TIDMEKF

RNS Number : 6282H

EKF Diagnostics Holdings PLC

14 March 2018

EKF Diagnostics Holdings plc

("EKF", the "Company" or the "Group")

Final results

EKF Diagnostics Holdings plc (AIM: EKF), the AIM listed

point-of-care business, announces its final results for the year

ended 31 December 2017.

Financial highlights

-- Revenue up 8% to GBP41.6m (2016: GBP38.6m)

-- Gross profit up 25% to GBP22.9m (2016: GBP18.3m)

-- Adjusted EBITDA* up 52% to GBP9.3m (2016: GBP6.1m)

-- Earnings per share of 0.59p (2016: nil)

-- Cash generated from operations of GBP10.1m (2016: GBP8.8m)

-- Cash at 31 December 2017 of GBP8.2m (31 Dec 2016: GBP7.9m),

net cash of GBP7.0m (31 Dec 2016: GBP2.2m)

-- Capital restructure creates distributable reserves and allows share buy back programme

* Excluding exceptional items and share based payments

Operational highlights

-- Continued effect of improvements to operational efficiency

-- Closure of Polish operations brings sites down from twelve to seven

-- Creation of Renalytix AI, Inc in January 2018 to exploit sTNFR technology

Christopher Mills, Non-executive Chairman of EKF, said:

"Trading in 2017 has been positive and this has continued into

the early part of 2018. We are currently trading in line with

management's expectations."

EKF Diagnostics Holdings plc Tel: 029 2071 0570

Christopher Mills, Non-executive Chairman

Julian Baines, CEO

Richard Evans, FD & COO

N + 1 Singer Tel: 020 7496 3000

Alex Price / Shaun Dobson / Alex Laughton-Scott

Walbrook PR Limited Tel: 020 7933 8780 or ekf@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

CHAIRMAN'S STATEMENT

I am delighted to present results which show continued good

progress with revenues, earnings, and net cash all significantly

improved compared with the previous year.

Strategy

The Group has continued to follow the path which led to the

successful turnaround of the business in 2016, namely concentrating

its activities on point-of-care diagnostics and the related central

laboratory reagents business, while reducing costs and simplifying

the business. In the first half, we closed our manufacturing site

in Poland and transferred activities to our main European hub in

Barleben, Germany. This led to a small number of redundancies, and

we thank those affected and wish them well for the future. As a

result, the number of sites used by the Group has reduced from a

peak of twelve to seven, of which four are in Europe, two in the

USA and one in China. While we are not currently planning further

closures, our efforts to improve efficiency and therefore reduce

costs continue.

After considerable deliberation and discussion with our

professional advisors, we were unable to proceed with our plan to

split out the central laboratory business in a tax efficient

manner.

sTNFR venture

Subsequent to the year end, on 11 January 2018 the Group

announced its intention to spin-out its sTNFR biomarker technology

into a separate entity, Renalytix AI, Inc., which has been

registered in the USA. sTNFR1/2 (Soluble Tumour Necrosis Factor

Receptors 1 and 2) are novel biomarkers used in combination with

artificial intelligence to identify which diabetes patients are at

the highest risk of progressive Diabetic Kidney Disease (DKD)

potentially leading to End Stage Renal Disease (ESRD). Plans for

the entity are at an early stage and discussions with partners are

continuing.

Capital changes

The Directors have taken a number of actions during the year to

create distributable reserves and to reduce the number of actual

and potential shares in issue. In June 2017, 21.6m share options

which had been granted to employees and others were cancelled at

the election of the holders, in return for payments totalling

GBP1.5m. In September 2017, court and shareholder approval were

received for a capital reduction, allowing us to create

distributable reserves through the write-off of the Company's share

premium account, and to buy back up to 15% of the Company's

ordinary shares. Subsequently, a total of 6.7m shares have been

cancelled. As a result of these actions, the total number of

potential shares has reduced by nearly 6%.

Results overview

The Chief Executive's and Finance Director's statements contain

a review of the year and an overview of the financial performance

of the Group.

Board

All of the Board members have served throughout the year.

Non-executive Directors have continued to waive their standard

director's fees, however as each has performed considerable amounts

of work for the Group in addition to their duties as directors,

they have been paid an appropriate bonus.

Outlook

Trading in 2017 has been positive and this has continued into

the early part of 2018. Trading is in line with management

expectations.

