Name, Address and

Year of Birth |

|

Positions(s) Held

With Fund(s) |

|

Term of Office

and Length of

Time Served* |

|

Principal Occupation(s) During the Past Five Years |

|

Megan Kennedy**

c/o abrdn Inc.

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1974 |

|

FAX, FCO, IAF Vice President, Secretary |

|

Since 2008 |

|

Currently, Senior Director, Product Governance for abrdn Inc. Ms. Kennedy joined abrdn Inc. as a Senior Fund Administrator in 2005. |

|

Andrew Kim**

c/o abrdn Inc.

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1983 |

|

FAX, FCO, IAF Vice President |

|

Since 2022 |

|

Currently, Senior Product Governance Manager, Product Governance US for abrdn Inc. Mr. Kim joined abrdn Inc. in 2013. |

|

Brian Kordeck**

c/o abrdn Inc.

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1978 |

|

FAX, FCO, IAF Vice President |

|

Since 2022 |

|

Currently, Senior Product Manager, Product Governance US for abrdn. Mr. Kordeck joined abrdn Inc. in 2013. |

|

Michael Marsico**

c/o abrdn Inc.

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1980 |

|

FAX, FCO, IAF Vice President |

|

Since 2022 |

|

Currently, Senior Product Manager, Product Governance US for abrdn Inc. Mr. Marsico joined abrdn Inc. in 2014. |

|

Adam McCabe**

abrdn Asia Limited

21 Church Street

#01-01 Capital Square Two

Singapore 049480

Year of Birth: 1979 |

|

FAX, FCO Vice President |

|

Since 2011 |

|

Currently, Head of Fixed Income—Asia Pacific at abrdn. Mr. McCabe joined abrdn in 2009 following the acquisition of certain asset management businesses from Credit Suisse. |

|

Christian Pittard**

c/o abrdn Investments Limited

280 Bishopsgate

London EC2M 4AG

Year of Birth: 1973 |

|

FAX, FCO, IAF President |

|

Since 2009 |

|

Currently, Group Head of Product Opportunities and a Director of abrdn PLC since 2010. Mr. Pittard joined abrdn from KPMG in 1999. |

|

Lucia Sitar**

c/o abrdn Inc.

1900 Market Street, Suite 200

Philadelphia, PA 19103

Year of Birth: 1971 |

|

FAX, FCO, IAF Vice President |

|

Since 2008 |

|

Currently, Vice President and Head of Product Management and Governance for abrdn Inc. since 2020. Previously, Ms. Sitar was Managing U.S. Counsel for abrdn Inc. Ms. Sitar joined abrdn Inc. as U.S. Counsel in July 2007. |

|

* Officers hold their positions with the Fund(s) until a successor has been duly elected and qualifies.

** Each officer may hold officer position(s) in one or more other funds which are part of the Fund Complex.

13

Ownership of Securities

Set forth in the table below is the dollar range of equity securities in each Fund and the aggregate dollar range of equity securities in the abrdn Family of Investment Companies (as defined below) beneficially owned by each Director or nominee as of October 31, 2022.

|

Name of Director or Nominee |

|

Dollar Range of Equity

Securities Owned

in Fund(1) |

|

Aggregate Dollar Range of Equity

Securities in All Funds Overseen by

Director or Nominee in the Family of

Investment Companies(2) |

|

|

Independent Directors/Nominees: |

|

|

P. Gerald Malone |

|

FCO: $1 — $10,000 |

|

$ |

50,001 — $100,000 |

|

|

|

|

|

FAX: $1 — $10,000 |

|

|

|

|

|

|

IAF: $1 — $10,000 |

|

|

|

|

William J. Potter |

|

FCO: $1 — $10,000 |

|

$ |

50,001 — $100,000 |

|

|

|

|

|

FAX: $1 — $10,000 |

|

|

|

|

|

|

IAF: $1 — $10,000 |

|

|

|

|

Moritz Sell |

|

FCO: $1 — $10,000 |

|

$ |

50,001 — $100,000 |

|

|

|

|

|

FAX: $1 — $10,000 |

|

|

|

|

|

|

IAF: $1 — $10,000 |

|

|

|

|

Radhika Ajmera |

|

FAX: $1 — $10,000 |

|

$ |

50,001 — $100,000 |

|

|

|

|

|

FCO: $1 — $10,000 |

|

|

|

|

|

|

IAF: $1 — $10,000 |

|

|

|

|

Interested Director: |

|

|

Stephen Bird |

|

FCO: $1 — $10,000 |

|

|

Over $100,000 |

|

|

|

|

|

FAX: $1 — $10,000 |

|

|

|

|

|

|

|

|

IAF: $1 — $10,000 |

|

|

|

(1) This information has been furnished by each Director as of October 31, 2022. "Beneficial ownership" is determined in accordance with Rule 16a-1(a)(2) promulgated under the Securities Exchange Act of 1934, as amended (the "1934 Act").

(2) "Family of Investment Companies" means those registered investment companies that share abrdn or an affiliate as the investment adviser and that hold themselves out to investors as related companies for purposes of investment and investor services.

As of October 31, 2022, each Fund's Directors and officers, in the aggregate, owned less than 1% of that Fund's outstanding equity securities. As of October 31, 2022, none of the Independent Directors or their immediate family members owned any shares of the Investment Manager or Sub-Adviser or of any person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with the Investment Manager or Sub-Adviser.

Mr. Pittard and Ms. Ferrari serve as executive officers of the Funds. As of October 31, 2022, Mr. Pittard and Ms. Ferrari did not own shares of the Funds' common stock.

14

BOARD AND COMMITTEE STRUCTURE

Each Board is currently composed of four Independent Directors and one Interested Director, Stephen Bird. Each Fund's bylaws provide that the Board to be elected by holders of a Fund's common stock shall be divided into three classes, as nearly equal in number as possible, each of which will serve for three years, with one class being elected each year.

