Yen Climbs On Risk Aversion

June 01 2012 - 6:29AM

RTTF2

The Japanese yen spiked up against other major currencies in the

European session on Friday as investors sought safe haven assets

amid weak PMI data from major European economies.

Eurozone manufacturing activity deteriorated at the strongest

pace in nearly three years in May, detailed results of a survey

conducted by Markit Economics showed.

The seasonally adjusted purchasing managers' index, a

performance indicator for the manufacturing sector, fell to 45.1 in

May from 45.9 in April. This was marginally above the flash

estimate of 45.

Also, data from a survey by Markit Economics and the Chartered

Institute of Purchasing and Supply (CIPS) showed that the British

manufacturing sector contracted for the first time in six months in

May, as companies scaled back production and employment as inflows

of new business declined sharply.

The seasonally adjusted purchasing managers' index (PMI) for the

manufacturing sector dropped to 45.9 in May from 50.2 in April,

hitting the lowest level in three years.

Against the European single currency, the yen hit a new 11-year

high of 96.20. The next upside target level for the yen is seen at

91.5. At Thursday's close, the pair was worth 96.85.

The yen that closed Thursday's trading at 80.66 against the

franc and 78.32 against the U.S. dollar hit a new 5-month high of

80.12 and a fresh 3-1/2-month high of 78.12, respectively. The next

upside target level for the yen is seen at 79.00 against the franc

and 77.8 against the greenback.

Switzerland's retail sales were broadly unchanged in April,

following strong growth in the previous month, data released by the

Federal Statistical Office showed.

Total retail sales edged up a calendar-adjusted 0.1 percent,

after March's upwardly revised 4.7 percent growth. Excluding fuel,

retail sales fell 0.3 percent, in contrast to March's 4.3 percent

gain.

Against the pound and the New Zealand dollar, the yen spiked up

to a new 4-month high of 119.30 and a fresh 5-1/2-month high of

58.44 with 118.5 and 58.00 seen as the next upside target levels,

respectively. At yesterday's close, the yen was worth 120.68

against the pound and 59.03 against the kiwi.

The yen also advanced to a fresh 6-month high of 75.28 against

the Australian dollar and a new 4-1/2-month high of 75.14 against

the Canadian dollar, when compared to yesterday's New York session

close of 76.25 and 75.85, respectively. On the upside, the yen may

target 74.00 against the aussie and 74.5 against the loonie.

Looking ahead, US jobs data for May, construction spending for

April, ISM manufacturing data for May and Canada GDP data for March

are due in the New York York morning session.

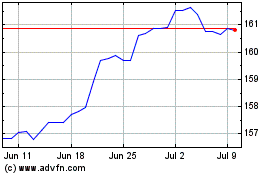

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024