Yum! Brands, Inc. (NYSE: YUM) today reported results for the

fourth quarter ended December 31, 2017. Fourth-quarter GAAP EPS was

$1.26, an increase of 53%. Full-year GAAP EPS was $3.77, an

increase of 48%. Fourth-quarter EPS excluding Special Items was

$0.96, an increase of 20%. Full-year EPS excluding Special Items

was $2.96, an increase of 20%.

This press release features multimedia. View

the full release here:

http://www.businesswire.com/news/home/20180208005427/en/

GREG CREED & DAVID GIBBS

COMMENTS

Greg Creed, CEO, said “As we close the first full year of our

transformation, I am very proud of the progress we are making

towards becoming a more focused, more franchised and more efficient

company that generates more growth. During 2017, system sales grew

a healthy 5% excluding the impact of lapping the 53rd week in 2016,

with same-store sales growth of 2% and net new unit growth of 3%.

As we move forward into 2018, we are particularly excited about our

investment in ‘Easy’ with our new partnership with Grubhub. We are

confident that the continued focus on our four key growth drivers

supports our vision for a ‘World with More Yum!’ and maximizes the

creation of value for all Yum! stakeholders.”

David Gibbs, President and CFO, continued “The fourth quarter

was a solid ending to a year where Yum! Brands met or exceeded each

component of our full-year guidance. Despite headwinds from

refranchising dilution and lapping a 53rd week, we delivered

full-year core operating profit growth of 7%. We are on track with

our strategic transformation to accelerate growth and made

significant progress towards achieving these objectives in 2017. We

look forward to updating you as we continue on our journey to build

the world’s most loved, trusted and fastest-growing restaurant

brands.”

SUMMARY FINANCIAL TABLE

Fourth Quarter

Full Year 2017 2016 %

Change 2017 2016 %

Change GAAP EPS $1.26 $0.83 +53 $3.77

$2.54 +48 Special Items EPS1 $0.30 $0.03

NM $0.81 $0.08 NM EPS Excluding Special

Items $0.96 $0.80 +20 $2.96

$2.46 +20 1See Reconciliation of Non-GAAP Measurements to

GAAP Results within this release for further detail of Special

Items. All comparisons are versus the same period a year ago.

Effective January 2017, we removed the reporting lags from our

international subsidiary fiscal calendars. To accommodate these

changes, Yum! Brands now reports on a monthly calendar basis though

certain subsidiaries, including our U.S. subsidiaries, continue to

be included in our consolidated results on a periodic basis with 3,

3, 3 & 4 four-week periods in each quarter, respectively. Prior

year figures in this earnings release have been restated to present

comparable results. An 8-K was filed on April 13, 2017 with

restated quarterly and full-year 2016 results. System sales

growth figures exclude foreign currency translation ("F/X") and

core operating profit growth figures exclude F/X and Special Items.

Special Items are not allocated to any segment and therefore only

impact worldwide GAAP results. See Reconciliation of Non-GAAP

Measurements to GAAP Results within this release for further

details. Unless otherwise noted, all results include the

impact of lapping the 53rd week in 2016.

FOURTH-QUARTER

HIGHLIGHTS

● Worldwide system sales grew 4%, with KFC at 6%, Taco Bell at 3%

and Pizza Hut at 1%, excluding the 53rd week. ● We opened 730 net

new units for 3% net unit growth. ●

We refranchised 896 restaurants, including

685 KFC, 144 Pizza Hut and 67 Taco Bell units, for pre-tax proceeds

of $1.1 billion. We recorded net refranchising gains of $752

million in Special Items. As of quarter end, our global franchise

ownership mix increased to 97%.

● We repurchased 7.5 million shares totaling $588 million at an

average price of $79. ● Foreign currency translation favorably

impacted divisional operating profit by $9 million.

% Change System Sales

Same-StoreSales

Net New Units

GAAPOperating Profit

CoreOperating Profit

KFC Division +4 +3 +4 +7 +4 Pizza Hut

Division (2) +1 +2 (18) (19) Taco Bell Division (2)

+2 +4 (8) (8) Worldwide +1 +2

+3 +134 (6)

Results Excluding 53rd Week (% Change) System Sales

CoreOperating Profit KFC Division +6 +8

Pizza Hut Division +1 (14) Taco Bell Division +3 (2)

Worldwide +4 (1)

FULL-YEAR HIGHLIGHTS

● Worldwide system sales grew 5%, with Taco Bell at 7%, KFC at 6%

and Pizza Hut at 2%, excluding the 53rd week. ● We opened 1,407 net

new units for 3% net unit growth. ● We refranchised 1,470

restaurants, including 828 KFC, 389 Pizza Hut and 253 Taco Bell

units, for pre-tax proceeds of $1.8 billion, recording net

refranchising gains of $1.1 billion in Special Items. ● We

repurchased 26.6 million shares totaling $1.9 billion at an average

price of $72.

% Change System

Sales

Same-StoreSales

Net New Units

GAAPOperating Profit

CoreOperating Profit

KFC Division +6 +3 +4 +13 +12 Pizza Hut

Division +1 Even +2 (7) (6) Taco Bell Division +5 +4

+4 +4 +4 Worldwide +4 +2

+3 +64 +7

Results

Excluding 53rd Week (% Change) System Sales

CoreOperating Profit KFC Division +6 +14 Pizza

Hut Division +2 (5) Taco Bell Division +7 +6

Worldwide +5 +9

KFC DIVISION

Fourth Quarter

Full Year %/ppts Change

%/ppts Change 2017 2016

Reported Ex F/X 2017

2016 Reported Ex F/X Restaurants

21,487 20,643 +4 NA 21,487 20,643 +4 NA System Sales

($MM) 6,827 6,424 +6 +4 24,515 23,242 +5 +6 Same-Store Sales Growth

(%) +3 +2 NM NM +3 +2 NM NM Franchise & License Fees ($MM) 351

308 +13 +10 1,182 1,069 +11 +10 Restaurant Margin (%) 14.6 15.5

(0.9) (1.0) 15.0 14.7 0.3 0.3 Operating Profit ($MM) 271 253 +7 +4

981 871 +13 +12 Operating Margin (%) 33.4 27.4

6.0 6.1 31.6 27.0 4.6 4.7

% Change Int'l Emerging

Markets Int'l Developed Markets

U.S.

