Fresenius 4Q Net Profit Increases on Hospital Segment

February 27 2018 - 2:38AM

Dow Jones News

By Sonia Amaral Rohter

Fresenius SE (FRE.XE) said late Monday that its fourth-quarter

net profit increased, due in part to a strong contribution from its

hospital-operating segment.

The German health-care company said that net profit was 511

million euros ($629.3 million) for the quarter, compared with

EUR442 million a year earlier. Sales rose 11% to EUR8.7 billion, it

said.

In the fourth quarter, sales at Fresenius Helios--which operates

private hospitals--increased 54% to EUR2.23 billion, the company

said. Fresenius acquired the Spanish hospital operator Quironsalud

at the start of 2017.

In 2018, Fresenius expects sales growth of 5% to 8% and net

income growth of 6% to 9%, both at constant currency. Excluding its

expenditure to further develop its biosimilars business, the

company expects net income to grow by around 10% to 13% at constant

currency. The 2018 targets exclude the pending acquisitions of

Akorn Inc. (AKRX) and NxStage Medical Inc. (NXTM), the company

said.

Fresenius confirmed its 2020 mid-term growth targets, saying

that group sales are expected to grow at a compounded annual growth

rate, or CAGR, of 7.1% to 10.3%. The company said that group net

income is expected to increase a CAGR of 8.3% to 12.6%.

Fresenius proposed a 2017 dividend of EUR0.75 a share, up 21%

from 2016.

Fresenius Medical Care AG (FME.XE)--a provider of dialysis

products and services which is owned by Fresenius--also reported

fourth-quarter results, with net profit rising to EUR394 million

from EUR363 million and revenue increasing 0.3% to EUR4.43

billion.

In 2018, Fresenius Medical Care expects revenue growth of around

8% and net income growth of 13% to 15%, both at constant currency.

The targets don't include the effects from the acquisition of

NxStage. The net income target includes recurring benefits from the

U.S. tax reform of EUR140 million to EUR160 million, the company

said.

Fresenius Medical Care proposed a 2017 dividend of EUR1.06 a

share, up 10% from 2016.

"We managed an unusual number of severe natural disasters, have

delivered on our financial targets, and again we are able to

propose the highest dividend in our company's history," said Rice

Powell, chief executive of Fresenius Medical Care.

Write to Sonia Amaral Rohter at

sonia.amaralrohter@dowjones.com

(END) Dow Jones Newswires

February 27, 2018 02:23 ET (07:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

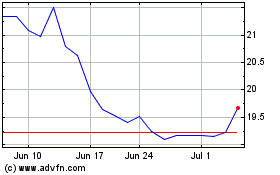

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Aug 2024 to Sep 2024

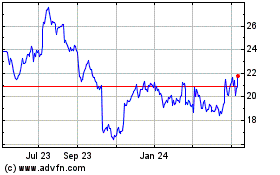

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Sep 2023 to Sep 2024