China Internet ETF: The Best Choice in the Space? - ETF News And Commentary

March 14 2014 - 10:00AM

Zacks

After witnessing 30 years of stellar economic growth, the Chinese

economy has been going through a choppy phase for quite some time

now. If we ignore some occasional upbeat data from the last 1.5

years, one has to question the health of the world’s second largest

economy.

The nation saw weakened growth for 2013 to hit 14-year lows. China

snapped a growth rate of 7.7%, which came a little above the market

expectation of 7.6% expansion. Notably, analysts’ expectations for

growth were the slowest since 1999.

For 2014, the Chinese government has targeted 7.5% growth rate,

though this muted growth projection comes at the cost of new

reforms in China, as per the government, while recent export

figures haven’t helped either (read: China ETFs Tumble to Start

2014).

Quite expectedly, this near-term gloomy outlook has punished most

of the China ETFs this year, as the vast majority are seeing modest

losses to start 2014. However, only one sector -- technology – has

held up pretty well in this downslide, with

Guggenheim

China Technology ETF (CQQQ) and

Global X China

Technology ETF (QQQC) returning just under 10.0%.

And beyond these, the China Internet ETF

CSI China Internet

ETF (KWEB) has also edged past the other two tech ETFs

gaining as much as 21% this year. This is why the space demands

close attention, especially given the broad weakness in other

corners of the Chinese market.

What’s Behind This Bullishness?

China is possibly the most important emerging market and has ample

room for expansion in the technology sector that will support its

journey toward becoming a developed nation. Internet penetration is

still low in China though people are embracing e-commerce

activities and PC sales are increasing, thus urging the nation to

go for further technological advancements.

China recorded 618 million Internet users to close out 2013 and 500

million mobile Internet users. The Internet penetration rate in

China also increased to 45.8% in 2013 from 42.1% in 2012. To

leverage this growing demand in the sector, China aims its

technology sector to contribute 5% of GDP now, 8% in 2015 and 15%

by 2020.

Several market analysts believe that market capitalizations of

Chinese Internet companies are contesting hard with the largest

U.S. and global industry players (read: Guide to China Technology

ETFs).

KWEB in Focus

This ETF is a rather new member in the China ETF space, having

forayed into the market on July 31 of 2013 and accumulated more

than $75.0 million in assets within such a short span. The ETF is

exposed to the companies doing business in the segments like

Internet software, home entertainment and educational software,

commercial or retail services primarily provided online, and

development of mobile Internet software or mobile Internet

services.

All companies are based in China or derive at least 50% of their

revenues from Mainland China. About 60% of the 30-holdings

portfolio is invested in the top 10 stocks indicating that the ETF

carries significant company-specific concentration risk.

Tencent (10.2%), QIHOO 360 (8.8%) and Baidu (7.0%) form the top

three holdings. KWEB charges 68% of expense ratio a year (read:

KraneShares Launches China Internet ETF).

During the launch of this ETF, the issuer noted that since 2000,

Internet spending by urban Chinese has crept up 14% annually as the

country’s rural populace is still migrating to cities thereby

drawing more users to the Internet.

Bottom Line

Bottom Line

From the chart above, we can see that the Chinese Internet ETF has

breezed past the biggest China ETF

iShares FTSE China 25

Index Fund (FXI), as well as

the

iShares MSCI China Index Fund (MCHI) and

SPDR S&P China ETF

(GXC) over the last

three-month period.

While all three broad market ETFs buckled under pressure and lost

for the time frame, the sole Internet-focused ETF, KWEB, soared in

comparison. No ‘hard landing’, no “QE taper”, no “debt issues” held

back the steadily growing Internet segment as well as the broader

tech space of China.

Of late, China has become a turning point (to a large extent) with

its domestic events either promoting stability to the broader

economy, or pushing other markets into a crisis situation. While we

believe that long-term outlook for the nation is still optimistic

as its government resorted to a slew of reformative measures, many

investors seemed wary of having a Chinese investment in their

portfolio in the near term.

Eventually, KWEB might open up an option to earn huge capital

appreciation out of Chinese stocks, and a way to tap into one of

the quickest growing sectors in the economic behemoth (read: China

ETFs Jump on Government Reform Afterglow).

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

GUGG-CHINA TEC (CQQQ): ETF Research Reports

ISHARS-CHINA LC (FXI): ETF Research Reports

KRANS-C CHN INT (KWEB): ETF Research Reports

GLBL-X NDQ CHIN (QQQC): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

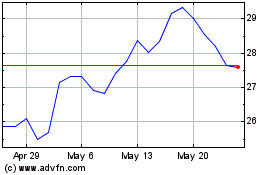

iShares China Large Cap (AMEX:FXI)

Historical Stock Chart

From Apr 2024 to May 2024

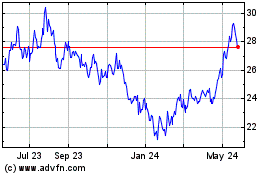

iShares China Large Cap (AMEX:FXI)

Historical Stock Chart

From May 2023 to May 2024