WSJ: Morgan Stanley Hires J.P. Morgan Asia Resources Banker - Sources

September 09 2009 - 6:49AM

Dow Jones News

Morgan Stanley (MS) has hired Hugh Thomas as a managing director

for its Asia-Pacific investment banking team, adding a veteran

banker to cut deals in the increasingly important metals and mining

sector, according to people familiar with the situation.

Thomas, previously head of Natural Resources Asia-Pacific at

J.P. Morgan Chase & Co. (JPM), resigned from that post on

Sunday, according to one person. A J.P. Morgan spokeswoman

confirmed his departure. He will take up a similar role at Morgan

Stanley after taking a standard three month 'gardening leave.'

(This story and related background material will be available on

The Wall Street Journal Web site, WSJ.com).

Natural resource deals in Asia are a growing business segment

for investment banks in Asia as China continues to show a strong

appetite for acquiring natural resources overseas, particularly

Australian mining companies. The latest major deal is China-based

Yanzhou Coal Mining Co.'s (YZC) A$3.54 billion proposed acquisition

of coal miner Felix Resources Ltd. (FLX.AU) That deal still needs

approval from Australian regulators.

Announced cross-border mergers and acquisitions in the metals

and mining sector involving Asian parties have totaled $16.4

billion so far this year, surpassing the $15.8 billion for the year

2008, according to data provider Dealogic.

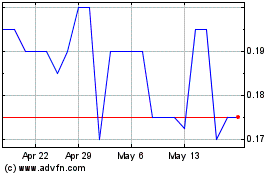

Felix (ASX:FLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Felix (ASX:FLX)

Historical Stock Chart

From Apr 2023 to Apr 2024