U.S. Stocks Wobble Ahead of Tax-Bill Vote

December 19 2017 - 10:42AM

Dow Jones News

By David Hodari

-- Dow industrials, S&P edge lower

-- Tech companies in S&P 500 fall 0.5%

-- Investors await crucial tax votes

Declining shares of technology companies caused stocks to wobble

Tuesday morning ahead of House Republicans' vote on a sweeping

rewrite of the U.S. tax code.

The Dow Jones Industrial Average fell 15 points, or less than

0.1%, to 24776 soon after the opening bell, while the S&P 500

also declined less than 0.1%. The Nasdaq Composite dropped

0.3%.

Shares of technology companies in the S&P 500 fell 0.5%,

making the sector the broad index's biggest laggard.

While analysts say the tax bill is expected to boost profits

among companies that pay relatively high effective tax rates, such

as retailers, banks and other firms, tech companies aren't expected

to benefit as much, analysts say, since they tend to pay a lower

tax bill than other industries.

Tech companies in the S&P 500 pay an effective tax rate of

about 18%, according to data from FactSet.

Facebook fell 1.2%, while Nvidia declined 1%. PayPal Holdings

shed 1.3%.

That offset gains among shares of consumer staples. Wal-Mart

Stores gained 1%, while Hershey Co. added 1.2%.

Those moves, as well as pockets of optimism among some European

and Asia-Pacific investors on Tuesday, came in conjunction with the

growing probability that Republican leaders will succeed in

overhauling the U.S. tax code and slashing the corporate tax rate

before the new year.

House Republicans are expected to pass the bill by a comfortable

margin, with the Senate expected to vote later Tuesday or

Wednesday.

"There'll be some movement the more likely it becomes. The

S&P's done well and that tells you it's not been priced in yet.

The tax cuts could add 7% to large cap earnings, double that to

small cap earnings... and tax reform should extend this earnings

cycle," said Ben Laidler, global equities strategist at HSBC.

European stocks' early momentum ran out of steam after most

Asia-Pacific indexes closed higher Tuesday. The Stoxx Europe 600

was down 0.1% in recent trading.

In Asia, the Shanghai Composite rose 0.9%, while Hong Kong's

Hang Seng Index returned to positive territory for December, rising

0.7%. Japan's Nikkei fell 0.1%, with Sony 0.9% lower and Nintendo

falling 0.8%.

Michael Wursthorn contributed to this article.

Write to David Hodari at David.Hodari@dowjones.com

(END) Dow Jones Newswires

December 19, 2017 10:27 ET (15:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

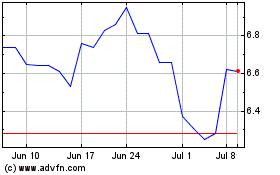

Under Armour (NYSE:UA)

Historical Stock Chart

From Mar 2024 to Apr 2024

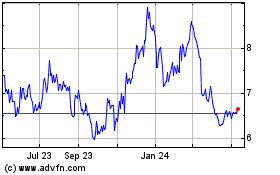

Under Armour (NYSE:UA)

Historical Stock Chart

From Apr 2023 to Apr 2024