Advent Announces Acceptance for Payment of Shares Tendered in Charlotte Russe Tender Offer and Commencement of Subsequent Offeri

September 29 2009 - 11:34PM

PR Newswire (US)

BOSTON, Sept. 29 /PRNewswire/ -- Advent International Corporation

("Advent"), a leading global buyout firm, and Charlotte Russe

Holding, Inc. ("Charlotte Russe") (NASDAQ:CHIC), a specialty

retailer of fashion for young women, announced today the successful

completion of the tender offer by Advent's acquisition vehicle,

Advent CR Holdings, Inc. ("Parent") and its wholly-owned

subsidiary, Advent CR, Inc. ("Purchaser"), for all of the

outstanding shares of common stock (including the associated

preferred stock purchase rights) of Charlotte Russe. Mellon

Investor Services LLC, the Depositary for the tender offer, has

advised Advent that, as of midnight, New York City Time, at the end

of the day on September 28, 2009, the expiration date of the tender

offer, a total of approximately 18,001,964 shares representing

approximately 79.255% of the outstanding shares of common stock of

Charlotte Russe on a fully-diluted basis and 85.477% of the

currently outstanding shares had been validly tendered and not

validly withdrawn as of the expiration date (in addition to 800,253

shares tendered under guaranteed delivery procedures). All validly

tendered shares have been accepted for payment and Advent will pay

for all such shares promptly. Advent and Charlotte Russe also

announced today that Purchaser would make available a subsequent

offering period commencing immediately and expiring at midnight,

New York City time, at the end of the day on Tuesday, October 13,

2009 for all shares of common stock (including the associated

preferred stock purchase rights) of Charlotte Russe not tendered

into the offer prior to the September 28th expiration date.

Stockholders who have already tendered their shares do not have to

re-tender their shares or take any other action as a result of the

subsequent offering period. During the subsequent offering period,

Purchaser will accept for payment and promptly pay for shares of

common stock (including the associated preferred stock purchase

rights) of Charlotte Russe as they are tendered. Stockholders who

tender shares during this period will receive the same $17.50 per

share of Charlotte Russe common stock tendered in the tender offer,

net to the seller in cash, without interest and less any applicable

withholding taxes. Procedures for tendering shares during the

subsequent offering period are the same as during the initial

offering period with two exceptions: (1) shares cannot be delivered

by the guaranteed delivery procedure and (2) pursuant to Rule

14d-7(a)(2) under the Securities Exchange Act of 1934, as amended,

shares tendered during the subsequent offering period may not be

withdrawn. Parent and Purchaser reserve the right to extend the

subsequent offering period in accordance with the offer to purchase

and applicable law. Following the expiration of the subsequent

offering period, Purchaser will acquire all of the remaining

outstanding shares of common stock (including the associated

preferred stock purchase rights) of Charlotte Russe by means of a

merger under Delaware law. Following the merger, Purchaser will be

merged with and into Charlotte Russe and will become a wholly-owned

subsidiary of Parent, and each share of Charlotte Russe's

outstanding common stock will be cancelled and converted into the

right to receive the same consideration, without interest, received

by holders who tendered in the tender offer or the subsequent

offering period. Thereafter, the shares of common stock (including

the associated preferred stock purchase rights) of Charlotte Russe

will cease to be traded on the NASDAQ Global Select Market. About

Charlotte Russe Charlotte Russe Holding, Inc. is a mall-based

specialty retailer of fashionable, value-priced apparel and

accessories targeting young women in their teens and twenties. As

of June 27, 2009, Charlotte Russe operated 501 stores in 45 states

and Puerto Rico. For more about Charlotte Russe, please visit

http://www.charlotterusse.com/. About Advent Founded in 1984,

Advent is one of the world's leading global buyout firms, with

offices in 15 countries on four continents. A driving force in

international private equity for 25 years, Advent has built an

unparalleled global platform of over 140 investment professionals

across Western and Central Europe, North America, Latin America and

Asia. The firm focuses on international buyouts, strategic

repositioning opportunities and growth buyouts in five core

sectors, working actively with management teams to drive revenue

growth and earnings improvements in portfolio companies. Since

inception, Advent has raised $24 billion in private equity capital

and, through its buyout programs, has completed more than 250

transactions valued at approximately $45 billion in 35 countries.

More information about Advent is available at

http://www.adventinternational.com/. Important Information about

the Tender Offer The description contained in this press release is

neither an offer to purchase nor a solicitation of an offer to sell

securities. The tender offer described in this press release is

being made pursuant to a tender offer statement on Schedule TO

(including the offer to purchase, the related letter of transmittal

and other tender offer documents) filed by Parent and the Purchaser

with the Securities and Exchange Commission (the "SEC") on August

31, 2009, as amended on September 16, 2009, September 28, 2009 and

September 29, 2009. Charlotte Russe filed a

solicitation/recommendation statement on Schedule 14D-9 with

respect to the tender offer on the same date. The tender offer

statement (including the offer to purchase, the related letter of

transmittal and other tender offer documents) and the

solicitation/recommendation statement contain important information

that should be read carefully before making any decision to tender

securities in the tender offer. Those materials are available to

Charlotte Russe's stockholders at no expense to them upon request

to Innisfree M&A Incorporated, the Information Agent for the

tender offer at (888) 750-5834 (toll free). In addition, all of

those materials (and all other tender offer documents filed with

the SEC) are available at no charge on the SEC's website:

http://www.sec.gov/. CONTACTS: Marissa Wolf Tel: 212-850-5647

DATASOURCE: Advent International Corporation CONTACT: Marissa Wolf,

for Advent International Corporation, +1-212-850-5647,

Copyright

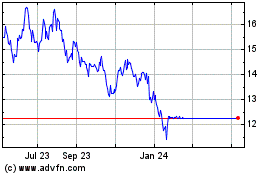

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global X Funds Global X ... (AMEX:CHIC)

Historical Stock Chart

From Apr 2023 to Apr 2024