FourthQuarter

Full Year

FourthQuarter

Full Year

FourthQuarter

Full Year System Sales Growth (Ex F/X) +9 +9

+2

+4

(7) (1) Same-Store Sales Growth +5 +4

+3

+3

(1) +1 ● KFC Division opened 539 new

international restaurants during the quarter. ○ For the year, KFC

Division opened 1,247 new international restaurants in 84

countries, including 1,042 units in emerging markets. ● Operating

margin increased 6.0 percentage points for the quarter and 4.6

percentage points for the year driven by refranchising and

same-store sales growth. ● For the quarter, the 53rd week

negatively impacted system sales growth by 2 percentage points and

core operating profit growth by 4 percentage points. For the year,

the 53rd week negatively impacted core operating profit growth by 2

percentage points. ● Foreign currency translation favorably

impacted operating profit by $8 million for the quarter and $4

million for the year.

KFC

Markets1

Percent of KFCSystem

Sales2

System Sales Growth Ex F/X Fourth

Quarter (%) Full Year (%) Emerging Markets

China3 27% +10 +9 Asia (e.g. Malaysia, Indonesia,

Philippines) 5% +8 +8 Latin America (e.g. Mexico, Peru) 5% +11 +12

Africa 4% (3) +2 Middle East / Turkey / North Africa 4% +6 +1

Russia 4% +26 +24 Continental Europe (e.g. Poland) 2% +14 +16

Thailand 2% +8 +5 India 1% +18 +9

Developed Markets U.S. 18%

(7) (1) Australia 7% Even +5 Asia (e.g. Japan, Korea) 6% Even Even

U.K. 6% +2 +5 Continental Europe (e.g. France, Germany) 6% +12 +11

Canada 2% Even +3 Latin America (e.g. Puerto Rico) 1%

(20) (6)

1Refer to

www.yum.com/investors/financial-information/financial-reports for a

list of the countries within each of the markets.

2Reflects full year 2017. 3Includes October, November and December;

YUMC Q4 reported results include September, October, November and

December.

PIZZA HUT DIVISION

Fourth Quarter

Full Year %/ppts Change

%/ppts Change 2017 2016

Reported Ex F/X 2017

2016 Reported Ex F/X

Restaurants 16,748 16,420 +2 NA 16,748 16,420 +2 NA

System Sales ($MM) 3,369 3,390 (1) (2) 12,034 12,019 Even +1

Same-Store Sales Growth (%) +1 (3) NM NM Even (2) NM NM Franchise

& License Fees ($MM) 175 182 (4) (5) 608 615 (1) (1) Restaurant

Margin (%) 2.4 9.3 (6.9) (6.9) 5.3 8.3 (3.0) (3.0) Operating Profit

($MM) 91 111 (18) (19) 341 367 (7) (6) Operating Margin (%)

38.8 35.9 2.9 3.1 38.2 33.1

5.1 5.4

% Change

Int'l Emerging Markets Int'l Developed

Markets1 U.S.

FourthQuarter

Full Year

FourthQuarter

Full Year

FourthQuarter

Full Year System Sales Growth (Ex F/X) +6 +7

(6) +2 (5) (4) Same-Store Sales Growth

+1 +1 (1) +1 +2 (2)

● Pizza Hut Division opened 340 new international

restaurants during the quarter. ○ For the year, Pizza Hut Division

opened 826 new international restaurants in 77 countries, including

592 units in emerging markets. ● Operating margin increased 2.9

percentage points for the quarter and 5.1 percentage points for the

year driven by refranchising partially offset by higher franchise

and license expense due to incremental advertising spend associated

with the U.S. Transformation Agreement. ● For the quarter, the 53rd

week negatively impacted system sales growth by 3 percentage points

and core operating profit growth by 5 percentage points. For the

year, the 53rd week negatively impacted system sales growth by 1

percentage point and core operating profit growth by 1 percentage

point. ● Foreign currency translation favorably impacted operating

profit by $1 million for the quarter and negatively impacted

operating profit by $4 million for the year.

Pizza Hut Markets2

Percent of Pizza HutSystem

Sales3

System Sales Growth Ex F/X Fourth

Quarter (%) Full Year (%) Emerging Markets

China4 17% +6 +7 Latin America (e.g. Mexico, Peru) 5% +1 +4

Asia (e.g. Malaysia, Indonesia, Philippines) 5% +12 +13 Middle East

/ Turkey / Africa 4% +1 +2 India 1% +18 +10 Continental Europe

(e.g. Poland) 1% +15 +12

Developed Markets U.S. 46% (5) (4)

Asia (e.g. Japan, Korea) 7% +6 +3 U.K.1 5% (23) (2) Continental

Europe (e.g. France, Germany) 4% (1) +3 Canada 2% (3) +1 Australia1

2% (11) +14 Latin America (e.g. Puerto Rico) 1% (20)

(5)

1Pizza Hut U.K. and Pizza Hut Australia,

both of which are International Developed Markets, transitioned

from a periodic weekly calendar to a monthly calendar beginning in

the first quarter of 2017. As a result, system sales growth for

both markets was negatively impacted in the fourth quarter due to

Q4 2017 results having approximately 13 weeks compared to Q4 2016

results having 17 weeks, including a 53rd week. There was not a

significant impact from this calendar change on full-year system

sales growth for either market.

2Refer to

www.yum.com/investors/financial-information/financial-reports for a

list of the countries within each of the markets.

3Reflects full year 2017. 4Includes October, November and December;

YUMC Q4 reported results include September, October, November and

December.