Each Board has appointed Mr. Malone, an Independent Director, as Chair. The Chair presides at meetings of the Directors, participates in the preparation of the agenda for meetings of the Board, and acts as a liaison between the Directors and management between Board meetings. Except for any duties specified herein, the designation of the Chair does not impose on such Director any duties, obligations or liability that is greater than the duties, obligations or liability imposed on such person as a member of the Board, generally.

Each Board holds regular quarterly meetings each year to consider and address matters involving the respective Fund. Each Board also may hold special meetings to address matters arising between regular meetings. The Independent Directors also meet outside the presence of management in executive session at least quarterly and have engaged separate, independent legal counsel to assist them in performing their oversight responsibilities.

Each Board has established a committee structure that includes an Audit Committee, and a Nominating and Corporate Governance Committee (each discussed in more detail below) to assist each Board in the oversight and direction of the business affairs of the respective Fund, and from time to time may establish informal ad hoc committees or working groups to review and address the practices of the respective Fund with respect to specific matters. The Committee system facilitates the timely and efficient consideration of matters by the Directors, and facilitates effective oversight of compliance with legal and regulatory requirements and of each Fund's activities and associated risks. The standing Committees currently conduct an annual review of their charters, which includes a review of their responsibilities and operations. Each Nominating and Corporate Governance Committee and each Board as a whole also conduct an annual self-assessment of the performance of the Board, including consideration of the effectiveness of the Board's Committee structure. Each Committee is comprised entirely of Independent Directors. Each Committee member is also "independent" within the meaning of the New York Stock Exchange ("NYSE") MKT listing standards. Each Board reviews its structure regularly and believes that its leadership structure, including having a super-majority of Independent Directors, coupled with an Independent Director as Chair, is appropriate because it allows the Board to exercise informed and independent judgment over the matters under its purview and it allocates areas of responsibility among the Committees and the full Board in a manner that enhances efficient and effective oversight.

Audit Committee

Each Audit Committee, established in accordance with Section 3(a)(58)(A) of the 1934 Act, is responsible for the selection and engagement of the Fund's independent registered public accounting firm (subject to ratification by the Fund's Independent Directors), pre-approves and reviews both the audit and non-audit work of the Fund's independent registered public accounting firm, and reviews compliance of the Fund with regulations of the SEC and the Internal Revenue Service, and other related matters. The members of each Audit Committee are Messrs. P. Gerald Malone, William J. Potter and Moritz Sell and Ms. Radhika Ajmera.

Each Board has adopted an Audit Committee Charter for its Audit Committee, the current copy of which is available on each Fund's respective website at http://abrdnfax.com, http://www.abrdnfco.com and http://www.abrdniaf.com.

Nominating and Corporate Governance Committee; Consideration of Potential Director Nominees

Each Nominating and Corporate Governance Committee recommends nominations for membership on the Board and reviews and evaluates the effectiveness of the Board in its role in governing the Fund and overseeing the management of the Fund. It evaluates candidates' qualifications for Board membership and, with respect to

15

nominees for positions as Independent Directors, their independence from the Investment Manager and Sub-Adviser, as appropriate, and other principal service providers. Each Nominating and Corporate Governance Committee generally meets twice annually to identify and evaluate nominees for director and makes its recommendations to its respective Board at the time of each Board's December meeting. Each Nominating and Corporate Governance Committee also periodically reviews director compensation and will recommend any appropriate changes to the Boards as a group. Each Nominating and Corporate Governance Committee also reviews and may make recommendations to its respective Board relating to the effectiveness of the Board in carrying out its responsibilities in governing the Fund and overseeing the management of the Fund. The members of each Nominating and Corporate Governance Committee are Messrs. P. Gerald Malone, William J. Potter and Moritz Sell and Ms. Radhika Ajmera.

Each Board has adopted a Nominating and Corporate Governance Committee Charter, a copy of which is on each Fund's respective website at http://abrdnfax.com, http://www.abrdnfco.com and http://www.abrdniaf.com.

Each Nominating and Corporate Governance Committee may take into account a wide variety of factors in considering prospective director candidates, including (but not limited to): (i) availability (including availability to attend to Board business on short notice) and commitment of a candidate to attend meetings and perform his or her responsibilities on the Board; (ii) relevant industry and related experience; (iii) educational background; (iv) reputation; (v) financial expertise; (vi) the candidate's ability, judgment and expertise; (vii) overall diversity of the Board's composition; and (viii) commitment to the representation of the interests of the Fund and its shareholders. Each Nominating and Corporate Governance Committee also considers the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, such as business, financial or family relationships with the Investment Manager or Sub-Adviser or their affiliates, as appropriate. Each Nominating and Corporate Governance Committee will consider potential director candidates, if any, recommended by its Fund shareholders provided that the proposed candidates: (i) satisfy any minimum qualifications of the Fund for its directors; (ii) are not "interested persons" of the Fund, as that term is defined in the 1940 Act; and (iii) are "independent" as defined in the listing standards of any exchange on which the Fund's shares are listed.

While the Nominating and Corporate Governance Committees have not adopted a particular definition of diversity or a particular policy with regard to the consideration of diversity in identifying candidates, when considering a candidate's and a Board's diversity, the Committees generally consider the manner in which each candidate's leadership, independence, interpersonal skills, financial acumen, integrity and professional ethics, educational and professional background, prior director or executive experience, industry knowledge, business judgment and specific experiences or expertise would complement or benefit the Board and, as a whole, contribute to the ability of the Board to oversee the Fund. Each Committee may also consider other factors or attributes as they may determine appropriate in their judgment. Each Committee believes that the significance of each candidate's background, experience, qualifications, attributes or skills must be considered in the context of the Board as a whole.

Each Fund's bylaws contain provisions regarding minimum qualifications for directors. These include a requirement that, to qualify as a nominee for a directorship, each candidate, at the time of nomination, other than persons who were directors at the time of the adoption of the minimum qualifications, must possess at least the following specific minimum qualifications: (i) a nominee shall have at least five years' experience in any of investment management, economics, public accounting or Australian business; (ii) a nominee shall have a college undergraduate or graduate degree in economics, finance, business administration, accounting or engineering, or a professional degree in law, engineering, or medicine, from an accredited university or college in the United States, Australia, the United Kingdom, Canada or New Zealand, or the equivalent degree from an equivalent institution of higher learning in another country; and (iii) a nominee shall not have violated any provision of the U.S. federal or state securities laws, or comparable laws of another country.

