As filed with the Securities and Exchange Commission on December 7,

2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BIOMX INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

|

82-3364020 |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

22 Einstein St., Floor 4

Ness Ziona, Israel

Telephone: (+972) 72-394-2377

(address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Avraham Gabay

BiomX Inc.

22 Einstein St., Floor 4

Ness Ziona, Israel

Telephone: (+972) 72-394-2377

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Howard E. Berkenblit

Sullivan & Worcester LLP

One Post Office Square

Boston, Massachusetts 02109

(617) 338-2800

Approximate date of commencement of proposed sale to the public: From

time to time after the effective date of this registration statement, as determined by market and other conditions.

If the only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection

with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☒

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states

that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended,

or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains:

| |

● |

A base prospectus, which covers the offering, issuance and sales by us of up to $150,000,000 in the aggregate of the securities identified above from time to time in one or more offerings; and |

| |

● |

A offering agreement prospectus covering the offering, issuance and sale by us of up to a maximum aggregate offering price of up to $7,500,000 of our common stock that may be issued and sold from time to time under an at the market offering agreement, or the offering agreement, with H.C. Wainwright & Co., or Wainwright. |

The base prospectus immediately follows this explanatory note. The

specific terms of any securities to be offered pursuant to the base prospectus will be specified in a prospectus supplement to the base

prospectus.

The offering agreement prospectus immediately follows the base prospectus.

The $7,500,000 of common stock that may be offered, issued and sold under the offering agreement prospectus is included in the $150,000,000

of securities that may be offered, issued and sold by us under the base prospectus. Upon termination of the offering agreement, any portion

of the $7,500,000 included in the offering agreement prospectus that is not sold pursuant to the offering agreement will be available

for sale in other offerings pursuant to the base prospectus, and if no shares are sold under the offering agreement, the full $7,500,000

of securities may be sold in other offerings pursuant to the base prospectus.

The information in this prospectus is

not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

| PROSPECTUS |

Subject

to completion, December 7, 2023 |

$150,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

We may from time to time sell common stock, preferred stock, debt securities,

warrants to purchase common stock, and units of two or more of such securities, in one or more offerings for an aggregate initial offering

price of $150,000,000. We refer to the common stock, the preferred stock, the debt securities, the warrants to purchase common stock and

the units collectively as the securities. This prospectus describes the general manner in which our securities may be offered using this

prospectus. Other than in connection with the exercise of certain outstanding warrants, we will specify in an accompanying prospectus

supplement the terms of the securities to be offered and sold. You should carefully read this prospectus and any accompanying supplements

before you decide to invest in any of these securities.

We may, from time to time, offer to sell the securities, through public

or private transactions, directly or through underwriters, agents or dealers, on or off the NYSE American Stock Market, or the NYSE American,

at prevailing market prices or at privately negotiated prices. If any underwriters, agents or dealers are involved in the sale of any

of these securities, the applicable prospectus supplement will set forth the names of the underwriter, agent or dealer and any applicable

fees, commissions or discounts.

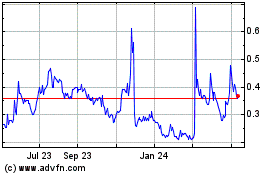

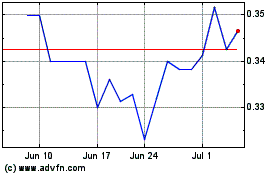

Our common stock is traded on the NYSE American, under the symbol “PHGE”.

On December 5, 2023, the last reported sale price of our common stock on NYSE American was $0.28 per share.

As of December 5, 2023, the aggregate market value worldwide of our

outstanding voting and non-voting common equity held by non-affiliates, as calculated pursuant to the rules of the Securities and Exchange

Commission, was approximately $28,155,047, based on 45,929,930 shares of common stock outstanding held by non-affiliates at a per share

of common stock price of $0.61 based on the closing sale price of our common stock on the NYSE American on November 24, 2023. As of the

date hereof, we have sold or offered 200 shares of common stock for a total of approximately $124 pursuant to General Instruction I.B.6

of Form S-3 during the prior 12 calendar month period that ends on and includes the date hereof. Pursuant to General Instruction I.B.6

of Form S-3, in no event will we sell securities registered on this registration statement of which any prospectus supplement forms a

part in a public primary offering with a value exceeding one-third of our outstanding voting and nonvoting common equity held by non-affiliates

(the “public float”) in any 12-month period so long as our public float remains below $75 million.

Investing in our securities involves risks. See “Risk Factors”

on page 2 of this prospectus. Additional risks will be described in the related prospectus supplements under the heading “Risk Factors”.

You should review that section of the related prospectus supplements for a discussion of matters that investors in our securities should

consider.

Neither the Securities and Exchange Commission, or the SEC, nor

any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus,

any prospectus supplement and the documents incorporated by reference herein or therein, or to which we have referred you. We have not

authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. This prospectus and any prospectus supplement do not constitute an offer to sell, or a solicitation of an offer to purchase,

the securities offered by this prospectus and any prospectus supplement in any jurisdiction to or from any person to whom or from whom

it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained

in this prospectus, any prospectus supplement or any document incorporated by reference is accurate as of any date other than the date

indicated in the applicable document.

Neither the delivery of this prospectus nor any distribution of securities

pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change in the information set

forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our business, financial condition,

results of operations and prospects may have changed since that date.

Our name and logo and the names of our products are our trademarks

or registered trademarks. Unless the context otherwise requires, references in this prospectus to “BiomX,” “we,”

“us,” and “our” refer to BiomX Inc. and its wholly-owned Israeli subsidiary, BiomX Ltd., and RondinX Ltd., an

Israeli company and wholly-owned subsidiary of BiomX Ltd.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with

the SEC using a “shelf” registration process. Under this shelf registration process, we may, from time to time, sell any combination

of the securities described in this prospectus in one or more offerings up to a total dollar amount of $150,000,000. This prospectus describes

the securities we may offer and the general manner in which our securities may be offered by this prospectus. Each time we sell securities

(other than in connection with the exercise of certain outstanding warrants), we will provide a prospectus supplement that will contain

specific information about the terms of that offering. We may also add, update or change in the prospectus supplement any of the information

contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus

supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents

is inconsistent with a statement in another document having a later date - for example, a document incorporated by reference in this prospectus

or any prospectus supplement - the statement in the document having the later date modifies or supersedes the earlier statement.