Christopher Mills

Non-executive Chairman

14 March 2018

Chief Executive's Review

It is pleasing to be able to report a strong set of results for

2017. In particular, cash generation has once again been very

strong, with net cash growing from GBP2.2m to GBP7.0m during the

year, despite spending GBP1.4m on capital expenditure and GBP1.5m

on the cancellation of share options.

Operations

We have succeeded in our aim for 2017 of driving the existing

business and continuing to reduce cost. Gross margins have improved

at a greater rate than the increase in sales. We have sold around

15,000 analysers and 70 million tests during the year and cemented

our place as number one supplier of Beta Hydroxybutyrate

(<BETA>-HB ) reagent in the USA, and number two worldwide in

Hemoglobin point-of-care products.

During the year we completed the restructuring of our

manufacturing operations by closing our manufacturing facility in

Poland. Production volume was shifted to our factory in Barleben,

Germany and customers successfully transitioned away from the older

style cuvette previously made in Poland. In Barleben we have

invested in modern production equipment including new automated

equipment for the manufacture and packaging of the Quo-Test

cartridge. At our Elkhart USA facility, where we manufacture a

number of wet chemistry products, we have a medium term programme

to update the facilities to improve quality and volumes.

Point-of-Care

EKF's point-of-care business model continues to be to sell

analysers into the market and then benefit from the ongoing revenue

stream generated by sales of the dedicated consumables. Over the

last five years we have sold over 80,000 analysers for use

worldwide, and each year we supply a growing number of tests for

use on these.

Hematology

Sales of Hematology products have increased by 10% to GBP12.9m

(2016: GBP11.7m). Sales of Hemo Control (sold in the USA as Hemo

Point H2) have built on the strong growth in 2016, rising a further

7%, while DiaSpect revenues have risen by a further 23%.

Diabetes

Diabetes revenues are up by 13% at GBP11.5m (2016: GBP10.2m).

The Saudi tender won in 2015 was completed during the year, and

this has lead to an increase in Quo Test and Quo Lab sales of 14%.

There has been further success for Biosen sales which have risen by

10%.

Central Laboratory

Central laboratory sales have grown by 5% to GBP12.6m, from

GBP12.1m last year, again driven sales of <BETA>-HB

Liquicolor reagent which are higher by a further 17%, having risen

by a very significant percentage in 2016. We have continued to

promote our Altair 240 analyser through an increasing portfolio of

specialist distributors. Sales of other Central Laboratory products

have been stable. We have discontinued a number of the marginal

former STI products.

New and updated products

We have concentrated in 2017 on widening the range of regulatory

approvals for our existing product ranges. In particular we have

conducted a number of clinical trials in the USA in anticipation of

submitting applications for FDA approval in the USA for our

DiaSpect Tm and Quo-Test products. Quo-Test is also in the lab

testing phase of its China FDA registration and we have secured

registration for it in Brazil alongside Hemo Control, DiaSpect Tm

and Quo-Lab. POC Connect, our connectivity solution for our

DiaSpect Tm handheld analyser was launched in November 2017. We

will soon be showcasing our new and updated Lactate Scout 4.0

product. As noted above, we are working to secure commercial launch

of our sTNFR biomarker (for early detection of end stage renal

disease in diabetic patients), alongside a number of partners.

Outlook

We are looking forward to finalising our two FDA applications in

the first half of 2018, and to update on progress with our sTNFR

project. At the same time, we anticipate receiving completed

registrations for Beta Hydroxybutyrate (<BETA>-HB) in Mexico,

Brazil and Colombia as well as the Indian registration of DiaSpect

Tm all in the first half of 2018. We are continuing to work hard to

increase efficiency and reduce costs by investing in automation and

streamlining processes. We are confident that we will continue to

see growth in the business on a steady and sustainable basis.

Julian Baines

Chief Executive Officer

14 March 2018

FINANCE DIRECTOR's Review

Revenue

Revenue for the year was GBP41.6m (2016: GBP38.6m), an increase

of 8%. 6.6% of the increase was the result of improvements in

foreign currency exchange rates, largely because of a further fall

in the average value of sterling against the US dollar and Euro

especially in the first half of the year. The remainder of the

increase comes from organic growth.