16

Each Fund's bylaws also contain advance notice provisions and general procedures with respect to the submission of proposals, including the nomination of directors. Shareholders who intend to propose potential director candidates must substantiate compliance with these requirements. Notice of shareholder proposals must be provided to the Fund's Secretary not earlier than the 150th day and not later than 5:00 p.m., Eastern Time, on the 120th day prior to the first anniversary of the date of the preceding year's proxy statement. Any shareholder may obtain a copy of the Funds' bylaws by calling the Investor Relations department of abrdn Inc., the Funds' investor relations services provider, toll-free at 1-800-522-5465, or by sending an e-mail to abrdn Inc. at InvestorRelations@abrdn.com.

Board Oversight of Risk Management

The Funds are subject to a number of risks, including, among others, investment, compliance, operational and valuation risks. Risk oversight forms part of each Board's general oversight of the respective Fund and is addressed as part of various Board and Committee activities. Each Board has adopted, and periodically reviews, policies and procedures designed to address these risks. Different processes, procedures and controls are employed with respect to different types of risks. Day-to-day risk management functions are subsumed within the responsibilities of AAL, who carries out each Fund's investment management and business affairs and oversee other service providers in connection with the services they provide to each Fund, and also by AIL, as applicable, and other service providers in connection with the services they provide to the Funds. Each of the Investment Manager, the Sub-Adviser, the Funds' administrator, as applicable, and the Funds' other service providers have their own, independent interest in risk management, and their policies and methods of risk management will depend on their functions and business models. As part of its regular oversight of each Fund, the respective Board, directly and/or through a Committee, interacts with and reviews reports from, among others, AAL and AIL, as applicable, and each Fund's other service providers (including the Funds' transfer agent), the Funds' Chief Compliance Officer, and the Funds' independent registered public accounting firm, legal counsel to the Funds, as appropriate, relating to the operations of the Funds. The Boards also require AAL to report to the Boards on other matters relating to risk management on a regular and as-needed basis. The Boards recognize that it may not be possible to identify all of the risks that may affect the Funds or to develop processes and controls to eliminate or mitigate their occurrence or effects. Each Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Board Retirement Policy

Each Board has adopted a retirement policy that seeks to balance the need for fresh perspectives against the benefits that the experience and institutional memory of existing Director may provide and seeks to enhance the overall effectiveness of the Board. Each Board's policy states that no Director candidate shall be presented to shareholders of the Fund for election at any meeting that is scheduled to occur after he or she has reached the age of 75. In addition, each Director shall automatically be deemed to retire from the Board at the next annual shareholders' meeting following the date he or she reaches the age of 75 years, even if his or her tenure of office has not expired on that date. Where no annual shareholders meeting is held, the retiring Director is deemed to retire at the conclusion of the next regular quarterly Board meeting following the date he or she reaches the age of 75.

Board and Committee Meetings in Fiscal Year 2022

During the Funds' fiscal year ended October 31, 2022, the Boards of FAX, FCO and IAF each held four regular meetings. The Audit Committees of FAX, FCO and IAF each held three meetings; the Nominating and Corporate Governance Committees of FAX, FCO and IAF each held one meeting; and the Leverage Committees of FAX, FCO and IAF held one meeting. During the fiscal year ended October 31, 2022, each incumbent Director attended at least 75% of the aggregate number of meetings of the Board and of Committees of the Board on which he or she served.

17

Communications with the Board of Directors

Shareholders who wish to communicate with Board members with respect to matters relating to the Funds may address their written correspondence to the Boards as a whole or to individual Board members c/o abrdn Inc., the Funds' administrator, at 1900 Market Street, Suite 200, Philadelphia, PA 19103, or via e-mail to the Director(s) c/o abrdn Inc. at investor.relations@abrdn.com.

Director Attendance at Annual Meetings of Shareholders

The Funds have not established a policy with respect to Director attendance at annual meetings of shareholders.

REPORTS OF THE AUDIT COMMITTEES; INFORMATION REGARDING THE FUNDS' INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Each Audit Committee has selected, and each Fund's Independent Directors have ratified the selection of, KPMG LLP ("KPMG"), 1601 Market Street, Philadelphia, PA 19103, an independent registered public accounting firm, to audit the financial statements of the Funds for the fiscal year ending October 31, 2023. Representatives from KPMG are not expected to be present at the Meetings to make a statement or respond to questions from shareholders. If requested by any shareholder by two (2) business days before the Meetings, a representative from KPMG will be present by telephone at the Meetings to respond to appropriate questions and will have an opportunity to make a statement if he or she chooses to do so.

Each Audit Committee has received from KPMG the written disclosures and the letter required by the Public Company Accounting Oversight Board ("PCAOB") regarding KPMG's communications with the Audit Committee concerning independence, and have discussed with KPMG its independence. Each Audit Committee has also reviewed and discussed the audited financial statements with Fund management and KPMG, and discussed matters with KPMG required to be discussed by the applicable requirements of the PCAOB and the SEC. Based on the foregoing, each Audit Committee recommended to its Board that the Fund's audited financial statements be included in the respective Fund's Annual Report to Shareholders for the fiscal year ended October 31, 2022.