OUR COMPANY

We are a clinical stage product discovery company developing products

using both natural and engineered phage technologies designed to target and kill specific harmful bacteria associated with chronic diseases,

such as cystic fibrosis, or CF. Bacteriophage or phage are bacterial, species-specific, strain-limited viruses that infect, amplify and

kill the target bacteria and are considered inert to mammalian cells. By utilizing proprietary combinations of naturally occurring phage

and by creating novel phage using synthetic biology, we develop phage-based therapies intended to address both large-market and orphan

diseases.

In our therapeutic programs, we focus on using phage therapy to target

specific strains of pathogenic bacteria that are associated with diseases. Our phage-based product candidates are developed utilizing

our proprietary research and development platform named BOLT. The BOLT platform is unique, employing cutting edge methodologies and capabilities

across disciplines including computational biology, microbiology, synthetic engineering of phage and their production bacterial hosts,

bioanalytical assay development, manufacturing and formulation, to allow agile and efficient development of natural or engineered phage

combinations, or cocktails. The cocktail contains phage with complementary features and is optimized for multiple characteristics such

as broad target host range, ability to prevent resistance, biofilm penetration, stability and ease of manufacturing.

Our goal is to develop multiple products based on the ability of phage

to precisely target harmful bacteria and on our ability to screen, identify and combine different phage, both naturally occurring and

created using synthetic engineering, to develop these treatments.

Corporate Information

We were incorporated as a Delaware corporation

in 2017. We have a wholly owned subsidiary in Israel called BiomX Ltd. Our executive offices are located at 22 Einstein St., Floor 4,

Ness Ziona, Israel, our telephone number is +972 723 942 377 and our website address is www.biomx.com. This reference to our website is

an inactive textual reference only and is not a hyperlink. The information on our website is not incorporated by reference in this prospectus

and should not be considered to be part of this prospectus. You should not consider the contents of our website in making an investment

decision with respect to the securities.

RISK FACTORS

An investment in our securities involves significant risks. You should

carefully consider the risk factors below as well as risk factors contained in any prospectus supplement and in our filings with the SEC,

including our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and our quarterly report on Form 10-Q for the quarter

ended September 30, 2023, as well as all of the information contained in this prospectus, any prospectus supplement and the other documents

incorporated by reference herein or therein, before you decide to invest in our securities. Our business, prospects, financial condition

and results of operations may be materially and adversely affected as a result of any of such risks. The value of our securities could

decline as a result of any of these risks. You could lose all or part of your investment in our securities. The risks and uncertainties

we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our business, prospects, financial condition and results of operations.

We conduct our operations in Israel. Conditions in Israel,

including the recent attack by Hamas and other terrorist organizations and Israel’s war against them, may affect our operations.

Our headquarters and principal offices and most of our operations are

located in the State of Israel. In addition, all of our key employees and officers are residents of Israel. Accordingly, political, economic

and military conditions in Israel and the surrounding region may directly affect our business.

Any hostilities involving Israel or the interruption or curtailment

of trade between Israel and its present trading partners, or a significant downturn in the economic or financial condition of Israel,

could affect adversely our operations. Ongoing and revived hostilities or other Israeli political or economic factors could harm our operations,

product development and results of operations.

On October 7, 2023, an unprecedented attack was launched against Israel

by terrorists from the Hamas terrorist organization that infiltrated Israel’s southern border from the Gaza Strip and in other

areas within the state of Israel attacking civilians and military targets while simultaneously launching extensive rocket attacks on the

Israeli population. These attacks resulted in extensive deaths, injuries and kidnapping of civilians and soldiers. In response, the Security

Cabinet of the State of Israel declared war against Hamas and a military campaign against these terrorist organizations commenced in parallel

to their continued rocket and terror attacks. To date, the State of Israel continues to be at war with Hamas.

Since the war broke out on October 7, 2023, our operations have not

been adversely affected by this situation. However, at this time, it is not possible to predict the intensity or duration of the war,

nor can we predict how this war will ultimately affect Israel’s economy in general and we continue to monitor the situation closely and

examine the potential disruptions that could adversely affect our operations.

In connection with the Israeli security cabinet’s declaration

of war against Hamas and possible hostilities with other organizations, several hundred thousand Israeli military reservists were drafted

to perform immediate military service. While none of our material employees in Israel have been called to active military duty, we rely

on service providers located in Israel and have entered into certain agreements with Israeli counterparties. Employees of such service

providers or contractual counterparties may be called for service in the current or future wars or other armed conflicts with Hamas and

such persons may be absent from their positions for a period of time. As of December 5, 2023, we have not been impacted by any absences

of personnel at our service providers or counterparties located in Israel. However, military service call ups that result in absences

of personnel from us, our service providers or contractual counterparties in Israel may disrupt our operations and absences for an extended

period of time may materially and adversely affect our business, prospects, financial condition and results of operations.

Following the attack by Hamas on Israel’s southern border, Hezbollah,

a terrorist organization in Lebanon has also launched missile, rocket, and shooting attacks against Israeli military sites, troops, and

Israeli towns in northern Israel. In response to these attacks, the Israeli army has carried out a number of targeted strikes on sites

belonging to Hezbollah in southern Lebanon. It is possible that other terrorist organizations, including Palestinian military organizations

in the West Bank, as well as other hostile countries, such as Iran, will join the hostilities. Such hostilities may include terror and

missile attacks. Any hostilities involving Israel or the interruption or curtailment of trade between Israel and its trading partners

could adversely affect our operations and results of operations. Our insurance policies do not cover losses that may occur as a result

of events associated with war and terrorism. Although the Israeli government currently covers the reinstatement value of direct damages

that are caused by terrorist attacks or acts of war, we cannot assure you that this government coverage will be maintained or that it

will sufficiently cover our potential damages. Any losses or damages incurred by us could have a material adverse effect on our business.

Any armed conflicts or political instability in the region would likely negatively affect business conditions and could harm our results

of operations.

Several countries, principally in the Middle East, still restrict doing

business with Israel and Israeli companies, and additional countries may impose restrictions on doing business with Israel and Israeli

companies, whether as a result of hostilities in the region or otherwise. In addition, there have been increased efforts by activists

to cause companies, research institutions and consumers to boycott Israeli goods and cooperation with Israeli-related entities based on

Israeli government policies. Such actions, particularly if they become more widespread, may adversely impact our ability to cooperate

with research institutions and collaborate with other third parties. Any hostilities involving Israel, any interruption or curtailment

of trade or scientific cooperation between Israel and its present partners, or a significant downturn in the economic or financial condition

of Israel could adversely affect our business, financial condition and results of operations. We may also be targeted by cyber terrorists

specifically because we are an Israeli-related company.

