TIDMAYM

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR

FROM THE UNITED STATES OR ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

FOR IMMEDIATE RELEASE

LEI: 213800X8BO8EK2B4HQ71

11 March 2022

Anglesey Mining plc

('Anglesey' or the 'Company')

APPIX TO SCHEDULE ONE ANNOUNCEMENT

Further information relating to Anglesey Mining plc in connection with the

proposed admission of its ordinary shares to trading on AIM

Further to the announcement made at 17:57 on 9 March 2022, the London Stock

Exchange has this morning published the correct Schedule One announcement. This

Appendix has been prepared in accordance with the requirements of Rule 2 of,

and Schedule One (including the Supplement to Schedule One for a quoted

applicant) to, the AIM Rules that, for a quoted applicant, all information that

is equivalent to that required for an 'admission document' which is not

currently public shall be made public. Information which is public includes,

without limitation, all information available in respect of the Company

accessed at the London Stock Exchange (available at www.londonstockexchange.com

), all information available in respect of the Company on the FCA's National

Storage Mechanism (available at https://data.fca.org.uk/#/nsm/

nationalstoragemechanism), all information available in respect of the Company

at the website of Companies House at www.companieshouse.gov.uk, all information

available on the Company's website (https://www.angleseymining.co.uk/) and the

contents of this Appendix (together comprising the "Company's Public Record").

AIM

AIM is a market designed primarily for emerging or smaller companies to which a

higher investment risk tends to be attached than to larger or more established

companies. AIM securities are not admitted to the Official List of the FCA.

A prospective investor should be aware of the risks of investing in such

companies and should make the decision to invest only after careful

consideration and, if appropriate, consultation with an independent financial

adviser.

Each AIM company is required pursuant to the AIM Rules to have a nominated

adviser. The nominated adviser is required to make a declaration to the London

Stock Exchange on admission in the form set out in Schedule Two to the AIM

Rules for Nominated Advisers.

The London Stock Exchange has not itself examined or approved the contents of

this document.

Nominated Adviser and Brokers

J&E Davy ("Davy"), which is authorised and regulated in Ireland by the Central

Bank of Ireland, is acting exclusively as nominated adviser and broker to the

Company in connection with the proposed AIM Admission and will not be

responsible to any person other than the Company for providing the protections

afforded to its customers or for advising any other person on the contents of

this Appendix or in connection with the proposed AIM Admission. The

responsibilities of Davy as the Company's nominated adviser under the AIM Rules

and the AIM Rules for Nominated Advisers are owed solely to the London Stock

Exchange and are not owed to the Company or to any Director or to any other

person in respect of such person's decision to acquire shares in the Company in

reliance on any part of this Appendix. Davy does not accept any responsibility

whatsoever for the contents of this Appendix, and no representation or

warranty, express or implied, is made by Davy with respect to the accuracy or

completeness of this Appendix or any part of it. No representation or warranty,

express or implied, is made by Davy as to any of the contents of this Appendix

and Davy has not authorised the contents of any part of this Appendix and

accepts no liability whatsoever for the accuracy of any information or opinions

contained in this Appendix or for the omission of any material information from

this Appendix for which the Company and the Directors are solely responsible.

Responsibility

The Company and the Directors, whose names and functions appear on pages 2 and

3 of this Appendix, accept responsibility, individually and collectively, for

the information contained in this Appendix including individual and collective

responsibility for compliance with the AIM Rules. To the best of the knowledge

and belief of the Directors (having taken all reasonable care to ensure that

such is the case), the information contained in this Appendix, for which they

are responsible, is in accordance with the facts and does not omit anything

likely to affect the import of such information.

DIRECTORS, COMPANY SECRETARY, REGISTERED OFFICE AND ADVISERS

Directors John Kearney (Chairman)

Bill Hooley (Deputy Chairman)

Jonathan Battershill (Chief Executive Officer)

Howard B. Miller (Non-Executive Director)

Danesh Varma (Finance Director)

Andrew King (Independent Non-Executive Director)

Namrata Verma (Independent Non-Executive

Director)

Company Secretary Danesh Varma

Registered Office Anglesey Mining plc

Tower Bridge House

St. Katharine's Way

London

E1W 1DD

United Kingdom

Broker and Nominated Adviser J&E Davy

Davy House

49 Dawson Street

Dublin 2

Ireland

Legal Advisers to the Company DLA Piper UK LLP

1 St Peter's Square

Manchester

M2 3DE

United Kingdom

Auditors Mazars LLP

Tower Bridge House

St. Katharine's Way

London

E1W 1DD

United Kingdom

Registrar Link Group

Central Square

29 Wellington Street

Leeds

LS1 4DU

United Kingdom

Geological and Mining Consultants Micon International Limited

Suite 10, Keswick Hall

Keswick

Norwich

NR4 6TJ

DEFINITIONS

The definitions set out below apply throughout this document unless the context

requires otherwise.

"2019 Annual Report the Company's annual report and accounts for the year ended

& Accounts" 31 March 2019;

"2020 Annual Report the Company's annual report and accounts for the year ended

& Accounts" 31 March 2020;

"2021 Annual Report the Company's annual report and accounts for the year ended

& Accounts" 31 March 2021;

"2021 Interim the Company's interim report and accounts for the six

Report & Accounts" months ended 30 September 2021;

"AIM" AIM, a market operated by the London Stock Exchange;

"AIM Admission" the admission of the Ordinary Shares to trading on AIM

becoming effective in accordance with the AIM Rules;

"AIM Rules" the "AIM Rules for Companies" published by the London Stock

Exchange from time to time;

"Anglesey" or the Anglesey Mining plc, a company incorporated in England and

"Company" Wales with registered number 1849957;

"Appendix" this document;

"Articles of the articles of association of the Company, as amended from

Association" time to time;

"Board" the board of directors of the Company;

"Companies Act" the Companies Act 2006, as amended, modified or re-enacted

from time to time;

"Company's Public information which is in the public domain and which

Record" includes, without limitation, all information available in

respect of the Company accessed at the London Stock

Exchange, all information available in respect of the

Company on the FCA's National Storage Mechanism and all

information available in respect of the Company at the

website of Companies House at www.companieshouse.gov.uk/

and all information available on the Company's website at

www.angleseymining.co.uk;

"Davy" J&E Davy;

"Delisting" the proposed cancellation of the listing of the Company's

Ordinary Shares on the Official List and from trading on

the London Stock Exchange's main market for listed

securities;

"Directors" means the directors of the Company at the date of this

document and "Director" means any one of them;

"Euroclear" Euroclear UK & Ireland Limited;