The following table sets forth the aggregate fees billed for professional services rendered by KPMG during the Funds' two most recent fiscal years ended October 31:

|

|

|

2022 |

|

2021 |

|

|

|

|

FAX |

|

FCO |

|

IAF |

|

FAX |

|

FCO |

|

IAF |

|

|

Audit Fees(1) |

|

$ |

90,660 |

|

|

$ |

125,780 |

|

|

$ |

62,250 |

|

|

$ |

85,587 |

|

|

$ |

81,656 |

|

|

$ |

57,033 |

|

|

|

Audit-Related Fees(2) |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

50,000 |

|

|

$ |

0 |

|

|

|

Tax Fees(3) |

|

$ |

7,720 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

7,980 |

|

|

$ |

7,980 |

|

|

$ |

7,980 |

|

|

|

All Other Fees(4) |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

|

Total |

|

$ |

98,380 |

|

|

$ |

125,780 |

|

|

$ |

62,250 |

|

|

$ |

93,567 |

|

|

$ |

139,636 |

|

|

$ |

65,013 |

|

|

(1) "Audit Fees" are the aggregate fees billed for professional services for the audit of the Fund's annual financial statements and services provided in connection with statutory and regulatory filings or engagements.

(2) "Audit Related Fees" are the aggregate fees billed for assurance and related services reasonably related to the performance of the audit or review of financial statements that are not reported under "Audit Fees". These fees include offerings related to the Fund's common shares.

(3) "Tax Fees" are the aggregate fees billed for professional services for tax advice, tax compliance, and tax planning. These fees include: federal and state income tax returns, review of excise tax distribution calculations and federal excise tax return.

18

(4) "All Other Fees" are the aggregate fees billed for products and services other than "Audit Fees," "Audit-Related Fees" and "Tax Fees."

All of the services described in the table above were pre-approved by the relevant Audit Committees.

Each Audit Committee is responsible for pre-approving (i) all audit and permissible non-audit services to be provided by the independent registered public accounting firm to each Fund and (ii) all permissible non-audit services to be provided by the independent registered public accounting firm to each Fund's Investment Manager, and any service provider to a Fund controlling, controlled by or under common control with each Fund's Investment Manager that provided ongoing services to the Fund ("Covered Service Provider"), if the engagement relates directly to the operations and financial reporting of the Fund. The following table shows the amount of fees that KPMG billed during the Funds' last two fiscal years for non-audit services to the Funds, the Investment Manager, and Covered Service Providers:

|

Fund |

|

Fiscal Year Ended |

|

Total Non-

Audit Fees

Billed to Fund* |

|

Total Non-Audit Fees

billed to the Investment

Manager and

Covered Service

Providers (engagements

related directly to the

operations and financial

reporting of the Fund) |

|

Total Non-Audit Fees

billed to the Investment

Manager and

Covered Service

Providers (all other

engagements) |

|

Total |

|

|

FAX |

|

October 31, 2022 |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

1,108,929 |

|

|

$ |

1,108,929 |

|

|

|

|

|

October 31, 2021 |

|

$ |

7,980 |

|

|

$ |

0 |

|

|

$ |

1,547,556 |

|

|

$ |

1,555,536 |

|

|

|

FCO |

|

October 31, 2022 |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

1,108,929 |

|

|

$ |

1,108,929 |

|

|

|

|

|

October 31, 2021 |

|

$ |

7,980 |

|

|

$ |

0 |

|

|

$ |

1,547,556 |

|

|

$ |

1,555,536 |

|

|

|

IAF |

|

October 31, 2022 |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

1,108,929 |

|

|

$ |

1,108,929 |

|

|

|

|

|

October 31, 2021 |

|

$ |

|

|

|

$ |

0 |

|

|

$ |

1,547,556 |

|

|

$ |

1,555,536 |

|

|

* "Total Non-Audit Fees billed to Fund" for both fiscal years represent "Tax Fees" and "All Other Fees" billed to Funds in their respective amounts from the previous table.

Each Audit Committee has adopted an Audit Committee Charter that provides that the Audit Committee shall annually select, retain or terminate, and recommend to the Audit Committee members of the Board and ratified by the entire Board, who are not "interested persons" (as that term is defined in Section 2(a)(19) of the 1940 Act), of the Fund for their ratification, the selection, retention or termination, the Fund's independent auditor and, in connection therewith, evaluate the terms of the engagement (including compensation of the auditor) and the qualifications and independence of the independent auditor, including whether the independent auditor provides any consulting, auditing or tax services to the Investment Manager or Sub-Adviser, if applicable, and receive the independent auditor's specific representations as to its independence, delineating all relationships between the independent auditor and the Fund, consistent with the Independent Standards Board ("ISB") Standard No. 1. Each Audit Committee Charter also provides that the Committee shall review in advance, and consider approval of, any and all proposals by Fund management or the Investment Manager that the Fund, Investment Manager or their affiliated persons, employ the independent auditor to render "permissible non-audit services" to the Fund and to consider whether such services are consistent with the independent auditor's independence.

Each Audit Committee has considered whether the provision of non-audit services that were rendered to the Investment Manager or Sub-Adviser, if applicable, and any entity controlling, controlled by, or under common control with these entities that provides ongoing services to the relevant Fund that were not pre-approved pursuant

19

to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant's independence and has concluded that it is independent.

COMPENSATION

The following table sets forth information regarding compensation of Directors by each Fund and by the Fund Complex of which the Funds are a part for the fiscal year ended October 31, 2022. Officers of the Funds and Directors who are interested persons of the Funds do not receive any compensation directly from the Funds or any other fund in the Fund Complex for performing their duties as officers or Directors, respectively.

|

Name of Director |

|

Aggregate Compensation

from Funds for

Fiscal Year Ended

October 31, 2022 |

|

Total Compensation

From Funds and Fund

Complex Paid

To Directors* |

|

|

|

|

FAX |

|

FCO |

|

IAF |

|

|

|

|

Independent Directors: |

|

|

|

|

|

|

Radhika Ajmera |

|

$ |

43,918 |

|

|

$ |

41,584 |

|

|

$ |

41,584 |

|

|

$ |

300,264 |

|

|

|

P. Gerald Malone |

|

$ |

62,920 |

|

|

$ |

59,752 |

|

|

$ |

51,513 |

|

|

$ |

583,729 |

|

|

|

William J. Potter |

|

$ |

44,585 |

|

|

$ |

43,245 |

|

|

$ |

42,251 |

|

|

$ |

130,082 |

|

|

|

Moritz Sell |

|

$ |

51,587 |

|

|

$ |

48,418 |

|

|

$ |

48,418 |

|

|

$ |

148,424 |

|

|

|

Interested Director: |

|

|

|

|

|

|

Stephen Bird |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

* See the "Directors" table for the number of funds within the Fund Complex that each Director serves.