Prior to the Hamas attack in October 2023, the Israeli government pursued

extensive changes to Israel’s judicial system. In response to the foregoing developments, individuals, organizations and institutions,

both within and outside of Israel, have voiced concerns that the proposed changes may negatively impact the business environment in Israel

including due to reluctance of foreign investors to invest or transact business in Israel as well as to increased currency fluctuations,

downgrades in credit rating, increased interest rates, increased volatility in securities markets, and other changes in macroeconomic

conditions. The risk of such negative developments has increased in light of the recent Hamas attacks and the war against Hamas declared

by Israel, regardless of the proposed changes to the judicial system and the related debate. To the extent that any of these negative

developments do occur, they may have an adverse effect on our business, our results of operations and our ability to raise additional

funds, if deemed necessary by our management and board of directors.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

This prospectus, any prospectus supplement and the documents we incorporate

by reference herein or therein include “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange

Act of 1934, as amended, or the Exchange Act, and other securities laws. The statements contained herein that are not purely historical,

are forward-looking statements. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions,

assumptions and other statements that are not historical facts. Words or phrases such as “anticipate,” “believe,”

“continue,” “estimate,” “expect,” “intend,” “may,” “ongoing,”

“plan,” “potential,” “predict,” “project,” “will” or similar words or phrases,

or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily

mean that a statement is not forward-looking. For example, we are making forward-looking statements when we discuss our business strategy

and plans, our clinical and pre-clinical development program, including timing, milestones and the design thereof, including acceptance

of regulatory agencies of such design, the potential opportunities for and benefits of the BacteriOphage Lead to Treatment, or BOLT, platform,

the potential of our product candidates and the sufficiency of financial resources and financial needs and ability to continue as a going

concern. However, you should understand that these statements are not guarantees of performance or results, and there are a number of

risks, uncertainties and other important factors that could cause our actual results to differ materially from those expressed in the

forward-looking statements, including, among others:

| |

● |

the ability to generate revenues, and raise sufficient financing to meet working capital requirements; |

| |

● |

our ability to continue as a going concern absent access to sources of liquidity; |

| |

● |

the unpredictable timing and cost associated with our approach to developing product candidates using phage technology; |

| |

● |

military, political and economic instability in the state of Israel, and in particular, the war situation in Israel that was declared by the security cabinet of the state of Israel; |

| |

● |

political and economic instability, including, without limitation, due to natural disasters or other catastrophic events, such as the Russian invasion of Ukraine and world sanctions on Russia, Belarus, and related parties, terrorist attacks, hurricanes, fire, floods, pollution and earthquakes; |

| |

● |

obtaining U.S. Food Drug Administration, or FDA, acceptance of any non-U.S. clinical trials of product candidates; |

| |

● |

our ability to enroll patients in clinical trials and achieve anticipated development milestones when expected; |

| |

● |

the ability to pursue and effectively develop new product opportunities and acquisitions and to obtain value from such product opportunities and acquisitions; |

| |

● |

penalties and market withdrawal associated with any unanticipated problems with product candidates and failure to comply with labeling and other restrictions; |

| |

● |

expenses associated with compliance with ongoing regulatory obligations and successful continuing regulatory review; |

| |

● |

market acceptance of our product candidates and ability to identify or discover additional product candidates; |

| |

● |

our ability to obtain high titers for specific phage cocktails necessary for preclinical and clinical testing; |

| |

● |

the ability of our product candidates to demonstrate requisite safety and efficacy for drug products, or safety, purity and potency for biologics without causing adverse effects; |

| |

● |

expected benefits from FDA fast track designation for our BX004 product candidate; |

| |

● |

the success of expected future advanced clinical trials of our product candidates; |

| |

● |

our ability to obtain required regulatory approvals; |

| |

● |

delays in developing manufacturing processes for our product candidates; |

| |

● |

the continued impact of general economic conditions, our current low stock price and other factors on our operations, the continuity of our business, including our preclinical and clinical trials, and our ability to raise additional capital; |

| |

● |

competition from similar technologies, products that are more effective, safer or more affordable than our product candidates or products that obtain marketing approval before our product candidates; |

| |

● |

the impact of unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives on our ability to sell product candidates or therapies profitably; |

| |

● |

protection of our intellectual property rights and compliance with the terms and conditions of current and future licenses with third parties; |

| |

● |

infringement on the intellectual property rights of third parties and claims for remuneration or royalties for assigned service invention rights; |

| |

● |

our ability to acquire, in-license or use proprietary rights held by third parties necessary to our product candidates or future development candidates; |

| |

● |

ethical, legal and social concerns about synthetic biology and genetic engineering that may adversely affect market acceptance of our product candidates; |

| |

● |

reliance on third-party collaborators; |

| |

● |

our ability to attract and retain key employees or to enforce the terms of noncompetition agreements with employees; |

| |

● |

the failure to comply with applicable laws and regulations other than drug manufacturing compliance; |

| |

● |

potential security breaches, including cybersecurity incidents; |

| |

● |

other factors described in the documents incorporated by reference in this prospectus and any prospectus supplement. |

The factors discussed herein, including those risks described under

the heading “Risk Factors” herein, in any prospectus supplement and in the documents we incorporate by reference could cause

actual results and developments to be materially different from those expressed in or implied by such statements. In addition, historic

results of scientific research, clinical and preclinical trials do not guarantee that the conclusions of future research or trials would

not suggest different conclusions. Also, historic results referred to in this prospectus, any prospectus supplement and the documents

we incorporate by reference may be interpreted differently in light of additional research, clinical and preclinical trials results. Except

as required by law we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

USE OF PROCEEDS

Unless we otherwise indicate in an applicable prospectus supplement,

we currently intend to use the net proceeds from the sale of the securities for research and product development activities, clinical

trial activities, manufacturing for clinical trials and for preparing our product candidates for commercialization, marketing and business

development, investment in capital equipment and infrastructure, repayment of our debt (including under our Loan and Security Agreement,

dated August 16, 2021, with Hercules Capital, Inc., the terms of which are described in the documents incorporated herein by reference)

and for working capital and other general corporate purposes.

We may set forth additional information on the use of net proceeds

from the sale of securities we offer under this prospectus in a prospectus supplement relating to the specific offering. Pending the application

of the net proceeds, we intend to invest the net proceeds in money market funds and investment securities consisting of U.S. Treasury

notes, or high quality, marketable debt instruments of corporations and government sponsored enterprises subject to any investment policies

our investment committee may determine from time to time.