"FCA" or "Financial the Financial Conduct Authority of the United Kingdom or

Conduct Authority" any successor body or bodies carrying out the functions

currently carried out by the Financial Conduct Authority;

"FSMA" the Financial Services and Markets Act 2000, as amended;

"GDPR" the EU General Data Protection Regulation (EU) 2016/679;

"Group" the Company together with its subsidiaries and subsidiary

undertakings;

"IFRS" International Financial Reporting Standards as adopted for

use by the EU;

"London Stock London Stock Exchange plc or its successor(s);

Exchange"

"Nominated Adviser the agreement dated 9 March 2022 entered into between the

& Broker Agreement" Company and Davy, details of which are set out in paragraph

10.1 of this Appendix;

"Official List" the list maintained by the UK Listing Authority in

accordance with section 74(1) of FSMA for the purpose of

Part VI of FSMA;

"Ordinary Shares" ordinary shares of 1 pence each in the capital of the

Company;

"pounds" or "£" or means the lawful currency of the United Kingdom;

"pound sterling"

"QCA Code" the corporate governance code for small and mid-size

companies issued by the Quoted Company Alliance, as amended

from time to time;

"Reference Date" 10 March 2022, the latest practicable date prior to

publication of this document;

"Registrar" Link Asset Services;

"Schedule One the announcement by the Company pursuant to Rule 2 and

Announcement" Schedule One to the AIM Rules for Companies, to which this

Appendix is attached, in connection with AIM Admission;

"shareholder(s)" means holder(s) of Ordinary Shares;

"subsidiary" has the meaning given in section 1159 of the Companies Act;

"subsidiary has the meaning given in section 1162 of the Companies Act;

undertaking"

"Takeover Code" the City Code on Takeovers and Mergers issued by the

Takeover Panel, as amended from time to time;

"Takeover Panel" the Panel on Takeovers and Mergers;

"United Kingdom" or the United Kingdom of Great Britain and Northern Ireland;

"UK"

INFORMATION relating TO ANGLESEY MINING PLC

1. Information and status on the company

1.1 The Company was incorporated and registered in England and Wales

under the Companies Act 2006 with registration number 1849957 with the name

Peakneat Limited on 21 September 1984. The Company changed its name to Anglesey

Mining PLC on 12 November 1984.

1.2 The principal legislation under which the Company operates and which

the Ordinary Shares have been, and the new Ordinary Shares will be, issued is

the Companies Act and regulations made thereunder. The Company is a public

limited company and, accordingly, the liability of its members is limited to

the amount paid up or to be paid up on their shares.

1.3 The Company is domiciled in the United Kingdom.

1.4 The business of the Group is the development of mineral properties

and its principal activity is exploring and developing its wholly owned Parys

Mountain zinc, lead and copper project in North Wales.

1.5 The legal entity identifier of the Company is 213800X8BO8EK2B4HQ71.

1.6 The Company is the holding company for a number of subsidiaries. The

Company's principal subsidiaries and its ownership interests are as follows:

Name of subsidiary Country of Percentage of Share Capital

Incorporation held

Parys Mountain Land Limited England & Wales 100

Parys Mountain Heritage England & Wales 100

Limited

Parys Mountain Mines Limited England & Wales 100

Angmag AB Sweden 100

2. Share capital of the company

2.1 The Company does not have an authorised share capital and does not

place any limit on the number of shares which the Company may issue.

2.2 The issued fully paid up share capital of the Company as at (i) the

Reference Date; and (ii) the date of the AIM Admission is 248,070,732 Ordinary

Shares with an aggregate nominal value of £2,480,707.32.

2.3 All Ordinary Shares in the capital of the Company are created under

the Companies Act, registered and may be held in either certificated or

uncertificated form.

2.4 The ISIN number for the Ordinary Shares is GB0000320472.

2.5 The Company's Ordinary Shares are currently admitted to listing on

the FCA's Official List (premium listing segment) and to trading on the London

Stock Exchange's Main Market, having first been so admitted on 18 May 1988.

Application will be made to the London Stock Exchange for the Ordinary Shares

to be admitted to trading on AIM. It is expected that AIM Admission will become

effective and that trading in Ordinary Shares will commence on AIM on or around

8 April 2022 and that admission of the Ordinary Shares to listing on the FCA's

Official List (premium listing segment) and to trading on the London Stock

Exchange's Main Market will simultaneously be cancelled on the same date. The

Ordinary Shares will not be admitted to trading on any other investment

exchange.

2.6 As at the Reference Date, no Ordinary Shares were held by or on

behalf of the Company.

2.7 As at the Reference Date, the Company also had 21,529,451 Deferred A

Shares and 116,241,384 Deferred B Shares in issue, however these shares do not

carry any rights to vote.

2.8 No person has any rights to purchase the unissued share capital of

the Company.

2.9Further information on the share capital of the Company is set out in the

Company's Public Record.

3. Articles of association

3.1 The Articles of Association of the Company adopted pursuant to a

resolution passed at the annual general meeting of the Company held on 24

September 2010 contain, among others, provisions to the following effect.

Objects

The objects of the Company are unrestricted.

Limited Liability

The liability of the Company's members is limited to the amount, if any, unpaid

on the shares in the Company held by them.

Share Rights

Subject to any rights attached to existing shares, shares may be issued with

such rights and restrictions as the Company may by ordinary resolution decide,

or (if there is no such resolution or so far as it does not make specific

provision) as the board may decide. Such rights and restrictions shall apply as

if they were set out in the Articles of Association. Redeemable shares may be

issued, subject to any rights attached to existing shares. The board may

determine the terms and conditions and the manner of redemption of any

redeemable share so issued. Such terms and conditions shall apply to the

relevant shares as if they were set out in the Articles of Association.

Voting Rights

Subject to special rights and restrictions as to voting attached to any class

of shares by or in accordance with the Articles of Association, on a vote on a

resolution:

(a)on a show of hands every member present in person has one vote and every

proxy present who has been duly appointed by one or more members will have one

vote, except that if a shareholder votes in person on a resolution then, as

regards that resolution, his proxy shall have no vote; and a proxy shall have

one vote for and one vote against if the proxy has been duly appointed by more

than one member and the proxy has been instructed by one or more members to

vote for and by one or more other members to vote against or by one or more

members to vote in the same way (whether for or against) and one or more of

those members has permitted the proxy discretion as to how to vote; and

(b) on a poll every member has one vote per share held by him and he may vote

in person or by one or more proxies.

This is subject to any special terms as to voting which are given to any shares

or on which shares are held. In the case of joint holders of a share the vote

of the senior who tenders a vote, whether in person or by proxy, shall be

accepted to the exclusion of the votes of the other joint holders and, for this

purpose, seniority shall be determined by the order in which the names stand in

the register in respect of the joint holding.