Delinquent Section 16(a) Reports

Section 16(a) of the 1934 Act and Section 30(h) of the 1940 Act, as applied to the Funds, require the Funds' officers and Directors, certain officers and directors of the Investment Manager and Sub-Adviser, affiliates of the Investment Manager and Sub-Adviser, and persons who beneficially own more than 10% of the Funds' outstanding securities (collectively, the "Reporting Persons") to electronically file reports of ownership of the Funds' securities and changes in such ownership with the SEC and the NYSE American.

Based solely on the Funds' review of such forms filed on EDGAR or written representations from Reporting Persons that all reportable transactions were reported, to the knowledge of the Funds, during the fiscal year ended October 31, 2022, the Funds' Reporting Persons timely filed all reports they were required to file under Section 16(a), except that: (i) Robert Hepp and Andrew Kim each filed a late Form 3 filing following their respective appointments as Vice Presidents of the Funds; (ii) Ai Hua Aik filed a late Form 3 filing following her appointment as a director of Funds' investment manager; and (iii) Grant Hotson and Neil Slater each filed a late Form 3 filing following their respective appointments as directors of the sub-adviser for FCO and FAX.

Relationship of Directors or Nominees with the Investment Manager, Sub-Adviser and Administrator

abrdn Asia Limited serves as the Investment Manager to the Funds pursuant to management agreements dated as of April 3, 2009 for FAX, as of June 7, 2006 for FCO, and as of March 8, 2004 for IAF. The Investment Manager is a Singapore corporation with its registered office located at 21 Church Street, #01-01 Capital Square Two, Singapore 049480. abrdn Investments Limited serves as the Sub-Adviser to FAX and FCO pursuant to sub-advisory agreements dated November 1, 2015 and March 1, 2012, respectively. The Sub-Adviser, with its registered office at 10 Queen's Terrace, Aberdeen, Scotland AB10 1YG, is a corporation organized under the laws of Scotland and

20

a U.S. registered investment adviser. The Investment Manager and Sub-Adviser are each wholly-owned subsidiaries of abrdn (Holdings) PLC, a Scottish company. The registered offices of abrdn (Holdings) PLC are located at 10 Queen's Terrace, Aberdeen, Scotland AB10 1XL. abrdn (Holdings) PLC is a wholly-owned subsidiary of abrdn plc ("abrdn"), which has registered offices at 1 George Street, Edinburgh, Scotland EH2 2LL.

In rendering investment advisory services, the Investment Manager and Sub-Adviser may use the resources of investment advisor subsidiaries of abrdn. These affiliates have entered into a memorandum of understanding/personnel sharing procedures pursuant to which investment professionals from each affiliate may render portfolio management and research services to U.S. clients of the abrdn plc affiliates, including the Funds, as associated persons of the Investment Manager. No remuneration is paid by the Funds with respect to the memorandum of understanding/personnel sharing arrangements.

abrdn Inc., an affiliate of the Investment Manager and Sub-Adviser, serves as the Funds' administrator. abrdn Inc. is a Delaware corporation with its principal business office located at 1900 Market Street, Suite 200, Philadelphia, PA 19103. abrdn Inc. also provides investor relations services to the Funds under an investor relations services agreement. Messrs. Andolina, Demetriou, Goodson and Mmes. Kennedy and Sitar, who serve as officers of the Funds, are also directors and/or officers of abrdn Inc.

EACH FUND'S BOARD RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE NOMINEES FOR DIRECTOR FOR THE RELEVANT FUND.

ADDITIONAL INFORMATION

Expenses. The expense of preparation, printing and mailing of the enclosed proxy card and accompanying Notice and Joint Proxy Statement will be borne proportionately by each Fund. Each Fund will reimburse banks, brokers and others for their reasonable expenses in forwarding proxy solicitation material to the beneficial owners of the shares of that Fund. In order to obtain the necessary quorum at each Meeting, supplementary solicitation may be made by mail, telephone, telegraph or personal interview. Such solicitation may be conducted by, among others, officers, Directors and employees of the Funds, the Investment Manager, the Sub-Adviser (in the case of FAX and FCO) or the Funds' administrator.

AST Fund Solutions, LLC ("AST") has been retained to assist in the solicitation of proxies and will receive an estimated fee of $2,500 (FAX), $1,000 (FCO) and $2,800 (IAF) and be reimbursed for its reasonable expenses, which are estimated to be $1,500-$2,000 for FAX, $1,000-$1,500 for FCO and $1,000-$1,500 for IAF.

Solicitation and Voting of Proxies. Solicitation of proxies is being made primarily by the mailing of this Joint Proxy Statement with its enclosures on or about April 15, 2023. As mentioned above, AST has been engaged to assist in the solicitation of proxies. As the date of the Meetings approach, certain shareholders of a Fund may receive a call from a representative of AST, if the Fund has not yet received their vote. Authorization to permit AST to execute proxies may be obtained by telephonic instructions from shareholders of a Fund. Proxies that are obtained telephonically will be recorded in accordance with procedures that management of each of the Funds believes are reasonably designed to ensure that the identity of the shareholder casting the vote is accurately determined and that the voting instructions of the shareholder are accurately determined.

Beneficial Owners. Based upon filings made with the SEC, as of December 31, 2022, the following table shows certain information concerning persons who may be deemed beneficial owners of 5% or more of a class of

21

shares of FAX, IAF and FCO because they possessed or shared voting or investment power with respect to FAX, IAF or FCO's shares:

|

Fund |

|

Class |

|

Name and Address |

|

Number of Shares

Beneficially Owned |

|

Percentage of

Shares |

|

|

FAX |

|

Preferred |

|

Voya Financial Inc.

