Uniswap Price Consolidates At $7, Chance Of Moving Past Resistance Remain Bleak

August 21 2022 - 12:00AM

NEWSBTC

Uniswap price displayed almost no movement over the last 24 hours

as the coin registered 0.8% downward movement on its chart. UNI was

hovering around the $7 price level and was unable to break past its

closest price ceiling. If the coin does not manage to move past the

resistance level then it could lose its support line. Technical

outlook for Uniswap price indicated that could it register further

drop on the chart. Move to the above resistance level will be

difficult as buyers have exited the market. Increased selling

pressure can push Uniswap price to the next support level. Bitcoin

price also fell considerably over the last 24 hours. The coin fell

to $21,000 and the altcoins moved in the same direction. Broader

market weakness have made Uniswap price remain at the current price

level. The global cryptocurrency market cap today is at $1.07

Trillion, with a 1.0% negative change in the last 24 hours.

Uniswap Price Analysis: Four Hour Chart UNI was trading for $7.01

at the time of writing. The overhead resistance for the coin stood

at $7.57. Uniswap price has been unable to move past the price

ceiling which is why the coin was met with selling pressure. A fall

from the current price level will push Uniswap price to $6.90

immediately, if the coin cannot remain steady over the

aforementioned level then the next price level stood at $5.99.

Amount of Uniswap traded in the last session fell which meant that

the selling pressure was high in the market. Technical Analysis UNI

was moving laterally and this has caused selling pressure to mount

on the four hour chart. It was also an indication that an upcoming

fall in chart could be expected. The Relative Strength Index was in

the oversold region however, over the last 24 hours the coin noted

an uptick. Despite the uptick sellers were considerably higher than

buyers on the four hour chart. Uniswap price was below the 20-SMA

line which indicated that sellers were driving the price momentum

in the market. Related Reading: Investor Sentiment Falls As Crypto

Market Sheds $100 Billion UNI’s laterally trading had pushed price

near to its immediate support level. The influx of sellers made

technical indicator point towards a sell signal however over the

last 24 hours the coin started to capture a buy signal. The Moving

Average Convergence Divergence depicts the price momentum and

reversal in the same. MACD underwent a bullish crossover with green

histograms on the half-line which meant that there was buy signal

for the coin. Bollinger Bands help understand the price volatility

and chance of price fluctuation. Bands were wide open and parallel

which suggested that price might witness a move up or down over the

upcoming trading sessions. Related Reading: Tether Asset Reserves

Figures Record Significant Plunge Compared To 2021 Featured image

from Katoch Tubes, chart from TradingView.com

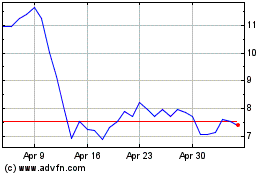

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

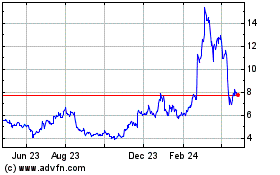

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024