Restrictions

Unless the board decides otherwise, no member shall be entitled to vote at any

general meeting or class meeting in respect of any share held by him if any

call or other sum then payable by him in respect of that share remains unpaid.

Dividends and Other Distributions

The Company may by ordinary resolution from time to time declare dividends not

exceeding the amount recommended by the board. Subject to the Companies Act,

the board may pay interim dividends, and also any fixed rate dividend, whenever

the financial position of the Company, in the opinion of the board, justifies

its payment.

Except insofar as the rights attaching to, or the terms of issue of, any share

otherwise provide, all dividends shall be declared and paid according to (i)

amounts paid up on the shares in respect of which the dividend is declared and

paid, but no amount paid up on a share in advance of a call may be treated as

paid up on the share; and (ii) the terms on which any share is allotted that

provide that such share shall be entitled to a dividend as if the nominal

amount of it were fully or partly paid from a particular date (in the past or

the future). Except as set out above, dividends may be declared or paid in any

currency.

No dividend or other monies payable by the Company on or in respect of any

share shall carry a right to receive interest from the Company, unless

otherwise provided by the rights attached to the shares.

Variation of Rights

Subject to the Companies Act, rights attached to any class of shares may be

varied with the written consent of the holders of not less than three-fourths

in nominal value of the issued shares of that class, or with the sanction of a

special resolution passed at a separate general meeting of the holders of those

shares validly held in accordance with the provisions of these articles, but

not otherwise.

The rights conferred upon the holders of any shares shall not, unless otherwise

expressly provided in the rights attaching to those shares, be deemed to be

varied by the creation or issue of further shares ranking pari passu with them

or by the purchase or redemption by the Company of its own shares.

Transfer of Shares

Subject to the Articles of Association, any member may transfer all or any of

his certificated shares by an instrument of transfer in writing in any usual

form or in any other form which the board may approve. The instrument of

transfer must be signed by or on behalf of the transferor and (in the case of a

partly-paid share) the transferee.

The transferor of a share is deemed to remain the holder until the transferee's

name is entered in the register.

The board can decline to register any transfer of any share which is not a

fully-paid share or the transfer of a share on which the Company has a lien.

The board may also decline to register a transfer of a certificated share

unless the instrument of transfer:

(a) is duly stamped (if required);

(b) is in respect of only one class of share;

(c) is in favour of (as the case may be) a single transferee or renouncee or

not more than four joint transferees or renouncees; and

(d) is delivered for registration to the office or such other place as the

board may decide, accompanied by the certificate for the shares to which it

relates and such other evidence as the board may reasonably require.

General Meetings

The board may convene a general meeting of the Company whenever it thinks fit.

If the board, in its absolute discretion, considers that it is impractical or

undesirable for any reason to hold a general meeting on the date or at the time

or place specified in the notice calling the general meeting, it may postpone

the meeting to another date, time and place.

No business shall be transacted at any general meeting unless a quorum of two

shareholders is present in person or by proxy and entitled to vote. The absence

of a quorum shall not preclude the appointment of a chairman of the meeting in

accordance with the provisions of these articles, which shall not be treated as

part of the business of the meeting.

Directors

(a) Number of directors

There is no maximum number of directors, but the minimum number of directors is

three.

(b) Directors' shareholding qualification

A director is eligible for appointment or reappointment if he is recommended by

the board or proposed by a notice from a shareholder entitled to attend and

vote at the meeting for appointment or reappointment.

(c) Appointment of directors

Directors may be appointed by the Company by ordinary resolution or by the

board. A director appointed by the board holds office only until the next

annual general meeting of the Company and shall not retire by rotation at such

meeting.

(d) Retirement of directors

At every annual general meeting one third of the directors who are subject to

retirement by rotation or, if their number is not three or a multiple of three,

the number nearest to but not less than one third, shall retire from office

provided that if there are fewer than three directors who are subject to

retirement by rotation, one shall retire from office.

If any one or more directors who have been a director at each of the preceding

two annual general meetings of the Company:

(i)was not appointed or reappointed at either such general meeting; and

(ii) has otherwise ceased to be a director (whether by resignation, retirement,

removal or otherwise) and was not reappointed by general meeting of the Company

at or since either such annual general meeting,

he or they shall retire from office and shall be counted in obtaining the

number required to retire at the meeting.

(e) Removal of directors by ordinary resolution

The Company may by ordinary resolution remove any director before the

expiration of his period of office.

(f) Vacation of office

The office of a director shall be vacated if:

(i) he resigns by notice delivered to the secretary at the office or tendered

at a board meeting;

(ii) he is prohibited by a law from being a director;

(iii) he ceases to be a director by virtue of the Companies Act;

(iv) he is removed from office pursuant to the Company's Articles of

Association.

(v) he becomes bankrupt or compounds with his creditors generally;

(vi) a registered medical practitioner writes an opinion to the company stating

that he has become physically and mentally incapable of acting as a director;

(vii) he is or has been suffering from mental ill health and a court makes an

order which wholly or partly prevents him from personally exercising any powers

or rights which he would otherwise have;

(viii) he and his alternate director (if any) are absent without the permission

of the board from meetings of the board for six consecutive months and the

board resolves that his office is vacated; or

(ix) he is removed from office by a notice addressed to him at his last known

address and signed by all his co-directors.

If the office of a director is vacated for any reason, he must cease to be a

member of any committee of the board.

(g) Alternate director

Any director may appoint as his alternate director (i) another director; or

(ii) another person approved by the board and willing to act, and may at his

discretion remove such alternate director. If the alternate director is not

already a director, the appointment, unless previously approved by the board,

shall have effect only upon and subject to being so approved.

(h) Proceedings of the Board

Subject to the provisions of the Articles of Association, the board may meet

for the despatch of business, adjourn and otherwise regulate meetings as it

thinks fit. Any director may summon a board meeting at any time by notice

served on the members of the board. The quorum necessary for the transaction of

the business of the board may be fixed by the board and, unless so fixed at any

other number, shall be two. A meeting of the board at which a quorum is present

shall be competent to exercise all the powers, authorities and discretions

vested in or exercisable by the board.

Questions arising at any meeting of the board shall be determined by a majority

of votes. In the case of an equality of votes the chairman of the meeting shall

have a second or casting vote.

All or any of the members of the board may participate in a meeting of the

board by means of a conference telephone or any communication equipment which

allows all persons participating in the meeting to speak to and hear each

other. A person so participating shall be deemed to be present at the meeting

and shall be entitled to vote and to be counted in the quorum.

