Fifth Third's Average Loans and Leases Post Slight Increase From a Year Ago -- Earnings Review

July 19 2018 - 7:42AM

Dow Jones News

By Allison Prang

Fifth Third Bancorp (FITB) released its second-quarter financial

results before the market opened Thursday. Here's what you need to

know.

PROFIT: The financial-services company reported a profit of $586

million, or 80 cents a share, up 60% from the $367 million, or 45

cents a share, that the company made for the comparable quarter a

year ago.

NET INTEREST INCOME: Net interest income rose 8.4% to $1.02

billion.

NET INTEREST MARGIN: The company's net interest margin expanded

20 basis points to 3.21%.

NONINTEREST INCOME: Total noninterest income rose 32% to $743

million, helped by a double-digit percentage increase in corporate

banking revenue. Net revenue for mortgage banking declined, but

card and processing revenue and revenue from wealth and asset

management both rose by single-digit percentages. Other noninterest

income nearly tripled. Taking out some items -- including gains

related to Worldpay and from the IPO of GreenSky -- total

noninterest income fell 1%.

NONINTEREST EXPENSES: Total noninterest expenses rose 8.4% to

$1.04 billion as costs for salaries, wages and incentives along

with technology and communications both rose by double-digit

percentages.

PROVISION FOR LOAN AND LEASE LOSSES: The provision for loan and

lease losses fell 37% to $33 million.

LOANS: Total average portfolio loans and leases rose 0.6% to

$92.56 billion. Consumer loans were almost unchanged compared to

the second quarter a year ago while commercial loans and leases

rose 1.1%.

Shares, down 0.3% year to date, were unchanged premarket.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

July 19, 2018 07:27 ET (11:27 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

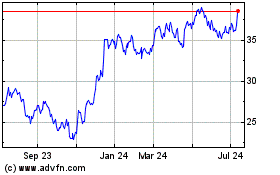

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Aug 2024 to Sep 2024

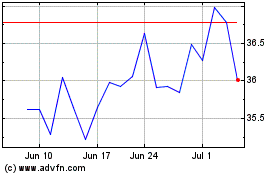

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

From Sep 2023 to Sep 2024