THE SECURITIES WE MAY OFFER

The descriptions of the securities contained in this prospectus, together

with any applicable prospectus supplement, summarize the material terms and provisions of the various types of securities that we may

offer. We will describe in any applicable prospectus supplement relating to any securities the particular terms of the securities offered

by that prospectus supplement. If we so indicate in any applicable prospectus supplement, the terms of the securities may differ from

the terms we have summarized below. We may also include in any prospectus supplement information, where applicable, about material U.S.

federal income tax consequences relating to the securities, and the securities exchange or market, if any, on which the securities will

be listed.

We may sell from time to time, in one or more offerings, one or more

of the following securities:

| |

● |

warrants to purchase common stock; and |

| |

● |

units of two or more of the securities mentioned above. |

The total initial offering price of all securities that we may issue

in these offerings will not exceed $150,000,000.

DESCRIPTION OF CAPITAL STOCK

The following summary is a description of the material terms

of our share capital. We encourage you to read our Amended and Restated Certificate of Incorporation, as amended, or our Certificate of

Incorporation, and Amended and Restated By-laws, or our Bylaws, which have been filed with the SEC, as well as the applicable provisions

of the General Corporation Law of the State of Delaware, or the DGCL, for more information.

As of December 5, 2023, our authorized capital stock consists of 120,000,000

shares of common stock, of which there were 45,979,930 shares outstanding as of December 5, 2023, and 1,000,000 shares of preferred stock,

none of which are outstanding. The following statements set forth the material terms of our capital stock; however, reference is made

to the more detailed provisions of, and these statements are qualified in their entirety by reference to, our Certificate of Incorporation

and Bylaws, copies of which are referenced as exhibits herein, and the provisions of the DGCL.

Common Stock

Our holders of record of our common stock are entitled to one vote

for each share held on all matters to be voted on by stockholders. Our stockholders have no conversion, preemptive or other subscription

rights and there are no sinking fund or redemption provisions applicable to the shares of common stock. There is no cumulative voting

with respect to the election of directors. Our stockholders are entitled to receive ratable dividends when, as and if declared by our

Board of Directors out of funds legally available therefor.

We have not paid any cash dividends on our common stock to date and

do not intend to pay cash dividends in the foreseeable future. The payment of cash dividends in the future will be dependent upon our

revenues and earnings, if any, capital requirements and general financial condition. The payment of any cash dividends will be within

the discretion of our Board of Directors at such time.

Preferred Stock

There are no shares of preferred stock outstanding. Our Certificate

of Incorporation authorizes the issuance of 1,000,000 shares of preferred stock with such designation, rights and preferences as may be

determined from time to time by our Board of Directors. Accordingly, our Board of Directors is empowered, without stockholder approval,

to issue preferred stock with dividend, liquidation, conversion, voting or other rights which could adversely affect the voting power

or other rights of the holders of common stock. In addition, the preferred stock could be utilized as a method of discouraging, delaying

or preventing a change in control of us. Although we do not currently intend to issue any shares of preferred stock, we reserve the right

to do so in the future. No shares of preferred stock are being issued or registered hereunder.

Transfer Agent

The transfer agent for our shares of common stock is Continental Stock

Transfer & Trust Company, 1 State Street 30th Floor New York, NY 10004-156117.

Certain Anti-Takeover Provisions of Delaware Law and our Certificate

of Incorporation and Bylaws

The provisions of DGCL, our Certificate of Incorporation and Bylaws

described below may have the effect of delaying, deferring or discouraging another party from acquiring control of us.

We are subject to the provisions of Section 203 of the DGCL regulating

corporate takeovers. This statute prevents certain Delaware corporations, under certain circumstances, from engaging in a “business

combination” with:

| |

● |

a stockholder who owns 10% or more of our outstanding voting stock (otherwise known as an “interested stockholder”); |

| |

● |

an affiliate of an interested stockholder; or |

| |

● |

an associate of an interested stockholder, for three years following the date that the stockholder became an interested stockholder. |

A “business combination” includes a merger or sale of more

than 10% of our assets. However, the above provisions of Section 203 do not apply if:

| |

● |

our Board of Directors approves the transaction that made the stockholder an “interested stockholder,” prior to the date of the transaction; |

| |

● |

after the completion of the transaction that resulted in the stockholder becoming an interested stockholder, that stockholder owned at least 85% of our voting stock outstanding at the time the transaction commenced, other than statutorily excluded shares of common stock; or |

| |

● |

on or subsequent to the date of the transaction, the business combination is approved by our Board of Directors and authorized at a meeting of our stockholders, and not by written consent, by an affirmative vote of at least two-thirds of the outstanding voting stock not owned by the interested stockholder. |

Special meeting of stockholders

Our Bylaws provide that special meetings of our stockholders may be

called only by a majority vote of our Board of Directors, or by our chief executive officer.

Classified Board of Directors

Our Board of Directors is divided into three classes, each of which

will generally serve for a term of three years with only one class of directors being elected in each year. This system of electing Directors

may tend to discourage a third party from making a tender offer or otherwise attempting to obtain control of us, because it generally

makes it more difficult for stockholders to replace a majority of the Directors.

Advance notice requirements for stockholder proposals and director

nominations

Our Bylaws provide that stockholders seeking to bring business before

our annual meeting of stockholders, or to nominate candidates for election as directors at our annual meeting of stockholders must provide

timely notice of their intent in writing. To be timely, a stockholder’s notice to bring matters before our annual meeting of stockholders

needs to be delivered to our principal executive offices not later than the close of business on the 90th

day nor earlier than the opening of business on the 120th day prior to the scheduled date

of the annual meeting of stockholders, and a stockholder’s notice to nominate candidates for election as directors needs to be delivered

to us not less than 120 days prior to any meeting of stockholders called for the election of directors. Our Bylaws also specify certain

requirements as to the form and content of a stockholders’ notice. These provisions may preclude our stockholders from bringing

matters before our annual meeting of stockholders or from making nominations for directors at our annual meeting of stockholders.

DESCRIPTION OF DEBT SECURITIES

The following description, together with the additional information

we may include in any applicable prospectus supplement, summarizes the material terms and provisions of the debt securities we may offer

under this prospectus. While the terms summarized below will apply generally to any debt securities that we may offer, we will describe

the particular terms of any series of debt securities in more detail in the applicable prospectus supplement. If we so indicate in a prospectus

supplement, the terms of any debt securities offered under that prospectus supplement may differ from the terms we describe below.

