0000870826

false

0000870826

2023-06-25

2023-06-25

0000870826

us-gaap:CommonStockMember

2023-06-25

2023-06-25

0000870826

imbi:SeniorNotes8.50PercentDue2026Member

2023-06-25

2023-06-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 25, 2023

iMedia

Brands, Inc.

(Exact name of registrant as specified in its

charter)

| Minnesota |

|

001-37495 |

|

41-1673770 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

6740

Shady Oak Road,

Eden

Prairie, Minnesota

55344-3433

(Address of principal executive offices)

(952)

943-6000

(Registrant’s telephone number, including

area code)

Not applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| Common

Stock, $0.01 par value |

IMBI |

The Nasdaq Stock Market, LLC |

| 8.50%

Senior Notes due 2026 |

IMBIL |

The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.02 | Termination of a Material Definitive Agreement. |

Background

As previously reported in the Current Report on

Form 8-K filed by iMedia Brands, Inc. (the “Company”) on April 12, 2023, the Company entered into a Forbearance

Agreement, Tenth Amendment to Loan and Security Agreement and Amendment to Fee Letter (the “Amendment”) on April 10,

2023, which amended the Loan and Security Agreement dated July 30, 2021 (as amended, the “Loan and Security Agreement”),

by and among the Company, as the lead borrower, certain of its subsidiaries party thereto as borrowers, Siena Lending Group LLC (“Siena”)

and the other financial institutions party thereto from time to time as lenders, Siena, as agent, and certain additional subsidiaries

of the Company, as guarantors thereunder, and provided that the lenders agreed to forbear from exercising rights and remedies available

as a result of certain existing events of default under the Loan and Security Agreement for a specified period of time. As previously

reported in the Company’s Current Report on Form 8-K filed on May 10, 2023, the forbearance period established by the

Amendment was terminated.

Termination Notice

On June 25, 2023, the Company received a Notice

of Revolving Loan Commitment Termination (the “Termination Notice”) from Siena with respect to the Loan and Security Agreement.

The Termination Notice informed the Company that Siena and the other financial institutions party to the Loan and Security Agreement have

terminated all revolving loan commitments under the Loan and Security Agreement as a result of certain existing events of default and

the termination of the forbearance period under the Amendment. Siena further informed the Company, among other things, that it had determined

that an Early Payment/Termination Premium (as defined in the Loan and Security Agreement) of approximately $1.6 million became payable

by the Company pursuant to the terms of the Loan and Security Agreement as a result of the termination.

| Item 1.03 | Bankruptcy or Receivership. |

Voluntary Petition for Bankruptcy

On June 28, 2023 (the

“Petition Date”), the Company and its U.S. subsidiaries filed a voluntary petition (Case No. 23-10852) (the “Chapter

11 Cases”) for relief under Chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States

Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”).

The Company continues to operate

its business as a “debtor-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable

provisions of the Bankruptcy Code and orders of the Bankruptcy Court. The Company has sought approval of a variety of “first day”

motions containing customary relief intended to enable the Company to continue ordinary course operations during the Chapter 11 Cases.

The Company cannot give any assurance that holders

of the Company’s common stock will receive any payment or other distribution on account of those shares following the Chapter 11

Cases.

Additional information on the Chapter 11 Cases (including

copies of all documents filed in the Chapter 11 Cases) can be found at: https://cases.stretto.com/iMediaBrands

| Item 2.04 | Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement. |

Existing Credit Agreement Events

of Default

The filing of the Chapter

11 Cases constitutes an event of default, and resulted in an immediate acceleration of the obligations arising therefrom, under the Loan

and Security Agreement, dated as of July 30, 2021 by and among the Company, as the lead borrower,

certain of its subsidiaries party thereto as borrowers, Siena Lending Group LLC and the other financial institutions party thereto from

time to time as lenders, Siena Lending Group LLC, as agent, and certain additional subsidiaries of the Company, as guarantors thereunder

(as amended, the “Existing Credit Agreement”). As of the Petition Date, the Company had an aggregate of approximately $19.4

million in outstanding principal and accrued interest under the Existing Credit Agreement.

