UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number |

811-02363 |

|

| Cornerstone Total Return Fund, Inc. |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, OH |

45246 |

| (Address of principal executive offices) |

(Zip code) |

Paul Leone, Esq.

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: |

(513) 587-3400 |

|

| Date of fiscal year end: |

December 31 |

|

| |

|

|

| Date of reporting period: |

June 30, 2023 |

|

Form N-CSR is to be used by management investment

companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required

to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use

the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information

specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection

of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”)

control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for

reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed

this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a)

Cornerstone Total

Return Fund, Inc.

June 30, 2023

CONTENTS

| |

|

Portfolio Summary |

1 |

Schedule of Investments |

2 |

Statement of Assets and Liabilities |

9 |

Statement of Operations |

10 |

Statements of Changes in Net Assets |

11 |

Financial Highlights |

12 |

Notes to Financial Statements |

13 |

Results of Annual Meeting of Stockholders |

18 |

Investment Management Agreement Approval Disclosure |

19 |

Description of Dividend Reinvestment Plan |

21 |

Proxy Voting and Portfolio Holdings Information |

23 |

Summary of General Information |

23 |

Stockholder Information |

23 |

Cornerstone Total Return Fund, Inc.

Portfolio Summary – as of June 30, 2023 (unaudited) |

SECTOR ALLOCATION

Sector |

Percent of

Net Assets |

Information Technology |

22.5 |

Closed-End Funds |

13.6 |

Health Care |

12.5 |

Financials |

10.6 |

Consumer Discretionary |

8.8 |

Communication Services |

7.4 |

Industrials |

7.0 |

Consumer Staples |

5.7 |

Exchange-Traded Funds |

4.3 |

Utilities |

2.4 |

Energy |

2.4 |

Real Estate |

1.2 |

Materials |

0.9 |

Other |

0.7 |

TOP TEN HOLDINGS, BY ISSUER

|

Holding |

Sector |

Percent of

Net Assets |

1. |

Apple Inc. |

Information Technology |

7.0% |

2. |

Microsoft Corporation |

Information Technology |

5.7% |

3. |

Alphabet Inc. - Class C |

Communication Services |

3.5% |

4. |

Amazon.com, Inc. |

Consumer Discretionary |

3.4% |

5. |

NVIDIA Corporation |

Information Technology |

2.7% |

6. |

Technology Select Sector SPDR®Fund (The) |

Exchange-Traded Funds |

2.2% |

7. |

Tesla, Inc. |

Consumer Discretionary |

1.9% |

8. |

Invesco QQQ TrustSM, Series 1 |

Exchange-Traded Funds |

1.8% |

9. |

UnitedHealth Group Incorporated |

Health Care |

1.6% |

10. |

Meta Platforms, Inc. - Class A |

Communication Services |

1.5% |

Cornerstone Total Return Fund, Inc.

Schedule of Investments – June 30, 2023 (Unaudited) |

Description |

|

No. of

Shares |

|

|

Value |

|

EQUITY SECURITIES — 99.35% |

CLOSED-END FUNDS — 13.64% |

CONVERTIBLE SECURITY FUNDS — 0.25% |

Bancroft Fund Ltd. |

|

|

5,767 |

|

|

$ |

98,558 |

|

Ellsworth Growth and Income Fund Ltd. |

|

|

24,453 |

|

|

|

210,296 |

|

Virtus Convertible & Income Fund |

|

|

123,798 |

|

|

|

430,817 |

|

Virtus Convertible & Income Fund II |

|

|

110,686 |

|

|

|

344,233 |

|

Virtus Diversified Income & Convertible Fund |

|

|

25,838 |

|

|

|

516,243 |

|

Virtus Equity & Convertible Income Fund |

|

|

9,612 |

|

|

|

203,294 |

|

| |

|

|

|

|

|

|

1,803,441 |

|

DEVELOPED MARKET — 0.03% |

Japan Smaller Capitalization Fund, Inc. |

|

|

27,717 |

|

|

|

199,562 |

|

| |

|

|

|

|

|

|

|

|

DIVERSIFIED EQUITY — 3.81% |

Adams Diversified Equity Fund, Inc. |

|

|

573,486 |

|

|

|

9,640,300 |

|

Eaton Vance Tax-Advantaged Dividend Income Fund |

|

|

115,622 |

|

|

|

2,630,400 |

|

Gabelli Dividend & Income Trust (The) |

|

|

326,780 |

|

|

|

6,904,862 |

|

General American Investors Company, Inc. |

|

|

132,569 |

|

|

|

5,530,779 |

|

Liberty All-Star® Growth Fund |

|

|

126,078 |

|

|

|

682,082 |

|

Royce Value Trust |

|

|

93,847 |

|

|

|

1,295,089 |

|

Tri-Continental Corporation |

|

|

22,655 |

|

|

|

621,200 |

|

| |

|

|

|

|

|

|

27,304,712 |

|

EMERGING MARKETS — 0.04% |

Morgan Stanley India Investment Fund, Inc. |

|

|

13,831 |

|

|

|

299,718 |

|

| |

ENERGY MLP FUNDS — 0.30% |

ClearBridge MLP and Midstream Total Return Fund Inc. |

|

|

15,176 |

|

|

|

481,534 |

|

First Trust MLP and Energy Income Fund |

|

|

15,849 |

|

|

|

122,196 |

|

Goldman Sachs MLP and Energy Renaissance Fund |

|

|

27,967 |

|

|

|

438,802 |

|

Kayne Anderson Energy Infrastructure Fund, Inc. |

|

|

61,200 |

|

|

|

498,168 |

|

Kayne Anderson NextGen Energy & Infrastructure, Inc. |

|

|

52,466 |

|

|

|

372,509 |

|

PIMCO Energy and Tactical Credit Opportunities Fund |

|

|

12,102 |

|

|

|

190,728 |

|

Tortoise Energy Infrastructure Corp. |

|

|

2,209 |

|

|

|

64,171 |

|

| |

|

|

|

|

|

|

2,168,108 |

|

GLOBAL — 0.71% |

abrdn Global Dynamic Dividend Fund |

|

|

17,513 |

|

|

|

167,074 |

|

abrdn Total Dynamic Dividend Fund |

|

|

3,920 |

|

|

|

32,379 |

|

Clough Global Dividend and Income Fund |

|

|

37,280 |

|

|

|

206,904 |

|

Clough Global Equity Fund |

|

|

31,911 |

|

|

|

199,125 |

|

Clough Global Opportunities Fund |

|

|

66,660 |

|

|

|

333,967 |

|

Eaton Vance Tax-Advantaged Global Dividend |

|

|

|

|

|

|

|

|

Income Fund |

|

|

115,599 |

|

|

|

1,930,502 |

|

Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund |

|

|

41,803 |

|

|

|

959,797 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Schedule of Investments – June 30, 2023 (Unaudited) (continued) |