230 Park Ave

New York, NY 10169 |

|

|

600,000 |

|

|

|

30.00 |

% |

|

|

FAX |

|

Common |

|

First Trust Portfolios L.P.*

First Trust Advisors L.P.* |

|

|

16,791,871 |

|

|

|

6.78 |

% |

|

|

|

|

|

|

The Charger Corporation* |

|

|

|

|

|

|

|

|

|

|

120 East Liberty Drive, Suite 400

Wheaton, IL 60187 |

|

|

|

|

|

|

IAF |

|

Common |

|

First Trust Portfolios L.P.**

First Trust Advisors L.P.** |

|

|

3,332,504 |

|

|

|

13.23 |

% |

|

|

|

|

|

|

The Charger Corporation** |

|

|

|

|

|

|

|

|

|

|

120 East Liberty Drive

Wheaton, IL 60187 |

|

|

|

|

|

* These entities jointly filed a Schedule 13G for the share amount and percentage shown.

** These entities jointly filed a Schedule 13G for the share amount and percentage shown.

Shareholder Proposals. Any Rule 14a-8 shareholder proposal to be considered for inclusion in a Fund's proxy statement and form of proxy for the annual meetings of shareholders to be held in 2024 should be received by the Secretary of the relevant Fund no later than December 17, 2023. There are additional requirements regarding proposals of shareholders, and a shareholder contemplating submission of a proposal for inclusion in a Fund's proxy materials is referred to Rule 14a-8 under the 1934 Act.

If a shareholder intends to present a proposal, including the nomination of a director, at the Annual Meeting of Shareholders of FCO or IAF to be held in 2024 and desires to have the proposal included in the Funds' proxy statement and form of proxy for that meeting, the shareholder must deliver the proposal to the Secretary of the Funds at the office of the Funds, 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and such proposal must be received by the Secretary no later than November 18, 2023. If a shareholder intends to present a proposal, including the nomination of a director, at the Annual Meeting of Shareholders of FAX to be held in 2024 and desires to have the proposal included in the Fund's proxy statement and form of proxy for that meeting, the shareholder must deliver the proposal to the Secretary of the Fund at the office of the Fund, 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and such proposal must be received by the Secretary no later than November 25, 2023.

Shareholders wishing to present proposals, including the nomination of a director, at the Annual Meeting of Shareholders of FCO and IAF to be held in 2024 which they do not wish to be included in the Funds' proxy materials must send written notice of such proposals to the Secretary of the Funds at the office of the Fund, 1900 Market Street Suite 200, Philadelphia, Pennsylvania 19103, and such notice must be received by the Secretary no sooner than October 8, 2023 and no later than 5:00 p.m., Eastern Time, on November 18, 2023 in the form prescribed from time to time in the Funds' bylaws and shareholders wishing to present proposals, including the nomination of a director, at the Annual Meeting of Shareholders of FAX to be held in 2024 which they do not wish to be included in the Fund's proxy materials must send written notice of such proposals to the Secretary of the Fund at the office of the Fund, 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and such notice must be received

22

by the Secretary no sooner than October 17, 2023 and no later than 5:00 p.m., Eastern Time, on November 25, 2023 in the form prescribed from time to time in the Funds' bylaws; provided, however, that in the event that the date of the annual meeting is advanced or delayed by more than 30 days from the first anniversary of the date of the preceding year's annual meeting, notice by the stockholder to be timely must be so delivered not earlier than the 150th day prior to the date of such annual meeting and not later than the close of business on the later of the 120th day prior to the date of such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made.

SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND THE MEETINGS AND WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO DATE AND SIGN THE ENCLOSED PROXY CARD(S) AND RETURN THEM IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

Delivery of Joint Proxy Statement

Unless the Funds have received contrary instructions from shareholders, only one copy of this Joint Proxy Statement may be mailed to households, even if more than one person in a household is a shareholder of record. If a shareholder needs an additional copy of this Joint Proxy Statement, please contact the Funds at 1-800-522-5465. If any shareholder does not want the mailing of this Joint Proxy Statement to be combined with those for other members of its household, please contact the Funds in writing at: 1900 Market Street, Suite 200, Philadelphia, PA 19103 or call the Funds at 1-800-522-5465.

Other Business

Management knows of no business to be presented at the Meetings, other than the Proposals set forth in this Joint Proxy Statement, but should any other matter requiring the vote of shareholders arise, the proxies will vote thereon according to their discretion.

By order of the Boards of Directors,

Megan Kennedy, Vice President and Secretary

abrdn Asia-Pacific Income Fund, Inc.

abrdn Global Income Fund, Inc.

abrdn Australia Equity Fund, Inc.

23

Please

detach at perforation before mailing.

PROXY |

ABRDN ASIA-PACIFIC INCOME FUND, INC. |

|

ANNUAL

MEETING OF SHAREHOLDERS

TO

BE HELD ON MAY 25, 2023

THIS

PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned shareholder(s) of abrdn Asia-Pacific Income Fund, Inc. (the “Fund”),

revoking previous proxies, hereby appoints Megan Kennedy, Andrew Kim and Robert Hepp, or any one of them true and lawful

attorneys with power of substitution of each, to vote all shares of abrdn Asia-Pacific Income Fund, Inc., which the undersigned is entitled

to vote, at the Annual Meeting of Shareholders to be held on Thursday, May 25, 2023, at 11:00 a.m. Eastern Time, at the offices of abrdn

Inc., located at 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and at any adjournment thereof as indicated on the

reverse side. Please refer to the Proxy Statement for a discussion of these matters.

In

their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting

or any adjournment thereof.

Receipt

of the Notice of the Annual Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions

are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for Directors.

| | VOTE

VIA THE INTERNET: www.proxy-direct.com

VOTE VIA THE TELEPHONE: 1-800-337-3503 |

FAX_33187_032323_Pref

PLEASE

SIGN, DATE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

EVERY

SHAREHOLDER’S VOTE IS IMPORTANT

Important

Notice Regarding the Availability of Proxy Materials for the

abrdn

Asia-Pacific Income Fund, Inc.