TACO BELL DIVISION

Fourth Quarter

Full Year %/ppts Change

%/ppts Change 2017 2016

Reported Ex F/X 2017

2016 Reported Ex F/X Restaurants

6,849 6,612 +4 NA 6,849 6,612 +4 NA System Sales

($MM) 3,087 3,137 (2) (2) 10,145 9,660 +5 +5 Same-Store Sales

Growth (%) +2 +3 NM NM +4 +2 NM NM Franchise & License Fees

($MM) 163 158 +4 +4 521 485 +7 +7 Restaurant Margin (%) 23.1 23.4

(0.3) (0.3) 22.4 22.2 0.2 0.2 Operating Profit ($MM) 179 195 (8)

(8) 619 595 +4 +4 Operating Margin (%) 33.6 29.8

3.8 3.8 32.9 29.4 3.5 3.5

● Taco Bell Division opened 134 new restaurants during the

quarter. ○ For the year, Taco Bell Division opened 314 new

restaurants, including 77 international new restaurants. ●

Operating margin increased 3.8 percentage points for the quarter

and 3.5 percentage points for the year driven by refranchising and

same-store sales growth. ● For the quarter, the 53rd week

negatively impacted system sales growth by 5 percentage points and

core operating profit growth by 6 percentage points. For the year,

the 53rd week negatively impacted both system sales growth and core

operating profit growth by 2 percentage points.

OTHER ITEMS

● The Tax Cuts and Jobs Act of 2017 (“Tax Act”) that was enacted on

December 22nd required that earnings repatriated from our foreign

entities with a November 30 year-end for tax purposes be included

in the Deemed Repatriation Tax on foreign earnings that was

included in the Tax Act. Our fourth quarter and full year effective

tax rates excluding Special Items were lower than anticipated

because they did not include tax on those earnings repatriated

after November 30. Instead, that tax was included in the one-time

Special Items charge of $434 million that we recorded in the fourth

quarter related to the Tax Act. ● Disclosures pertaining to

outstanding debt in our Restricted Group capital structure will be

provided at the time of the filing of the Form 10-K.

CONFERENCE CALL

Yum! Brands, Inc. will host a conference call to review the

company's financial performance and strategies at 8:15 a.m. Eastern

Time Thursday, February 8, 2018. The number is 877/815-2029 for

U.S. callers and 706/645-9271 for international callers, conference

ID 4894878.

The call will be available for playback beginning at 11:15 a.m.

Eastern Time Thursday, February 8, 2018 through Thursday, March 15,

2018. To access the playback, dial 855/859-2056 in the U.S. and

404/537-3406 internationally, conference ID 4894878.

The webcast and playback can be accessed via the internet by

visiting Yum! Brands' website,

www.yum.com/investors/events-presentations and selecting “Q4 2017

Earnings Conference Call.”

ADDITIONAL INFORMATION

ONLINE

Quarter end dates for each division, restaurant count details,

definitions of terms and Restricted Group financial information are

available at www.yum.com/investors. Reconciliation of non-GAAP

financial measures to the most directly comparable GAAP results are

included within this release.

FORWARD-LOOKING

STATEMENTS

This announcement may contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. We intend all

forward-looking statements to be covered by the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally can be identified by the fact

that they do not relate strictly to historical or current facts and

by the use of forward-looking words such as “expect,”

“expectation,” “believe,” “anticipate,” “may,” “could,” “intend,”

“belief,” “plan,” “estimate,” “target,” “predict,” “likely,”

“seek,” “project,” “model,” “ongoing,” “will,” “should,”

“forecast,” “outlook” or similar terminology. These statements are

based on and reflect our current expectations, estimates,

assumptions and/ or projections, our perception of historical

trends and current conditions, as well as other factors that we

believe are appropriate and reasonable under the circumstances.

Forward-looking statements are neither predictions nor guarantees

of future events, circumstances or performance and are inherently

subject to known and unknown risks, uncertainties and assumptions

that could cause our actual results to differ materially from those

indicated by those statements. There can be no assurance that our

expectations, estimates, assumptions and/or projections, including

with respect to the future earnings and performance or capital

structure of Yum! Brands, will prove to be correct or that any of

our expectations, estimates or projections will be achieved.

Numerous factors could cause our actual results and events to

differ materially from those expressed or implied by

forward-looking statements, including, without limitation: food

safety and food borne-illness issues; health concerns arising from

outbreaks of viruses or other diseases; the success of our

franchisees and licensees, and the success of our refranchising

strategy generally; changes in economic and political conditions in

countries and territories outside of the U.S. where we operate; our

ability to protect the integrity and security of individually

identifiable data of our customers and employees; our increasing

dependence on digital commerce platforms and information technology

systems; the impact of social media; our ability to secure and

maintain distribution and adequate supply to our restaurants; the

success of our development strategy in emerging markets; changes in

commodity, labor and other operating costs; pending or future

litigation and legal claims or proceedings; changes in or

noncompliance with government regulations, including labor

standards and anti-bribery or anti-corruption laws; recent Tax

Legislation (defined below) and other tax matters, including

disagreements with taxing authorities; consumer preferences and

perceptions of our brands; changes in consumer discretionary

spending and general economic conditions; competition within the

retail food industry; and risks relating to our significant amount

of indebtedness. In addition, other risks and uncertainties not

presently known to us or that we currently believe to be immaterial

could affect the accuracy of any such forward-looking statements.

All forward-looking statements should be evaluated with the

understanding of their inherent uncertainty.

Information regarding the impact of the Tax Cuts and Jobs Act of

2017 (“Tax Legislation”) consists of preliminary estimates which

are forward-looking statements and are subject to change, possibly

materially, as the company completes its financial statements.

Information regarding the impact of Tax Legislation is based on our

current calculations, as well our current interpretations,

assumptions and expectations relating to Tax Legislation, which are

subject to further change.

The forward-looking statements included in this announcement are

only made as of the date of this announcement and we disclaim any

obligation to publicly update any forward-looking statement to

reflect subsequent events or circumstances. You should consult our

filings with the Securities and Exchange Commission (including the

information set forth under the captions “Risk Factors” and

“Forward-Looking Statements” in our most recently filed Annual

Report on Form 10-K and Quarterly Report on Form 10-Q) for

additional detail about factors that could affect our financial and

other results.

Yum! Brands, Inc., based in Louisville, Kentucky, has over

45,000 restaurants in more than 135 countries and territories and

is one of the Aon Hewitt Top Companies for Leaders in North

America. In 2018, Yum! Brands was recognized as part of the

inaugural Bloomberg Gender-Equality Index. In 2017, Yum! Brands was

named to the Dow Jones Sustainability North America Index and

ranked among the top 100 Best Corporate Citizens by Corporate

Responsibility Magazine. The company’s restaurant brands - KFC,

Pizza Hut and Taco Bell - are global leaders of the chicken, pizza

and Mexican-style food categories. Worldwide, the Yum! Brands

system opens over seven new restaurants per day on average, making

it a leader in global retail development.

