the midst of an overhaul. It is

making efforts to trim costs as its cost base is higher than those

of other European airlines. Last July, Air France-KLM recorded a

second-quarter loss of €79 million ($86.7 million), larger than the

€11 million loss it posted last year in the same period. Revenue

grew 3% to €6.64 billion from €6.45 billion in the second quarter

of last year.

Write to Ellen Proper at Ellen.Proper@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 20, 2015 12:45 ET (16:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

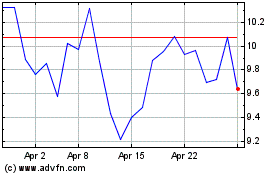

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024