A resolution in writing signed by all the directors who are at the relevant

time entitled to receive notice of a board meeting and who would be entitled to

vote on the resolution at a board meeting shall be as valid and effective for

all purposes as a resolution duly passed at a meeting of the board (or

committee).

The board may delegate any of its powers, authorities and discretions to a

committee. The meetings and proceedings of any committee consisting of two or

more members shall be governed by the provisions contained in the Articles of

Association for regulating the meetings and proceedings of the board so far as

the same are applicable and are not superseded by any regulations imposed by

the board.

(i) Remuneration of directors

Each of the executive directors (but not alternate directors) shall be paid a

fee at such rate as may from time to time be determined by the board, and may

be either a fixed sum of money, or may altogether or in part be governed by

business done or profits made or otherwise determined by the board.

Each director may be paid his reasonable travelling, hotel and incidental

expenses of attending meetings of the board, or committees of the board or of

the Company or any other meeting which as a director he is entitled to attend

and shall be paid all other costs and expenses properly and reasonably incurred

by him in the conduct of the Company's business or in the discharge of his

duties as a director.

(j) Pensions and gratuities for directors

The board may exercise the powers of the Company to provide pensions or other

retirement or superannuation benefits and to provide death or disability

benefits or other allowances or gratuities (by insurance or otherwise) for a

person who is or has at any time been a director of (i) the Company; (ii) a

company which is or was a subsidiary undertaking of the Company; (iii) a

company which is or was allied to or associated with the Company or a

subsidiary undertaking of the Company; or (iv) a predecessor in business of the

Company or of a subsidiary undertaking of the Company, (or in each case, for

any member of his family, including a spouse or former spouse or a person who

is or was dependent on him).

(k) Directors' interests

The board may authorise any matter which would otherwise involve a director

breaching his duty under the Companies Act to avoid conflicts of interest.

The board may give any such authorisation upon such terms as it thinks fit and

may revoke or vary such authority at any time.

Subject to the provisions of the Companies Act, and provided he has declared

the nature and extent of his interest to the board as required by the Companies

Act, a director may:

(i) be party to, or otherwise interested in, any transaction or arrangement

with the Company or in which the Company has a direct or indirect interest;

(ii) act by himself or through a firm with which he is associated in a

professional capacity for the Company or any other company in which the Company

may be interested (otherwise than as auditor);

(iii) be a director or other officer of, or employed by or a party to a

transaction or arrangement with, or otherwise be interested in any body

corporate in which the Company may be interested, and a director shall not, by

reason of his office, be accountable to the Company for any remuneration or

other benefit realised by reason of having an interest permitted as described

above or by reason of having a conflict of interest authorised by the board and

no contract shall be liable to be avoided on the grounds of a director having

any such interest.

(l) Restrictions on voting

Subject to certain exceptions set out in the Articles of Association, no

director may vote on or be counted in the quorum in relation to any resolution

of the board concerning a matter in which he has a direct or indirect interest

which is, to his knowledge, a material interest.

No director may vote on, or be counted in a quorum in relation to, any

resolution of the board or committee concerning his own appointment.

Subject to the Companies Act, the Company may by ordinary resolution suspend or

relax to any extent the provisions relating to directors' interests or the

restrictions on voting or ratify any transaction not duly authorised by reason

of a contravention of the provisions.

(m) Borrowing powers

Subject to the Articles of Association and the provision of the Companies Act,

the board may exercise all the powers of the Company to borrow money and to

mortgage or charge all or part of the undertaking, property, and assets

(present or future) and uncalled capital of the Company and to issue debentures

and other securities, whether outright or as collateral security for a debt,

liability or obligation of the Company or of a third party.

The board must restrict the borrowings of the Company and exercise all voting

and other rights or powers of control exercisable by the Company in relation to

its subsidiary undertakings so as to secure that, save with the previous

sanction of an ordinary resolution, no money shall be borrowed if the aggregate

principal amount outstanding of all borrowings by the Group then exceeds, or

would as a result of such borrowing exceed, an amount equal to two times the

adjusted capital and reserves (as defined in the Articles of Association).

3.2 A complete copy of the Articles of Association may be accessed at

www.angleseymining.co.uk

4. Risk factors

In addition to the risk factors relating to the Company and its industry set

out in the 2021 Annual Report & Accounts, the risk factors set out in this

paragraph 4 relating to the Ordinary Shares should be considered carefully when

evaluating whether to make an investment in the Company. An investment in the

Company is only suitable for investors who are capable or evaluating the risks

and merits of such investment and who have sufficient resources to bear any

loss which might result from such investment. If you are in any doubt as to

the action you should take, you should consult a professional adviser

authorised under FSMA who specialises in advising on the acquisition of shares

and other securities. This summary of risk factors is not intended to be

exhaustive.

4.1 The price of the Ordinary Shares may fluctuate

The value of an investment in the Ordinary Shares may go down as well as up.

The price of the Ordinary Shares may fall in response to a range of external

factors including the results of the Group, appointments to and resignations

from the board of directors and executive management team, speculation in the

market regarding the Group's business or other events affecting the Group and

general stock market conditions. In addition, significant sales of Ordinary

Shares by major shareholders, could have a material adverse effect on the

market price of Ordinary Shares as a whole.

4.2 Investment in AIM securities

An investment in companies whose shares are traded on AIM is perceived to

involve a higher degree of risk and be less liquid than an investment in

companies whose shares are listed on the Official List. AIM is a market

designed primarily for emerging or smaller companies. An investment in the

Ordinary Shares may be difficult to realise. Existing and prospective investors

should be aware that the value of an investment in the Company may go down as

well as up and that the market price of the Ordinary Shares may not reflect the

underlying value of the Company. Investors may realise less than their

investment. Further, a quotation on AIM will afford shareholders a lower level

of regulatory protection than that afforded to shareholders in a company with

its shares listed on the premium segment of the Official List.

