For Immediate Release

Chicago, IL – January 19, 2012 – Today, Zacks Investment Ideas

feature highlights Features: Apple ( AAPL),

Berkshire Hathaway ( BRK.B),

Google ( GOOG), Procter &

Gamble ( PG) and Southwest Airlines (

LUV).

America’s Most Admired Companies…On

Sale!

"It takes 20 years to build a reputation and five minutes to

ruin it." - Warren Buffett

In business, reputation is everything. And each year, Fortune

magazine attempts to quantify this by asking businesspeople and

securities analysts which companies they admire the most.

It's interesting to see the shift in the list from pre-Great

Recession to post-Great Recession.

In 2007, for instance, the top 3 most admired companies were

General Electric, Starbucks and Toyota Motor. This year, they're

13th, 16th and 33rd, respectively. And a number of former

sacrosanct financial institutions have fallen way down on the

list.

Meanwhile, tech companies have climbed in the rankings. Now the

top 2 most admired companies (and 5 of the top 12) are tech

companies, including #7 Amazon.com, which wasn't even in the top 50

just 5 years ago.

Wonderful Businesses at a Reasonable Price

Some companies have managed to stay in the top 20 before, during

and after the financial crisis. And even better, because of

concerns over global economic growth in 2012 and risks stemming

from the Eurozone debt crisis, some of these wonderful businesses

are currently trading at very reasonable prices.

For the long-term investor, this could be a great opportunity to

generate strong returns by buying some of the most revered

businesses in the world.

5 Great Companies on Sale

Apple ( AAPL)

Average 'Most Admired' Ranking Since 2007: 2.2

2012 Ranking: 1

Current Forward P/E: 11.5x

10-year Median P/E: 28.7x

On the verge of bankruptcy 15 years ago, Apple has now topped

the list of most admired companies for 4 years in a row. And its

reputation as a premium brand is spreading like wildfire in a

market more than 4x the size of the U.S. - China.

The company is about as far from bankruptcy as possible now,

with no debt and over $81 billion ($87/share) in cash and

securities.

Berkshire Hathaway (

BRK.B)

Average 'Most Admired' Ranking Since 2007: 2.8

2012 Ranking: 3

Current Forward P/E: 14.9x

10-year Median P/E: 18.9x

No doubt Berkshire's sterling reputation is an extension of its

popular chairman and CEO, Warren Buffett. He almost ate his own

words on reputation during the David Sokol/Lubrizol fiasco, but

that seemed to blow over rather quickly.

The down-to-earth Oracle of Omaha is admired for living like a

normal American. He lives in the Midwest in a nice (but not lavish)

home, drives himself to work every day, and eats fast food. And

he's giving away the bulk of his fortune to charity when he

dies.

Berkshire has managed to grow its book value by more than 20%

per year for almost half a century. Although Mr. Buffett has warned

shareholders not to expect these kinds of returns in the future,

the wide-moat company should still perform very well.

Google ( GOOG)

Average 'Most Admired' Ranking Since 2007: 4.0

2012 Ranking: 2

Current Forward P/E: 16.2x

Historical Median P/E: 27.3x

One of Google's philosophies is that "You can make money

without doing evil." A lot of companies might have similar

mission statements. And why not? It makes for good PR.

But for some reason, it seems like Google actually

means it.

Shares are trading around the same price as they were back in

late 2007, when it earned $13.29 per share. But in 2012, it's

expected to earn $38.22 per share.

Procter & Gamble ( PG)

Average 'Most Admired' Ranking Since 2007: 6.8

2012 Ranking: 5

Current Forward P/E: 14.9x

10-year Median P/E: 19.0x

Procter & Gamble has been around since 1837. It scores high

for its innovation, people management, social responsibility and

financial soundness.

The company also owns some of the best-known household brands

like Braun, Crest, Pampers, Tide, Dawn, Charmin, Gillette, and

Pepto-Bismol, just to name a few. And the company is expanding

rapidly in the emerging markets.

P&G generates steady and consistent free cash flow, which it

has been using to reward shareholders through higher dividends. It

currently yields a solid 3.2%.

Southwest Airlines ( LUV)

Average 'Most Admired' Ranking Since 2007: 8.0

2012 Ranking: 4

Current Forward P/E: 10.9x

10-year Median P/E: 23.5x

Flying is neither fun for the traveler nor consistently

profitable for the airline. So to see an airline anywhere on this

list is saying something. Southwest is revered for its low cost,

exceptional service and the fact that it doesn't nickel and dime

its customers with fees ("Bags fly free").

They say the fastest way to become a millionaire is to start as

a billionaire and buy an airline. But Southwest has been a much

more consistent performer than most of its competitors.

The stock has gotten beaten up lately over concerns about oil

prices and slower economic growth. But these fears may be

overblown. The company is expected to see strong EPS growth in

2012, and the acquisition of AirTran should provide Southwest with

strong growth opportunities in the future. Despite this, shares

trade at just 11x forward earnings and 1.1x book value - near its

Great Recession lows.

The Bottom Line

These 5 companies are consistently some of the most admired in

the world. They also happen to be trading at very reasonable

prices. For the long-term investor, this could be a great

opportunity to generate strong returns owning some of America's

most reputable businesses.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Len Zacks. The company continually

processes stock reports issued by 3,000 analysts from 150 brokerage

firms. It monitors more than 200,000 earnings estimates,

looking for changes.

Then when changes are discovered, they’re applied to help assign

more than 4,400 stocks into five Zacks Rank categories: #1

Strong Buy, #2 Buy, #3 Hold, #4 Sell, and #5 Strong Sell. This

proprietary stock picking system; the Zacks Rank, continues to

outperform the market by nearly a 3 to 1 margin. The best way

to unlock the profitable stock recommendations and market insights

of Zacks Investment Research is through our free daily email

newsletter Profit from the Pros. In short, it’s your steady

flow of profitable ideas GUARANTEED to be worth your time.

Get your free subscription to Profit from the Pros at:

http://at.zacks.com/?id=7298

Follow us on Twitter: http://twitter.com/ZacksResearch

Join us on Facebook:

http://www.facebook.com/ZacksInvestmentResearch

Zacks Investment Research is under common control with

affiliated entities (including a broker-dealer and an investment

adviser), which may engage in transactions involving the foregoing

securities for the clients of such affiliates.

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

APPLE INC (AAPL): Free Stock Analysis Report

BERKSHIRE HTH-B (BRK.B): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

SOUTHWEST AIR (LUV): Free Stock Analysis Report

PROCTER & GAMBL (PG): Free Stock Analysis Report

To read this article on Zacks.com click here.

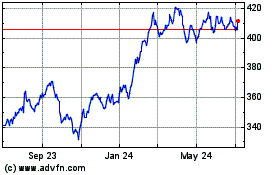

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Aug 2024 to Sep 2024

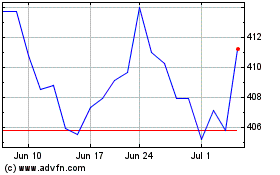

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Sep 2023 to Sep 2024