Description |

|

No. of

Shares |

|

|

Value |

|

GLOBAL (Continued) |

Gabelli Global Small and Mid Cap Value Trust (The) |

|

|

3,966 |

|

|

$ |

47,527 |

|

GDL Fund (The) |

|

|

82,960 |

|

|

|

650,821 |

|

John Hancock Tax-Advantaged Global Shareholder |

|

|

|

|

|

|

|

|

Yield Fund |

|

|

9,684 |

|

|

|

45,418 |

|

Lazard Global Total Return and Income Fund, Inc. |

|

|

24,642 |

|

|

|

384,662 |

|

Miller/Howard High Income Equity Fund |

|

|

7,636 |

|

|

|

77,353 |

|

Royce Global Value Trust |

|

|

5,172 |

|

|

|

47,789 |

|

| |

|

|

|

|

|

|

5,083,318 |

|

INCOME & PREFERRED STOCK — 0.39% |

Calamos Long/Short Equity & Dynamic Income Trust |

|

|

79,155 |

|

|

|

1,224,528 |

|

LMP Capital and Income Fund Inc. |

|

|

117,455 |

|

|

|

1,504,599 |

|

RiverNorth Opportunities Fund, Inc. |

|

|

8,901 |

|

|

|

101,827 |

|

| |

|

|

|

|

|

|

2,830,954 |

|

| |

NATURAL RESOURCES — 0.85% |

Adams Natural Resources Fund, Inc. |

|

|

221,888 |

|

|

|

4,619,708 |

|

First Trust Energy Income and Growth Fund |

|

|

36,123 |

|

|

|

503,193 |

|

NXG NextGen Infrastructure Income Fund |

|

|

24,318 |

|

|

|

935,027 |

|

Tortoise Energy Independence Fund, Inc. |

|

|

2,130 |

|

|

|

61,238 |

|

| |

|

|

|

|

|

|

6,119,166 |

|

| |

|

|

|

|

|

|

|

|

OPTION ARBITRAGE/OPTIONS STRATEGIES — 2.37% |

BlackRock Enhanced Global Dividend Trust |

|

|

150,048 |

|

|

|

1,510,983 |

|

Eaton Vance Enhanced Equity Income Fund |

|

|

21,140 |

|

|

|

348,599 |

|

Eaton Vance Enhanced Equity Income Fund II |

|

|

208,043 |

|

|

|

3,721,889 |

|

Eaton Vance Risk-Managed Diversified Equity Income Fund |

|

|

56,787 |

|

|

|

466,789 |

|

Eaton Vance Tax-Managed Buy-Write Income Fund |

|

|

60,680 |

|

|

|

842,845 |

|

Eaton Vance Tax-Managed Buy-Write Opportunities Fund |

|

|

170,293 |

|

|

|

2,176,345 |

|

Eaton Vance Tax-Managed Diversified Equity Income Fund |

|

|

29,000 |

|

|

|

361,340 |

|

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund |

|

|

118,831 |

|

|

|

976,791 |

|

Eaton Vance Tax-Managed Global Diversified Equity Income Fund |

|

|

212,322 |

|

|

|

1,681,590 |

|

First Trust Enhanced Equity Income Fund |

|

|

9,469 |

|

|

|

165,992 |

|

Nuveen Core Equity Alpha Fund |

|

|

18,862 |

|

|

|

240,679 |

|

Nuveen Dow 30SM Dynamic Overwrite Fund |

|

|

94,968 |

|

|

|

1,339,998 |

|

Nuveen S&P 500 Dynamic Overwrite Fund |

|

|

8,617 |

|

|

|

135,115 |

|

Virtus Dividend, Interest & Premium Strategy Fund |

|

|

246,011 |

|

|

|

3,003,794 |

|

Voya Global Equity Dividend and Premium Opportunity Fund |

|

|

3,112 |

|

|

|

15,996 |

|

| |

|

|

|

|

|

|

16,988,745 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Schedule of Investments – June 30, 2023 (Unaudited) (continued) |

Description |

|

No. of

Shares |

|

|

Value |

|

REAL ESTATE — 0.52% |

Cohen & Steers Quality Income Realty Fund, Inc. |

|

|

149,405 |

|

|

$ |

1,733,098 |

|

Cohen & Steers Real Estate Opportunities andIncome Fund |

|

|

58,222 |

|

|

|

802,299 |

|

Cohen & Steers Total Return Realty Fund, Inc. |

|

|

29,502 |

|

|

|

336,913 |

|

Neuberger Berman Real Estate Securities Income Fund Inc. |

|

|

91,950 |

|

|

|

279,528 |

|

Nuveen Real Estate Income Fund |

|

|

76,268 |

|

|

|

566,671 |

|

| |

|

|

|

|

|

|

3,718,509 |

|

| |

SECTOR EQUITY — 3.78% |

BlackRock Innovation & Growth Trust |

|

|

1,118,032 |

|

|

|

8,776,552 |

|

Gabelli Healthcare & WellnessRx Trust (The) |

|

|

122,937 |

|

|

|

1,224,453 |

|

GAMCO Natural Resources, Gold & Income Trust |

|

|

45,169 |

|

|

|

226,748 |

|

Neuberger Berman Next Generation Connectivity Fund Inc. |

|

|

646,466 |

|

|

|

7,052,944 |

|

Nuveen Real Asset Income and Growth Fund |

|

|

299,287 |

|

|

|

3,417,858 |

|

Tekla Healthcare Investors |

|

|

132,947 |

|

|

|

2,266,746 |

|

Tekla Healthcare Opportunities Fund |

|

|

95,846 |

|

|

|

1,827,783 |

|

Tekla Life Sciences Investors |

|

|

168,200 |

|

|

|

2,277,428 |

|

Virtus Artificial Intelligence & Technology Opportunities Fund |

|

|

4,333 |

|

|

|

79,727 |

|

| |

|

|

|

|

|

|

27,150,239 |

|

| |

|

|

|

|

|

|

|

|

UTILITY — 0.59% |

abrdn Global Infrastructure Income Fund |

|

|

100,493 |

|

|

|

1,787,770 |

|

Allspring Utilities and High Income Fund |

|

|

5,906 |

|

|

|

59,769 |

|

BlackRock Utilities, Infrastructure & Power Opportunities Trust |

|

|

7,637 |

|

|

|

168,319 |

|

Cohen & Steers Infrastructure Fund, Inc. |

|

|

91,170 |

|

|

|

2,153,436 |

|

Macquarie/First Trust Global Infrastructure/Utilities Dividend & Income Fund |

|

|

9,545 |

|

|

|

74,451 |

|

| |

|

|

|

|

|

|

4,243,745 |

|

| |

|

|

|

|

|

|

|

|

TOTAL CLOSED-END FUNDS |

|

|

97,910,217 |

|

| |

|

|

|

|

|

|

|

|

COMMUNICATION SERVICES — 7.43% |

Alphabet Inc. - Class C * |

|

|

210,800 |

|

|

|

25,500,476 |

|

AT&T Inc. |

|

|

54,100 |

|

|

|

862,895 |

|

Comcast Corporation - Class A |

|

|

136,000 |

|

|

|

5,650,800 |

|

Meta Platforms, Inc. - Class A * |

|

|

37,700 |

|

|

|

10,819,146 |

|

Netflix, Inc. * |

|

|

8,200 |

|

|

|

3,612,018 |

|

T-Mobile US, Inc. * |

|

|

15,900 |

|

|

|

2,208,510 |

|

Verizon Communications Inc. |

|

|

51,000 |

|

|

|

1,896,690 |

|

Walt Disney Company (The) * |

|

|

30,800 |

|

|

|

2,749,824 |

|

| |

|

|

|

|

|

|

53,300,359 |

|

CONSUMER DISCRETIONARY — 8.81% |

Amazon.com, Inc. * |

|

|

188,400 |

|

|

|

24,559,824 |

|

Booking Holdings Inc. * |

|

|

700 |

|

|

|

1,890,231 |

|

Chipotle Mexican Grill, Inc. * |

|

|

400 |

|

|

|

855,600 |

|

eBay Inc. |

|

|

12,200 |

|

|

|

545,218 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Schedule of Investments – June 30, 2023 (Unaudited) (continued) |