5. Information on the directors

5.1 As at the Reference Date and immediately following AIM Admission

becoming effective in accordance with the AIM Rules, the interests (including

related financial products as defined in the AIM Rules) of the Directors

(including persons connected with the Directors within the meaning of section

252 of the Companies Act and any member of the Director's family (as defined in

the AIM Rules)) in the issued share capital of the Company are as follows:

Director Legally owned Ordinary Shares Share options

John Kearney - -

Bill Hooley 200,000 -

Jonathan Battershill 1,787,688 -

Howard B. Miller - -

Danesh Varma - -

Andrew King - -

Namrata Verma - -

5.2 Save as stated above:

(i) None of the Directors (nor any person connected with any of them within the

meaning of section 252 of the Companies Act) has any interest, whether

beneficial or non-beneficial, in the share or loan capital in the Company or

any company in the Group or in any related financial product (as defined in the

AIM Rules) referenced to the Ordinary Shares;

(ii) There are no outstanding loans granted or guarantees provided by any

member of the Group to or for the benefit of the Directors or provided by any

Director to any member of the Group;

(iii)None of the Directors has any interest, direct or indirect, in any assets

which have been or are proposed to be acquired or disposed of by, or leased to,

any member of the Group;

(iv) None of the Directors has any option or warrant to subscribe for any

shares in the Company; and

(v) None of the Directors has any interest, direct or indirect, in any contract

or arrangement which is or was unusual in its nature or conditions or

significant to the business of the Group taken as a whole, which were effected

by any member of the Group and which remains in any respect outstanding or

unperformed.

5.3 The Directors hold, or have during the five years preceding the date

of this Appendix held, the following directorships or partnerships:

Director Age Current Directorships / Past Directorships / Partnerships

Partnerships

John Kearney 71 Buchans Resources Limited African Gold Plc

Canadian Manganese Canadian Zinc Corporation

Company Inc. Xtierra Inc.

Labrador Iron Mines Avnel Gold Mining Limited

Holdings Limited Minco Plc

Conquest Resources

Limited

Energold Minerals Inc.

681358 Alberta Limited

Getty Resources Inc.

Karbonate Minerals

Corporation

Pelly River Mines Limited

Rose Creek Vangorda Mines

Limited

Stranton Limited

WFD Limited

Golden Sun Resources

Oncologica UK Limited

Saskatchewan Mining and

Minerals Inc.

Minco Exploration Plc

Northgate Exploration

Limited

Bill Hooley 74 Labrador Iron Mines -

Holdings Limited

Grängesberg Iron AB

Jonathan 51 Silver Mines Limited -

Battershill Black Dragon Gold

Corporation

Alien Metals Limited

E-Cycle Metals Limited

JJB Advisory Limited

Howard B. 78 - Avnel Gold Mining Limited

Miller

Danesh Varma 72 Brook Payroll Services Minco Plc

Limited Brookfield Infrastructure Partners

Brookfield Investments Juno Limited

Corp. Arkle Resources

Buchans Resources Limited Aviary Films Limited

Labrador Iron Mines

Holdings Limited

Canadian Manganese

Company Inc.

Grängesberg Iron AB

Minco Exploration plc

Andromeda Life Sciences

Limited

Traders Own Ltd

Brook Corporate Finance

Limited

KCA Nominees Limited

Kennard Cousins &

Associates Limited

Centaur Seaplane Limited

GPS Wealth Limited

Global Presentation

Strategies Limited

Brook Precious Metals

Limited

Prima Properties

Management Limited

Minco Mining Limited

Crowd for Angels (UK)

Limited

Andrew King 57 Scanmetals (UK) Limited Avnel Gold Mining Limited

Mincore Inc. Regia Limited

Highland Metals Pte. Ltd.

Mil-Ver Metal Company Limited

Brookside Metal Corporation Limited

Amalgamated Metal Corporation Plc

Ceramics & Alloy Specialists (Pty)

Ltd

Consolidated Tin Smelters Limited

Amalgamated Metal Investment

Holdings Limited

British Amalgamated Metal

Investments Limited

British Metal Corporation Limited

The British Metal Corporation

(India) Pty. Ltd.

The British Metal Corporation

(South Africa) (Pty) Ltd.

Alloys Metals and Ceramics Holdings

(Pty) Ltd

AMT Futures Limited

Sansing Limited

African Panther Resources (U)

Limited

Namrata Verma 42 Terrafranca Capital -

Partners Limited

Terrafranca Advisory

Limited

5.4 None of the Directors has:

(i) any unspent convictions relating to indictable offences;

(ii) had a bankruptcy order made against them or entered into any individual

voluntary arrangements;

(iii) been a director of a company which has been placed in receivership,

compulsory liquidation, creditors' voluntary liquidation or administration or

entered into a company voluntary arrangement or any composition or arrangement

with its creditors generally or any class of its creditors whilst they were a

director of that company at the time of, or within the twelve months preceding,

such events;

(iv) been a partner of a firm which has been placed in compulsory liquidation

or administration or which has entered into a partnership voluntary arrangement

whilst they were a partner of that firm at the time of, or within twelve months

preceding, such events;

(v) had any asset belonging to them placed in receivership or been a partner of

a partnership any of whose assets have been placed in receivership whilst they

were a partner at the time of, or within twelve months preceding, such

receivership; or

(vi) been publicly criticised by any statutory or regulatory authority

(including any recognised professional body) or been disqualified by a court

from acting as a director of a company or from acting in the management or

conduct of the affairs of any company.

6. Major shareholders

6.1 The names and shareholdings in the Company held by 'significant

shareholders' (being persons holding 3% or more of the Ordinary Shares in the

Company), with such shareholdings expressed as a percentage of the Company's

issued share capital both before and upon AIM Admission are set out in the

Schedule One announcement.

6.2 As at the Reference Date, no major shareholder has any different

voting rights to the other holders of Ordinary Shares in the capital of the

Company.

6.3 The Company is not aware of any person or persons who, directly or

indirectly, jointly or severally, exercise(s) or could exercise control of the

Company or any arrangements the operation of which may, at a subsequent date,

result in a change in the control of the Company.

7. Company's financial information

7.1 The Group's audited consolidated financial statements included in

the Group's 2021 Annual Report and Accounts, the Group's Annual Report and

Accounts for FY 2019/20 and the Group's Annual Report and Accounts for FY 2018/

19, respectively, together with the audit reports thereon, are incorporated by

reference into this document. The Group's audited consolidated financial

statements for FY 2020/21, FY 2019/2020 and FY 2018/19 were prepared in

accordance with IFRS. The Group's unaudited interim results for the six-month

period ended 30 September 2021, which contain comparative statements for the

same period in the prior financial year, are also incorporated by reference

into this document. These documents are all available from the Company's

website at www.angleseymining.co.uk:

