Zacks Top Ranked Bond ETF In Focus - ETF News And Commentary

March 08 2013 - 8:45AM

Zacks

Even though interest rates in the domestic U.S. markets have

been at extremely low levels, investors have kept their confidence

alive in the fixed income market. This is true despite the

possibility of the Federal Reserve finally being tired of printing

more money, thanks to stronger employment levels in the U.S. (see

Target Date Bond ETFs: Best or Worst Fixed Income Funds?).

While this will surely draw the Treasury bond bull run to a

close, especially given the fact that that the Fed is the largest

purchaser of these debt securities, the big question still remains

– WHEN?

Although the quantitative easing will probably have some severe

consequences in the Fed balance sheet (which has increased

substantially), it seems that the benefits of the easing are

finally showing. The unemployment level is gradually decreasing and

business as well as consumer spending is slowly inching forward

although a low level of inflation still remains a concern for the

economy.

Given these facts, it seems rather unlikely for the monetary

easing to stop anytime soon, as unemployment rates are still

elevated (see Is the Best Performing Bond ETF Really in

Europe?).

Nevertheless, bond investors will have their work cut out for

themselves as the interest rates are not expected to increase this

fiscal year by many analysts. In any case, yield-hungry investors

have found solace in other unconventional income sources.

With this backdrop, we would like to highlight yet another

unconventional source of yield- via a Zacks Ranked # 2 Bond ETF

which investors could consider for current income.

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook of the underlying industry, sector, style

box, or asset class. Our proprietary methodology also takes into

account the risk preferences of investors as well.

The aim of our models is to select the best ETFs within each

risk category. We assign each ETF one of five ranks within each

risk bucket. Thus, Zacks Rank reflects the expected return of an

ETF relative to other ETFs with similar level of risk (see more in

the Zacks ETF Center).

Using this strategy, we have found a Ranked 2 or ‘Buy’ Bond ETF

which we have highlighted in greater detail below:

SPDR BofA Merrill Lynch Crossover Corporate Bond ETF

(XOVR)

The ETF tracks the BofA Merrill Lynch US Diversified Crossover

Corporate Index. The benchmark tracks the performance of such

corporate bonds which belong to the lower end of the investment

grade spectrum and the higher end of the non investment grade

spectrum.

Naturally, given the very nature of the product, one would

imagine that the ETF provides an efficient mix in terms of risk

return tradeoff offering relative stability (thanks to investment

grade bonds in portfolio), along with a scope of high yields (due

to junk bonds in its portfolio) (read 3 Reasons to Consider the

Crossover Bond ETF).

However, the ETF does not seem to be well placed in terms of

popularity and liquidity. XOVR was launched in June of 2012 and

since then it has managed to amass an asset base of around $18

million; on an average only around 15,000 shares of XOVR exchange

hands each day.

It charges investors 30 basis points in fees and expenses and

pays out a yield of 2.19% while holding 223 components in its

portfolio. This suggests that the fund is quite spread out and that

while trading costs might be somewhat elevated, XOVR clearly has

other benefits.

Investors should also note that this bond ETF doesn’t have a

whole lot of interest rate risk as it focuses on the intermediate

part of the curve with an average maturity of 7.92 years. It also

carries moderate levels of interest rate risk as measured by an

average duration of 5.67 years (read AGG vs. BND: Which Bond ETF Do

You Choose?).

The ETF has fetched total returns of around 3% since its

inception and it is expected to continue its strong run going

forward. Additionally, its higher yield could help investors

seeking bigger payouts that have lower interest rate risk, in case

the Fed does look to tighten at some point this year or next.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-BR AG BD (AGG): ETF Research Reports

VANGD-TOT BOND (BND): ETF Research Reports

SPDR-BAML CR CB (XOVR): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

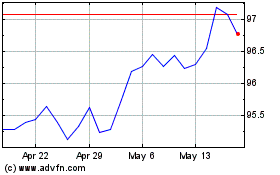

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

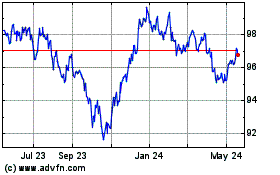

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Apr 2023 to Apr 2024