Description |

|

No. of

Shares |

|

|

Value |

|

CONSUMER DISCRETIONARY (Continued) |

Ford Motor Company |

|

|

47,000 |

|

|

$ |

711,110 |

|

General Motors Company |

|

|

31,300 |

|

|

|

1,206,928 |

|

Hilton Worldwide Holdings Inc. |

|

|

7,400 |

|

|

|

1,077,070 |

|

Home Depot, Inc. (The) |

|

|

13,500 |

|

|

|

4,193,640 |

|

Lowe’s Companies, Inc. |

|

|

11,800 |

|

|

|

2,663,260 |

|

Marriott International, Inc. - Class A |

|

|

6,900 |

|

|

|

1,267,461 |

|

McDonald’s Corporation |

|

|

9,100 |

|

|

|

2,715,531 |

|

NIKE, Inc. - Class B |

|

|

21,700 |

|

|

|

2,395,029 |

|

Ross Stores, Inc. |

|

|

9,100 |

|

|

|

1,020,383 |

|

Starbucks Corporation |

|

|

13,600 |

|

|

|

1,347,216 |

|

Target Corporation |

|

|

6,600 |

|

|

|

870,540 |

|

Tesla, Inc. * |

|

|

52,400 |

|

|

|

13,716,748 |

|

TJX Companies, Inc. (The) |

|

|

26,200 |

|

|

|

2,221,498 |

|

| |

|

|

|

|

|

|

63,257,287 |

|

CONSUMER STAPLES — 5.74% |

Coca-Cola Company (The) |

|

|

102,700 |

|

|

|

6,184,594 |

|

Colgate-Palmolive Company |

|

|

11,600 |

|

|

|

893,664 |

|

Costco Wholesale Corporation |

|

|

10,600 |

|

|

|

5,706,828 |

|

Dollar General Corporation |

|

|

7,000 |

|

|

|

1,188,460 |

|

Hershey Company (The) |

|

|

5,600 |

|

|

|

1,398,320 |

|

Mondelēz International, Inc. - Class A |

|

|

26,000 |

|

|

|

1,896,440 |

|

Monster Beverage Corporation * |

|

|

30,600 |

|

|

|

1,757,664 |

|

PepsiCo, Inc. |

|

|

22,900 |

|

|

|

4,241,538 |

|

Philip Morris International Inc. |

|

|

41,100 |

|

|

|

4,012,182 |

|

Procter & Gamble Company (The) |

|

|

43,000 |

|

|

|

6,524,820 |

|

Walmart Inc. |

|

|

47,200 |

|

|

|

7,418,896 |

|

| |

|

|

|

|

|

|

41,223,406 |

|

| |

|

|

|

|

|

|

|

|

ENERGY — 2.37% |

Chevron Corporation |

|

|

17,700 |

|

|

|

2,785,095 |

|

ConocoPhillips |

|

|

22,300 |

|

|

|

2,310,503 |

|

Devon Energy Corporation |

|

|

22,000 |

|

|

|

1,063,480 |

|

EOG Resources, Inc. |

|

|

5,800 |

|

|

|

663,752 |

|

Exxon Mobil Corporation |

|

|

20,000 |

|

|

|

2,145,000 |

|

Hess Corporation |

|

|

2,000 |

|

|

|

271,900 |

|

Kinder Morgan, Inc. - Class P |

|

|

75,000 |

|

|

|

1,291,500 |

|

Marathon Petroleum Corporation |

|

|

12,300 |

|

|

|

1,434,180 |

|

Occidental Petroleum Corporation |

|

|

22,700 |

|

|

|

1,334,760 |

|

Phillips 66 |

|

|

3,100 |

|

|

|

295,678 |

|

Pioneer Natural Resources Company |

|

|

4,300 |

|

|

|

890,874 |

|

Schlumberger Limited |

|

|

27,500 |

|

|

|

1,350,800 |

|

Valero Energy Corporation |

|

|

5,800 |

|

|

|

680,340 |

|

Williams Companies, Inc. (The) |

|

|

15,000 |

|

|

|

489,450 |

|

| |

|

|

|

|

|

|

17,007,312 |

|

EXCHANGE-TRADED FUNDS — 4.34% |

Energy Select Sector SPDR® Fund (The) |

|

|

30,000 |

|

|

|

2,435,100 |

|

Invesco QQQ TrustSM, Series 1 |

|

|

34,800 |

|

|

|

12,855,816 |

|

Technology Select Sector SPDR® Fund (The) |

|

|

91,100 |

|

|

|

15,838,646 |

|

| |

|

|

|

|

|

|

31,129,562 |

|

FINANCIALS — 10.62% |

American Express Company |

|

|

14,800 |

|

|

|

2,578,160 |

|

Aon plc - Class A |

|

|

8,000 |

|

|

|

2,761,600 |

|

Arthur J. Gallagher & Co. |

|

|

1,200 |

|

|

|

263,484 |

|

Bank of America Corporation |

|

|

170,600 |

|

|

|

4,894,514 |

|

Bank of New York Mellon Corporation (The) |

|

|

27,000 |

|

|

|

1,202,040 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Schedule of Investments – June 30, 2023 (Unaudited) (continued) |

