Rank Group PLC Trading Statement (8761J)

April 05 2018 - 2:00AM

UK Regulatory

TIDMRNK

RNS Number : 8761J

Rank Group PLC

05 April 2018

5 April 2018

The Rank Group Plc

LEI: 213800TXKD6XZWOFTE12

Trading Statement

The Rank Group Plc (LSE: RNK) (Rank or the Group) announces the

following trading update for the 40 weeks to 1 April 2018.

Rank today announces Group* like-for-like revenue for the 13

weeks to 1 April 2018 has declined by 2%. On a divisional basis,

Mecca's venues revenue fell by 2%, Grosvenor's venues revenues fell

by 9% and UK digital revenue grew by 17%.

Like-for-like Like-for-like

revenue for the revenue for the

13 weeks to 1 40 weeks to 1

April 2018 April 2018

Mecca venues (2)% (2)%

----------------- -----------------

Grosvenor Casinos

venues (9)% (3)%

----------------- -----------------

UK digital 17% 17%

----------------- -----------------

Total Group* (2)% 0%

----------------- -----------------

Rank's digital business continues to trade strongly. Following

the Group's 2017/18 interim results statement, both UK venues

businesses have been impacted by weaker than expected visits which

have been compounded by two periods of cold weather. Grosvenor

Casinos' underperformance has also been exacerbated by a negative

contribution from its VIP players.

The Board is cautious about the UK consumer outlook and as a

result expects the Group's UK venues to continue to be impacted for

the remainder of the 2017/18 financial year and into 2018/19. As

highlighted in Rank's recent interim results statement, a number of

key operational actions have been identified and are being put into

place to improve Grosvenor's performance over the medium to long

term.

Taking all the above into consideration, management now expect

the Group's full year operating profit to be in the range of

GBP76m-GBP78m.

*including Enracha's performance

Forthcoming announcements

Rank will announce its preliminary results on 16 August

2018.

Ends

Market Abuse Regulation

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain. The person responsible for arranging the release

of this announcement on behalf of Rank is Clive Jennings, Group

Finance Director.

Contacts:

Rank

Sarah Powell - investor Tel: +44 1628

relations 504 303

Media Enquiries:

FTI Consulting LLP

(PR adviser to Rank)

Edward Bridges Tel: +44 20

3727 1067

Alex Beagley Tel: +44 20

3727 1045

Notes to editors:

1. Figures are not adjusted for customer incentives.

2. Like-for-like excludes the effects of club openings, closures and relocations.

3. All comparisons are with the same period in 2016/17.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTUSVKRWUASRAR

(END) Dow Jones Newswires

April 05, 2018 02:00 ET (06:00 GMT)

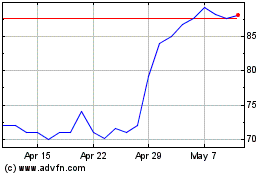

Rank (LSE:RNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

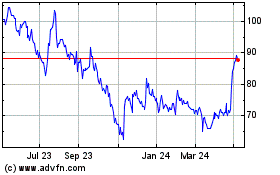

Rank (LSE:RNK)

Historical Stock Chart

From Apr 2023 to Apr 2024