8.50% Senior Notes due

2026 Event of Default

The filing of the Chapter

11 Cases constitutes an event of default, and resulted in an immediate acceleration of the obligations arising therefrom, under the indenture

governing the Company’s 8.50% Senior Notes due 2026, dated September 28, 2021, by and between the Company and U.S. Bank National

Association (the “Senior Notes”). As of the Petition Date, the Company had an aggregate of approximately $81.7 million in

outstanding principal and accrued interest under the Senior Notes.

Loan Agreement and Promissory Note

Event of Default

The filing of the Chapter 11 Cases constitutes an

event of default, and resulted in an immediate acceleration of the obligations arising therefrom, under each of the Company’s promissory

notes, each dated April 10, 2023, by and between the Company and the purchaser party thereto (the “Promissory Notes”).

As of the Petition Date, the Company had an aggregate of approximately $3.5 million in outstanding principal under the Promissory Notes.

Pursuant to Section 362 of the Bankruptcy

Code, the filing of the Chapter 11 Cases automatically stayed most actions against the Company, including actions to collect indebtedness

incurred prior to the Petition Date or to exercise control over the Company’s property. Subject to certain exceptions under the

Bankruptcy Code, the filing of the Chapter 11 Cases also automatically stayed the continuation of most legal proceedings or the filing

of other actions against or on behalf of the Company or its property to recover on, collect or secure a claim arising prior to the Petition

Date or to exercise control over property of the Company’s bankruptcy estate, unless and until the Bankruptcy Court modifies or

lifts the automatic stay as to any such claim. Notwithstanding the general application of the automatic stay described above, governmental

authorities may determine to continue actions brought under their police and regulatory powers.

| Item 3.01. | Notice

of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of

Listing. |

On June 29, 2023, the Company received written notice (the “Delisting Notice”)

from the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that, as a result

of the Chapter 11 Cases and in accordance with Nasdaq Listing Rules 5101, 5110(b) and IM-5101-1, Nasdaq had determined that the Company's

common stock and Senior Notes will be delisted from Nasdaq. The Company does not intend to appeal this determination.

Trading of the Company’s common stock

and Senior Notes will be suspended at the opening of business on July 10, 2023, and Nasdaq will file a Form 25-NSE with the

Securities and Exchange Commission, which will remove the Company’s common stock and Senior Notes from listing and

registration on Nasdaq.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company cautions that

trading in the Company’s common stock during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks.

Trading prices for the Company’s common stock may bear little or no relationship to the actual recovery, if any, by holders

of the Company’s common stock in the Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and

future investments in its common stock.

Forward-Looking Statements

This document may contain certain “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements contained herein that are

not statements of historical fact, including statements regarding anticipated timing of filings with the Securities and Exchange Commission

are forward-looking. The Company often use words such as anticipates, believes, estimates, expects, intends, seeks, predicts, hopes, should,

plans, will, or the negative of these terms and similar expressions to identify forward-looking statements, although not all forward looking-statements

contain these words. These statements are based on management's current expectations and accordingly are subject to uncertainty and changes

in circumstances. Actual results may vary materially from the expectations contained herein due to various important factors, including

(but not limited to), the Company’s ability to resolve the foregoing matters involving its liquidity and indebtedness. Investors

are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this announcement. The Company

is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements whether as a result

of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: June 29, 2023 |

iMedia Brands, Inc. |

| |

|

|

| |

By: |

/s/ Timothy A. Peterman |

| |

|

Timothy A. Peterman |

| |

|

Chief Executive Officer & Interim Chief Financial Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=imbi_SeniorNotes8.50PercentDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

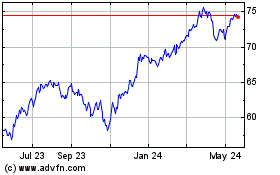

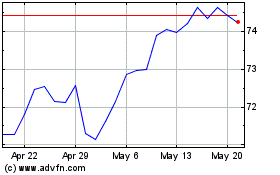

WisdomTree US Value (AMEX:WTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

WisdomTree US Value (AMEX:WTV)

Historical Stock Chart

From Apr 2023 to Apr 2024