Description |

|

No. of

Shares |

|

|

Value |

|

FINANCIALS (Continued) |

Berkshire Hathaway Inc. - Class B * |

|

|

23,800 |

|

|

$ |

8,115,800 |

|

BlackRock, Inc. |

|

|

3,000 |

|

|

|

2,073,420 |

|

Charles Schwab Corporation (The) |

|

|

41,100 |

|

|

|

2,329,548 |

|

Chubb Limited |

|

|

4,800 |

|

|

|

924,288 |

|

Citigroup Inc. |

|

|

23,500 |

|

|

|

1,081,940 |

|

Fiserv, Inc. * |

|

|

8,000 |

|

|

|

1,009,200 |

|

Goldman Sachs Group, Inc. (The) |

|

|

8,000 |

|

|

|

2,580,320 |

|

JPMorgan Chase & Co. |

|

|

60,800 |

|

|

|

8,842,752 |

|

Marsh & McLennan Companies, Inc. |

|

|

5,900 |

|

|

|

1,109,672 |

|

Mastercard Incorporated - Class A |

|

|

18,000 |

|

|

|

7,079,400 |

|

Moody’s Corporation |

|

|

6,000 |

|

|

|

2,086,320 |

|

Morgan Stanley |

|

|

50,100 |

|

|

|

4,278,540 |

|

PayPal Holdings, Inc. * |

|

|

35,000 |

|

|

|

2,335,550 |

|

Progressive Corporation (The) |

|

|

22,000 |

|

|

|

2,912,140 |

|

S&P Global Inc. |

|

|

11,200 |

|

|

|

4,489,968 |

|

Visa, Inc. - Class A |

|

|

42,700 |

|

|

|

10,140,396 |

|

Wells Fargo & Company |

|

|

74,300 |

|

|

|

3,171,124 |

|

| |

|

|

|

|

|

|

76,260,176 |

|

HEALTH CARE — 12.48% |

Abbott Laboratories |

|

|

26,700 |

|

|

|

2,910,834 |

|

AbbVie Inc. |

|

|

27,800 |

|

|

|

3,745,494 |

|

Amgen Inc. |

|

|

6,600 |

|

|

|

1,465,332 |

|

Becton, Dickinson and Company |

|

|

3,300 |

|

|

|

871,233 |

|

Biogen Inc. * |

|

|

6,000 |

|

|

|

1,709,100 |

|

Boston Scientific Corporation * |

|

|

42,000 |

|

|

|

2,271,780 |

|

Bristol-Myers Squibb Company |

|

|

67,400 |

|

|

|

4,310,230 |

|

Centene Corporation * |

|

|

18,000 |

|

|

|

1,214,100 |

|

Cigna Group (The) |

|

|

12,000 |

|

|

|

3,367,200 |

|

CVS Health Corporation |

|

|

15,400 |

|

|

|

1,064,602 |

|

Danaher Corporation |

|

|

17,300 |

|

|

|

4,152,000 |

|

DexCom, Inc. * |

|

|

9,000 |

|

|

|

1,156,590 |

|

Elevance Health, Inc. |

|

|

9,000 |

|

|

|

3,998,610 |

|

Eli Lilly and Company |

|

|

15,700 |

|

|

|

7,362,986 |

|

Gilead Sciences, Inc. |

|

|

45,000 |

|

|

|

3,468,150 |

|

HCA Healthcare, Inc. |

|

|

8,000 |

|

|

|

2,427,840 |

|

Humana Inc. |

|

|

4,000 |

|

|

|

1,788,520 |

|

Intuitive Surgical, Inc. * |

|

|

4,400 |

|

|

|

1,504,536 |

|

IQVIA Holdings Inc. * |

|

|

7,000 |

|

|

|

1,573,390 |

|

Johnson & Johnson |

|

|

42,300 |

|

|

|

7,001,496 |

|

McKesson Corporation |

|

|

3,000 |

|

|

|

1,281,930 |

|

Medtronic plc |

|

|

15,800 |

|

|

|

1,391,980 |

|

Merck & Co., Inc. |

|

|

60,000 |

|

|

|

6,923,400 |

|

Pfizer Inc. |

|

|

90,700 |

|

|

|

3,326,876 |

|

Regeneron Pharmaceuticals, Inc. * |

|

|

1,100 |

|

|

|

790,394 |

|

Stryker Corporation |

|

|

4,400 |

|

|

|

1,342,396 |

|

Thermo Fisher Scientific Inc. |

|

|

7,400 |

|

|

|

3,860,950 |

|

UnitedHealth Group Incorporated |

|

|

23,303 |

|

|

|

11,200,354 |

|

Vertex Pharmaceuticals Incorporated * |

|

|

3,300 |

|

|

|

1,161,303 |

|

Zoetis Inc. |

|

|

5,500 |

|

|

|

947,155 |

|

| |

|

|

|

|

|

|

89,590,761 |

|

INDUSTRIALS — 6.98% |

Boeing Company (The) * |

|

|

20,000 |

|

|

|

4,223,200 |

|

Caterpillar Inc. |

|

|

1,500 |

|

|

|

369,075 |

|

CSX Corporation |

|

|

90,000 |

|

|

|

3,069,000 |

|

Cummins Inc. |

|

|

6,000 |

|

|

|

1,470,960 |

|

Deere & Company |

|

|

5,000 |

|

|

|

2,025,950 |

|

Eaton Corporation plc |

|

|

17,000 |

|

|

|

3,418,700 |

|

General Dynamics Corporation |

|

|

7,000 |

|

|

|

1,506,050 |

|

General Electric Company |

|

|

3,100 |

|

|

|

340,535 |

|

Honeywell International Inc. |

|

|

31,500 |

|

|

|

6,536,250 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Schedule of Investments – June 30, 2023 (Unaudited) (continued) |