We may issue debt securities either separately, or together with, or

upon the conversion or exercise of or in exchange for, other securities described in this prospectus. Debt securities may be our senior,

senior subordinated or subordinated obligations and, unless otherwise specified in a supplement to this prospectus, the debt securities

will be our direct, unsecured obligations and may be issued in one or more series.

The debt securities will be issued under an indenture between us and

a trustee to be named in the applicable indenture, or the indenture. We have summarized select portions of the indenture below. The summary

is not complete. The form of the indenture has been filed as an exhibit to the registration statement of which this prospectus forms a

part and you should read the indenture for provisions that may be important to you. Capitalized terms used in the summary and not defined

herein have the meanings specified in the indenture.

As of December 5, 2023, we have no outstanding registered debt securities.

As used in this section only, “BiomX,” “we,”

“our” or “us” refer to BiomX Inc., excluding our subsidiaries, unless expressly stated or the context otherwise

requires.

General

The terms of each series of debt securities will be established by

or pursuant to a resolution of our Board of Directors and set forth or determined in the manner provided in a resolution of our Board

of Directors, by a supplemental indenture or an Officer’s Certificate. The particular terms of each series of debt securities will

be described in a prospectus supplement relating to such series (including any pricing supplement or term sheet).

We can issue an unlimited amount of debt securities under the indenture

that may be in one or more series with the same or various maturities, at par, at a premium, or at a discount. We will set forth in a

prospectus supplement (including any pricing supplement or term sheet) relating to any series of debt securities being offered, the aggregate

principal amount and the following terms of such debt securities, if applicable:

| |

● |

the title and ranking of the debt securities of such series (including the terms of any subordination provisions); |

| |

● |

the price or prices (expressed as a percentage of the principal amount) at which we will issue the debt securities of such series; |

| |

● |

any limit on the aggregate principal amount of the debt securities of such series; |

| |

● |

the date or dates on which the principal of the debt securities of such series is payable; |

| |

● |

the rate or rates (which may be fixed or variable) per annum or the method used to determine the rate or rates (including any commodity, commodity index, stock exchange index or financial index) at which the debt securities of such series will bear interest, the date or dates from which interest will accrue, the date or dates on which interest will commence and be payable and any regular record date for the interest payable on any interest payment date; |

| |

● |

the place or places where principal of, and interest, if any, on the debt securities of such series will be payable (and the method of such payment), where the debt securities of such series may be surrendered for registration of transfer or exchange, and where notices and demands to us in respect of the debt securities of such series may be delivered; |

| |

● |

the period or periods within which, the price or prices at which and the terms and conditions upon which we may redeem, in whole or in part, the debt securities of such series; |

| |

● |

any obligation we have to redeem or purchase the debt securities of such series pursuant to any sinking fund or analogous provisions or at the option of a holder of debt securities and the period or periods within which, the price or prices at which and in the terms and conditions upon which the debt securities of such series shall be redeemed or purchased, in whole or in part, pursuant to such obligation; |

| |

● |

the dates on which and the price or prices at which we will repurchase debt securities of such series at the option of the holders of such debt securities and other detailed terms and provisions of these repurchase obligations; |

| |

● |

the denominations in which the debt securities of such series will be issued, if other than denominations of $1,000 and any integral multiple thereof; |

| |

● |

whether the debt securities of such series will be issued in the form of certificated debt securities or global debt securities; |

| |

● |

the portion of principal amount of the debt securities of such series payable upon declaration of acceleration of the maturity date, if other than the principal amount; |

| |

● |

the currency of denomination of the debt securities of such series, which may be Dollars or any Foreign Currency, and if such currency of denomination is a composite currency, the agency or organization, if any, responsible for overseeing such composite currency; |

| |

● |

the designation of the currency, currencies or currency units in which payment of principal of, premium and interest on the debt securities of such series will be made; |

| |

● |

if payments of principal of, premium or interest on the debt securities of such series will be made in one or more currencies or currency units other than that or those in which such debt securities are denominated, the manner in which the exchange rate with respect to these payments will be determined; |

| |

● |

the manner in which the amounts of payment of principal of, premium, if any, or interest on the debt securities of such series will be determined, if these amounts may be determined by reference to an index based on a currency or currencies or by reference to a commodity, commodity index, stock exchange index or financial index; |

| |

● |

any provisions relating to any security provided for the debt securities of such series; |

| |

● |

any addition to, deletion of or change in the Events of Default described in this prospectus or in the indenture with respect to the debt securities of such series and any change in the acceleration provisions described in this prospectus or in the indenture with respect to such debt securities; |

| |

● |

any addition to, deletion of or change in the covenants described in this prospectus or in the indenture with respect to the debt securities of such series; |

| |

● |

any depositaries, interest rate calculation agents, exchange rate calculation agents or other agents with respect to the debt securities of such series; |

| |

● |

the provisions, if any, relating to conversion or exchange of any debt securities of such series, including if applicable, the conversion or exchange price and period, provisions as to whether conversion or exchange will be mandatory, at the option of holders or at our option, the events requiring an adjustment of the conversion or exchange price and provisions affecting conversion or exchange; |

| |

● |

any other terms of the debt securities of such series, which may supplement, modify or delete any provision of the indenture as it applies to that series, including any terms that may be required under applicable law or regulations or advisable in connection with the marketing of such debt securities; and |

| |

● |

whether any of our direct or indirect subsidiaries will guarantee the debt securities of that series, including the terms of subordination, if any, of such guarantees. |

We may issue debt securities that provide for an amount less than their

stated principal amount to be due and payable upon declaration of acceleration of their maturity pursuant to the terms of the indenture.

We will provide you with information on the federal income tax considerations and other special considerations applicable to any of these

debt securities in the applicable prospectus supplement.

If we denominate the purchase price of any debt securities in a foreign

currency or currencies or a foreign currency unit or units, or if the principal of and any premium and interest on any series of debt

securities is payable in a foreign currency or currencies or a foreign currency unit or units, we will provide you with information on

the restrictions, elections, general tax considerations, specific terms and other information with respect to that issue of debt securities

and such foreign currency or currencies or foreign currency unit or units in the applicable prospectus supplement.

