UPDATE: EDF Requests Extraordinary Edison Board Meeting- Sources

April 11 2012 - 8:35AM

Dow Jones News

French power group Electricite de France SA (EDF.FR) has

requested an extraordinary meeting of Edison SpA's (EDN.MI) board

for Monday, to discuss the Italian utility's financing needs and a

potential capital increase, people familiar with the situation

said.

The meeting has been set up at the request of EDF's

representative within Edison's board, one of the people said,

noting that the discussion was to focus on Edison's finances. Board

members could discuss a potential plan to increase the group's

capital.

The Milan-based company had a net debt of EUR3.88 billion at the

end of 2011, slightly higher than a year earlier. Wednesday,

Edison's market capitalization was around EUR4.46 billion.

The French group and other shareholders of Edison are currently

in talks to salvage an agreed plan to reorganize Edison's

shareholding and increase EDF's stake to more than 80%, after

Italy's market regulator struck a blow to the agreement.

EDF is seeking control of Edison--and its natural-gas assets and

infrastructure--as part of its expansion strategy in Europe and in

the gas segment, after years of tension with the Italian

municipalities that hold half of the utility's controlling

shareholder.

A preliminary deal, announced in December, would see EDF

increase its stake in Edison from 50% to 80.7% at a cost of around

EUR700 million, and would grant Delmi, a company controlled by

Italian utility A2A SpA (A2A.MI), 70% of Edipower SpA, which owns

nine power plants in Italy. Edison owns 50% of Edipower.

Last week, EDF said it is seeking alternative ways to "secure"

the future of Edison after the Italian regulator, known as Consob,

said the EUR0.84-a-share price offered for a planned bid for

additional shares in Edison was too low.

EDF made confirmation by Consob of the EUR0.84-a-share price an

undisputable condition for the deal to be sealed.

"This condition hasn't been satisfied by Consob's

communication," EDF said last week, adding it will now look at

steps to be taken "without further delay to secure Edison's

future."

Even though analysts initially believed EDF could increase the

price, some of them have turned more sceptical and believe a

capital increase could be the solution for the French group, which

has sought to increase its control over Edison for more than two

years now.

"EDF maintains its strict position of a maximum price of EUR0.84

per Edison share," Natixis analyst Philippe Ourpatian said, adding

EDF's statement last week on the matter was "very clear." He rates

EDF at neutral.

A capital increase would allow EDF to increase its shareholding

position as other shareholders such as A2A SpA (A2A.MI) and Iren

SpA (IRE.MI) through Delmi and Carlo Tassara might not have the

means to inject additional cash into Edison, Ourpatian noted,

adding that this would also lower Edison's ultimate valuation.

Credit Suisse analyst Michel Debs noted that "EDF now says it is

considering its options and how to best ensure Edison's future,"

and recalled that "a rights issue has been suggested by EDF last

winter as a backup plan to its takeover of Edison."

The situation is "a test of EDF's capital discipline," Debs

said. "While Edison has a clear strategic value to EDF as it plays

into its long-term strategy of diversifying away from nuclear and

building up a gas platform, any cash paid for minorities would have

to be backed by clear value-creation targets and a well-defined

strategy."

Macquarie's analysts said they believe there is a good chance

the capital increase previously mentioned by EDF could be back on

the agenda.

"Given that Edison is in a very tough financial situation,

having been downgraded to junk by two rating agencies, it is likely

the waiting game will not last too long and shareholders would need

to act soon," the Macquarie analysts said.

-By Geraldine Amiel and Liam Moloney, Dow Jones Newswires; +33 1

40171767; geraldine.amiel@dowjones.com,

liam.moloney@dowjones.com;

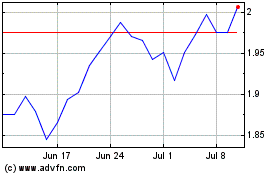

Iren (BIT:IRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iren (BIT:IRE)

Historical Stock Chart

From Apr 2023 to Apr 2024