Geox Profit Falls 19%; Costs, Currency Pressures Endure

May 12 2011 - 12:38PM

Dow Jones News

Italian shoemaker Geox SpA (GEO.MI) said Thursday its first-

quarter net profit fell a better-than-expected 18.9% to EUR43.4

million as its margins were hit by rising raw material and labor

costs and currency fluctuations, factors that will continue to pose

challenges in 2011.

The company posted a 3.7% rise in revenue to EUR345.4 million

and said fall/winter 2011 orders are up 8% compared with

fall/winter 2010 orders.

MAIN FACTS:

-Ebitda fell to EUR79.2 million compared to EUR93.6 million in

the first quarter of 2010.

-Ebit fell to EUR68.9 million from EUR83.7 million.

-Forex, raw material prices, labor costs in supplier countries

will continue to put pressure on margins in the second half of

2011.

-Earnings per share fell to EUR0.17 from EUR0.21.

-By Sofia Celeste, Dow Jones Newswires, +39 06 69766923;

sofia.celeste@dowjones.com

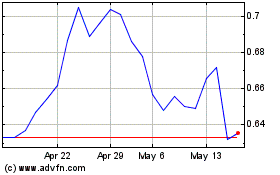

Geox (BIT:GEO)

Historical Stock Chart

From Apr 2024 to May 2024

Geox (BIT:GEO)

Historical Stock Chart

From May 2023 to May 2024