Transfer and Exchange

Each debt security will be represented by either one or more global

securities registered in the name of The Depository Trust Company, or the Depositary, or a nominee of the Depositary (we will refer to

any debt security represented by a global debt security as a “book-entry debt security”), or a certificate issued in definitive

registered form (we will refer to any debt security represented by a certificated security as a “certificated debt security”)

as set forth in the applicable prospectus supplement. Except as set forth under the heading “Global Debt Securities” below,

book-entry debt securities will not be issuable in certificated form.

Certificated Debt Securities. You may transfer or exchange certificated

debt securities at any office we maintain for this purpose in accordance with the terms of the indenture. No service charge will be made

for any transfer or exchange of certificated debt securities, but we may require payment of a sum sufficient to cover any tax or other

governmental charge payable in connection with a transfer or exchange.

You may effect the transfer of certificated debt securities and the

right to receive the principal of, premium and interest on certificated debt securities only by surrendering the certificate representing

those certificated debt securities and either reissuance by us or the trustee of the certificate to the new holder or the issuance by

us or the trustee of a new certificate to the new holder.

Global Debt Securities and Book-Entry System. Each global debt security

representing book-entry debt securities will be deposited with, or on behalf of, the Depositary, and registered in the name of the Depositary

or a nominee of the Depositary. Please see “Global Debt Securities.”

Covenants

We will set forth in the applicable prospectus supplement any restrictive

covenants applicable to any issue of debt securities.

No Protection in the Event of a Change of Control

Unless we state otherwise in the applicable prospectus supplement,

the debt securities will not contain any provisions which may afford holders of the debt securities protection in the event we have a

change in control or in the event of a highly leveraged transaction (whether or not such transaction results in a change in control) which

could adversely affect holders of debt securities.

Consolidation, Merger and Sale of Assets

We may not consolidate with or merge with or into, or convey, transfer

or lease all or substantially all of our properties and assets to any person (a “successor person”) unless:

| |

● |

we are the surviving corporation or the successor person (if other than BiomX) is a corporation organized and validly existing under the laws of any U.S. domestic jurisdiction and expressly assumes our obligations on the debt securities and under the indenture; and |

| |

● |

immediately after giving effect to the transaction, no Default or Event of Default, shall have occurred and be continuing. |

Notwithstanding the above, any of our subsidiaries may consolidate

with, merge into or transfer all or part of its properties to us.

Events of Default

“Event of Default” means with respect to any series of

debt securities, any of the following:

| |

● |

default in the payment of any interest upon any debt security of that series when it becomes due and payable, and continuance of such default for a period of 30 days; |

| |

● |

default in the payment of principal or premium, if any, of any debt security of that series at its maturity; |

| |

● |

default in the performance or breach of any other covenant or warranty by us in the indenture (other than a covenant or warranty that has been included in the indenture solely for the benefit of a series of debt securities other than that series), which default continues uncured for a period of 60 days after we receive written notice from the trustee or we and the trustee receive written notice from the holders of not less than a majority in principal amount of the outstanding debt securities of that series as provided in the indenture; |

| |

● |

certain voluntary or involuntary events of bankruptcy, insolvency or reorganization of us; and |

| |

● |

any other Event of Default provided with respect to debt securities of that series that is described in the applicable prospectus supplement. |

No Event of Default with respect to a particular series of debt securities

(except as to certain events of bankruptcy, insolvency or reorganization) will necessarily constitute an Event of Default with respect

to any other series of debt securities. The occurrence of certain Events of Default or an acceleration under the indenture may constitute

an event of default under certain indebtedness of ours or our subsidiaries outstanding from time to time.

We will provide the trustee written notice of any Default or

Event of Default within 30 days of becoming aware of the occurrence of such Default or Event of Default, which notice will describe

in reasonable detail the status of such Default or Event of Default and what action we are taking or propose to take in respect

thereof.

If an Event of Default with respect to debt securities of any series at the time outstanding occurs and is continuing, then

the trustee or the holders of not less than a majority in principal amount of the outstanding debt securities of that series may, by

a notice in writing to us (and to the trustee if given by the holders), declare to be due and payable immediately the principal of

(or, if the debt securities of that series are discount securities, that portion of the principal amount as may be specified in the

terms of that series) and accrued and unpaid interest, if any, on all debt securities of that series. In the case of an Event of

Default resulting from certain events of bankruptcy, insolvency or reorganization, the principal (or such specified amount) of and

accrued and unpaid interest, if any, on all outstanding debt securities will become and be immediately due and payable without any

declaration or other act on the part of the trustee or any holder of outstanding debt securities. At any time after a declaration of

acceleration with respect to debt securities of any series has been made, but before a judgment or decree for payment of the money

due has been obtained by the trustee, the holders of a majority in principal amount of the outstanding debt securities of that

series may rescind and annul the acceleration if all Events of Default, other than the non-payment of accelerated principal and

interest, if any, with respect to debt securities of that series, have been cured or waived as provided in the indenture. We refer

you to the prospectus supplement relating to any series of debt securities that are discount securities for the particular

provisions relating to acceleration of a portion of the principal amount of such discount securities upon the occurrence of an Event

of Default.

The indenture provides that the trustee may refuse to perform any duty

or exercise any of its rights or powers under the indenture unless the trustee receives indemnity satisfactory to it against any cost,

liability or expense which might be incurred by it in performing such duty or exercising such right or power. Subject to certain rights

of the trustee, the holders of a majority in principal amount of the outstanding debt securities of any series will have the right to

direct the time, method and place of conducting any proceeding for any remedy available to the trustee or exercising any trust or power

conferred on the trustee with respect to the debt securities of that series.

No holder of any debt security of any series will have any right to

institute any proceeding, judicial or otherwise, with respect to the indenture or for the appointment of a receiver or trustee, or for

any remedy under the indenture, unless:

| |

● |

that holder has previously given to the trustee written notice of a continuing Event of Default with respect to debt securities of that series; and |

| |

● |

the holders of not less than a majority in principal amount of the outstanding debt securities of that series have made written request, and offered indemnity or security satisfactory to the trustee, to the trustee to institute the proceeding as trustee, and the trustee has not received from the holders of not less than a majority in principal amount of the outstanding debt securities of that series a direction inconsistent with that request and has failed to institute the proceeding within 60 days. |

Notwithstanding any other provision in the indenture, the holder of

any debt security will have an absolute and unconditional right to receive payment of the principal of, premium and any interest on that

debt security on or after the due dates expressed in that debt security and to institute suit for the enforcement of payment.

