Although yields are low, fixed income ETF investing can still be

a valuable part of an investor’s portfolio. Securities in this

space still have low levels of correlation to broad equity markets

and are often less volatile as well.

This could be especially important if Europe descends into

anarchy again or if the American economy has trouble keeping up its

modest momentum. Furthermore, although interest rate risk is

certainly an issue, the current investment climate and the policies

of the Federal Reserve suggest that we could be a long way off from

seeing a boost in rates.

As a result, some investors may still want to cycle into bond

ETFs at this time. However, there are a host of choices that are

available to investors targeting nearly every sector of the market;

in fact, over 150 products currently occupy the space.

Yet, for those who are new to the bond ETF market a look at

some of the most popular products could be a great first step. For

these investors, we have briefly highlighted seven of the most

popular bond ETFs on the market today, any of which could help

investors better diversify their portfolios and smooth volatility

over the short-term:

Barclays TIPS Bond Fund

(TIP)

To play the largest fund in the bond universe, investors may bet

on iShares’ TIP which has total assets of $22.2 billion. The fund

tracks the price and performance of the Barclays Capital U.S.

Treasury Inflation Protected Securities (TIPS) Index, before fees

and expenses.

The index is a market capitalization weighted benchmark

including all the U.S. Treasury inflation-protected securities that

are rated investment grade having at least 1 year remaining to

maturity with face value of minimum $250 million. (Read: Can You

Fight Inflation With This Real Return ETF?)

The product holds 35 securities in total and charges investors

20 basis points in fees. With an annual distribution yield of about

3.25% and average yield to maturity of 1.74%, the fund is entirely

focused on government debt and is generally AAA rated by Moody’s

and AA+ by S&P.

In fact, the medium-term bonds comprise a group of holdings at

69% of the total, giving the fund an effective duration of about

5.41 years. Launched in December 2003, the product has delivered

healthy returns of 13.40% last year and 1.05% in the first three

months of this year.

iBoxx $ Investment Grade Corporate Bond

(LQD)

Initiated in July 2002 by iShares, the fund seeks to match the

price and yield performance of the iBoxx $ Liquid Investment

Grade Index, before fees and expenses. The index is a rules-based

benchmark and invests in U.S. liquid investment grade corporate

bonds. The fund holds 783 securities with 5% concentrated in top 10

corporate bonds, including AT&T notes due in 2018, Wells Fargo

notes due in 2017, and Wal-Mart notes due in 2037.

The product is tilted towards the mid-to-high quality securities

as bonds in the BBB+ to BBB- range make up just 30% of the total

while financial securities make up the top sector. With total

assets of $19.8 billion, the fund has an effective duration of 7.47

years and charges investors a low fee of 15 bps a year.

In addition, it has an annual distribution yield of about 4.09%

and average yield to maturity of 3.65%. The product has delivered

healthy returns of 8.89% last year and 0.59% in the first three

months of this year. (Read: Top Three High Yield Junk Bond

ETFs)

Total Bond Market ETF

(BND)

Another exciting option available for broad exposure in the

space is Vanguard’s BND, holding 5,086 bonds. The fund uses a

passive approach and tracks the performance of the Barclays Capital

U.S. Aggregate Float Adjusted Index. With total assets of $15.3

billion, the product consists largely of government Treasury bonds

followed by mortgage-backed and asset-backed securities, and

finally corporate bonds.

A large part of the fund is geared towards 10 years maturity

notes, which makes up about 86% of the assets on a combined basis.

The average maturity is 7.2 years and average duration is 5.1

years, suggesting modest duration risk. However, the fund does

charge a low fee of 11 bps per year and generates an annual

return of 7.80% in one-year period (as of March 31, 2012). (Read:

Three Bond ETFs For A Fixed Income Bear Market)

Barclays Aggregate Bond

(AGG)

Launched in September 2003 by iShares, the fund seeks to match

the performance of the Barclays Capital U.S. Aggregate Bond Index.

Treasury bonds take the top spot in the basket of securities

followed by the mortgage pass-through notes, asset-backed

securities, and corporate bonds. The notes are fixed rate,

non-convertible, and taxable having the remaining maturity of at

least one year. With total holdings of 1,441, the average yield to

maturity and average duration of the fund are 1.78% and 4.37 years,

respectively. (Read: Sterilization- QE 3 With Another "Twist"?)

The fund has total assets of $14.7 billion and charges investors

a fee of 22 bps. The risk is more concentrated to the ‘A’ rated and

above notes with roughly 85% of its assets. The product yields

2.62% dividends per annum and generated good annual returns of

7.58% in 2011.

iBoxx $ High Yield Corporate Bond Fund

(HYG)

The fund, issued by iShares in April 2007, seeks to match the

performance of the iBoxx $ Liquid High Yield Index, before fees and

expenses. The product holds 504 junk bonds with heavy focus on

short and intermediate term corporates.

The average yield to maturity is 6.89% and the effective

duration is 4.26 years. Consumer service, financials, and telecom

constitutes a large part of the fund’s assets with Blackrock notes

on top, followed by First Data notes due in 2021, and Sprint

Nextel’s notes due in 2018. (Read: U.S. Telecom ETFs: Opportunities

and Threats)

The fund charges investors 50 basis points a year in fees and

has total assets of $14.5 billion. HYG delivers a massive

dividend of 7.17% per annum and excellent annual returns of 5.89%

and 1.01% last year and year-to-date, respectively.

SPDR Barclays Capital High Yield Bond ETF

(JNK)

For another option in the junk bond ETF space, investors have

the ultra popular JNK. With assets of $12 billion under its

management, the fund tracks the overall performance of the Barclays

Capital High Yield Very Liquid Index, which includes fixed-rate,

taxable, low rated corporate bonds usually ‘BBB’ and below. The

individual bond is having more than $600 million in face value and

remaining maturity of at least one year.

With lower fees of 40 bps per year, the fund is heavily exposed

to industrial sector and holds around 226 bonds in its basket. It

provides attractive dividend yield of 7.38% like other high yield

junk bond ETFs. The fund has generated annual returns of 6.66%

in 2011 and 1.98% year-to-date. (Read: Top Three High Yield Junk

Bond ETFs)

Barclays 1-3 Year Treasury Bond

(SHY)

For investors looking to play short-term bonds, iShares’

SHY seems to be intriguing option in the space with AUM of $10.2

billion. The fund seeks to replicate the performance of 61 Treasury

bonds having maturities remaining between 1-3 years and a minimum

$250 million in face value as depicted by the Barclays Capital U.S.

1-3 Year Treasury Bond Index. This results in a product that has

virtually no credit or interest rate risk, although yields are

extremely low for this fund

Still, SHY charge investors a low fee of 15 bps a year and has

an average yield to maturity of 0.36% with the effective duration

being 1.92 years. The product has delivered unimpressive annual

returns of 1.43% last year and yields 0.42% dividend per annum.

Since the start of the year, the product is not doing as well as

some of its counterparts, as it has lost 0.3% in year-to-date

terms, however, safety should be the goal with this fund as opposed

to capital gains (Read: Go Local With Emerging Market Bond

ETFs).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

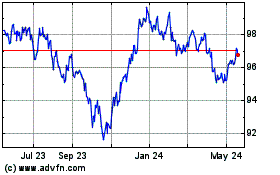

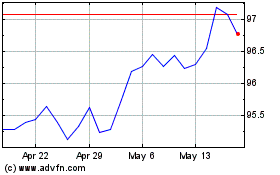

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Apr 2023 to Apr 2024