Like many other emerging economies, concerns over the Indian

economy have been mounting since the beginning of the year as the

nation is grappling with internal and external economic issues.

Plagued with slowing economic growth, persistent sky-high

inflation, lower per-capita income and massive corruption, the

country is now experiencing the real pain from a weakening

currency. As a result, a lot is being written and said about

it.

The Indian rupee hit an all-time

low of 61.21 to a dollar due to a massive sell-off in the emerging

market currencies after the U.S. Fed chairman Ben Bernanke’s

earlier hint regarding curtailing the easy monetary policy later

this year. The currency depreciated 13.5% over nine weeks against

the dollar. A general risk-off trade, the recent firmness in the

dollar and a wide current account deficit resulted in the

currency’s weakness.

However, the rupee had recovered

a bit after Fed’s dovish comment to continue with accommodative monetary policy

in the near future. The currency recovered further and

reached it two-week high after the central bank announced some

tough measures to stem the slide.

The measures taken by the Reserve

Bank included increasing the interest rate on its short-term

liquidity window by two percentage points to 10.25% and capping its

daily liquidity window at 750 billion rupees.

In addition to raising short-term

borrowing costs and restricting funds available to banks, the

central bank also announced that would sell Rs 120 billion in

bonds, effectively draining liquidity from the market. While these

measures were successful in halting the fall in short-term, they

will affect economic growth in the longer-term.

Why Tumbling Rupee is a Key Concern?

India has a huge domestic market

and barring a few sectors like, gems and jewelry, textiles,

software, engineering goods, it is not an export oriented economy

as a whole. On the contrary, high levels of oil import are

resulting in continued trade deficits over the years.

As per

tradingeconomics, India recorded a

trade deficit of 1108.11 INR billion in May 2013. Over the last

four decades, its best trade performance was a surplus level of

13.91 INR billion in April 1991. Apart from Indonesia, India is

another Asian country to face a current account deficit. In such an

import-centric scenario, continued stress on the currency is not

surprising at all.

Weak exports also do not make

India immune to economic contagion from developed nations as most

of its export-partners like Eurozone and China are reeling under

pressure (Read: China ETFs Tumbling on Fears of Credit

Crunch). This has substantially

marred Indian exports because of reduced demand. Thus, India keeps

on witnessing current account deficit, higher than the tolerance

level, eating up the forex reserve and thus depreciating the

rupee.

Fallout

India’s inflation rate is

stubbornly high, above 10%, for more than one year now. As of

May 2013, India’s consumer price index stood at

10.68%, up 44 bpssequentially and 52

bps year over year. A continued fall in rupee will further

aggravate inflation.

Last but not the least, a weak rupee is sure to mar profits of

companies with high ECB exposure.

Quite expectedly, owing to such

shocks, India ETFs have been struggling this year, plunging double

digits in the year-to-date timeframe. Some popular ETF choices that

have been crushed so far this year include Wisdom Tree India Earning Fund

(EPI) losing 19.4%, PowerShares India Portfolio

(PIN) shedding about 14.1%, iShares S&P India Nifty 50 Index

(INDY) and iShares MSCI India (INDA)

being beaten down by about 13.3% and 10.5%. All above-mentioned

ETFs underperformed SPY in the past six months.

Is there Any Hope?

The current account deficit (CAD)

data for the first quarter signals a ray of hope which actually

narrowed down to $18.1 billion from the lofty levels of $31.9 billion in the

previous quarter. It was a sharp moderation in CAD to 3.6% for the

March quarter from 6.7% in the previous quarter. Further, the rate

is now not much higher than the 2.5% comfort zone of the Indian

central bank.

Second, while consumer inflation

still remains firm, the wholesale price index softened to 4.7% in

May indicating a third straight month of decline. In fact, the rate is now

within RBI’s comfort zone of 5.0%.

Third, the Fed’s comment that it

will continue with easy monetary policy should calm anxious

investors and lead to a quick shift in risk perception.

Fourth, the abundance of

technically skilled manpower put India’s outsourcing business on

fast track for the past few years. A weakened currency will likely

take this booming industry a step ahead.

Finally, policy easing on foreign

direct investment since last September is being implemented to

attract a large influx of capital.

Bottom Line

Even though the estimates hold

up, India still remains a strong growth vehicle in the global map.

Although cut from the prior level, latest projections for India’s

growth in 2014 of a respective of 5.8% and 6.1% by IMF and World Bank are still quite high when

compared to many of its western as well as eastern counterparts

(read: Forget China, Buy These Emerging Market ETFs

Instead). A set of reformative

measures, aimed primarily at building an investor-friendly climate

have actually created a buzz in the recent months (see more ETFs in

the Zacks ETF

Center).

While a plunging currency has

sent the Indian market on pins and needles lately, leaving little

scope of improvement anytime soon, we can look at the attractive

valuation as an indication of a good entry point to Indian ETFs for

risk-tolerance investors (Read: India ETFs: Back on

Track?).

Investors might also want to

consider positive factors like a rising middle class and a younger

population with growing spending power as these would result in

soaring domestic consumption and economic growth. Considering

these, the India ETF outlook—at least over the long term—isn’t as

grim as one might think.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7

Best Stocks for the Next 30 Days. Click

to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

ISHARS-M INDIA (INDA): ETF Research Reports

ISHARS-SP INDIA (INDY): ETF Research Reports

PWRSH-INDIA POR (PIN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

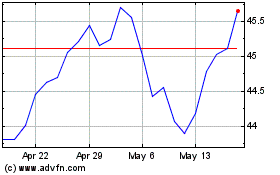

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Apr 2023 to Apr 2024