BNY Mellon Embraces Long-Term Digital Asset Initiatives Across All Lines of Business

May 16 2023 - 9:30AM

NEWSBTC

In a dynamic move towards digital transformation, BNY Mellon, one

of the oldest banks in the United States, is pushing forward with

its initiatives focused on distributed ledger technology,

tokenization, and digital cash. Roman Regelman, the CEO of

securities services and digital, revealed in a recent interview

that the bank has been prioritizing digital assets for the past two

years in response to increasing client demand. This latest

disclosure comes amid the US banking crisis and United States

regulators’ continuous crackdown on the crypto industry, a sector

of the global digital asset market. Notably, yesterday, the US

Securities Exchange and Commission (SEC) responded to Coinbase’s

complaint saying crypto rulemaking may take years and that it is

“in no rush.” BNY Mellon Embraces Digital Asset Including Crypto?

While BNY Mellon did not explicitly mention cryptocurrencies as

part of its digital asset focus, the American Banker reported on

the bank’s prudent motion into the crypto-verse. CEO Robin Vince,

during the bank’s first-quarter earnings call, highlighted the

bank’s meticulous and methodical approach, characterizing their

progress as being “exceptionally slow.” Related Reading: US Banking

Crisis Worsens With Half Of America’s Banks On the Verge Of Failure

To demonstrate its commitment to digital assets, BNY Mellon is

actively pursuing three key initiatives. This includes actively

expanding its services to include custody and clearing solutions

for digital assets, with the aim of diversifying its offerings and

accommodating a wider range of asset classes. Regelman revealed the

bank’s vision for digital assets going forward, saying that

“Everything that we do, we want to do for digital assets.” BNY

Mellon is also placing significant emphasis on the adoption of

blockchain technology and other innovative advancements to

modernize its infrastructure. This decision is aimed at improving

operational efficiency, reducing costs, and enabling real-time

capabilities across the bank’s systems. Another initiative the

240-year-old bank is planning to pursue is actively exploring the

concept of tokenization as a strategy to democratize investment

opportunities. By embracing tokenization, the bank seeks to unlock

new avenues for investors and enable broader access to alternative

asset classes, fostering a more inclusive investment ecosystem.

Leading the Digital Transformation in Financial Services By

embracing long-term digital asset initiatives across all lines of

business, BNY Mellon appears to be positioning itself as a leader

in the financial industry’s digital transformation. As the demand

for digital assets such as cryptocurrencies and innovative

technologies continues to rise, the bank’s strategic focus on

distributed ledger technology, tokenization, and digital cash

highlights its commitment to meeting the evolving needs of its

clients and staying at the forefront of financial innovation.

Related Reading: Crypto Firms Should Ditch Banks To De-risk From

Volatile Systems, Says Cardano Founder It is worth noting that BNY

Mellon’s gradual approach to the crypto realm reflects the cautious

stance adopted by other traditional financial institutions.

Recently, Investment bank JPMorgan announced that it will launch

trial applications on blockchain technology to offer dollar-based

settlement services. Meanwhile, following the news, BNY Mellon’s

stock price hasn’t made any significant movement, however, it has

recorded a few gains in the past day up by 1.3%. BNY Mellon

currently trades at $40.70 at the time of writing. Featured image

from Unsplash, chart from TradingView.com

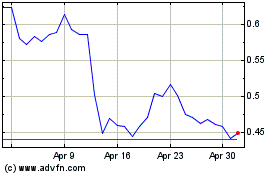

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

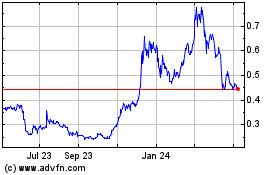

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024