YUM! Brands, Inc.

Consolidated Summary of Results

(amounts in millions, except per share

amounts)

(unaudited)

Quarter ended Year ended 12/31/17

12/31/16(As Restated)

% ChangeB/(W)

12/31/17

12/31/16(As Restated)

% ChangeB/(W)

Company sales $ 890 $ 1,238 (28) $ 3,572 $ 4,189 (15)

Franchise and license fees and income 687 648 6 2,306

2,167 6 Total revenues 1,577 1,886 (16)

5,878 6,356 (8) Company restaurant expenses

Food and paper 272 370 26 1,103 1,267 13 Payroll and employee

benefits 232 326 29 939 1,106 15 Occupancy and other operating

expenses 227 318 29 912 1,116 18

Company restaurant expenses 731 1,014 28 2,954 3,489 15

General and administrative expenses 300 362 17 999 1,129 12

Franchise and license expenses 76 56 (35) 237 201 (18) Closures and

impairment (income) expenses — 5 95 3 15 82 Refranchising (gain)

loss (752 ) (88 ) NM (1,083 ) (163 ) NM Other (income) expense 7

17 60 7 3 NM Total costs and expenses,

net 362 1,366 74 3,117 4,674 33

Operating Profit 1,215 520 134 2,761 1,682 64 Interest expense, net

118 114 (4) 440 305 (44) Other pension (income) expense 5 34

84 47 32 (45) Income from continuing

operations before income taxes 1,092 372

193

2,274 1,345 69 Income tax provision 656 64 NM 934

327 NM Income from continuing operations 436 308 42

1,340 1,018 32 Income (loss) from discontinued operations, net of

tax — (5 ) NM — 625 NM Net income 436

303 44 1,340 1,643 (18)

Effective tax rate

from Continuing Operations

60.1 % 17.2 % (42.9) ppts. 41.1 % 24.3 % (16.8) ppts.

Basic EPS from

Continuing Operations

EPS $ 1.29 $ 0.84 54 $ 3.86 $ 2.58 49

Average shares outstanding 337 366 8 347 394

12

Diluted EPS from

Continuing Operations

EPS $ 1.26 $ 0.83 53 $ 3.77 $ 2.54 48

Average shares outstanding 345 372 7 355 400

11

Basic EPS from

Discontinued Operations

EPS N/A $ (0.01 ) NM N/A $ 1.59 NM Average shares

outstanding N/A 366 NM N/A 394 NM

Diluted EPS from

Discontinued Operations

EPS N/A $ (0.01 ) NM N/A $ 1.56 NM Average shares

outstanding N/A 372 NM N/A 400 NM Dividends

declared per common share $ 0.30 $ 0.30 $ 0.90

$ 1.73

See accompanying notes.Percentages may not

recompute due to rounding.

YUM! Brands, Inc.

KFC DIVISION Operating Results

(amounts in millions)

(unaudited)

Quarter ended Year ended 12/31/17

12/31/16(As Restated)

% ChangeB/(W)

12/31/17

12/31/16(As Restated)

% ChangeB/(W)

Company sales $ 463 $ 615 (25) $ 1,928 $ 2,156 (11)

Franchise and license fees and income 351 308 13

1,182 1,069 11 Total revenues 814 923

(12) 3,110 3,225 (4) Company restaurant

expenses Food and paper 160 207 23 664 733 9 Payroll and employee

benefits 106 145 27 451 507 11 Occupancy and other operating

expenses 129 167 23 524 599 13 Company

restaurant expenses 395 519 24 1,639 1,839 11 General and

administrative expenses 111 120 7 370 396 7 Franchise and license

expenses 37 26 (39) 117 108 (8) Closures and impairment (income)

expenses (1 ) 5 NM 2 11 81 Other (income) expense 1 —

NM 1 — NM Total costs and expenses, net 543

670 19 2,129 2,354 10 Operating Profit $ 271

$ 253 7 $ 981 $ 871 13 Company

sales 100.0 % 100.0 % 100.0 % 100.0 % Food and paper 34.7 % 33.9 %

(0.8) ppts. 34.4 % 34.0 % (0.4) ppts. Payroll and employee benefits

23.0 % 23.6 % 0.6 ppts. 23.4 % 23.5 % 0.1 ppts. Occupancy and other

operating expenses 27.7 % 27.0 % (0.7) ppts. 27.2 % 27.8 % 0.6

ppts. Restaurant margin 14.6 % 15.5 % (0.9) ppts. 15.0 % 14.7 % 0.3

ppts. Operating margin 33.4 % 27.4 % 6.0 ppts. 31.6 % 27.0 %

4.6 ppts.

See accompanying notes.Percentages may not

recompute due to rounding.

YUM! Brands, Inc.

PIZZA HUT DIVISION Operating

Results

(amounts in millions)

(unaudited)

Quarter ended Year ended 12/31/17

12/31/16(As Restated)

% ChangeB/(W)

12/31/17

12/31/16(As Restated)

% ChangeB/(W)

Company sales $ 59 $ 127 (54) $ 285 $ 493 (42) Franchise and

license fees and income 175 182 (4) 608 615

(1) Total revenues 234 309 (24) 893

1,108 (19) Company restaurant expenses Food and paper

18 36 51 83 137 40 Payroll and employee benefits 20 40 51 94 156 40

Occupancy and other operating expenses 21 39 49 94

159 41 Company restaurant expenses 59 115 50 271 452

40 General and administrative expenses 60 72 15 211 242 13

Franchise and license expenses 24 13 (81) 68 48 (42) Closures and

impairment (income) expenses 1 (2 ) NM 1 1 16 Other (income)

expense (1 ) — NM 1 (2 ) NM Total costs and expenses,

net 143 198 28 552 741 26 Operating

Profit $ 91 $ 111 (18) $ 341 $ 367 (7)

Company sales 100.0 % 100.0 % 100.0 % 100.0 % Food and paper

29.8 % 28.0 % (1.8) ppts. 28.9 % 27.7 % (1.2) ppts. Payroll and

employee benefits 33.2 % 31.3 % (1.9) ppts. 32.8 % 31.7 % (1.1)

ppts. Occupancy and other operating expenses 34.6 % 31.4 % (3.2)

ppts. 33.0 % 32.3 % (0.7) ppts. 2.4 % 9.3 % (6.9) ppts. 5.3 % 8.3 %

(3.0) ppts. Operating margin 38.8 % 35.9 % 2.9 ppts. 38.2 %

33.1 % 5.1 ppts.