Reference document Information incorporated by Page number in

reference the reference

document

Anglesey Mining Half Yearly Unaudited Condensed Page 4

Report for the six months to 30 Consolidated Income Statement

September 2021

Unaudited Condensed Page 5

Consolidated Statement of

Financial Position

Unaudited Condensed Page 6

Consolidated Statement of

Cash Flows

Unaudited Condensed Page 7

Consolidated Statement of

Changes in Group Equity

Notes to the Condensed Pages 8 to 11

Consolidated Financial

Statements

Anglesey Mining Annual Report Group Income Statement Page 43

for the year to 31 March 2021

Group Statement of Page 43

Comprehensive Income

Group Statement of Financial Page 44

Position

Company Statement of Page 45

Financial Position

Statement of Changes in Page 46

Equity

Group Statement of Cash Flows Page 47

Company Statement of Cash Page 48

Flows

Notes to the Financial Pages 49 - 63

Statements

Anglesey Mining Annual Report Group Income Statement Page 35

for the year to 31 March 2020

Group Statement of Page 35

Comprehensive Income

Group Statement of Financial Page 36

Position

Company Statement of Page 37

Financial Position

Statement of Changes in Page 38

Equity

Group Statement of Cash Flows Page 39

Company Statement of Cash Page 40

Flows

Notes to the Financial Pages 41 - 55

Statements

Anglesey Mining Annual Report Group Income Statement Page 27

for the year to 31 March 2019

Group Statement of Page 27

Comprehensive Income

Group Statement of Financial Page 28

Position

Company Statement of Page 29

Financial Position

Statement of Changes in Page 30

Equity

Group Statement of Cash Flows Page 31

Company Statement of Cash Page 32

Flows

Notes to the Financial Pages 33 - 49

Statements

7.2 Mazars LLP of Tower Bridge House, St Katharine's Way, London E1W

1DD, United Kingdom are the current auditors of the Company.

8. Dividend policy

The Group does not pay a dividend.

9. Litigation and arbitration

Neither the Company nor any other member of the Group is, nor has it been at

any time during the 12 months immediately preceding the date of this Appendix,

involved in any governmental, legal or arbitration proceedings, which may have,

or have had in the recent past, a significant effect on the Company's and/or

the Group's financial position or profitability and there are no such

proceedings of which the Company is aware which are pending or threatened.

10. Material contracts

The following are all of the contracts (not being contracts entered into in the

ordinary course of business) that have been entered into by the Group in the

two years prior to the date of this Appendix and are, or may be, material to

the Group or have been entered into by any member of the Group at any time and

contain obligations or entitlements which are, or may be, material to the

Group, in each case as at the date of this Appendix:

10.1 Nominated Adviser and Broker Agreement

On 9 March 2022, the Company entered into an agreement with Davy under which

Davy agreed to act as nominated adviser and broker to the Company, as required

under the AIM Rules for Companies. Following Admission, the Nominated Adviser

and Broker Agreement is terminable by either party on sixty days' notice and

Davy will be entitled to terminate the agreement in certain customary

circumstances, including if there has been a material breach by the Company of

its obligations under the agreement or if the Ordinary Shares cease to be

admitted to trading on AIM. The Company has given customary undertakings,

warranties and indemnities to Davy.

10.2 Project Development and Cooperation Agreement

On 26 November 2018, the Company entered into an agreement with QME Mining

Technical Services ("QME"), a division of QME Ltd pursuant to which QME agreed

to carry out an agreed programme of design, engineering and optimisation

studies relating to the future development of Parys Mountain. Subsequent to the

agreement, QME carried out a detailed review of various development and mining

alternatives for Parys Mountain and delivered the results to the Company. In

consideration for services rendered, the Company has granted QME various rights

and options relating to the future development of Parys Mountain, including:

(i) awarding exclusive contracts for the development of the decline and

underground mind development on terms to be agreed;

(ii) in the event that the Company and QME are not able to agree terms AYM may

offer such contracts to third parties, subject to a right of first refusal in

favour of QME, and subject to a payment by AYM to QME, upon the award of such

contracts to a third-party, of a break-fee; and

(iii) a right and option granted to QME, upon completion of the pre-feasibility

study to undertake, at QME's cost and investment, the mine development

component of the Parys Mountain project, including decline and related

underground development and shaft development, with a scope to be agreed, to

the point of commencement of production, in consideration of which QME would

earn a 30% undivided joint venture interest in the Parys Mountain project.

11. Corporate governance

11.1 Up to the date of AIM Admission, the recognised corporate governance

code that the Board has been and will be applying is the UK Corporate

Governance Code. The Corporate Governance Report is set out on pages 29 to 34

of the 2021 Annual Report and outlines how the Company seeks to apply the

Principles of the UK Corporate Governance Code under five sections, the actions

the Company has taken and some resulting outcomes.

11.2 The recognised corporate governance code that the Board will comply

with following the AIM Admission is the QCA Code.

12. The Takeover Code and the Companies Act

12.1 Mandatory takeover bids

(i) The Takeover Code applies to all takeover and merger transactions in

relation to the Company and operates principally to ensure that shareholders

are treated fairly and are not denied an opportunity to decide on the merits of

a takeover and that shareholders of the same class are afforded equivalent

treatment. The Takeover Code provides an orderly framework within which

takeovers are conducted and the Takeover Panel has now been placed on a

statutory footing.(ii) The Takeover Code is based upon a number of General Principles which are

essentially statements of standards of commercial behaviour. General Principle

One states that all holders of securities of an offeree company of the same

class must be afforded equivalent treatment and if a person acquires control of

a company, the other holders of securities must be protected. This is

reinforced by Rule 9 of the Takeover Code which requires a person, together

with persons acting in concert with him, who acquires shares carrying voting

rights which amount to 30 per cent. or more of the voting rights to make a

general offer. "Voting rights" for these purposes means all the voting rights

attributable to the share capital of a company which are currently exercisable

at a general meeting. A general offer will also be required where a person who,

together with persons acting in concert with him, holds not less than 30 per

cent. but not more than 50 per cent. of the voting rights, acquires additional

shares which increase his percentage of the voting rights. Unless the Takeover

Panel consents, the offer must be made to all other shareholders, be in cash

(or have a cash alternative) and cannot be conditional on anything other than

the securing of acceptances which will result in the offeror and persons acting

in concert with him holding shares carrying more than 50 per cent. of the

voting rights.

(iii) There are not in existence any current mandatory takeover bids in

relation to the Company.

12.2 Squeeze out

Section 979 of the Companies Act provides that if, within certain time limits,

an offer is made for the share capital of the Company, the offeror is entitled

to acquire compulsorily any remaining shares if it has, by virtue of

acceptances of the offer, acquired or unconditionally contracted to acquire not

less than 90 per cent. in value of the shares to which the offer relates and in

a case where the shares to which the offer relates are voting shares, not less

than 90 per cent. of the voting rights carried by those shares. The offeror

would effect the compulsory acquisition by sending a notice to any remaining

minority shareholders telling them that it will compulsorily acquire their

shares and then, six weeks from the date of the notice, pay the consideration

for the shares to the Company to hold on trust for such shareholders. The

consideration offered to shareholders whose shares are compulsorily acquired

under the Companies Act must, in general, be the same as the consideration

available under the takeover offer.