Shareholders

Meeting to be held on May 25, 2023, at 11:00 a.m. (Eastern Time)

The

Proxy Statement for this meeting is available at: http://abrdnfax.com

IF

YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU

NEED NOT RETURN THIS PROXY CARD

Please

detach at perforation before mailing.

In

their discretion, the proxy holders are authorized to vote upon the matters set forth in the Notice of Meeting and Proxy Statement dated

April [15], 2023 and upon all other such matters as may properly come before the meeting

or any adjournment thereof.

| TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: |

X |

|

|

Proposals |

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES FOR DIRECTORS IN THE PROPOSALS. |

| 1. | To

elect one Class II Director of the Fund, for a three-year term until the 2026 Annual Meeting

of Shareholders. |

| |

FOR |

AGAINST |

ABSTAIN |

|

| 01. P. Gerald Malone |

☐ |

☐ |

☐ |

|

| 2. | To consider the continuation of the term of one Director under the Fund’s Corporate Governance Policies. |

| |

FOR |

AGAINST |

ABSTAIN |

|

| 01. William J. Potter (Preferred Share Director, 3-year term ending 2024) |

☐ |

☐ |

☐ |

|

|

Authorized

Signatures — This section must be completed for your vote to be counted.— Sign and Date Below |

| Note: |

Please sign exactly as your name(s)

appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor,

guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full

title under the signature. |

| Date (mm/dd/yyyy) — Please print date below |

|

Signature 1 — Please keep signature within the box |

|

Signature 2 — Please keep signature within the box |

| |

|

|

|

|

| / / |

|

|

|

|

| |

|

|

|

|

| |

xxxxxxxxxxxxxx |

FAX2 33187 |

|

xxxxxxxx |

|

Please

detach at perforation before mailing.

PROXY |

ABRDN ASIA-PACIFIC INCOME FUND, INC. |

|

ANNUAL

MEETING OF SHAREHOLDERS

TO

BE HELD ON MAY 25, 2023

THIS

PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned shareholder(s) of abrdn Asia-Pacific Income Fund, Inc. (the “Fund”),

revoking previous proxies, hereby appoints Megan Kennedy, Andrew Kim and Robert Hepp, or any one of them true and lawful

attorneys with power of substitution of each, to vote all shares of abrdn Asia-Pacific Income Fund, Inc., which the undersigned is entitled

to vote, at the Annual Meeting of Shareholders to be held on Thursday, May 25, 2023, at 11:00 a.m. Eastern Time, at the offices of abrdn

Inc., located at 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and at any adjournment thereof as indicated on the

reverse side. Please refer to the Proxy Statement for a discussion of these matters.

In

their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting

or any adjournment thereof.

Receipt

of the Notice of the Annual Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions

are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for Directors.

| | VOTE

VIA THE INTERNET: www.proxy-direct.com

VOTE VIA THE TELEPHONE: 1-800-337-3503 |

FAX_33187_032323

PLEASE

SIGN, DATE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

EVERY

SHAREHOLDER’S VOTE IS IMPORTANT

Important

Notice Regarding the Availability of Proxy Materials for the

abrdn

Asia-Pacific Income Fund, Inc.

Shareholders

Meeting to be held on May 25, 2023, at 11:00 a.m. (Eastern Time)

The

Proxy Statement for this meeting is available at: http://abrdnfax.com

IF

YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU

NEED NOT RETURN THIS PROXY CARD

Please

detach at perforation before mailing.

In

their discretion, the proxy holders are authorized to vote upon the matters set forth in the Notice of Meeting and Proxy Statement dated

April [15], 2023 and upon all other such matters as may properly come before the meeting

or any adjournment thereof.

| TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: |

X |

|

|

Proposals |

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES FOR DIRECTORS IN THE PROPOSALS. |

| 1. | To

elect one Class II Director of the Fund, for a three-year term until the 2026 Annual Meeting

of Shareholders. |

| |

FOR |

AGAINST |

ABSTAIN |

|

| 01. P. Gerald Malone |

☐ |

☐ |

☐ |

|

| 2. | To consider the continuation of the term of one Director under the Fund’s Corporate Governance Policies. |

| |

FOR |

AGAINST |

ABSTAIN |

|

| 01. William J. Potter (Preferred Share Director, 3-year term ending 2024) |

☐ |

☐ |

☐ |

|

|

Authorized

Signatures — This section must be completed for your vote to be counted.— Sign and Date Below |

| Note: |

Please sign exactly as your name(s)

appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor,

guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full

title under the signature. |

| Date (mm/dd/yyyy) — Please print date below |

|

Signature 1 — Please keep signature within the box |

|

Signature 2 — Please keep signature within the box |

| |

|

|

|

|

| / / |

|

|

|

|

| |

|

|

|

|

| |

xxxxxxxxxxxxxx |

FAX 33187 |

|

xxxxxxxx |

|

Please

detach at perforation before mailing.

PROXY |

ABRDN GLOBAL INCOME FUND, INC. |

|

ANNUAL

MEETING OF SHAREHOLDERS

TO

BE HELD ON MAY 25, 2023

THIS

PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned shareholder(s) of abrdn Global Income Fund, Inc. (the “Fund”),

revoking previous proxies, hereby appoints Megan Kennedy, Andrew Kim and Robert Hepp, or any one of them true and lawful

attorneys with power of substitution of each, to vote all shares of abrdn Global Income Fund, Inc., which the undersigned is entitled

to vote, at the Annual Meeting of Shareholders to be held on Thursday, May 25, 2023, at 11:30 a.m. Eastern Time, at the offices of abrdn

Inc., located at 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and at any adjournment thereof as indicated on the

reverse side. Please refer to the Proxy Statement for a discussion of these matters.

In

their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting

or any adjournment thereof.

Receipt

of the Notice of the Annual Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions

are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for Directors.

| | VOTE

VIA THE INTERNET: www.proxy-direct.com

VOTE VIA THE TELEPHONE: 1-800-337-3503 |

FCO_33187_032323

PLEASE

SIGN, DATE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

EVERY

SHAREHOLDER’S VOTE IS IMPORTANT

Important

Notice Regarding the Availability of Proxy Materials for the

abrdn

Global Income Fund, Inc.

