Uniswap Depreciates, Vital Levels To Keep An Eye On

April 19 2023 - 7:00PM

NEWSBTC

The past few days saw a recovery in the Uniswap price, but it

appears that the bullish trend has reached exhaustion. UNI dropped

by 6% in the past 24 hours, causing its price to fall below its

descending line. Although Uniswap gained 0.7% on the weekly chart,

most of its gains were wiped out due to the recent drop in price.

Currently, the technical outlook for Uniswap indicates that the

bears are gaining strength, with demand for the altcoin dipping as

buyers lose confidence and accumulation decreases. Related Reading:

Coinbase Turns To Europe For Growth Amid Clampdown By US Regulators

For buyers to re-enter the market, UNI must surpass its immediate

resistance mark, and buyer strength must make a comeback. However,

if Bitcoin fails to remain above the $30,000 mark, it is likely

that other altcoins like UNI will also experience a dip. Even if

BTC surges again, UNI’s recovery may not be sustainable in the long

run. In addition, UNI’s trading volume has declined, suggesting an

increase in short-term selling on the one-day chart. Uniswap Price

Analysis: One-Day Chart At the time of writing, UNI was priced at

$5.95 with a key resistance level of $6. Breaking through this

resistance could potentially push UNI to reach $6.30, thereby

reversing the bearish thesis. Conversely, if UNI loses its current

price level, it may find support at $5.70. However, if it falls

below this level, it could drop to $5.30. The recent trading

session saw an increase in the number of sellers, which was

reflected by the red volume bars on the chart. Technical Analysis

Buyers are leaving the market owing to decreased demand. This has

caused Relative Strength Index (RSI) to dip below the half-line,

indicating that sellers currently outnumber buyers. A further drop

in price could lead to a complete return of bearish sentiment as

the price falls into a supply zone. Additionally, UNI’s price has

fallen below the 20-Simple Moving Average (SMA) line, indicating

that sellers are currently driving the price momentum in the

market. However, if buyers were to step in, UNI could potentially

rise above the 20-SMA line. The bears have taken over, as evidenced

by other technical indicators. Despite this, the Moving Average

Convergence Divergence (MACD) indicator displayed green histograms.

These are associated with buy signals. Related Reading: These Top 5

Cryptos Are Thriving Despite A Slippery Market However, the buy

signal’s strength has decreased. It indicated mounting bearish

pressure. Meanwhile, the Bollinger Bands, which measure price

volatility and fluctuation, have tightened, suggesting that UNI

could experience range-bound movement in the upcoming trading

sessions. Moving forward the broader market strength will be

crucial for the price of the altcoin. Featured Image From UnSplash,

Charts From TradingView.com

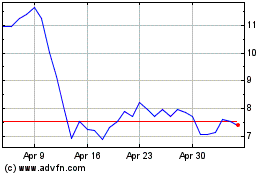

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

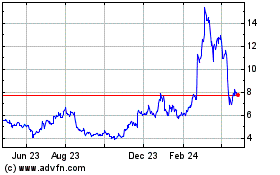

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024