Description |

|

No. of

Shares |

|

|

Value |

|

INDUSTRIALS (Continued) |

Illinois Tool Works Inc. |

|

|

10,000 |

|

|

$ |

2,501,600 |

|

Lockheed Martin Corporation |

|

|

10,000 |

|

|

|

4,603,800 |

|

Norfolk Southern Corporation |

|

|

11,000 |

|

|

|

2,494,360 |

|

Northrop Grumman Corporation |

|

|

400 |

|

|

|

182,320 |

|

Raytheon Technologies Corporation |

|

|

51,800 |

|

|

|

5,074,328 |

|

TransDigm Group Incorporated |

|

|

2,000 |

|

|

|

1,788,340 |

|

Union Pacific Corporation |

|

|

26,000 |

|

|

|

5,320,120 |

|

United Parcel Service, Inc. - Class B |

|

|

28,000 |

|

|

|

5,019,000 |

|

Waste Management, Inc. |

|

|

1,100 |

|

|

|

190,762 |

|

| |

|

|

|

|

|

|

50,134,350 |

|

INFORMATION TECHNOLOGY — 22.45% |

Accenture plc - Class A |

|

|

10,300 |

|

|

|

3,178,374 |

|

Adobe Inc. * |

|

|

8,400 |

|

|

|

4,107,516 |

|

Advanced Micro Devices, Inc. * |

|

|

27,200 |

|

|

|

3,098,352 |

|

Analog Devices, Inc. |

|

|

8,800 |

|

|

|

1,714,328 |

|

Apple Inc. |

|

|

257,300 |

|

|

|

49,908,481 |

|

Applied Materials, Inc. |

|

|

15,600 |

|

|

|

2,254,824 |

|

Autodesk, Inc. * |

|

|

4,000 |

|

|

|

818,440 |

|

Broadcom Inc. |

|

|

7,100 |

|

|

|

6,158,753 |

|

Cadence Design Systems, Inc. * |

|

|

4,400 |

|

|

|

1,031,888 |

|

Cisco Systems, Inc. |

|

|

65,000 |

|

|

|

3,363,100 |

|

Intel Corporation |

|

|

70,800 |

|

|

|

2,367,552 |

|

International Business Machines Corporation |

|

|

15,400 |

|

|

|

2,060,674 |

|

Intuit Inc. |

|

|

5,000 |

|

|

|

2,290,950 |

|

KLA Corporation |

|

|

2,200 |

|

|

|

1,067,044 |

|

Lam Research Corporation |

|

|

2,000 |

|

|

|

1,285,720 |

|

Micron Technology, Inc. |

|

|

18,700 |

|

|

|

1,180,157 |

|

Microsoft Corporation |

|

|

120,200 |

|

|

|

40,932,907 |

|

NVIDIA Corporation |

|

|

45,400 |

|

|

|

19,205,108 |

|

Oracle Corporation |

|

|

20,000 |

|

|

|

2,381,800 |

|

QUALCOMM Incorporated |

|

|

19,100 |

|

|

|

2,273,664 |

|

Roper Technologies, Inc. |

|

|

1,900 |

|

|

|

913,520 |

|

Salesforce, Inc. * |

|

|

17,900 |

|

|

|

3,781,554 |

|

ServiceNow, Inc. * |

|

|

3,300 |

|

|

|

1,854,501 |

|

Synopsys, Inc. * |

|

|

2,600 |

|

|

|

1,132,066 |

|

Texas Instruments Incorporated |

|

|

15,400 |

|

|

|

2,772,308 |

|

| |

|

|

|

|

|

|

161,133,581 |

|

MATERIALS — 0.92% |

Air Products and Chemicals, Inc. |

|

|

800 |

|

|

|

239,624 |

|

Albemarle Corporation |

|

|

2,200 |

|

|

|

490,798 |

|

Corteva, Inc. |

|

|

13,000 |

|

|

|

744,900 |

|

DuPont de Nemours, Inc. |

|

|

8,500 |

|

|

|

607,240 |

|

Freeport-McMoRan Inc. |

|

|

26,600 |

|

|

|

1,064,000 |

|

Linde plc |

|

|

9,000 |

|

|

|

3,429,720 |

|

| |

|

|

|

|

|

|

6,576,282 |

|

REAL ESTATE — 1.18% |

AvalonBay Communities, Inc. |

|

|

6,000 |

|

|

|

1,135,620 |

|

CBRE Group, Inc. - Class A * |

|

|

13,000 |

|

|

|

1,049,230 |

|

Digital Realty Trust, Inc. |

|

|

3,000 |

|

|

|

341,610 |

|

Equinix, Inc. |

|

|

3,000 |

|

|

|

2,351,820 |

|

Extra Space Storage Inc. |

|

|

1,000 |

|

|

|

148,850 |

|

Prologis, Inc. |

|

|

8,500 |

|

|

|

1,042,355 |

|

Public Storage |

|

|

5,000 |

|

|

|

1,459,400 |

|

SBA Communications Corporation - Class A |

|

|

4,000 |

|

|

|

927,040 |

|

| |

|

|

|

|

|

|

8,455,925 |

|

UTILITIES — 2.39% |

American Electric Power Company, Inc. |

|

|

8,300 |

|

|

|

698,860 |

|

American Water Works Company, Inc. |

|

|

5,000 |

|

|

|

713,750 |

|

Consolidated Edison, Inc. |

|

|

13,000 |

|

|

|

1,175,200 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Schedule of Investments – June 30, 2023 (Unaudited) (concluded) |

Description |

|

No. of

Shares |

|

|

Value |

|

UTILITIES (Continued) |

Constellation Energy Corporation |

|

|

8,433 |

|

|

$ |

772,041 |

|

Dominion Energy, Inc. |

|

|

23,700 |

|

|

|

1,227,423 |

|

Duke Energy Corporation |

|

|

13,900 |

|

|

|

1,247,386 |

|

Edison International |

|

|

10,900 |

|

|

|

757,005 |

|

Exelon Corporation |

|

|

40,300 |

|

|

|

1,641,822 |

|

NextEra Energy, Inc. |

|

|

37,200 |

|

|

|

2,760,240 |

|

PG&E Corporation * |

|

|

22,600 |

|

|

|

390,528 |

|

Public Service Enterprise Group Incorporated |

|

|

14,100 |

|

|

|

882,801 |

|

Sempra Energy |

|

|

12,000 |

|

|

|

1,747,080 |

|

Southern Company (The) |

|

|

20,200 |

|

|

|

1,419,050 |

|

WEC Energy Group, Inc. |

|

|

8,900 |

|

|

|

785,336 |

|

Xcel Energy Inc. |

|

|

15,600 |

|

|

|

969,852 |

|

| |

|

|

|

|

|

|

17,188,374 |

|

| |

|

|

|

|

|

|

|

|

TOTAL EQUITY SECURITIES |

(cost - $611,137,712) |

|

|

|

|

|

|

713,167,592 |

|

| |

|

|

|

|

|

|

|

|

SHORT-TERM INVESTMENT — 0.67% |

MONEY MARKET FUND — 0.67% |

Fidelity Institutional Money Market Government Portfolio - Class I, 4.99% ^ (cost - $4,783,510) |

|

|

4,783,510 |

|

|

|

4,783,510 |

|

| |

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS — 100.02% (cost - $615,921,222) |

|

|

717,951,102 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.02%) |

|

|

(156,274 |

) |

| |

|

|

|

|

|

|

|

|

NET ASSETS — 100.00% |

|

$ |

717,794,828 |

|

| |

*

|

Non-income producing security.

|

| |

^

|

The rate shown is the 7-day effective yield as of

June 30, 2023.

|

| |

plc

|

Public Limited Company

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Statement of Assets and Liabilities – June 30, 2023 (unaudited) |

ASSETS |

|

|

|

|

Investments, at value (cost – $615,921,222) (Notes B and C) |

|

$ |

717,951,102 |

|

Receivables: |

|

|

|

|

Investments sold |

|

|

1,135,325 |

|

Dividends |

|

|

507,587 |

|

Prepaid expenses |

|

|

32,749 |

|

Total Assets |

|

|

719,626,763 |

|

| |

|

|

|

|

LIABILITIES |

|

|

|

|

Payables: |

|

|

|

|

Investments purchased |

|

|

1,036,162 |

|

Investment management fees (Note D) |

|

|

576,368 |

|

Administration and fund accounting fees (Note D) |

|

|

59,830 |

|

Directors’ fees and expenses |

|

|

60,076 |

|

Other accrued expenses |

|

|

99,499 |

|

Total Liabilities |

|

|

1,831,935 |

|

| |

|

|

|

|

NET ASSETS (applicable to 106,005,758 shares of common stock) |

|

$ |

717,794,828 |

|

| |

|

|

|

|

NET ASSET VALUE PER SHARE ($717,794,828 ÷ 106,005,758) |

|

$ |

6.77 |

|

| |

|

|

|

|

NET ASSETS CONSISTS OF |

|

|

|

|

Common stock, $0.01 par value; 106,005,758 shares issued and outstanding (1,000,000,000 shares authorized) |

|

$ |

1,060,058 |

|

Paid-in capital |

|

|

616,427,247 |

|

Accumulated earnings |

|

|

100,307,523 |

|

Net assets applicable to shares outstanding |

|

$ |

717,794,828 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Statement of Operations – for the Six months Ended June 30, 2023 (unaudited) |

