2nd UPDATE: Yanzhou Makes Bid For Felix Resources - Source

August 10 2009 - 2:58AM

Dow Jones News

Yanzhou Coal Mining Co. Ltd. (1171.HK) has made a takeover bid

for Felix Resources Ltd. (FLX.AU) in a deal agreed by both parties,

a person familiar with the situation said Monday.

There have been media reports that Yanzhou could be offering as

much as A$25 a share for Felix but the person said the offer is

pitched below A$20 a share. They last traded at A$16.90, giving the

company a market capitalization of about A$3.32 billion.

The bid is the latest in a steady stream of Chinese investments

in Australia's key mining sector which have sparked concern among

some politicians and commentators. It also comes amid diplomatic

tensions between Australia and China over the detention of four Rio

Tinto Ltd. (RTP) employees and will be closely watched by the

market for signs of the Australian government's attitude to Chinese

investment.

Shares in both Felix and Yanzhou were placed on trading halts

Monday with Felix flagging an upcoming announcement on a potential

change of control.

The bid has been a long time in the making, with Felix first

signaling it was in talks over a possible deal a year ago.

A previous round of talks with Yanzhou stalled in March this

year and in June Felix said that, given the global financial

environment, it was unlikely that talks with interested parties

would be concluded in the near term.

Since then a resurgent Asian steel sector has revived demand for

metallurgical coals, and in July the miner said several parties had

expressed interest in a "potential change of control

transaction."

Deal To Highlight Australia's Stance On China Investment

The deal will be reviewed by Australia's Foreign Investment

Review Board, which gives its recommendations to the Australian

Treasurer who makes the final decision on whether foreign

investments are in line with Australia's national interests.

The biggest Chinese investment mooted so far, Aluminum Corp. of

China's US$19.5 billion investment in Rio Tinto, was abandoned in

June on commercial grounds but many in China believe the Australian

government opposed the deal.

Foreign Investment Review Board officials have signaled

Australia's preference is for bidders to take stakes of less than

49.9% in local companies, so the Yanzhou deal will be a test of the

government's willingness to allow state-owned Chinese companies to

make full takeovers.

The market will also be looking for any signs that the

diplomatic row over the detention of the Rio Tinto employees is

coloring the government's attitude to Chinese investment, although

Australian Treasurer Wayne Swan has said the screening process

remains unchanged.

Felix operates mines in New South Wales and Queensland state and

its production is currently weighted toward higher margin

metallurgical coal used in steel making.

However, this weighting is set to change with the development of

the miner's A$400 million Moolarben thermal coal project in New

South Wales state.

Moolarben is under construction and is expected to boost Felix's

thermal coal sales to about 75% of total output as it ramps up from

mid 2010.

Felix has an 80% stake in Moolarben, Japan's Sojitz Corp.

(2768.TO) holds 10% and a Korean consortium including consortium

including Korea Resource Corp. and Korea Electric Power Co. (KEP)

holds the remaining 10%.

Felix Managing Director Brian Flannery wasn't immediately

available for comment.

Yanzhou said in a statement that it had halted trading in its

Hong Kong-listed shares in relation to a proposed acquisition, but

gave no further detail.

-By Alex Wilson, Dow Jones Newswires; 61-3-9292-2094;

alex.wilson@dowjones.com

(Yvonne Lee and Aries Poon in Hong Kong contributed to this

story)

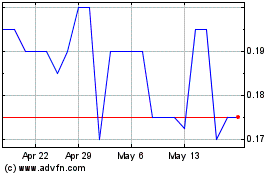

Felix (ASX:FLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Felix (ASX:FLX)

Historical Stock Chart

From Apr 2023 to Apr 2024