12.3 Sell out

Section 983 of the Companies Act permits a minority shareholder to require an

offeror to acquire its shares if the offeror has acquired or contracted to

acquire shares in the Company which amount to not less than 90 per cent. in

value of all the voting shares in the Company and carry not less than 90 per

cent. of the voting rights. Certain time limits apply to this entitlement. If a

shareholder exercises its rights under these provisions the offeror is bound to

acquire those shares on the terms of the offer or on such other terms as may be

agreed.

13. Taxation

The following summary is intended as a general guide only for Shareholders who

are UK tax resident as to their tax position under current UK tax legislation

and HMRC practice as at the date of this Appendix. Such law and practice

(including, without limitation, rates of tax) is in principle subject to change

at any time.

The Company is at the date of this Appendix resident for tax purposes in the

United Kingdom and the following is based on that status.

This summary is not a complete and exhaustive analysis of all the potential UK

tax consequences for holders of Ordinary Shares. It addresses certain limited

aspects of the UK taxation position applicable to shareholders resident and

domiciled for tax purposes in the United Kingdom (except in so far as express

reference is made to the treatment of non-UK residents) and who are absolute

beneficial owners of their Ordinary Shares (as applicable) and who hold their

Ordinary Shares as an investment and not as party to an arrangement that would

produce a return that is economically equivalent to interest or which has the

main purpose, or one of the main purposes, the obtaining of a tax advantage.

This summary does not address the position of certain classes of shareholders

who (together with associates) have a 10 per cent. or greater interest in the

Company, or such as dealers in securities, market makers, brokers,

intermediaries, collective investment schemes, pension funds, charities or UK

insurance companies or whose shares are held under a self-invested personal

pension or an individual savings account or are 'employment related securities'

as defined in section 421B of the Income Tax (Earnings and Pensions) Act 2003.

Any person who is in any doubt as to his tax position or who is subject to

taxation in a jurisdiction other than the United Kingdom should consult his or

her professional advisers immediately as to the taxation consequences of his or

her ownership and disposition of Ordinary Shares.

This summary is based on current United Kingdom tax legislation. Shareholders

should be aware that future legislative, administrative and judicial changes

could affect the taxation consequences described below.

13.1 Taxation of Dividends

Under current UK taxation legislation, there is no UK withholding tax on

dividends, including cases where dividends are paid to a shareholder who is not

resident (for tax purposes) in the United Kingdom.

UK tax resident and domiciled or deemed domiciled individual shareholders

All dividends received from the Company by an individual shareholder who is

resident and domiciled (or deemed domiciled) in the UK will, except to the

extent that they are earned through an ISA, self-invested pension plan or other

regime which exempts the dividend from tax, form part of the shareholder's

total income for income tax purposes and will represent the highest part of

that income.

A nil rate of income tax applies to the first £2,000 of dividend income

received by an individual shareholder in a tax year (the "Nil Rate Amount"),

regardless of what tax rate would otherwise apply to that dividend income. If

an individual receives dividends in excess of this allowance in a tax year, the

excess will be taxed at 7.5 per cent (due to increase to 8.75 per cent on 6

April 2022). (for individuals not liable to tax at a rate above the basic

rate), 32.5 per cent. (due to increase to 33.75 per cent on 6 April 2022) (for

individuals subject to the higher rate of income tax) and 38.1 per cent. (due

to increase to 39.35 per cent on 6 April 2022) (for individuals subject to the

additional rate of income tax) for 2020/21.

To the extent that total income exceeds any remaining standard rate band

(maximum £1,000), trustees of discretionary trusts receiving dividends from

shares are liable to account for income tax at the dividend trust rate,

currently 38.1 per cent (due to increase to 39.35 per cent on 6 April 2022) (a

rate of 7.5 per cent (8.75 per cent from 6 April 2022)) applies to dividend

income within the standard rate band). Trustees do not qualify for the £2,000

dividend allowance available to individuals. This is a complex area and

trustees of such trusts should consult their own tax advisers.

UK pension funds and charities are generally exempt from tax on dividends which

they receive.

Corporate shareholders within the charge to UK corporation tax

Shareholders within the charge to UK corporation tax which are 'small

companies' for the purposes of Chapter 2 of Part 9A of the Corporation Tax Act

2009 will generally not be subject to UK corporation tax on any dividend

received provided certain conditions are met (including an anti-avoidance

condition).

A UK resident corporate shareholder (which is not a 'small company' for the

purposes of the UK taxation of dividends legislation in Part 9A of the

Corporation Tax Act 2009) will be liable to UK corporation tax (currently at a

rate of 19 per cent as from 1 April 2020) unless the dividend falls within one

of the exempt classes set out in Part 9A. Examples of exempt classes (as

defined in Chapter 3 of Part 9A of the Corporation Tax Act 2009) include

dividends paid on shares that are 'ordinary shares' (that is shares that do not

carry any present or future preferential right to dividends or to the Company's

assets on its winding up) and which are not 'redeemable', and dividends paid to

a person holding less than 10 per cent. of the issued share capital of the

payer (or any class of that share capital in respect of which the distribution

is made). However, the exemptions are not comprehensive and are subject to

various conditions and anti-avoidance rules.

Non-resident shareholders

Non-UK resident corporate shareholders are not generally subject to UK tax on

dividend receipts.

Non-UK resident individual shareholders who receive a dividend from the Company

are treated as having paid UK income tax on their dividend income at the

dividend ordinary rate (7.5 per cent, due to increase to 8.75 per cent on 6

April 2022). Such income tax will not be repayable to a non-UK resident

individual shareholder. A non-UK resident individual shareholder is not

generally subject to further UK tax on dividend receipts.

Non-UK resident shareholders may however be subject to taxation on dividend

income under local law, in their country or jurisdiction of residence and/or

citizenship. Non-UK resident shareholders should consult their own tax advisers

in respect of the application of such provisions, their liabilities on dividend

payments and/or what relief or credit may be claimed in the jurisdiction in

which they are resident.

13.2 Taxation of Chargeable Gains

Individual Shareholders

If an individual shareholder is within the charge to UK capital gains tax, a

disposal (or deemed disposal) of all or some of his or her Ordinary Shares may

give rise to a chargeable gain or an allowable loss for the purposes of capital

gains tax, depending on his or her circumstances. The rate of capital gains tax

on disposal of shares is 10 per cent. (current and proposed 2022/2023) for

individuals who are subject to income tax at the basic rate and 20 per cent.