Revenue by disease state, which is presented for illustration

purposes only, is as follows:

FY 2017 FY 2016 +/-%

GBP'000 GBP'000

Hematology 12,911 11,704 +10%

Diabetes Care 11,547 10,203 +13%

Central Laboratory 12,597 12,051 +5%

Other 4,529 4,631 (2)%

-------------------- --------- --------- -----

Total revenue 41,584 38,589 +8%

-------------------- --------- --------- -----

Gross profit

Gross profit increased to GBP22.9m (2016: GBP18.3m). The gross

margin percentage on sales was 55.0% (2016: 47.5%). The increase

was attributable in part to cost reductions arising from the

actions taken in previous years, partly through mix and volume

effects, and partly as a result of the release of inventory

provisions set in prior years.

Administration costs and research and development costs

Administration expenses have again fallen, to GBP18.2m (2016:

GBP18.7m). R&D costs included in administration expenses were

GBP2.2m, with a further GBP0.7m being capitalised as an intangible

cost. Gross R&D expenses have therefore increased to GBP2.9m

from GBP2.7m in 2016.

The charge for depreciation of fixed assets and amortisation of

intangible assets is GBP4.6m (2016: GBP5.0m). The charge includes

an impairment in the year related to the carrying value of our

Polish operations which were closed during the year, as well as the

reassessment of the carrying value of certain non-core development

projects.

Exceptional items relate to provisions made and costs incurred

in the closure of the Polish manufacturing site, the increase in

the fair value of the warranty claim associated with the

acquisition of EKF-Diagnostic GmbH, which is attributable to the

increase in the Company's share price during the year, and to the

benefit at fair value of the shares released to EKF from an escrow

account associated with the acquisition of Selah Genomics, Inc.

Operating profit and adjusted earnings before interest tax and

depreciation

The Group made an operating profit of GBP4.7m, having made a

small loss of GBP0.3m in 2016. This reflects the considerable

efforts made in the last two years to reduce costs and improve

efficiency. We continue to consider that adjusted earnings before

interest, tax, depreciation and amortisation, share-based payments

and exceptional items (adjusted EBITDA) is a better measure of

progress because the Board believes it gives clearer comparability

of operating performance between periods. In 2017 we achieved

adjusted EBITDA of GBP9.3m (2016: GBP6.1m). The calculation of this

non-GAAP measure is shown on the face of the income statement. It

excludes the effect of share-based payment charges of GBP1.5m

(2016: GBP1.0m), which increased largely because of the

acceleration of charges as a result of the programme of share

option cancellations, and exceptional profits of GBP1.6m (2016:

losses of GBP0.5m). Of the increase in adjusted EBITDA of GBP3.2m,

GBP0.6m is attributable to the effect of more favourable exchange

rates, with the remainder being attributable to improved underlying

performance.

Finance costs

Finance costs have continued to fall, to GBP0.5m in 2017 (2016:

GBP0.7m). This is largely as a result of lower interest costs

associated with the reduction of debt during the year, offset by

higher charges relating to the discounting of deferred

consideration.

Tax

There is an income tax charge of GBP1.4m (2016: credit of

GBP1.2m). This is because of a tax adjustment in the USA caused by

timing differences on the carry back of losses in previous years,

while in 2016 there was a large credit relating to 2015. In future

years the Group anticipates a positive impact on its tax charge as

a result of the tax policy changes recently made by the US

Government.

Balance sheet

Property, plant and equipment

Additions to fixed assets were GBP1.4m (2016: GBP1.3m). This

reflected investment in production equipment in both Germany and in

the USA, including automated pouching equipment in Barleben and the

replacement of obsolete plant in Elkhart.

Intangible assets

The value of intangible assets has fallen from GBP46.5m to

GBP43.6m year-on-year. This is partially attributable to the annual

amortisation charge, plus the offsetting effect of additions and

impairments.

Deferred consideration

The remaining deferred consideration relates to the share-based

payment to the former owner of EKF-Diagnostic GmbH. Finalisation of

the contracts to conclude the position is now expected to take

place in 2018.

Cash and working capital

Net cash has increased from GBP2.2m to GBP7.0m during the year.

Gross cash has increased to GBP8.2m (2016: GBP7.9m), and borrowings

have reduced from GBP5.7m to GBP1.2m. All borrowings in the UK and

the USA have been paid off. The remaining borrowings are being

reduced over the loan period to 2023 and were used to fund the new

building in Barleben. GBP1.5m was used to buy employees out of

share option agreements and GBP0.2m was used to acquire ordinary

shares for cancellation.