Shareholders

Meeting to be held on May 25, 2023, at 11:30 a.m. (Eastern Time)

The

Proxy Statement for this meeting is available at: http://www.abrdnfco.com

IF

YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU

NEED NOT RETURN THIS PROXY CARD

Please

detach at perforation before mailing.

In

their discretion, the proxy holders are authorized to vote upon the matters set forth in the Notice of Meeting and Proxy Statement dated

April [15], 2023 and upon all other such matters as may properly come before the meeting

or any adjournment thereof.

| TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: |

X |

|

|

Proposals |

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES FOR DIRECTORS IN THE PROPOSALS. |

| 1. | To elect two Class I Directors of the Fund, for a three-year term until the 2026 Annual Meeting of Shareholders. |

| |

FOR |

AGAINST |

ABSTAIN |

|

| 01. P. Gerald Malone |

☐ |

☐ |

☐ |

|

| 02. Moritz

Sell |

☐ |

☐ |

☐ |

|

| 2. | To consider the continuation of the term of one Director under the Fund’s Corporate Governance Policies. |

| |

FOR |

AGAINST |

ABSTAIN |

|

| 01. William J. Potter (Class II Director, 3-year term ending 2024) |

☐ |

☐ |

☐ |

|

|

Authorized

Signatures — This section must be completed for your vote to be counted.— Sign and Date Below |

| Note: |

Please sign exactly as your name(s)

appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor,

guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full

title under the signature. |

| Date (mm/dd/yyyy) — Please print date below |

|

Signature 1 — Please keep signature within the box |

|

Signature 2 — Please keep signature within the box |

| |

|

|

|

|

| / / |

|

|

|

|

| |

|

|

|

|

| |

xxxxxxxxxxxxxx |

FCO 33187 |

|

xxxxxxxx |

|

Please

detach at perforation before mailing.

PROXY |

ABRDN AUSTRALIA EQUITY FUND, INC. |

|

ANNUAL

MEETING OF SHAREHOLDERS

TO

BE HELD ON MAY 25, 2023

THIS

PROXY IS BEING SOLICITED BY THE BOARD OF DIRECTORS. The undersigned shareholder(s) of abrdn Australia Equity Fund, Inc. (the “Fund”),

revoking previous proxies, hereby appoints Megan Kennedy, Andrew Kim and Robert Hepp, or any one of them true and lawful

attorneys with power of substitution of each, to vote all shares of abrdn Australia Equity Fund, Inc., which the undersigned is entitled

to vote, at the Annual Meeting of Shareholders to be held on Thursday, May 25, 2023, at 12:00 p.m. Eastern Time, at the offices of abrdn

Inc., located at 1900 Market Street, Suite 200, Philadelphia, Pennsylvania 19103, and at any adjournment thereof as indicated on the

reverse side. Please refer to the Proxy Statement for a discussion of these matters.

In

their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the meeting

or any adjournment thereof.

Receipt

of the Notice of the Annual Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions

are given, the votes entitled to be cast by the undersigned will be cast “FOR” the nominees for Directors.

| | VOTE

VIA THE INTERNET: www.proxy-direct.com

VOTE VIA THE TELEPHONE: 1-800-337-3503 |

IAF_33187_032323

PLEASE

SIGN, DATE AND RETURN THE PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

EVERY

SHAREHOLDER’S VOTE IS IMPORTANT

Important

Notice Regarding the Availability of Proxy Materials for the

abrdn

Australia Equity Fund, Inc.

Shareholders

Meeting to be held on May 25, 2023, at 12:00 p.m. (Eastern Time)

The

Proxy Statement for this meeting is available at: http://www.abrdniaf.com

IF

YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU

NEED NOT RETURN THIS PROXY CARD

Please

detach at perforation before mailing.

In

their discretion, the proxy holders are authorized to vote upon the matters set forth in the Notice of Meeting and Proxy Statement dated

April [15], 2023 and upon all other such matters as may properly come before the meeting

or any adjournment thereof.

| TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: |

X |

|

|

Proposals |

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NOMINEES FOR DIRECTORS IN THE PROPOSALS. |

| 1. | To elect two Class II Directors of the Fund, for a three-year term until the 2026 Annual Meeting of Shareholders. |

| |

FOR |

WITHHOLD |

|

|

| 01. Radhika

Ajmera |

☐ |

☐ |

|

|

| 02. P. Gerald

Malone |

☐ |

☐ |

|

|

| 2. | To consider the continuation of the terms of two Directors under the Fund’s Corporate Governance Policies. |

| |

FOR |

WITHHOLD |

|

| 01.

William J. Potter (Class III Director, 3-year term ending 2024) |

☐ |

☐ |

|

| 02.

Moritz Sell (Class I Director, 3-year term ending 2025) |

☐ |

☐ |

|

|

Authorized

Signatures — This section must be completed for your vote to be counted.— Sign and Date Below |

| Note: |

Please sign exactly as your name(s)

appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor,

guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full

title under the signature. |

| Date (mm/dd/yyyy) — Please print date below |

|

Signature 1 — Please keep signature within the box |

|

Signature 2 — Please keep signature within the box |

| |

|

|

|

|

| / / |

|

|

|

|

| |

|

|

|

|

| |

xxxxxxxxxxxxxx |

IAF 33187 |

|

xxxxxxxx |

|

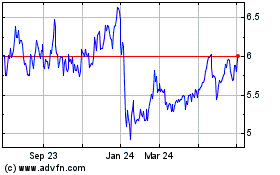

abrdn Global Income (AMEX:FCO)

Historical Stock Chart

From Apr 2024 to May 2024

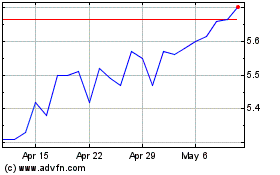

abrdn Global Income (AMEX:FCO)

Historical Stock Chart

From May 2023 to May 2024