(current and proposed for 2022/2023) for individuals who are subject to income

tax at the higher or additional rates. An individual shareholder is entitled to

realise an annual exempt amount (£12,300 from 6 April 2022).

Corporate Shareholders

For a corporate shareholder within the charge to UK corporation tax, a disposal

(or deemed disposal) of Ordinary Shares may give rise to a chargeable gain at

the rate of corporation tax applicable to that shareholder (currently 19 per

cent, due to increase to 25 per cent from 1 April 2023) or an allowable loss

for the purposes of UK corporation tax. Indexation allowance may reduce the

amount of chargeable gain that is subject to corporation tax by increasing the

chargeable gains tax base cost of an asset in accordance with the rise in the

retail prices index from the month of acquisition up to 31 December 2017.

Indexation allowance is currently 'frozen' so that it does not increase the

chargeable gains tax base cost for any period from 1 January 2018 onwards, even

if the date of disposal occurs at a later point in time.

Non-resident shareholders

A shareholder who is not resident in the United Kingdom for tax purposes, but

who carries on a trade, profession or vocation in the United Kingdom through a

permanent establishment (where the shareholder is a company) or through a

branch or agency (where the shareholder is not a company) and has used, held or

acquired the Ordinary Shares for the purposes of such trade, profession or

vocation or such permanent establishment, branch or agency (as appropriate) may

be subject to UK tax on capital gains on the disposal of Ordinary Shares.

In addition, holders of Ordinary Shares who are individuals and who dispose of

Ordinary Shares while they are temporarily non-resident may be treated as

disposing of them in the tax year in which they again become resident in the

United Kingdom.

13.3 Inheritance Tax

Individual and trustee Shareholders domiciled or deemed to be domiciled in any

part of the United Kingdom may be liable on occasions to inheritance tax

("IHT") on the value of any Ordinary Shares held by them. Under current law,

the primary occasions on which IHT is charged are on the death of the

Shareholder, on any gifts made during the seven years prior to the death of the

Shareholder (which will also be brought into account when calculating the IHT

on the death of the Shareholder), and on certain lifetime transfers, including

transfers to trusts or appointments out of trusts to beneficiaries, save in

very limited and exceptional circumstances.

However, a relief from IHT known as business property relief ("BPR") may apply

to ordinary shares or preference shares in unlisted trading companies once

these have been held with such status for two years by the Shareholder. This

relief may apply notwithstanding that a company's shares will be admitted to

trading on AIM (although it does not apply to companies whose shares are listed

on the Official List, which was the case for the Ordinary Shares prior to

admission to AIM). BPR operates by reducing the value of shares by 100 per

cent. for IHT purposes which means that there will be no IHT to pay.

Shareholders should consult an appropriate professional adviser if they intend

to make a gift of any kind or intend to hold any Ordinary Shares through trust

arrangements. They should also seek professional advice in a situation where

there is a potential for a double charge to UK IHT and an equivalent tax in

another country.

13.4 Stamp Duty and Stamp Duty Reserve Tax ("SDRT")

Neither UK stamp duty nor SDRT should arise on transfers of Ordinary Shares on

AIM (including instruments transferring Ordinary Shares and agreements to

transfer Ordinary Shares) based on the following assumptions:

(i) the Ordinary Shares are admitted to trading on AIM, but are not listed on

any market (with the term 'listed' being construed in accordance with section

99A of the Finance Act 1986) , and this has been certified to Euroclear; and

(ii) AIM continues to be accepted as a 'recognised growth market' (as construed

in accordance with section 99A of the Finance Act 1986). In the event that

either of the above assumptions does not apply, stamp duty or SDRT may apply to

transfers of Ordinary Shares in certain circumstances, at the rate of 0.5 per

cent. of the amount or value of the consideration (rounded up in the case of

stamp duty to the nearest £5).

13.5 AIM

Companies whose shares trade on AIM are deemed unlisted for the purposes of

certain areas of UK taxation. Following the AIM Admission, Ordinary Shares held

by individuals for at least two years from the AIM Admission may qualify for

more generous exemptions from inheritance tax on death or in relation to

lifetime transfers of those Ordinary Shares. Shareholders should consult their

own professional advisers on whether an investment in an AIM security is

suitable for them, or whether the tax benefit referred to above may be

available to them.

The comments set out above are intended only as a general guide to the current

tax position in the United Kingdom at the date of this Appendix. The rates and

basis of taxation can change and will be dependent on a shareholder's personal

circumstances.

Neither the Company nor its advisers warrant in any way the tax position

outlined above which, in any event, is subject to changes in the relevant

legislation and its interpretation and application.

14. Related party transactions

Details of related party transactions are set out in note 14 to the 2021

Interim Report & Accounts, in note 24 to the 2021 Annual Report & Accounts, in

note 24 to 2020 Annual Report & Accounts and in note 25 to the 2019 Annual

Report & Accounts.

15. Investments

Details of the Group's investments are set out in note 10 to the 2021 Interim

Report & Accounts, in note 13 to the 2021 Annual Report & Accounts, in note 13

to the 2020 Annual Report & Accounts and in note 13 to the 2019 Annual Report &

Accounts.

16. Employees

For the six months ended 30 September 2021, the Group had one full-time

employee.

17. General

17.1 Davy has given and not withdrawn its written consent to the issue of

this Appendix with the inclusion of its name and references to it in the form

and context in which it is included.

17.2 The independent Preliminary Economic Assessment ("PEA") on the Parys

Mountain project completed by Micon International Limited and a letter by Micon

International Limited stating that there had been no significant change to the

PEA as at 7 March 2022 are incorporated by reference in full into this document

and are available on the Company's website at www.angleseymining.co.uk.

17.3 No public takeover bids have been made by third parties in respect of

the Company's issued share capital during the six months ended 30 September

2021 or during the current accounting period up to the date of this Appendix.

17.4 There are no environmental issues that affect the Group's utilisation

of its tangible fixed assets.

17.5 Save as disclosed in the Company's Public Record, the Directors are

not aware of any known trends, uncertainties, demands, commitments, or events

that are reasonably likely to have a material effect on the Company's prospects

for at least the current financial year.

- Ends -

END

(END) Dow Jones Newswires

March 11, 2022 05:00 ET (10:00 GMT)

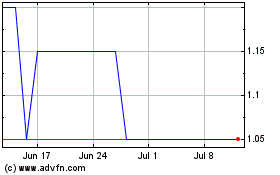

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Aug 2024 to Sep 2024

Anglesey Mining (AQSE:AYM.GB)

Historical Stock Chart

From Sep 2023 to Sep 2024