By Alyssa Abkowitz

BEIJING -- Chinese internet giant Tencent Holdings Ltd. says it

wants to improve the world through technology. David Wallerstein is

on it.

Mr. Wallerstein, 43, is Tencent's chief exploration officer. The

unusual title reflects his mission: To find so-called moonshot

investments that could lead to big payoffs down the road. Mr.

Wallerstein, a native Californian, has guided Tencent's investments

in startups such as Lilium Aviation, which hopes to cut down on

travel time with its electric flying cars, and Phytech Ltd., which

helps farmers figure out when their plants need water.

"People who don't know him that well can make a mistake and say,

'This is an odd pocket of utopian money coming out of China'," said

Matt Ocko, a Silicon Valley venture capitalist and friend of Mr.

Wallerstein's. "Ten minutes, an hour, a day later -- depending on

how astute they are -- they realize he and Tencent mean

business."

Tencent, which built an empire on videogames and the popular

WeChat social-media app and QQ messaging service, can afford to

take some risks. It has a market value of nearly half a trillion

dollars and about $24 billion in cash on hand, and has invested

nearly $9 billion in enterprises outside China in the past five

years, according to Dow Jones VentureSource. Last year, it snared a

5% stake in Tesla Inc.

The company is committed to "improving human life," said Tencent

president Martin Lau in an emailed statement, adding that Mr.

Wallerstein is advancing that agenda through exploratory investing

in health care, agriculture and transportation.

"We basically need to take our planet back," Mr. Wallerstein

said in a recent speech in Beijing. "This is how we're doing it at

Tencent."

Tencent chairman and chief executive Ma Huateng -- also known as

Pony Ma -- and his co-founders know Mr. Wallerstein's sharp

investment eye firsthand. In 2001, Tencent was an unprofitable

startup with a popular messaging service called QQ. Mr. Wallerstein

was working in Beijing for the investment arm of Naspers Ltd., the

South African media conglomerate.

Seeing QQ's potential, Mr. Wallerstein flew to Shenzhen, where

Tencent is based, to propose an investment. Mr. Ma "politely

declined," Mr. Wallerstein recalled. "I was very shocked."

Ultimately, Naspers bought 46.5% of Tencent for $32 million from

two of the company's earliest investors. Naspers's stake is now

worth nearly $180 billion today, even after being diluted to

33.4%.

Mr. Wallerstein soon joined Tencent, becoming the sixth man on

its leadership team and helping in its early growth, including

forging deals with Nokia and Motorola to integrate QQ into their

handsets. After about a decade overseeing international business,

Mr. Wallerstein moved into his current role, which he says allows

him to work with entrepreneurs around the world. He remains the

only foreigner on Tencent's 15-member management team, and is its

main conduit to Silicon Valley.

Today, the guitar-playing vegan is based in Palo Alto, Calif.,

where he and his five-member team work out of a converted church. A

fluent Mandarin speaker, he visits China every six weeks. Longtime

associates say Mr. Wallerstein's quirky personality -- he once

welcomed guests to a San Francisco dinner party by asking them to

share their most embarrassing moments -- and unusual role at

Tencent belie an investor who is dead serious.

Silicon Valley angel investor Ron Conway calls himself a fan.

Mr. Conway said the two meet and trade notes on investment

prospects several times a year.

"He encourages us to make the leap and invest in new market

areas that normally we wouldn't look at," Mr. Conway said. Both

their firms have invested in Watsi, a crowdsourcing platform to

fund medical care in developing countries, and Skymind, an

artificial-intelligence startup.

In September, Tencent led a $90 million investment in Lilium,

the air-taxi company. "I wasn't thinking about it as a cool

technology," Mr. Wallerstein said in an interview. "I was thinking,

how do you solve the problem of cities being overcrowded and no

roads in developing areas?"

Mr. Wallerstein also oversaw Tencent's 2011 acquisition of Los

Angeles-based Riot Games, whose "League of Legends" is among the

world's most popular games. Riot Games co-founder Marc Merrill said

Mr. Wallerstein mediated between the two companies when Tencent

wanted to use "League of Legends" characters in other content they

owned, including comics and fiction. Riot had resisted on grounds

that it would diminish its brand.

"David has helped contextualize things and Tencent has stayed

true to allowing Riot to remain independent," Mr. Merrill said.

Mr. Wallerstein is using Tencent for other creative pursuits as

well. A fan of heavy metal, he has recorded an album of original

songs that he plans to release on Tencent's music streaming service

this spring. One song, entitled "The Last Chance," opens with

nature sounds, and ends with Mr. Wallerstein singing, "This is a

chance to face the reality/One last dance for all of humanity,"

before fading out with the sound of a clock ticking.

Write to Alyssa Abkowitz at alyssa.abkowitz@wsj.com

(END) Dow Jones Newswires

February 08, 2018 09:14 ET (14:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

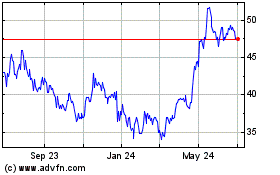

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

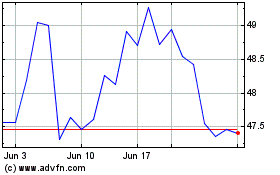

Tencent (PK) (USOTC:TCEHY)

Historical Stock Chart

From Apr 2023 to Apr 2024