See accompanying notes.Percentages may not

recompute due to rounding.

YUM! Brands, Inc.

TACO BELL DIVISION Operating

Results

(amounts in millions)

(unaudited)

Quarter ended Year ended 12/31/17 12/31/16

(As Restated)

% ChangeB/(W)

12/31/17 12/31/16

(As Restated)

% ChangeB/(W)

Company sales $ 368 $ 496 (26) $ 1,359 $ 1,540 (12)

Franchise and license fees and income 163 158 4 521

485 7 Total revenues 531 654 (19) 1,880

2,025 (7) Company restaurant expenses Food and

paper 94 127 25 356 397 10 Payroll and employee benefits 106 141 25

394 443 11 Occupancy and other operating expenses 82 112

27 304 358 15 Company restaurant expenses 282

380 26 1,054 1,198 12 General and administrative expenses 66

70 7 188 211 11 Franchise and license expenses 6 8 30 22 21 (6)

Closures and impairment (income) expenses — 2 80 — 3 NM Other

(income) expense (2 ) (1 ) 47 (3 ) (3 ) (19) Total costs and

expenses, net 352 459 23 1,261 1,430 12

Operating Profit $ 179 $ 195 (8) $ 619 $ 595

4 Company sales 100.0 % 100.0 % 100.0 % 100.0 % Food

and paper 25.7 % 25.5 % (0.2) ppts. 26.2 % 25.7 % (0.5) ppts.

Payroll and employee benefits 28.9 % 28.5 % (0.4) ppts. 29.0 % 28.8

% (0.2) ppts. Occupancy and other operating expenses 22.3 % 22.6 %

0.3 ppts. 22.4 % 23.3 % 0.9 ppts. 23.1 % 23.4 % (0.3) ppts. 22.4 %

22.2 % 0.2 ppts. Operating margin 33.6 % 29.8 % 3.8 ppts.

32.9 % 29.4 % 3.5 ppts.

See accompanying notes.Percentages may not

recompute due to rounding.

YUM! Brands, Inc.

Consolidated Balance Sheets

(amounts in millions)

(unaudited)

12/31/2017

12/31/16(As Restated)

ASSETS Current Assets Cash and cash equivalents $

1,522 $ 725 Accounts and notes receivable, less allowance: $19 in

2017 and $14 in 2016 400 370 Inventories 13 37 Prepaid expenses and

other current assets 371 236 Advertising cooperative assets,

restricted 201 137

Total Current Assets 2,507

1,505

Property, plant and equipment, net of

accumulated depreciation and amortization of $1,480 in 2017 and

$1,995 in 2016

1,697 2,113 Goodwill 512 536 Intangible assets, net 110 151 Other

assets 346 376 Deferred income taxes 139 772

Total

Assets $ 5,311 $ 5,453

LIABILITIES AND

SHAREHOLDERS' DEFICIT Current Liabilities Accounts

payable and other current liabilities $ 813 $ 1,067 Income taxes

payable 123 36 Short-term borrowings 375 66 Advertising cooperative

liabilities 201 137

Total Current Liabilities

1,512 1,306 Long-term debt 9,429 9,059 Other liabilities and

deferred credits 704 703

Total Liabilities

11,645 11,068

Shareholders' Deficit

Common stock, no par value, 750 shares authorized; 332 shares and

355 shares issued in 2017 and 2016, respectively — — Accumulated

deficit (6,063 ) (5,157 ) Accumulated other comprehensive loss (271

) (458 )

Total Shareholders' Deficit (6,334 ) (5,615 )

Total Liabilities and Shareholders' Deficit $ 5,311 $

5,453

See accompanying notes.

YUM! Brands, Inc.

Consolidated Statements of Cash

Flows

(amounts in millions)

(unaudited)

Year ended 12/31/17

12/31/16(As Restated)

Cash Flows - Operating Activities from Continuing Operations

Income from continuing operations $ 1,340 $ 1,643 Income from

discontinued operations, net of tax — (625 ) Depreciation and

amortization 253 310 Closures and impairment (income) expenses 3 15

Refranchising (gain) loss (1,083 ) (163 ) Contributions to defined

benefit pension plans (55 ) (41 ) Deferred income taxes 634 28

Share-based compensation expense 65 80 Changes in accounts and

notes receivable (19 ) (23 ) Changes in inventories 3 1 Changes in

prepaid expenses and other current assets (13 ) 12 Changes in

accounts payable and other current liabilities (173 ) (53 ) Changes

in income taxes payable (55 ) 20 Other, net 130 44

Net Cash Provided by Operating Activities from Continuing

Operations 1,030 1,248

Cash Flows -

Investing Activities from Continuing Operations Capital

spending (318 ) (427 ) Proceeds from refranchising of restaurants

1,773 370 Other, net 17 53

Net Cash Used in

Investing Activities from Continuing Operations 1,472 (4

)

Cash Flows - Financing Activities from Continuing

Operations Proceeds from long-term debt 1,088 6,900 Repayments

of long-term debt (385 ) (323 ) Revolving credit facilities, three

months or less, net — (685 ) Short-term borrowings, by original

maturity

More than three months - proceeds — 1,400 More than three months -

payments — (2,000 ) Three months or less, net — — Repurchase shares

of Common Stock (1,960 ) (5,403 ) Dividends paid on Common Stock

(416 ) (744 ) Debt issuance costs (32 ) (86 ) Net transfers from

discontinued operations — 289 Other, net (90 ) (92 )

Net Cash Provided by (Used in)

Financing Activities from Continuing Operations

(1,795 ) (744 )

Effect of Exchange Rate on Cash and Cash

Equivalents 61 (34 )

Net Increase in Cash, Cash Equivalents,

Restricted Cash and Restricted Cash Equivalents - Continuing

Operations

768 466

Cash, Cash Equivalents, Restricted Cash and

Restricted Cash Equivalents - Beginning of Period 831

365

Cash, Cash Equivalents, Restricted Cash and

Restricted Cash Equivalents - End of Period $ 1,599 $

831

Cash Provided by Operating Activities

from Discontinued Operations

— 829

Cash Used in Investing Activities from

Discontinued Operations

— (287 )

Cash Used in Financing Activities from

Discontinued Operations

— (292 )

See accompanying notes.