Inventory has reduced from GBP6.0m to GBP5.6m in 2017 as our

programme to reduce inventory levels continued. While results so

far have been encouraging, and we have seen inventory levels reduce

by over 30% since December 2015, despite higher revenue, our

ambition remains to reduce our holdings further, while ensuring

production and sales run efficiently.

Trade receivables have reduced, partly because of the completion

of payments relating to business in Saudi Arabia which required

extended payment terms. The increase in payables, reflects

increased activity during the year and the liability recognised in

respect of cash settled share-based payments.

Richard Evans

Finance Director and Chief Operating Officer

14 March 2018

Consolidated Income Statement

FOR THE YEARED 31 DECEMBER 2017

2017 2016

GBP'000 GBP'000

========================================================= ======== ========

Revenue 41,584 38,589

Cost of sales (18,721) (20,267)

========================================================== ======== ========

Gross profit 22,863 18,322

Administrative expenses (18,186) (18,734)

Other income 52 85

========================================================== ======== ========

Operating profit/(loss) 4,729 (327)

---------------------------------------------------------- -------- --------

Depreciation and amortisation (4,623) (4,961)

Share-based payments (1,514) (973)

Exceptional items 1,562 (532)

EBITDA before exceptional items and share-based payments 9,304 6,139

---------------------------------------------------------- -------- --------

Finance income 53 37

Finance costs (475) (713)

========================================================== ======== ========

Profit/(loss) before income tax 4,307 (1,003)

Income tax (charge)/credit (1,367) 1,172

========================================================== ======== ========

Profit for the year 2,940 169

========================================================== ======== ========

Profit/(loss) attributable to:

Owners of the parent 2,715 (18)

Non-controlling interest 225 187

========================================================== ======== ========

2,940 169

--------------------------------------------------------- -------- --------

Pence Pence

=================================================== ===== ======

Earnings/(loss) per Ordinary Share attributable to

the owners of the parent during the year

From continuing operations

Basic 0.59 (0.00)

Diluted 0.58 -

---------------------------------------------------- ----- ------

Consolidated Statement of Comprehensive Income

2017 2016

GBP'000 GBP'000

------------------------------------------------------ -------- --------

Profit for the year 2,940 169

Other comprehensive income:

Items that may be subsequently reclassified to profit

or loss

Currency translation differences (622) 9,343

======================================================= ======== ========

Other comprehensive (loss)/gain for the year (622) 9,343

======================================================= ======== ========

Total comprehensive gain for the year 2,318 9,512

======================================================= ======== ========

Attributable to:

Owners of the parent 2,096 9,198

Non-controlling interests 222 314

======================================================= ======== ========

Total comprehensive gain for the year 2,318 9,512

======================================================= ======== ========

Consolidated Statement of Financial Position

AS AT 31 December 2017

Group Group

2017 2016

GBP'000 GBP'000

============================================ ======== ========

Assets

Non-current assets

Property, plant and equipment 12,121 12,124

Intangible assets 43,600 46,503

Investments 152 152

Deferred tax assets 34 371

============================================= ======== ========

Total non-current assets 55,907 59,150

============================================= ======== ========

Current assets

Inventories 5,638 6,025

Trade and other receivables 7,396 9,370

Deferred tax assets 13 13

Cash and cash equivalents 8,203 7,874

============================================= ======== ========

Total current assets 21,250 23,282

============================================= ======== ========

Total assets 77,157 82,432

============================================= ======== ========

Equity attributable to owners of the parent

Share capital 4,576 4,643

Share premium account - 95,393

Other reserve 108 41

Foreign currency reserves 4,892 5,609

Retained earnings 50,394 (45,236)

============================================= ======== ========

59,970 60,450

============================================ ======== ========

Non-controlling interest 528 521

============================================= ======== ========

Total equity 60,498 60,971

============================================= ======== ========

Liabilities

Non-current liabilities

Borrowings 872 1,130

Deferred tax liabilities 3,467 3,751

Total non-current liabilities 4,339 4,881

============================================= ======== ========

Current liabilities

Trade and other payables 9,429 9,401

Deferred consideration 1,062 693

Current income tax liabilities 1,473 1,160

Deferred tax liabilities 23 738

Borrowings 333 4,588

============================================= ======== ========

Total current liabilities 12,320 16,580

============================================= ======== ========

Total liabilities 16,659 21,461

============================================= ======== ========

Total equity and liabilities 77,157 82,432

============================================= ======== ========

Consolidated Statement of Cash Flows

FOR THE YEARED 31 DECEMBER 2017

Group Group

2017 2016

GBP'000 GBP'000

============================================= ======== ========

Cash flow from operating activities

Cash generated by operations 10,118 8,816

Interest paid (106) (496)