INVESTMENT INCOME |

|

|

|

|

Income: |

|

|

|

|

Dividends |

|

$ |

6,840,563 |

|

| |

|

|

|

|

Expenses: |

|

|

|

|

Investment management fees (Note D) |

|

|

3,328,428 |

|

Administration and fund accounting fees (Note D) |

|

|

181,288 |

|

Directors’ fees and expenses |

|

|

126,086 |

|

Printing |

|

|

88,340 |

|

Custodian fees |

|

|

37,668 |

|

Legal and audit fees |

|

|

25,583 |

|

Transfer agent fees |

|

|

24,352 |

|

Insurance |

|

|

13,698 |

|

Stock exchange listing fees |

|

|

7,968 |

|

Miscellaneous |

|

|

14,741 |

|

Total Expenses |

|

|

3,848,152 |

|

| |

|

|

|

|

Net Investment Income |

|

|

2,992,411 |

|

| |

|

|

|

|

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS |

|

|

|

|

Net realized gain from investments |

|

|

26,886,804 |

|

Long-term capital gain distributions from regulated investment companies |

|

|

11,093 |

|

Net change in unrealized appreciation/(depreciation) in value of investments |

|

|

98,262,027 |

|

Net realized and unrealized gain on investments |

|

|

125,159,924 |

|

| |

|

|

|

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

|

$ |

128,152,335 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Statements of Changes in Net Assets |

| |

|

For the Six

Months Ended

June 30, 2023

(Unaudited) |

|

|

|

For the

Year Ended

December 31,

2022 |

|

| |

|

|

|

|

|

|

|

|

|

INCREASE IN NET ASSETS |

|

|

|

|

|

|

|

|

|

Operations: |

|

|

|

|

|

|

|

|

|

Net investment income |

|

$ |

2,992,411 |

|

|

|

$ |

1,969,023 |

|

Net realized gain from investments |

|

|

26,897,897 |

|

|

|

|

15,659,369 |

|

Net change in unrealized appreciation/ (depreciation) in value of investments |

|

|

98,262,027 |

|

|

|

|

(138,858,870 |

) |

| |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in net assets resulting from operations |

|

|

128,152,335 |

|

|

|

|

(121,230,478 |

) |

| |

|

|

|

|

|

|

|

|

|

Distributions to stockholders (Note B): |

|

|

|

|

|

|

|

|

|

From earnings |

|

|

(28,718,259 |

) |

|

|

|

(20,086,120 |

) |

Return-of-capital |

|

|

(44,389,753 |

) |

|

|

|

(149,640,606 |

) |

Total distributions to stockholders |

|

|

(73,108,012 |

) |

|

|

|

(169,726,726 |

) |

| |

|

|

|

|

|

|

|

|

|

Common stock transactions: |

|

|

|

|

|

|

|

|

|

Proceeds from rights offering of 0 and 32,028,301 shares of newly issued common stock, respectively |

|

|

— |

|

|

|

|

254,624,993 |

|

Offering expenses associated with rights offering |

|

|

— |

|

|

|

|

(355,197 |

) |

Proceeds from 3,691,259 and 6,988,803 shares newly issued in reinvestment of dividends and distributions, respectively |

|

|

23,839,521 |

|

|

|

|

50,383,185 |

|

| |

|

|

|

|

|

|

|

|

|

Net increase in net assets from common stock transactions |

|

|

23,839,521 |

|

|

|

|

304,652,981 |

|

| |

|

|

|

|

|

|

|

|

|

Total increase in net assets |

|

|

78,883,844 |

|

|

|

|

13,695,777 |

|

| |

|

|

|

|

|

|

|

|

|

NET ASSETS |

|

|

|

|

|

|

|

|

|

Beginning of period |

|

|

638,910,984 |

|

|

|

|

625,215,207 |

|

End of period |

|

$ |

717,794,828 |

|

|

|

$ |

638,910,984 |

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Financial Highlights |

Contained below is per share operating performance data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for each period indicated. This information has been derived from information provided in the financial statements and market price data for the Fund’s shares. |

| |

|

For the Six

Months

Ended

June 30, |

|

|

For the Years Ended December 31, |

|

| |

|

2022

(Unaudited) |

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

2019 |

|

|

2018 |

|

PER SHARE OPERATING PERFORMANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of period |

|

$ |

6.24 |

|

|

$ |

9.88 |

|

|

$ |

9.56 |

|

|

$ |

10.46 |

|

|

$ |

10.15 |

|

|

$ |

13.18 |

|

Net investment income # |

|

|

0.03 |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.04 |

|

|

|

0.10 |

|

|

|

0.10 |

|

Net realized and unrealized gain/(loss) on investments |

|

|

1.21 |

|

|

|

(2.00 |

) |

|

|

1.82 |

|

|

|

1.21 |

|

|

|

2.59 |

|

|

|

(0.94 |

) |

Net increase/(decrease) in net assets resulting from operations |

|

|

1.24 |

|

|

|

(1.98 |

) |

|

|

1.83 |

|

|

|

1.25 |

|

|

|

2.69 |

|

|

|

(0.84 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends and distributions to stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

|

(0.03 |

) |

|

|

(0.03 |

) |

|

|

(0.01 |

) |

|

|

(0.04 |

) |

|

|

(0.10 |

) |

|

|

(0.10 |

) |

Net realized capital gains |

|

|

(0.25 |

) |

|

|

(0.22 |

) |

|

|

(1.12 |

) |

|

|

(0.58 |

) |

|

|

(0.43 |

) |

|

|

(0.32 |

) |

Return-of-capital |

|

|

(0.43 |

) |

|

|

(1.83 |

) |

|

|

(0.71 |

) |

|

|

(1.54 |

) |

|

|

(1.85 |

) |

|

|

(2.34 |

) |

Total dividends and distributions to stockholders |

|

|

(0.71 |

) |

|

|

(2.08 |

) |

|

|

(1.84 |

) |

|

|

(2.16 |

) |

|

|

(2.38 |

) |

|

|

(2.76 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anti-dilutive effect due to shares issued: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rights offering |

|

|

— |

|

|

|

0.42 |

|

|

|

0.33 |

|

|

|

— |

|

|

|

— |

|

|

|

0.57 |

|

Reinvestment of dividends and distributions |

|

|

0.00 |

+ |

|

|

0.00 |

+ |

|

|

0.00 |

+ |

|

|

0.00 |

+ |

|

|

0.00 |

+ |

|

|

0.00 |

+ |

Common stock repurchases |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

0.00 |

+ |

Total common stock transactions |

|

|

— |

|

|

|

0.42 |

|

|

|

0.33 |

|

|

|

0.01 |

|

|

|

0.00 |

+ |

|

|

0.57 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of period |

|

$ |

6.77 |

|

|

$ |

6.24 |

|

|

$ |

9.88 |

|

|

$ |

9.56 |

|

|

$ |

10.46 |

|

|

$ |

10.15 |

|

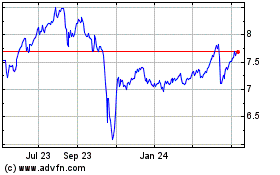

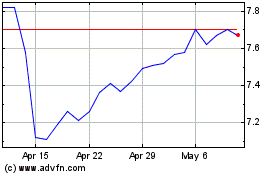

Market value, end of period |

|

$ |

8.00 |

|

|

$ |

7.10 |

|

|

$ |

13.75 |

|

|

$ |

11.40 |

|

|

$ |

10.99 |

|

|

$ |

11.11 |

|

Total investment return (a) |

|

|

25.52 |

%(b) |

|

|

(32.11 |

)% |

|

|

45.50 |

% |

|

|

30.70 |

% |

|

|

23.68 |

% |

|

|

(8.89 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RATIOS/SUPPLEMENTAL DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of period (000 omitted) |