Reconciliation of Non-GAAP Measurements to

GAAP Results(amounts in millions, except per share

amounts)(unaudited)

In addition to the results provided in accordance with U.S.

Generally Accepted Accounting Principles ("GAAP") throughout this

document, the Company has provided non-GAAP measurements which

present Diluted Earnings Per Share from Continuing Operations

excluding Special Items, our Effective Tax Rate excluding Special

Items, System sales, System sales excluding the impact of foreign

currency translation ("FX"), System sales excluding the impact of

FX and 53rd week, Core Operating Profit and Core Operating Profit

excluding 53rd week. Core Operating Profit excludes Special Items

and FX and we use Core Operating Profit for the purposes of

evaluating performance internally. We provide Core Operating Profit

and System sales excluding 53rd week to further enhance the

comparability with the lapping of the 53rd week that was part of

our fiscal calendar in 2016. Special Items are not included in any

of our Division segment results, and we believe the elimination of

FX provides better year-to-year comparability without the

distortion of foreign currency fluctuations. The Special Items are

described in (b), (c), (d), (e), (f), (g) and (h) in the

accompanying notes.

These non-GAAP measurements are not intended to replace the

presentation of our financial results in accordance with GAAP.

Rather, the Company believes that the presentation of Diluted

Earnings Per Share from Continuing Operations excluding Special

Items, our Effective Tax Rate excluding Special Items, Core

Operating Profit and Core Operating Profit excluding 53rd week

provide additional information to investors to facilitate the

comparison of past and present operations, excluding items in the

quarters and years ended December 31, 2017 and December 31, 2016

that the Company does not believe are indicative of our ongoing

operations due to their size and/or nature. System sales and System

sales growth include the results of all restaurants regardless of

ownership, including company-owned and franchise restaurants that

operate our Concepts. Sales of franchise restaurants typically

generate ongoing franchise and license fees for the Company at a

rate of 3% to 6% of sales. Franchise restaurant sales are not

included in Company sales on the Consolidated Statements of Income;

however, the franchise and license fees are included in the

Company’s revenues. We believe System sales and System sales growth

are useful to investors as significant indicators of the overall

strength of our business as they incorporate all of our revenue

drivers, Company and franchise same-store sales as well as net unit

growth.

Quarter ended Year ended 12/31/17

12/31/16(As Restated)

12/31/17

12/31/16(As Restated)

Detail of Special Items Refranchising gain (loss)(b) $ 752 $

88 $ 1,083 $ 163 YUM's Strategic Transformation initiatives(c) (8 )

(33 ) (23 ) (67 ) Costs associated with Pizza Hut U.S.

Transformation Agreement(d) (11 ) — (31 ) — Costs associated with

KFC U.S. Acceleration Agreement(e) (5 ) (9 ) (17 ) (26 ) Non-cash

charges associated with share-based compensation(f) — (30 ) (18 )

(30 ) Other Special Items Income (Expense) 4 (2 ) 7

(5 ) Special Items Income - Operating Profit 732 14 1,001 35

Special Items - Other Pension Income (Expense)(g) — (26 )

(23 ) (26 ) Special Items Income (Expense) from Continuing

Operations before Income Taxes 732 (12 ) 978 9 Tax Benefit

(Expense) on Special Items (192 ) 24 (256 ) 24 Tax (Expense) - U.S.

Tax Act(h) (434 ) — (434 ) — Special Items Income,

net of tax $ 106 $ 12 $ 288 $ 33

Average diluted shares outstanding 345 372 355

400 Special Items diluted EPS $ 0.30 $ 0.03 $

0.81 $ 0.08

Reconciliation of GAAP

Operating Profit to Core Operating Profit and Core Operating

Profit, excluding 53rd Week

Consolidated

GAAP Operating Profit $ 1,215 $ 520 $ 2,761 $ 1,682 Special Items

Income 732 14 1,001 35 Foreign Currency Impact on Divisional

Operating Profit 9 N/A — N/A Core Operating Profit

474 506 1,760 1,647 Impact of 53rd Week N/A 28 N/A 28

Core Operating Profit, excluding 53rd Week $ 474 $ 478

$ 1,760 $ 1,619 Quarter ended

Year ended

12/31/17

12/31/16(As Restated)

12/31/17

12/31/16(As Restated)