Income tax (paid)/received (959) 623

============================================== ======== ========

Net cash generated by operating activities 9,053 8,943

============================================== ======== ========

Cash flow from investing activities

Sale of investments - 250

Purchase of property, plant and equipment

(PPE) (1,361) (1,261)

Purchase of intangibles (852) (663)

Proceeds from sale of PPE 128 211

Interest received 53 37

============================================== ======== ========

Net cash used in investing activities (2,032) (1,426)

============================================== ======== ========

Cash flow from financing activities

Proceeds from issuance of Ordinary Shares - 4,539

Share based payments (1,505) -

Share buy back (241) -

New loans - 5,957

Repayments on borrowings (4,458) (12,555)

Dividend payment to non-controlling interest (215) (54)

Net cash used in financing activities (6,419) (2,113)

============================================== ======== ========

Net increase in cash and cash equivalents 602 5,404

Cash and cash equivalents at beginning

of year 7,874 2,017

Exchange (losses)/gains on cash and cash

equivalents (273) 453

============================================== ======== ========

Cash and cash equivalents at end of year 8,203 7,874

============================================== ======== ========

Consolidated Statement of Changes in Equity

Share Foreign

Share premium Other currency Retained Non-controlling Total

capital account reserve reserve earnings Total interest equity

Consolidated GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================= ======== ======== ======== ========= ========= ======== =============== ========

At 1 January 2016 4,221 91,276 41 (3,607) (45,438) 46,493 261 46,754

============================= ======== ======== ======== ========= ========= ======== =============== ========

Comprehensive income

(Loss)/profit for the year - - - - (18) (18) 187 169

Other comprehensive income

Currency translation

differences - - - 9,216 - 9,216 127 9,343

============================= ======== ======== ======== ========= ========= ======== =============== ========

Total comprehensive

income/(expense) - - - 9,216 (18) 9,198 314 9,512

============================= ======== ======== ======== ========= ========= ======== =============== ========

Transactions with owners

Proceeds from shares issued 422 4,117 - - - 4,539 - 4,539

Dividends to non-controlling

interest - - - - - - (54) (54)

Share-based payments - - - - 220 220 - 220

============================= ======== ======== ======== ========= ========= ======== =============== ========

Total contributions by and

distributions to owners 422 4,117 - - 220 4,759 (54) 4,705

============================= ======== ======== ======== ========= ========= ======== =============== ========

At 31 December 2016 and 1

January

2017 4,643 95,393 41 5,609 (45,236) 60,450 521 60,971

============================= ======== ======== ======== ========= ========= ======== =============== ========

Comprehensive income

Profit for the year - - - - 2,715 2,715 225 2,940

Other comprehensive income

Currency translation

differences - - - (717) 98 (619) (3) (622)

============================= ======== ======== ======== ========= ========= ======== =============== ========

Total comprehensive

(expense)/income - - - (717) 2,813 2,096 222 2,318

============================= ======== ======== ======== ========= ========= ======== =============== ========

Transactions with owners

Share cancellation (67) - 67 - (3,121) (3,121) - (3,121)

Capital reconstruction - (95,393) - - 95,393 - - -

Dividends to non-controlling

interest (215) (215)

Share-based payments 545 545 - 545

============================= ======== ======== ======== ========= ========= ======== =============== ========

Total contributions by and

distributions to owners (67) (95,393) 67 - 92,817 (2,576) (215) (2,791)

============================= ======== ======== ======== ========= ========= ======== =============== ========

At 31 December 2017 4,576 - 108 4,892 50,394 59,970 528 60,498

============================= ======== ======== ======== ========= ========= ======== =============== ========

Notes to the Financial Statements

for the year ended 31 December 2017

1. Basis of presentation

EKF Diagnostics Holdings Plc is a company incorporated in the

United Kingdom. The Company is a public limited company, which is

listed on the AIM market of the London Stock Exchange.