|

$ |

717,795 |

|

|

$ |

638,911 |

|

|

$ |

625,215 |

|

|

$ |

391,374 |

|

|

$ |

415,560 |

|

|

$ |

389,231 |

|

Ratio of net expenses to average net assets (c) |

|

|

1.16 |

%(d) |

|

|

1.15 |

% |

|

|

1.15 |

% |

|

|

1.19 |

% |

|

|

1.17 |

%(e) |

|

|

1.18 |

% |

Ratio of net investment income to average net assets (f) |

|

|

0.90 |

%(d) |

|

|

0.31 |

% |

|

|

0.17 |

% |

|

|

0.43 |

% |

|

|

0.96 |

% |

|

|

0.86 |

% |

Portfolio turnover rate |

|

|

32 |

%(b) |

|

|

49 |

% |

|

|

77 |

% |

|

|

104 |

% |

|

|

46 |

% |

|

|

57 |

% |

| |

#

|

Based on average shares outstanding.

|

| |

+

|

Amount rounds to less than $0.01 per share.

|

| |

(a)

|

Total investment return at market value is based on the changes in market price of a share during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions.

|

| |

(c)

|

Expenses do not include expenses of investment companies in which the Fund invests.

|

| |

(e)

|

Includes the reimbursement of proxy solicitation costs by the investment manager. If these costs had not been reimbursed by the investment manager, the ratio of expenses to average net assets would have been 1.19%, annualized, for the year ended December 31, 2019.

|

| |

(f)

|

Recognition of net investment income by the Fund may be affected by the timing of the declaration of dividends, if any, by investment companies in which the Fund invests.

|

See accompanying notes to financial statements.

Cornerstone Total Return Fund, Inc.

Notes to Financial Statements (Unaudited) |

NOTE A. ORGANIZATION

Cornerstone Total Return Fund, Inc. (the “Fund”) was incorporated in New York on March 16, 1973 and commenced investment operations on May 15, 1973. Its investment objective is to seek capital appreciation with current income as a secondary objective. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, diversified management investment company. As an investment company, the Fund follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

NOTE B. SIGNIFICANT ACCOUNTING POLICIES

Management Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make certain estimates and assumptions that may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increase (decrease) in net assets from operations during the reporting period. Actual results could differ from those estimates.

Subsequent Events: The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date its financial statements were issued. Based on this evaluation, no additional disclosures or adjustments were required to such financial statements.

Portfolio Valuation: Investments are stated at value in the accompanying financial statements. Readily marketable portfolio securities listed on the New York Stock Exchange (“NYSE”) are valued, except as indicated below, at the last sale price reflected on the consolidated tape at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices on such day. If no bid or asked prices are quoted on such day or if market prices may be unreliable because of events occurring after the close of trading, then the security is valued by such method as the Board of Directors shall determine in good faith to reflect its fair market value. Readily marketable securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a like manner. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected on the consolidated tape at the close of the exchange representing the principal market for such securities. Securities trading on the Nasdaq Stock Market, Inc. (“NASDAQ”) are valued at the NASDAQ Official Closing Price.

Readily marketable securities traded in the over-the counter market, including listed securities whose primary market is believed by Cornerstone Advisors, LLC (the “Investment Manager” or “Cornerstone”) to be over-the-counter, are valued at the mean of the current bid and asked prices as reported by the NASDAQ or, in the case of securities not reported by the NASDAQ or a comparable source, as the Board of Directors deem appropriate to reflect their fair market value. Where securities are traded on more than one exchange and also over-the-counter, the securities will generally be valued using the quotations the Board of Directors believes reflect most closely the value of such securities. At June 30, 2023, the Fund held no securities valued in good faith by the Board of Directors.

The net asset value per share of the Fund is calculated weekly and on the last business day of the month with the exception of those days on which the NYSE is closed.

The Fund is exposed to financial market risks, including the valuations of its investment portfolio. During the six months ended June 30, 2023, the Fund did not invest in derivative instruments or engage in hedging activities.

Cornerstone Total Return Fund, Inc.

Notes to Financial Statements (unaudited) (continued) |

Investment Transactions and Investment Income: Investment transactions are accounted for on the trade date. The cost of investments sold is determined by use of the specific identification method for both financial reporting and income tax purposes. Interest income is recorded on an accrual basis; dividend income is recorded on the ex-dividend date.

The Fund holds certain investments which pay distributions to their stockholders based upon available funds from operations. It is possible for these dividends to exceed the underlying investments’ taxable earnings and profits resulting in the excess portion of such dividends being designated as a return of capital. Distributions received from investments in securities that represent a return of capital or long-term capital gains are treated as a reduction of the cost of investments or as a realized gain, respectively.

Taxes: No provision is made for U.S. federal income or excise taxes as it is the Fund’s intention to continue to qualify as a regulated investment company and to make the requisite distributions to its stockholders which will be sufficient to relieve it from all or substantially all U.S. federal income and excise taxes.

The Accounting for Uncertainty in Income Taxes Topic of the FASB Accounting Standards Codification defines the threshold for recognizing the benefits of tax-return positions in the financial statements as “more-likely-than-not” to be sustained by the taxing authority and requires measurement of a tax position meeting the more-likely-than-not criterion, based on the largest benefit that is more than 50 percent likely to be realized. The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. As of June 30, 2023, the Fund does not have any interest or penalties associated with the under-payment of any income taxes. Management reviewed any uncertain tax positions for open tax years 2020 through 2022, and for the six months ended June 30, 2023. There was no material impact to the financial statements.

Distributions to Stockholders: Effective January 2002, the Fund initiated a fixed, monthly distribution to stockholders. On November 29, 2006, this distribution policy was updated to provide for the annual resetting of the monthly distribution amount per share based on the Fund’s net asset value on the last business day in each October. The terms of the distribution policy will be reviewed and approved at least annually by the Fund’s Board of Directors and can be modified at their discretion. To the extent that these distributions exceed the current earnings of the Fund, the balance will be generated from sales of portfolio securities held by the Fund, which will either be short-term or long- term capital gains, or a tax-free return-of-capital. To the extent these distributions are not represented by net investment income and capital gains, they will not represent yield or investment return on the Fund’s investment portfolio. The Fund plans to maintain this distribution policy even if regulatory requirements would make part of a return-of-capital, necessary to maintain the distribution, taxable to stockholders and to disclose that portion of the distribution that is classified as ordinary income. Although it has no current intention to do so, the Board may terminate this distribution policy at any time and such termination may have an adverse effect on the market price for the Fund’s common shares. The Fund determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses, including capital loss carryovers, if any. To the extent that the Fund’s taxable income in any calendar year exceeds the aggregate amount distributed pursuant to this distribution policy, an additional distribution may be made to avoid the payment of a 4% U.S. federal excise tax, and to the extent that the aggregate amount distributed in any calendar year exceeds the Fund’s taxable income, the amount of that excess may constitute a return-of-capital for tax purposes.