The indenture requires us, within 120 days after the end of our fiscal

year, to furnish to the trustee a statement as to compliance with the indenture. If a Default or Event of Default occurs and is continuing

with respect to the securities of any series and if it is known to a responsible officer of the trustee, the trustee shall mail to each

Securityholder of the securities of that series notice of a Default or Event of Default within 90 days after it occurs or, if later, after

a responsible officer of the trustee has knowledge of such Default or Event of Default. The indenture provides that the trustee may withhold

notice to the holders of debt securities of any series of any Default or Event of Default (except in payment on any debt securities of

that series) with respect to debt securities of that series if the trustee determines in good faith that withholding notice is in the

interest of the holders of those debt securities.

Modification and Waiver

We and the trustee may modify, amend or supplement the indenture or

the debt securities of any series without the consent of any holder of any debt security:

| |

● |

to cure any ambiguity, defect or inconsistency; |

| |

● |

to comply with covenants in the indenture described above under the heading “Consolidation, Merger and Sale of Assets”; |

| |

● |

to provide for uncertificated securities in addition to or in place of certificated securities; |

| |

● |

to add guarantees with respect to debt securities of any series or secure debt securities of any series; |

| |

● |

to surrender any of our rights or powers under the indenture; |

| |

● |

to add covenants or events of default for the benefit of the holders of debt securities of any series; |

| |

● |

to comply with the applicable procedures of the applicable depositary; |

| |

● |

to make any change that does not adversely affect the rights of any holder of debt securities; |

| |

● |

to provide for the issuance of and establish the form and terms and conditions of debt securities of any series as permitted by the indenture; |

| |

● |

to effect the appointment of a successor trustee with respect to the debt securities of any series and to add to or change any of the provisions of the indenture to provide for or facilitate administration by more than one trustee; or |

| |

● |

to comply with requirements of the SEC in order to effect or maintain the qualification of the indenture under the Trust Indenture Act. |

We may also modify and amend the indenture with the consent of the

holders of at least a majority in principal amount of the outstanding debt securities of each series affected by the modifications or

amendments. We may not make any modification or amendment without the consent of the holders of each affected debt security then outstanding

if that amendment will:

| |

● |

reduce the amount of debt securities whose holders must consent to an amendment, supplement or waiver; |

| |

● |

reduce the rate of or extend the time for payment of interest (including default interest) on any debt security; |

| |

● |

reduce the principal of or premium on or change the fixed maturity of any debt security or reduce the amount of, or postpone the date fixed for, the payment of any sinking fund or analogous obligation with respect to any series of debt securities; |

| |

● |

reduce the principal amount of discount securities payable upon acceleration of maturity; |

| |

● |

waive a default in the payment of the principal of, premium or interest on any debt security (except a rescission of acceleration of the debt securities of any series by the holders of at least a majority in aggregate principal amount of the then outstanding debt securities of that series and a waiver of the payment default that resulted from such acceleration); |

| |

● |

make the principal of or premium or interest on any debt security payable in currency other than that stated in the debt security; |

| |

● |

make any change to certain provisions of the indenture relating to, among other things, the right of holders of debt securities to receive payment of the principal of, premium and interest on those debt securities and to institute suit for the enforcement of any such payment and to waivers or amendments; or |

| |

● |

waive a redemption payment with respect to any debt security. |

Except for certain specified provisions, the holders of at least a

majority in principal amount of the outstanding debt securities of any series may on behalf of the holders of all debt securities of that

series waive our compliance with provisions of the indenture. The holders of a majority in principal amount of the outstanding debt securities

of any series may on behalf of the holders of all the debt securities of such series waive any past default under the indenture with respect

to that series and its consequences, except a default in the payment of the principal of, premium or any interest on any debt security

of that series; provided, however, that the holders of a majority in principal amount of the outstanding debt securities of any series

may rescind an acceleration and its consequences, including any related payment default that resulted from the acceleration.

Defeasance of Debt Securities and Certain Covenants in Certain Circumstances

Legal Defeasance. The indenture provides that, unless otherwise

provided by the terms of the applicable series of debt securities, we may be discharged from any and all obligations in respect of the

debt securities of any series (subject to certain exceptions). We will be so discharged upon the irrevocable deposit with the trustee,

in trust, of money and/or U.S. government obligations or, in the case of debt securities denominated in a single currency other than U.S.

Dollars, government obligations of the government that issued or caused to be issued such currency, that, through the payment of interest

and principal in accordance with their terms, will provide money or U.S. government obligations in an amount sufficient in the opinion

of a nationally recognized firm of independent public accountants or investment bank to pay and discharge each installment of principal,

premium and interest on and any mandatory sinking fund payments in respect of the debt securities of that series on the stated maturity

of those payments in accordance with the terms of the indenture and those debt securities.

This discharge may occur only if, among other things, we have delivered

to the trustee an opinion of counsel stating that we have received from, or there has been published by, the United States Internal Revenue

Service a ruling or, since the date of execution of the indenture, there has been a change in the applicable United States federal income

tax law, in either case to the effect that, and based thereon such opinion shall confirm that, the holders of the debt securities of that

series will not recognize income, gain or loss for United States federal income tax purposes as a result of the deposit, defeasance and

discharge and will be subject to United States federal income tax on the same amounts and in the same manner and at the same times as

would have been the case if the deposit, defeasance and discharge had not occurred.

Defeasance of Certain Covenants. The indenture provides that,

unless otherwise provided by the terms of the applicable series of debt securities, upon compliance with certain conditions:

| |

● |

we may omit to comply with the covenant described under the heading “Consolidation, Merger and Sale of Assets” and certain other covenants set forth in the indenture, as well as any additional covenants which may be set forth in the applicable prospectus supplement; and |

| |

● |

any omission to comply with those covenants will not constitute a Default or an Event of Default with respect to the debt securities of that series (“covenant defeasance”). |

The conditions include:

| |

● |

depositing with the trustee money and/or U.S. government obligations or, in the case of debt securities denominated in a single currency other than U.S. Dollars, government obligations of the government that issued or caused to be issued such currency, that, through the payment of interest and principal in accordance with their terms, will provide money in an amount sufficient in the opinion of a nationally recognized firm of independent public accountants or investment bank to pay and discharge each installment of principal of, premium and interest on and any mandatory sinking fund payments in respect of the debt securities of that series on the stated maturity of those payments in accordance with the terms of the indenture and those debt securities; and |

| |

● |

delivering to the trustee an opinion of counsel to the effect that the holders of the debt securities of that series will not recognize income, gain or loss for United States federal income tax purposes as a result of the deposit and related covenant defeasance and will be subject to United States federal income tax on the same amounts and in the same manner and at the same times as would have been the case if the deposit and related covenant defeasance had not occurred. |

No Personal Liability of Directors, Officers, Employees or Securityholders

None of our past, present or future Directors, officers, employees

or securityholders, as such, will have any liability for any of our obligations under the debt securities or the indenture or for any

claim based on, or in respect or by reason of, such obligations or their creation. By accepting a debt security, each holder waives and

releases all such liability. This waiver and release is part of the consideration for the issue of the debt securities. However, this

waiver and release may not be effective to waive liabilities under U.S. federal securities laws, and it is the view of the SEC that such

a waiver is against public policy.