The audited preliminary announcement has been prepared in

accordance with the Group's accounting policies as disclosed in the

financial statements for the year ended 31 December 2017 and

International Financial Reporting Standards ("IFRSs") and

International Financial Reporting Standards Interpretations

Committee (IFRS IC) interpretations as adopted by the European

Union and with those parts of the Companies Act 2006 applicable to

companies reporting under IFRS. This preliminary announcement was

approved by the Board of Directors on 14 March 2018. The

preliminary announcement does not constitute statutory financial

statements within the meaning of section 434 of the Companies Act

2006. Statutory accounts for the year to 31 December 2016 have been

delivered to the Registrar of Companies. The audit report for those

accounts was unqualified and did not contain statements under 498

(2) or (3) of the Companies Act 2006 and did not contain any

emphasis of matter.

Certain statements in this announcement constitute

forward-looking statements. Any statement in this announcement that

is not a statement of historical fact including, without

limitation, those regarding the Company's future expectations,

operations, financial performance, financial condition and business

is a forward-looking statement. Such forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially. These risks and uncertainties include, amongst

other factors, changing economic, financial, business or other

market conditions. These and other factors could adversely affect

the outcome and financial effects of the plans and events described

in this announcement and the Company undertakes no obligation to

update its view of such risks and uncertainties or to update the

forward-looking statements contained herein. Nothing in this

announcement should be construed as a profit forecast.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRSs), this announcement does not itself contain

sufficient information to comply with IFRSs. The Company will

publish its full financial statements for the year ended 31

December 2017 by 16 April 2018, which will be available on the

Company's website at www.ekfdiagnostics.com and at the Company's

registered office at Avon House, 19 Stanwell Road Penarth CF64 2EZ.

The Annual General Meeting will be held on Tuesday 8 May 2017.

2. Geographic sales

Disclosure of Group revenues by geographic location of customer

is as follows:

2017 2016

GBP'000 GBP'000

====================================== ======== ========

Americas

United States of America 17,174 15,122

Rest of Americas 3,195 3,979

Europe, Middle East and Africa (EMEA)

Germany 6,016 6,082

United Kingdom 300 276

Rest of Europe 3,423 2,761

Russia 2,743 2,687

Middle East 2,912 2,870

Africa 1,611 882

Asia and Rest of World

China 915 929

Rest of Asia 3,168 2,922

New Zealand/Australia 127 79

====================================== ======== ========

Total revenue 41,584 38,589

====================================== ======== ========

No single external customer represented more than 10% of

revenues in either 2017 or 2016.

3. Exceptional items

Included within administrative expenses are exceptional items as

shown below:

2017 2016

Note GBP'000 GBP'000

===================================== ===== ======== ========

* Warranty claim a 339 129

* Business reorganisation costs b (183) (661)

* Cancellation of shares c 1,406 -

Exceptional items 1,562 (532)

============================================ ======== ========

(a) Estimated warranty claim in relation to the acquisition of

EKF-diagnostic GmbH increased because of higher share price.

(b) Restructuring costs, mainly redundancy and notice costs,

associated in 2017 with the closure of EKF's Polish facility and

other restructuring activities.

(c) Fair value of shares released to EKF by former shareholders

of Selah Genomics Inc. which had been issued as part of the

consideration for the acquisition of Selah, but held in escrow.

These shares have subsequently been cancelled.

4. Finance income and costs

2017 2016

GBP'000 GBP'000

============================================================= ======== ========

Finance costs:

* Bank borrowings 83 338

* Other interest 23 158

* Financial liabilities at fair value through profit or

loss - losses/(gains) 369 208

* Convertible debt - 9

============================================================= ======== ========

Finance costs 475 713

============================================================= ======== ========

Finance income

* Interest income on cash and short-term deposits 14 37

* Other interest 39 -

============================================================= ======== ========

Finance income 53 37

============================================================= ======== ========

Net finance costs 422 676

============================================================= ======== ========

5. Income tax

2017 2016

Group GBP'000 GBP'000

================================================== ======== ========

Current tax:

Current tax on profit/(loss) for the year 2,045 1,602

Adjustments for prior periods (100) (2,219)

================================================== ======== ========

Total current tax 1,945 (617)

================================================== ======== ========

Deferred tax:

Origination and reversal of temporary differences (578) (555)

Total deferred tax (578) (555)

================================================== ======== ========

Income tax charge/(credit) 1,367 (1,172)

================================================== ======== ========

The Finance Act 2015 which was substantively enacted in 2015

included legislation to reduce the main rate of UK corporation tax

to 19% from 1 April 2017 and the Finance Act 2016 which was

substantively enacted in 2016 included legislation to reduce the

main rate of UK corporation tax to 17% from 1 April 2020.

