DEXUS Property Group Completes $770 Million Sale of Its United States Central Portfolio

June 22 2012 - 4:30PM

Business Wire

DEXUS Property Group today announced the completion of the sale

of its US central portfolio to affiliates of Blackstone Real Estate

Partners VII for $770 million. The transaction is the largest

single industrial real estate portfolio sale in the US in 2012.

The central portfolio consisted of 65 industrial properties and

included three recently completed large Class A distribution

facilities leased to Whirlpool Corporation.

DEXUS Property Group CEO Darren Steinberg said, “The settlement

of the central portfolio is a good result and allows our US team to

focus on the remaining west coast portfolio and to leverage our

local industrial real estate management and development expertise

going forward.

“Since being established in June 2010, DEXUS’s US team has

assumed direct asset management control of the west coast portfolio

and taken an active role in leasing and managing the central

portfolio. This active approach resulted in the significant

improvement in occupancy of the central portfolio from 79% to 90%

prior to its sale.”

The residual investment, representing approximately 7% of total

Group assets, is a high quality portfolio concentrated in the west

coast markets. These are highly attractive markets, with high

levels of demand from tenants, strong market fundamentals and good

revenue prospects.

As a consequence of the restructure announced on 7 May 2012,

Jane Lloyd has left the Group and Bruce McDonald has assumed the

role of Managing Director, US Investments.

DEXUS now owns and manages 24 US industrial properties totalling

more than 6.8 million square feet and valued at approximately $550

million. DEXUS also manages properties valued at approximately $200

million on behalf of US third party clients.

The Los Angeles office of Eastdil Secured represented DEXUS in

the transaction.

About DEXUS

DEXUS is one of Australia’s leading property groups specialising

in world-class office, industrial and retail properties with total

assets under management of $13 billion. In Australia, DEXUS is the

market leader in office and industrial and, on behalf of third

party clients, a leading manager and developer of shopping centres.

DEXUS is committed to being a market leader in Corporate

Responsibility and Sustainability. www.dexus.com

DEXUS Funds Management Ltd ABN 24 060 920 783, AFSL 238163, as

Responsible Entity for DEXUS Property Group (ASX: DXS)

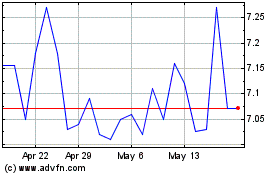

Dexus (ASX:DXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

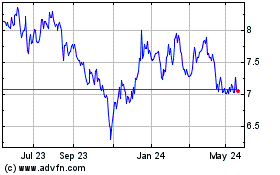

Dexus (ASX:DXS)

Historical Stock Chart

From Apr 2023 to Apr 2024