SEC Opens Probe of Honeywell -- WSJ

October 20 2018 - 3:02AM

Dow Jones News

By Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 20, 2018).

Honeywell International Inc. said the Securities and Exchange

Commission has opened an investigation into the company's

accounting for asbestos-related liabilities.

The conglomerate said the investigation follows discussions with

the SEC that prompted it to correct and restate its asbestos

liabilities by about $1.1 billion more than its prior estimate.

The company, in an SEC filing Friday, said the SEC's division of

enforcement had notified Honeywell on Sept. 13 that it was opening

an investigation.

The company said it intended to cooperate with the probe and

provide requested information.

Honeywell said it had revised its previous results to correct

how it accounts for legacy liabilities from Bendix Corp., a

vehicle-brakes company that Honeywell sold more than a decade ago,

but was hit with thousands of asbestos-related claims.

Honeywell said its revised liabilities are now $2.61 billion as

of Dec. 31, 2017, which is $1.1 billion higher than its previous

estimate.

"We will fully cooperate with the SEC on its inquiry," Honeywell

said late Friday. In a statement, the company said it previously

disclosed the accounting correction and the SEC's division of

corporate finance had closed its review on Sept. 9.

Also on Friday, Honeywell reported its latest quarterly results.

It lowered its full-year guidance profit guidance to reflect the

spinoffs in its home and transportation businesses, while also

reporting positive quarterly results supported by higher volumesand

demand for its warehouse automation and aerospace segments.

Honeywell now expects to earn between $7.95 and $8 a share,

lower than its previous range of $8.05 to $8.15 a share. It expects

sales to come in between $41.7 billion and $41.8 billion, compared

with its previous guidance of $43.1 billion to $43.6 billion. It

also expects organic sales growth to hit 6%, compared with its

prior guidance of between 5% and 6%.

The company recently spun off its transportation-systems

business as a separate entity called Garrett Motion Inc., and it

plans to complete the spinoff of its home business, which will

become Resideo Technologies Inc., on Oct. 29.

Net sales at the New Jersey-based industrials firm rose 6% to

$10.76 billion from the same quarter a year ago. Product sales were

up 5%, while service sales rose 10%. Honeywell reported sales

increases in all of its segments: aerospace, home and building

technologies, performance materials and technologies and safety and

productivity solutions. Analysts polled by Refinitiv were expecting

sales of $10.75 billion.

Honeywell reported profit rose 73% to $2.34 billion, or $3.11 a

share, from a year ago. On an adjusted basis, the company earned

$2.03 a share. Analysts expected the company to earn $1.99 a share.

Honeywell said it received a tax benefit of $498 million.

Shares of Honeywell, up 2.3% for the year, rose 3.2% to $160.17

a share in premarket trading on low volume.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

October 20, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

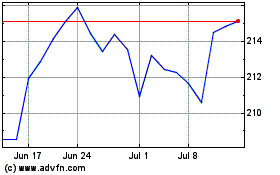

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Aug 2024 to Sep 2024

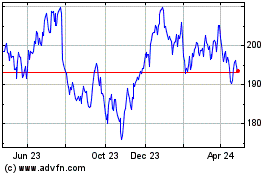

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Sep 2023 to Sep 2024