KFC

Division

GAAP Operating Profit $ 271 $ 253 $ 981 $ 871 Foreign Currency

Impact on Divisional Operating Profit 8 N/A 4 N/A

Core Operating Profit 263 253 977 871 Impact of 53rd Week N/A 11

N/A 11 Core Operating Profit, excluding 53rd Week $

263 $ 242 $ 977 $ 860

Pizza Hut

Division

GAAP Operating Profit $ 91 $ 111 $ 341 $ 367 Foreign Currency

Impact on Divisional Operating Profit 1 N/A (4 ) N/A Core

Operating Profit 90 111 345 367 Impact of 53rd Week N/A 5

N/A 5 Core Operating Profit, excluding 53rd Week $ 90

$ 106 $ 345 $ 362

Taco Bell

Division

GAAP Operating Profit $ 179 $ 195 $ 619 $ 595 Foreign Currency

Impact on Divisional Operating Profit — N/A — N/A

Core Operating Profit 179 195 619 595 Impact of 53rd Week N/A 12

N/A 12 Core Operating Profit, excluding 53rd Week $

179 $ 183 $ 619 $ 583

Reconciliation of Diluted EPS from Continuing Operations to

Diluted EPS from Continuing Operations excluding Special Items

Diluted EPS from Continuing Operations $ 1.26 $ 0.83 $ 3.77 $ 2.54

Special Items Diluted EPS 0.30 0.03 0.81 0.08

Diluted EPS from Continuing Operations excluding Special

Items $ 0.96 $ 0.80 $ 2.96 $ 2.46

Reconciliation of GAAP Effective Tax Rate to Effective

Tax Rate excluding Special Items GAAP Effective Tax Rate 60.1 %

17.2 % 41.1 % 24.3 % Impact on Tax Rate as a result of Special

Items 51.8 % (5.8 )% 22.3 % (2.0 )% Effective Tax Rate excluding

Special Items 8.3 % 23.0 % 18.8 % 26.3 %

Reconciliation

of GAAP Company Sales to System Sales, System Sales excluding FX

and System Sales excluding FX and 53rd Week

Consolidated

GAAP Company sales

$ 890 $ 1,238 $ 3,572 $ 4,189

Franchise sales

12,393 11,713 43,122 40,732

System sales

13,283 12,951 46,694 44,921

Foreign Currency Impact on System

sales

225 N/A (90 ) N/A System sales, excluding FX 13,058 12,951

46,784 44,921 Impact of 53rd week N/A 434 N/A 434

System sales, excluding FX and 53rd Week $ 13,058 $ 12,517

$ 46,784 $ 44,487

KFC

Division

GAAP Company sales

$ 463 $ 615 $ 1,928 $ 2,156

Franchise sales

6,364 5,809 22,587 21,086

System sales

6,827 6,424 24,515 23,242

Foreign Currency Impact on System

sales

178 N/A (28 ) N/A System sales, excluding FX 6,649 6,424

24,543 23,242 Impact of 53rd week N/A 165 N/A 165

System sales, excluding FX and 53rd Week $ 6,649 $ 6,259

$ 24,543 $ 23,077 Quarter ended

Year ended 12/31/17

12/31/16(As Restated)

12/31/17

12/31/16(As Restated)

Pizza Hut

Division

GAAP Company sales

$ 59 $ 127 $ 285 $ 493

Franchise sales

3,310 3,263 11,749 11,526

System sales

3,369 3,390 12,034 12,019

Foreign Currency Impact on System

sales

45 N/A (66 ) N/A System sales, excluding FX 3,324 3,390

12,100 12,019 Impact of 53rd week N/A 113 N/A 113

System sales, excluding FX and 53rd Week $ 3,324 $ 3,277

$ 12,100 $ 11,906

Taco Bell

Division

GAAP Company sales

$ 368 $ 496 $ 1,359 $ 1,540

Franchise sales

2,719 2,641 8,786 8,120

System sales

3,087 3,137 10,145 9,660

Foreign Currency Impact on System

sales

2 N/A 4 N/A System sales, excluding FX 3,085 3,137

10,141 9,660 Impact of 53rd week N/A 156 N/A 156

System sales, excluding FX and 53rd Week $ 3,085 $ 2,981

$ 10,141 $ 9,504

YUM! Brands, Inc.

Segment Results

(amounts in millions)

(unaudited)

Quarter Ended 12/31/17 KFC Pizza Hut Taco Bell

Corporate andUnallocated

Consolidated Total revenues $ 814 $ 234 $ 531

$ (2 ) $ 1,577 Company restaurant expenses 395 59 282

(5 ) 731 General and administrative expenses 111 60 66 63 300

Franchise and license expenses 37 24 6 9 76 Closures and impairment

(income) expenses (1 ) 1 — — — Refranchising (gain) loss — — — (752

) (752 ) Other (income) expense 1 (1 ) (2 ) 9 7

Total costs and expenses, net 543 143 352

(676 ) 362 Operating Profit (loss) $ 271 $ 91

$ 179 $ 674 $ 1,215

Quarter Ended 12/31/16 (As Restated) KFC Pizza Hut Taco Bell

Corporate andUnallocated

Consolidated Total revenues $ 923 $ 309 $ 654

$ — $ 1,886 Company restaurant expenses 519

115 380 — 1,014 General and administrative expenses 120 72 70 100

362 Franchise and license expenses 26 13 8 9 56 Closures and

impairment (income) expenses 5 (2 ) 2 — 5 Refranchising (gain) loss

— — — (88 ) (88 ) Other (income) expense — — (1 ) 18

17 Total costs and expenses, net 670 198

459 39 1,366 Operating Profit (loss) $

253 $ 111 $ 195 $ (39 ) $ 520

The above tables reconcile segment information, which is based

on management responsibility, with our Consolidated Summary of

Results. Corporate and unallocated expenses comprise items that are

not allocated to segments for performance reporting purposes.

The Corporate and Unallocated column in the above tables

includes, among other amounts, all amounts that we have deemed

Special Items. See Reconciliation of Non-GAAP Measurements to GAAP

Results.

YUM! Brands, Inc.

Segment Results

(amounts in millions)

(unaudited)

Year Ended 12/31/17 KFC Pizza Hut Taco Bell

Corporate andUnallocated

Consolidated Total revenues $ 3,110 $ 893 $ 1,880

$ (5 ) $ 5,878 Company restaurant expenses

1,639 271 1,054 (10 ) 2,954 General and administrative expenses 370

211 188 230 999 Franchise and license expenses 117 68 22 30 237

Closures and impairment (income) expenses 2 1 — — 3 Refranchising

(gain) loss — — — (1,083 ) (1,083 ) Other (income) expense 1

1 (3 ) 8 7 Total costs and expenses, net 2,129

552 1,261 (825 ) 3,117 Operating Profit

(loss) $ 981 $ 341 $ 619 $ 820 $ 2,761

Year Ended 12/31/16 (As Restated) KFC

Pizza Hut Taco Bell

Corporate andUnallocated

Consolidated Total revenues $ 3,225 $ 1,108 $ 2,025

$ (2 ) $ 6,356 Company restaurant expenses

1,839 452 1,198 — 3,489 General and administrative expenses 396 242

211 280 1,129 Franchise and license expenses 108 48 21 24 201

Closures and impairment (income) expenses 11 1 3 — 15 Refranchising

(gain) loss — — — (163 ) (163 ) Other (income) expense — (2

) (3 ) 8 3 Total costs and expenses, net 2,354

741 1,430 149 4,674 Operating Profit

(loss) $ 871 $ 367 $ 595 $ (151 ) $ 1,682

The above tables reconcile segment information, which is based

on management responsibility, with our Consolidated Summary of

Results. Corporate and unallocated expenses comprise items that are

not allocated to segments for performance reporting purposes.

