2013 turned out to be an excellent year for the equity markets. All

of the ten sectors of the S&P participated in the broad based

rally. The rally was not only limited to the large caps, but

small-cap stocks too participated in the bull market.

In fact, the small-cap stocks delivered better returns than the

large caps. The Russell 2000 Index – which measures the performance

of the small-cap pocket of the U.S. equity market-- added around

39% in 2013, beating the Russell 1000 Index (measuring the

performance of U.S. large-cap stocks) by a 6% margin.

The stellar returns by the small caps were largely due to a

recovering U.S. economy. Normally, smaller companies pick up faster

than the larger ones in a growing economy. The small-cap stocks are

more closely tied to the U.S. economy and generate the majority of

their revenues in the domestic market.

Moreover, the Fed, in spite of announcing that the taper will begin

this month, has indicated that the key interest rate would continue

to remain at a record low for a longer period than what was

previously promised. Thus, small caps around the globe are expected

to continue their upward trend in 2014 as well (read: 5 ETF

Predictions for 2014).

How to Play Small Caps

Although small caps have the potential to offer good returns in a

trending market, these stocks are often blamed for increasing

volatility. A slight drag in the U.S. economy might disrupt the

momentum. Thus, for investors willing to add return to their

portfolio via the equity markets, value stocks within the

small-cap space might be an interesting play.

The small-cap value funds offer exposure to a wide variety of

stocks with value characteristics, such as, low P/B, low P/S and

low P/E ratios, which reduce the risk quotient in a

security (read: Profit from Small Caps with These Value

ETFs).

Given the benefits, a look at this top-ranked, small-cap value ETF

could be a good way to target the best of this segment. One way to

find a top ranked ETF in the small-cap value space is by using the

Zacks ETF Ranking system.

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook for the underlying industry, sector, style

box, or asset class. Our proprietary methodology also takes into

account the risk preferences of investors. ETFs are ranked on a

scale of 1 (Strong Buy) to 5 (Strong Sell) while they also receive

one of three risk ratings, namely, Low, Medium, or High.

The aim of our models is to select the best ETFs within each risk

category. We assign each ETF one of five ranks within each risk

bucket. Thus, the Zacks ETF Rank reflects the expected return of an

ETF relative to other products with a similar level of risk (see:

all the Top Ranked ETFs).

For investors seeking to apply this methodology to their portfolio,

we have taken a closer look below at a Top Ranked ETF in the

small-cap value space, the

SPDR S&P 600 Small Cap Value

ETF (SLYV).

SPDR S&P 600 Small Cap Value ETF (SLYV)

Launched in September 2000, this ETF offers exposure to the

small-cap value sector of the U.S. equity market, by tracking the

S&P SmallCap 600 Value Index. Holding 449 stocks in its basket,

the fund is spread well across individual stocks. None of the

individual securities comprise more than 1% of total

assets.

Centene Corporation (0.93%), Prospect Capital Corporation (0.92%)

and ProAssurance Corporation (0.85%) are the top three holdings of

the fund.

In terms of sector allocations, the top four sectors, namely,

Financials (22.56%), Industrials (17.04%), Technology (15.25%) and

Consumer Discretionary form almost 70% of total fund holdings. At

the other end of the scale, Energy, Consumer Staples and Telecoms

make up the smallest sectors, combining to account for less than

10% of the assets.

The fund is also relatively cheap in its space, charging investors

with just 25 basis points as annual fees. Moreover, the fund has a

dividend yield of 1.07%.

SLYV has performed quite well in 2013 adding 33.86%. Thanks in part

to this stellar performance and a solid outlook, we currently give

SLYV a Zacks ETF Rank of 1 or ‘Strong Buy’ along with a medium risk

rating (read: Time for This Top Ranked Industrial ETF).

This means that we are looking for a decent level of outperformance

from this product in the next few months, over and above similar

funds in the style box world. Thus, if the current trend holds in

the market, investors can surely consider adding this top ranked

small cap value ETF to their portfolio.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-R 2000 (IWM): ETF Research Reports

SPDR-SP6 SC VL (SLYV): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

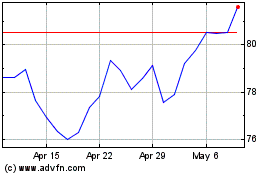

SPDR S&P 600 Small Cap V... (AMEX:SLYV)

Historical Stock Chart

From Mar 2024 to Apr 2024

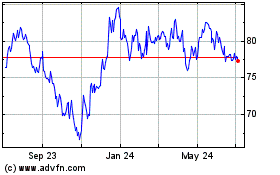

SPDR S&P 600 Small Cap V... (AMEX:SLYV)

Historical Stock Chart

From Apr 2023 to Apr 2024