EUROPE MARKETS: European Stocks Stage Small Comeback As Jitters Over Italy Ease

May 24 2018 - 5:48AM

Dow Jones News

By Sara Sjolin, MarketWatch

Pound rises after U.K. retail sales beat forecasts

European stocks inched higher on Thursday, rebounding after a

sharp selloff the prior day. Italian equities were among the

biggest advancers, after the candidate for prime minister put

forward by a euroskeptic party coalition was given the go-ahead to

form a government.

What are markets doing?

The Stoxx Europe 600 index rose 0.2% to 393.50, after logging

its worst one-day percentage fall since March 22

(http://www.marketwatch.com/story/european-stocks-fall-from-4-month-high-after-weak-pmi-numbers-2018-05-23).

The pan-European benchmark on Wednesday ended down 1.1% as traders

fretted about weak eurozone data and the renewed prospect of a

China-U.S. trade war.

Italy's FTSE MIB index climbed 0.5% to 23,023.07, standing out

as one of Europe's best performing indexes on Thursday.

Germany's DAX 30 index inched 0.1% higher to 12,990.69, while

France's CAC 40 index gained 0.4% to 5,587.97.

The U.K.'s FTSE 100 index slipped 0.1% to 7,782.69

(http://www.marketwatch.com/story/ftse-100-searches-for-impetus-with-retail-sales-data-on-deck-2018-05-24).

The blue-chip benchmark turned lower as the pound rallied on the

back of a better-than-expected retail sales reading for April.

Sterling bought $1.3406, compared with $1.3348 late Wednesday in

New York.

The euro rose to $1.1739, from $1.1699 on Wednesday.

In Turkey, the lira resumed its slide, even after the Turkish

central bank on Wednesday intervened to halt the currency's recent

slide. The dollar bought 4.6971 lira, up from 4.5762 late Wednesday

in New York.

Read: Turkey's halted the freefall in lira -- but it's not out

of the woods yet

(http://www.marketwatch.com/story/turkey-halts-lira-free-fall-but-its-not-out-of-the-woods-yet-2018-05-23)

What is driving the markets?

Stocks in Italy advanced after President Sergio Mattarella late

Wednesday gave little-known law professor Giuseppe Conte a formal

mandate to form a government

(http://www.marketwatch.com/story/italy-president-asks-giuseppe-conte-to-form-government-reports-2018-05-23),

potentially ending 11 months of political gridlock.

Conte was proposed as prime minister by the coalition of 5 Star

Movement and League, which now stand to take power and make Italy

the largest country in Europe to be led by an antiestablishment

government.

The two parties are already on a collision course with the EU,

having promised to challenge Brussels's budget guidelines and rules

on immigration.They have also vowed to increase fiscal spending and

cut taxes -- moves some worry could throw the Italian economy into

disarray and create a new sovereign debt crisis.

More broadly, traders were still digesting the minutes from the

U.S. Federal Reserve's May 1-2 meeting, which were released late

Wednesday. The minutes suggest the U.S. central bank is on track to

hike interest rates in June

(http://www.marketwatch.com/story/fed-minutes-show-support-for-june-hike-and-calm-about-inflation-outlook-2018-05-23)

and is keeping calm about the inflation outlook.

Check out:How stock-market investors could be surprised by a

peak in interest rates

(http://www.marketwatch.com/story/heres-how-stock-market-investors-could-be-surprised-by-a-peak-in-rates-2018-05-23)

Offsetting the cheer kindled by the dovish Fed, U.S. President

Donald Trump rekindled concerns about a global trade war by

announcing an investigation that could lead to U.S. import tariffs

on cars

(http://www.marketwatch.com/story/trump-administration-mulls-tariffs-of-up-to-25-on-imported-autos-2018-05-23).

The news weighed on Europe's car makers, and the Stoxx Europe 600

Automobiles & Parts Index fell 1.2% in Thursday's action.

What are strategists saying?

"We see two opposing forces impacting Italian and, by extension,

euro-area assets. The slow-burning force is the deepening of the

growth cycle, which is helping the balance sheet of the Italian

economy to improve, boosting the performance of riskier asset

classes," analysts at UBS said in a note.

"The faster-moving force is the ebb and flow in political risk

premium. Our working assumption has been that risk premium would

not escalate dramatically enough to derail the positive impact from

stronger growth. The events of the last few days in Italy have

questioned our views. It is still early to shift camps. Yet it is

high time to stress-test key assets and trades to levels of

escalation in Italian risk premia," they added.

The yield on 10-year Italian government bonds fell 10 basis

points to 2.307% on Thursday.

Stock movers

Shares of Aryzta AG (ARYN.EB) plunged 29% after the Swiss bakery

group reported a 17% drop in third-quarter revenue and lowered its

full-year guidance.

Mediclinic International PLC (MDC.LN) lost 4.2% after the health

care group said it swung to a full-year pretax loss

(http://www.marketwatch.com/story/mediclinic-swings-to-loss-on-swiss-related-charges-2018-05-24)

due to one-time charges related to its Switzerland business and

intangible assets.

United Utilities Group PLC (UU.LN) gave up 4.5% after reporting

a 2.4% fall in fiscal 2018 pretax profit

(http://www.marketwatch.com/story/united-utilities-pretax-profit-slips-in-2018-2018-05-24).

Shares of Tate & Lyle PLC (TATE.LN) rose 7.2% after the food

ingredients maker said adjusted profit rose 13%

(http://www.marketwatch.com/story/tate-lyle-profit-rises-plans-100-mln-cost-cuts-2018-05-24)

in the last fiscal year.

Shares of Daily Mail & General Trust PLC (DMGT.LN) lost 5%

after the newspaper publisher reported a drop in revenue in the

first half of fiscal 2018

(http://www.marketwatch.com/story/daily-mail-general-trust-pretax-profit-jumps-2018-05-24).

(END) Dow Jones Newswires

May 24, 2018 05:33 ET (09:33 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

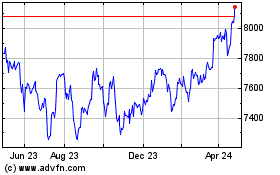

FTSE 100

Index Chart

From Aug 2024 to Sep 2024

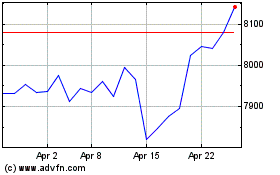

FTSE 100

Index Chart

From Sep 2023 to Sep 2024