Cornerstone Total Return Fund, Inc.

Notes to Financial Statements (unaudited) (continued) |

A return-of-capital distribution reduces the cost basis of an investor’s shares in the Fund. Dividends and distributions to stockholders are recorded by the Fund on the ex-dividend date.

NOTE C. FAIR VALUE

As required by the Fair Value Measurement and Disclosures Topic of the FASB Accounting Standards Codification, the Fund has performed an analysis of all assets and liabilities measured at fair value to determine the significance and character of all inputs to their fair value determination.

The fair value hierarchy prioritizes the inputs to valuation techniques used to measure fair value into the following three broad categories:

| |

●

|

Level 1 – quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement.

|

| |

●

|

Level 2 – quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers.

|

| |

●

|

Level 3 – model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information.

|

Securities or other assets that are not publicly traded or for which a market price is not otherwise readily available will be valued at a price that reflects such security’s fair value, as determined by the Investment Manager and ratified by the Board in accordance with the Fund’s Policy for Valuation of Portfolio Securities. In making such fair value determinations, the Investment Manager is required to consider all appropriate factors relevant to the value of securities for which other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debit issues, or a combination of these and other methods. Fair-value pricing is permitted if , in the Investment Manager’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Investment Manager is aware of any other data that calls into question the reliability of market quotations.

Cornerstone Total Return Fund, Inc.

Notes to Financial Statements (unaudited) (continued) |

The following is a summary of the Fund’s investments and the inputs used as of June 30, 2023, in valuing the investments carried at value:

Valuation Inputs |

|

Investments

in Securities |

|

|

Other

Financial

Instruments* |

|

Level 1 – Quoted Prices |

|

|

|

|

|

|

|

|

Equity Securities |

|

$ |

713,167,592 |

|

|

$ |

— |

|

Short-Term Investment |

|

|

4,783,510 |

|

|

|

— |

|

Level 2 – Other Significant Observable Inputs |

|

|

— |

|

|

|

— |

|

Level 3 – Significant Unobservable Inputs |

|

|

— |

|

|

|

— |

|

Total |

|

$ |

717,951,102 |

|

|

$ |

— |

|

|

*

|

Other financial instruments include futures, forwards and swap contracts, if any.

|

The breakdown of the Fund’s investments into major categories is disclosed in its Schedule of Investments.

The Fund did not have any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) at June 30, 2023.

NOTE D. AGREEMENTS WITH AFFILIATES

At June 30, 2023, certain officers of the Fund are also officers of Cornerstone or Ultimus Fund Solutions, LLC (“Ultimus”). Such officers are paid no fees by the Fund for serving as officers of the Fund.

Investment Management Agreement

Cornerstone serves as the Fund’s Investment Manager with respect to all investments. As compensation for its investment management services, Cornerstone receives from the Fund an annual fee, calculated weekly and paid monthly, equal to 1.00% of the Fund’s average weekly net assets. For the six months ended June 30, 2023, Cornerstone earned $3,328,428 for investment management services.

Fund Accounting and Administration Agreement

Under the fund accounting and administration agreement with the Fund, Ultimus is responsible for generally managing the administrative affairs of the Fund, including supervising the preparation of reports to stockholders, reports to and filings with the Securities and Exchange Commission (“SEC”) and materials for meetings of the Board.

Ultimus is also responsible for calculating the net asset value per share and maintaining the financial books and records of the Fund. Ultimus is entitled to receive a fee in accordance with the agreements. For the six months ended June 30, 2023, Ultimus earned $181,288 as fund accounting agent and administrator

NOTE E. INVESTMENT IN SECURITIES

For the six months ended June 30, 2023, purchases and sales of securities, other than short-term investments, were $217,152,855 and $263,657,838, respectively.

NOTE F. SHARES OF COMMON STOCK

The Fund has 1,000,000,000 shares of common stock authorized and 106,005,758 shares issued and outstanding at June 30, 2023. Transactions in common stock for the six months ended June 30, 2023, were as follows:

Shares at beginning of period |

|

|

102,314,499 |

|

Shares newly issued from rights offering |

|

|

— |

|

Shares issued in reinvestment of dividends and distributions |

|

|

3,691,259 |

|

Shares at end of period |

|

|

106,005,758 |

|

Cornerstone Total Return Fund, Inc.

Notes to Financial Statements (unaudited) (concluded) |

NOTE G. FEDERAL INCOME TAXES

Income and capital gains distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. These differences are primarily due to differing treatments of losses deferred due to wash sales.

The tax character of dividends and distributions paid to stockholders during the periods ended June 30, 2023 and December 31, 2022 was as follows:

|

|

June 30,

2023 |

|

|

December 31,

2022 |

|

Ordinary Income |

|

$ |

2,992,411 |

|

|

$ |

4,928,395 |

|

Long-Term Capital Gains |

|

|

25,725,848 |

|

|

|

15,157,725 |

|

Return-of-Capital |

|

|

44,389,753 |

|

|

|

149,640,606 |

|

Total Distributions |

|

$ |

73,108,012 |

|

|

$ |

169,726,726 |

|

At December 31, 2022, the components of accumulated earnings on a tax basis for the Fund were as follows:

Net unrealized appreciation |

|

$ |

873,447 |

|

Total accumulated earnings |

|

$ |

873,447 |

|

The following information is computed on a tax basis for each item as of June 30, 2023:

Cost of portfolio investments |

|

$ |

617,643,579 |

|

Gross unrealized appreciation |

|

$ |

119,171,038 |

|

Gross unrealized depreciation |

|

|

(18,863,515 |

) |

Net unrealized appreciation |

|

$ |

100,307,523 |

|

Results of Annual Meeting of Stockholders (unaudited)

On April 11, 2023, the Annual Meeting of Stockholders of the Fund was held and the following matter was voted upon based on 102,931,514 shares of common stock outstanding on the record date of February 15, 2023:

(1) To approve the election of nine directors to hold office until the year 2024 Annual Meeting of Stockholders.

Name of Directors |

|

For |

|

Withheld |

Daniel W. Bradshaw |

|

59,114,769 |

|

2,796,208 |

Joshua G. Bradshaw |

|

59,071,167 |

|

2,839,810 |

Ralph W. Bradshaw |

|

59,322,560 |

|

2,588,417 |

Robert E. Dean |

|

59,389,691 |

|

2,521,286 |

Marcia E. Malzahn |

|

59,504,921 |

|

2,406,056 |

Frank J. Maresca |

|

59,412,877 |

|

2,498,100 |

Matthew W. Morris |

|

59,443,942 |

|

2,467,035 |

Scott B. Rogers |

|

59,405,842 |

|

2,505,135 |

Andrew A. Strauss |

|

59,372,653 |

|

2,538,324 |

Investment Management Agreement Approval Disclosure (unaudited)