Advent Announces Official Closing of Tender Offer for Charlotte Russe

October 14 2009 - 8:05AM

PR Newswire (US)

BOSTON, Oct. 14 /PRNewswire/ -- Advent International Corporation

("Advent"), a leading global buyout firm, and Charlotte Russe

Holding, Inc. ("Charlotte Russe") (NASDAQ:CHIC), a specialty

retailer of fashion for young women, announced today the official

closing of the tender offer by Advent's acquisition vehicle, Advent

CR Holdings, Inc. ("Parent") and its wholly-owned subsidiary,

Advent CR, Inc. ("Purchaser"), for all of the outstanding shares of

common stock (including the associated preferred stock purchase

rights) of Charlotte Russe. Mellon Investor Services LLC, the

Depositary for the tender offer, has advised Advent that, as of the

expiration of the subsequent offering period at midnight, New York

City Time, at the end of the day on Tuesday, October 13, 2009, a

total of approximately 19,323,125 shares representing approximately

88.91% of the outstanding shares of common stock of Charlotte Russe

on a fully-diluted basis and 91.74% of the currently outstanding

shares had been validly tendered and not validly withdrawn. All

validly tendered shares have been accepted for payment and

Purchaser either has already paid or will pay for all such shares

promptly. Advent also announced today that Parent has acquired all

of the remaining outstanding shares of common stock (including the

associated preferred stock purchase rights) of Charlotte Russe by

means of a short-form merger under Delaware law. As a result of the

Merger, any shares of common stock (including the associated

preferred stock purchase rights) of Charlotte Russe not tendered

have been cancelled and (except for shares held by Parent or its

subsidiaries, or shares for which appraisal rights are properly

demanded) converted into the right to receive the same $17.50 per

share, net to the seller in cash, without interest and less any

required withholding taxes, that was paid in the Offer. Following

the merger, the shares of common stock (including the associated

preferred stock purchase rights) of Charlotte Russe will cease to

be traded on the NASDAQ Global Select Market. David Mussafer, a

Managing Partner at Advent, said, "We are pleased with the

overwhelming support we have received from shareholders, and we are

excited to begin working to help Charlotte Russe achieve the

numerous growth opportunities before it. The company has initiated

a number of important steps recently that will improve its

operations, financial position and strategic direction. Advent's

investment in Charlotte Russe is consistent with the strategy we

have successfully adhered to over the past 25 years of building

valuable companies in retail and our other target industries. We

believe partnering with our Operating Partner and the former

President of Old Navy Jenny Ming will help Charlotte Russe build on

its recent progress and grow for the benefit of its customers,

employees and other stakeholders." About Charlotte Russe Charlotte

Russe Holding, Inc. is a specialty retailer offering exclusive

collections of fashionable, value-priced apparel and accessories to

women in their teens and twenties. As of September 26, 2009, the

company operated 504 stores in 45 states and Puerto Rico, as well

as a burgeoning e-commerce business. More information about

Charlotte Russe is available at http://www.charlotterusse.com/.

About Advent Founded in 1984, Advent is one of the world's leading

global buyout firms, with offices in 16 countries on four

continents. A driving force in international private equity for 25

years, Advent has built an unparalleled global platform of over 140

investment professionals across Western and Central Europe, North

America, Latin America and Asia. The firm focuses on international

buyouts, strategic repositioning opportunities and growth buyouts

in five core sectors, working actively with management teams to

drive revenue growth and earnings improvements in portfolio

companies. Since inception, Advent has raised $24 billion in

private equity capital and, through its buyout programs, has

completed more than 250 transactions valued at approximately $45

billion in 35 countries. More information about Advent is available

at http://www.adventinternational.com/. Forward-looking Statements

This press release contains forward-looking statements. Advent,

Parent and Purchaser disclaim any intent or obligation to update

these forward-looking statements. All statements contained herein

that are not clearly historical in nature or that may necessarily

depend on future events are forward-looking, and the words

"anticipate," "believe," "expect," "estimate," "plan," "potential,"

"strategy," "pursue," and similar expressions are generally

intended to identify forward-looking statements. Such statements

are based on management's current expectations, but actual events

may differ materially due to various factors such as delays in

effecting the tender offer, unanticipated events, prolonged adverse

conditions in the U.S. economy, and expectations regarding

Charlotte Russe's financial condition and liquidity.

Forward-looking statements involve risks and uncertainties.

Important Information about the Tender Offer The description

contained in this press release is neither an offer to purchase nor

a solicitation of an offer to sell securities. The tender offer

described in this press release is being made pursuant to a tender

offer statement on Schedule TO (including the offer to purchase,

the related letter of transmittal and other tender offer documents)

filed by Parent and the Purchaser with the Securities and Exchange

Commission (the "SEC") on August 31, 2009, as amended on September

16, 2009, September 28, 2009, September 29, 2009 and October 14,

2009. Charlotte Russe initially filed a solicitation/recommendation

statement on Schedule 14D-9 with respect to the tender offer on

August 31, 2009, which has been subsequently amended. The tender

offer statement (including the offer to purchase, the related

letter of transmittal and other tender offer documents) and the

solicitation/recommendation statement contain important information

that should be read carefully before making any decision to tender

securities in the tender offer. Those materials are available to

Charlotte Russe's stockholders at no expense to them upon request

to Innisfree M&A Incorporated, the Information Agent for the

tender offer at (888) 750-5834 (toll free). In addition, all of

those materials (and all other tender offer documents filed with

the SEC) are available at no charge on the SEC's website:

http://www.sec.gov/. DATASOURCE: Advent International Corporation

CONTACT: Steve Bruce, Chuck Dohrenwend, or Monica Everett, all of

The Abernathy MacGregor Group, +1-212-371-5999, for Advent

International Corporation Web Site:

http://www.adventinternational.com/

Copyright

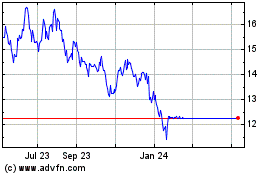

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Apr 2023 to Apr 2024