Global Debt Securities

We may issue the debt securities of a series in whole or in part in

the form of one or more registered global securities that we will deposit with a depositary or with an nominee for a depositary identified

in the applicable prospectus supplement and registered in the name of such depositary or nominee. In such case, we will issue one or more

registered global securities denominated in an amount equal to the aggregate principal amount of all of the debt securities of the series

to be issued and represented by such registered global security or securities.

Unless and until it is exchanged in whole or in part for debt securities

in definitive registered form, a registered global security may not be transferred except as a whole:

| |

● |

by the depositary for such registered global security to its nominee; |

| |

● |

by a nominee of the depositary to the depositary or another nominee of the depositary; or |

| |

● |

by the depositary or its nominee to a successor of the depositary or a nominee of the successor. |

The prospectus supplement relating to a series of debt securities will

describe the specific terms of the depositary arrangement with respect to any portion of such series represented by a registered global

security. We currently anticipate that the following provisions will apply to all depositary arrangements for debt securities:

| |

● |

ownership of beneficial interests in a registered global security will be limited to persons that have accounts with the depositary for the registered global security, those persons being referred to as “participants,” or persons that may hold interests through participants; |

| |

● |

upon the issuance of a registered global security, the depositary for the registered global security will credit, on its book-entry registration and transfer system, the participants’ accounts with the respective principal amounts of the debt securities represented by the registered global security beneficially owned by the participants; |

| |

● |

any dealers, underwriters or agents participating in the distribution of the debt securities will designate the accounts to be credited; and |

| |

● |

ownership of any beneficial interest in the registered global security will be shown on, and the transfer of any ownership interest will be effected only through, records maintained by the depositary for the registered global security (with respect to interests of participants) and on the records of participants (with respect to interests of persons holding through participants). |

The laws of some states may require that certain purchasers of securities

take physical delivery of the securities in definitive form. These laws may limit the ability of those persons to own, transfer or pledge

beneficial interests in registered global securities.

So long as the depositary for a registered global security, or its

nominee, is the registered owner of the registered global security, the depositary, or the nominee, as the case may be, will be considered

the sole owner or holder of the debt securities represented by the registered global security for all purposes under the applicable indenture.

Except as set forth below, owners of beneficial interests in a registered global security:

| |

● |

will not be entitled to have the debt securities represented by a registered global security registered in their names; |

| |

● |

will not receive or be entitled to receive physical delivery of the debt securities in the definitive form; and |

| |

● |

will not be considered the owners or holders of the debt securities under the applicable indenture. |

Accordingly, each person owning a beneficial interest in a registered

global security must rely on the procedures of the depositary or the registered global security and, if the person is not a participant,

on the procedures of a participant through which the person owns its interest, to exercise any rights of a holder under the applicable

indenture.

We understand that under currently existing industry practices, if

we request any action of holders or if an owner of a beneficial interest in a registered global security desires to give or take any action

that a holder is entitled to give or take under an indenture, the depositary for the registered global security would authorize the participants

holding the relevant beneficial interests to give or take the action, and those participants would authorize beneficial owners owning

through those participants to give or take the action or would otherwise act upon the instructions of beneficial owners holding through

them.

We will make payments of principal of and premium, if any, and interest,

if any, on debt securities represented by a registered global security registered in the name of a depositary or its nominee to the depositary

or its nominee, as the case may be, as the registered owners of the registered global security. Neither we nor any trustee or any other

agent of us or a trustee will be responsible or liable for any aspect of the records relating to, or payments made on account of, beneficial

ownership interests in the registered global security or for maintaining, supervising or reviewing any records relating to the beneficial

ownership interests.

We expect that the depositary for any debt securities represented by

a registered global security, upon receipt of any payments of principal and premium, if any, and interest, if any, in respect of the registered

global security, will immediately credit participants’ accounts with payments in amounts proportionate to their respective beneficial

interests in the registered global security as shown on the records of the depositary. We also expect that standing customer instructions

and customary practices will govern payments by participants to owners of beneficial interests in the registered global security held

through the participants, as is now the case with the securities held for the accounts of customers in bearer form or registered in “street

name.” We also expect that any of these payments will be the responsibility of the participants.

No registered global security may be exchanged in whole or in part

for debt securities registered, and no transfer of a registered global security in whole or in part may be registered, in the name of

any person other than the depositary for such registered global security, unless (1) such depositary notifies us that it is unwilling

or unable to continue as depositary for such registered global security or has ceased to be a clearing agency registered under the Securities

Exchange Act of 1934, as amended, or the Exchange Act, and we fail to appoint an eligible successor depositary within 90 days, (2) an

event of default shall have occurred and be continuing with respect to such debt securities, or (3) circumstances, if any, exist in addition

to or in lieu of the foregoing as have been specified for that purpose in an applicable prospectus supplement. In any such case, the affected

registered global security may be exchanged in whole or in part for debt securities in definitive form and the applicable trustee will

register any such debt securities in such name or names as such depositary directs.

We currently anticipate that certain registered global securities will

be deposited with, or on behalf of, The Depository Trust Company, New York, New York, or DTC, and will be registered in the name of Cede

& Co., as the nominee of DTC. DTC has advised us that DTC is a limited-purpose trust company organized under the New York Banking

Law, a “banking organization” within the meaning of the New York Banking Law, a member of the Federal Reserve System, a “clearing

corporation” within the meaning of the New York Uniform Commercial Code and a “clearing agency” registered pursuant to

the provisions of Section 17A of the Exchange Act. DTC holds securities that its participants, or direct participants, deposit with DTC.

DTC also facilitates the post-trade settlement among direct participants of sales and other securities transactions in deposited securities,

through electronic computerized book-entry transfers and pledges between direct participants’ accounts. This eliminates the need for physical

movement of securities certificates. Direct participants include both U.S. and non-U.S. securities brokers and dealers, banks, trust companies,