UPDATE: Geox Maintains Full-Year Targets As 1st Half Profit Falls 33%

July 29 2010 - 12:11PM

Dow Jones News

ROME (DOW JONES)--Italian shoemaker Geox SpA (GEO.MI) Thursday

confirmed its full-year guidance after reporting a

lower-than-expected 33% drop in first-half net profit, adding it is

confident markets will recover.

The company's founder and Chairman Mario Moretti Polegato cited

a 2% yearly rise in orders for the Autumn/Winter collection in the

wholesale and franchising channels, as well as improved sales in

the second quarter as reasons to be positive about the full-year

result.

"Net sales in the second quarter, which are 4% up on the same

period of 2009, are reflecting an encouraging performance in our

shops which in May and June show comparable growth of 3%," Polegato

said in a statement.

"We still expect revenue to drop between 6% and 8% in 2010 and

Ebitda [earnings before interest, taxes, depreciation and

amortization] to fall between 4% and 5%," Corporate Managing

Director Massimo Stefanello told Dow Jones Newswires in an

interview.

He said retail sales accounted for the 60% of the company's

revenue in the second quarter compared with an average 20% in

previous quarters.

However, sales in its core markets by revenue--Italy and

Europe--fell 5% and 15% respectively in the second quarter, while

sales in the U.S. fell almost 9%.

Stefanello said newspaper reports suggested "we shouldn't be too

cheerful about consumption in Europe in the next 12 months," adding

the company had backtracked in the US market and had paid a high

cost for the mistake of rapid expansion.

Geox, which owns more than 1000 shops worldwide, openeded 61

stores in the first half of 2010, and closed 37 non-performing

stores.

While sales of shoes, which total around 90% of revenue, fell

12%, clothing sales rose 8% on the year.

"Our president always says that he would like to see the 50% of

total revenues coming from clothes," Stefanello said.

Geox's first-half net profit fell to EUR37.9 million from

EUR56.6 million a year earlier.

Best known for its "breathable" shoes, the shoemaker said

first-half earnings before interest and taxes, or EBIT, fell to

EUR59.0 million from EUR96.5 million in the first half of 2009.

Revenue for the first half fell 10% to EUR435.5 million.

Geox's shares rose up to EUR4.31 after the release, as the drop

was less than analysts had expected.

Analysts at Equita Sim had predicted revenue of EUR432 million

and net profit of EUR37 million.

-By Chiara Vasarri, Dow Jones Newswires; +39 06 69766923;

chiara.vasarri@dowjones.com

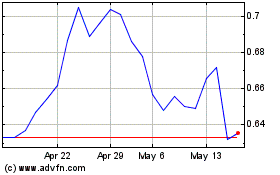

Geox (BIT:GEO)

Historical Stock Chart

From Apr 2024 to May 2024

Geox (BIT:GEO)

Historical Stock Chart

From May 2023 to May 2024