The Corporate and Unallocated column in the above tables

includes, among other amounts, all amounts that we have deemed

Special Items. See Reconciliation of Non-GAAP Measurements to GAAP

Results.

Notes to the Consolidated Summary of

Results, Consolidated Balance Sheets

and Consolidated Statements of Cash

Flows

(amounts in millions)

(unaudited)

(a) Amounts presented as of and for the quarters and years

ended December 31, 2017 and December 31, 2016 are preliminary.

(b)

In connection with our previously

announced plans to have at least 98% franchise restaurant ownership

by the end of 2018, we recorded net refranchising gains during the

quarters ended December 31, 2017 and 2016 of $752 million and $88

million, respectively, that have been reflected as Special Items.

During the years ended December 31, 2017 and 2016, we recorded net

refranchising gains of $1.1 billion and $163 million, respectively,

that have been reflected as Special Items. The fourth quarter 2017

net refranchising gains related primarily to refranchising KFC

restaurants in Thailand, Australia and the UK, and the

refranchising of Taco Bell, KFC and Pizza Hut restaurants in the

U.S. The fourth quarter 2016 net refranchising gains related

primarily to refranchising Taco Bell restaurants in the U.S. and

KFC restaurants in Thailand and Germany.

(c)

In the fourth quarter of 2016, we

announced our plan to transform our business. Major features of the

Company's strategic transformation plans involve being more focused

on development of our three brands, increasing our franchise

ownership and creating a leaner, more efficient cost structure

(“YUM’s Strategic Transformation Initiatives”). During the quarters

ended December 31, 2017 and 2016, we recognized Special Item

charges of $8 million and $33 million, respectively, related to

these initiatives. During the years ended December 31, 2017 and

2016, we recognized Special Item charges of $23 million and $67

million, respectively. In the fourth quarter of 2017, these costs

primarily related to contract termination costs, that were recorded

within G&A. During the remainder of 2017 and 2016, these costs

related primarily to severance, a 2016 voluntary retirement program

offered to certain U.S. employees and relocation costs that were

recorded within G&A.

(d)

On May 1, 2017, we reached an agreement

with our Pizza Hut U.S. franchisees that will improve brand

marketing alignment, accelerate enhancements in operations and

technology and includes a permanent commitment to incremental

advertising contributions by franchisees beginning in 2018. During

the quarter and year ended December 31, 2017, we recorded Special

Item charges of $11 million and $31 million, respectively, for

these investments. The majority of these amounts were recorded as

Franchise and license expenses or G&A.

(e) During the first quarter of 2015, we reached an

agreement with our KFC U.S. franchisees that gave us brand

marketing control as well as an accelerated path to improved assets

and customer experience. In connection with this agreement, we

recognized Special Item charges of $5 million and $9 million for

the quarters ended December 31, 2017 and December 31, 2016. During

the years ended December 31, 2017 and December 31, 2016, we

recognized Special Item charges of $17 million and $26 million,

respectively. The majority of these costs were recorded as

Franchise and license expenses. (f) In connection with the

separation of Yum China, we modified certain share-based

compensation awards held as part of our Executive Income Deferral

Plan in YUM stock to provide one Yum China share-based award for

each outstanding YUM share-based award. These Yum China awards may

now be settled in cash, as opposed to stock, which requires

recognition of the fair value of these awards each quarter within

G&A in our Consolidated Income Statement. During the quarter

and year ended December 31, 2017, we recorded non-cash Special Item

charges of less than $1 million and $18 million, respectively,

related to these awards. In the fourth quarter of 2016, we recorded

non-cash Special Item charges of $30 million related to these

awards. (g)

We recorded a non-cash charge of $22

million related to the adjustment of certain historical deferred

vested liability balances in our qualified U.S. plan during the

first quarter of 2017. Additionally, during the fourth quarter of

2016, the Company allowed certain former employees with deferred

vested balances in the YUM Retirement Plan an opportunity to

voluntarily elect an early payout of their pension benefits. As a

result of payments made of $225 million related to this program

exceeding the sum of service and interest costs within the Plan, we

recorded a Special Items settlement charge of $24 million in

G&A during the quarter and year ended December 31, 2016. In

connection with this program, we incurred an additional Special

Items settlement charge of $1 million during the third quarter of

2017. These charges are recorded in Other pension (income)

expense.

(h)

During the fourth quarter of 2017, we

recorded a one-time charge of $434 million related to the Tax Cuts

and Jobs Act of 2017 (“Tax Act”) as enacted by the United States

government on December 22, 2017. This charge included a deemed

repatriation tax expense of $170 million on undistributed foreign

earnings, $75 million of expense associated with the remeasurement

of net deferred tax assets to the new 21% U.S. corporate tax rate

and $189 million of valuation allowances established against

foreign tax credit carryforwards which we no longer expect to

utilize under the territorial system that is part of the Tax Act.

This one-time charge is based upon our current estimates and

interpretations of the Tax Act, and could be subject to further

change as additional guidance and accounting interpretation is

issued.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180208005427/en/

Analysts are invited to contact:Keith Siegner, 888-298-6986Vice

President, Investor Relations, Corporate Strategy and

TreasurerorKelly Knybel, 888-298-6986Director, Investor

RelationsorMembers of the media are invited to contact:Virginia

Ferguson, 502-874-8200Director, Public Relations

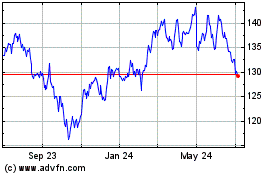

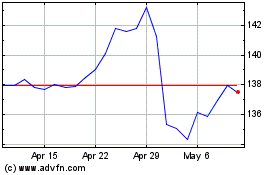

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024