The tax on the Group's profit/(loss) before tax differs from the

theoretical amount that would arise using the standard tax rate

applicable to the profits of the consolidated entities as

follows:

2017 2016

GBP'000 GBP'000

=============================================================== ======== ========

Profit/(loss) before tax 4,307 (1,003)

=============================================================== ======== ========

Tax calculated at domestic tax rates applicable to UK standard

rate of tax of 19.25% (2016: 20%) 829 (201)

Tax effects of:

* Expenses not deductible for tax purposes 31 390

* Remeasurement of deferred tax - change in future tax

rate (360) -

* Income not subject to tax 267 -

* Utilisation of losses carried forward/ group relief (178) (63)

* Adjustment in respect of prior years (100) (2,219)

* Impact of different tax rates in other jurisdictions 634 428

* Other movements 244 493

=============================================================== ======== ========

Tax charge/(credit) 1,367 (1,172)

=============================================================== ======== ========

There are no tax effects on the items in the statement of other

comprehensive income.

6. Earnings per share

(a) Basic

Basic earnings per share is calculated by dividing the profit

attributable to owners of the parent by the weighted average number

of Ordinary Shares in issue during the year.

2017 2016

GBP'000 GBP'000

==================================================== =========== ============

Profit/(loss) attributable to owners of the parent 2,715 (18)

==================================================== =========== ============

Weighted average number of Ordinary Shares in issue 463,098,526 446,042,831

==================================================== =========== ============

Basic profit/(loss) per share 0.59 pence (0.00) pence

---------------------------------------------------- ----------- ------------

(b) Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of Ordinary Shares outstanding assuming

conversion of all dilutive potential Ordinary Shares. The Company

has two categories of dilutive potential ordinary shares:

equity-based long-term incentive plans and share options. The

potential shares were not dilutive in 2016 as the Group made a loss

per share.

2017 2016

GBP'000 GBP'000

=================================================== =========== ============

Profit/(loss) attributable to owners of the parent 2,715 (18)

Weighted average diluted number of Ordinary Shares 469,343,547 446,042,831

=================================================== =========== ============

Diluted profit/(loss) per share 0.58 pence (0.00) pence

--------------------------------------------------- ----------- ------------

2017 2016

======================================================== =========== ===========

Weighted average number of Ordinary Shares in issue 463,098,526 446,042,831

Adjustment for:

* Assumed conversion of share awards 2,201,081 -

* Assumed payment of equity deferred consideration 4,043,940 4,043,940

======================================================== =========== ===========

Weighted average number of Ordinary Shares including

potentially dilutive shares 469,343,547 450,086,771

======================================================== =========== ===========

7. Dividends

There were no dividends paid or proposed by the Company in

either year. The Board's policy is to enhance shareholder value

mainly through the growth of the Group, and through a programme of

share buy backs. The Board will however consider the payment of

dividends if and when appropriate.

8 Cash used in operations

Group

==================

2017 2016

GBP'000 GBP'000

========================================

Profit/(loss) before tax 4,307 (1,003)

Adjustments for:

* Depreciation 1,160 1,209

* Amortisation 3,463 3,752

* Warranty claim (339) (129)

* Loss on disposal of fixed assets (33) 30

* Restructure of operations - (360)

* Share-based payments 1,510 220

* Escrow cancellation (1,371) -

* Fair value adjustment 369 208

- Foreign exchange 233 481

* Bad debt written down - -

* Net finance costs 53 468

Changes in working capital

* Inventories 306 2,767

* Trade and other receivables 1,535 (1,127)

* Trade and other payables (1,075) 2,300

======================================== ======== ========

Net cash generated by operations 10,118 8,816

---------------------------------------- -------- --------

In the statement of cash flows, proceeds from the sale of

property, plant and equipment comprise:

2017 2016

Group GBP'000 GBP'000

======================================================== ======== ========

Net book value 95 241

Loss on disposal of property, plant and equipment 33 (30)

======================================================== ======== ========

Proceeds from disposal of property, plant and equipment 128 211

======================================================== ======== ========

Non-cash transactions

The principal non-cash transactions are; movements on deferred

consideration provisions; the fair value adjustment relating to the

deferred equity consideration in respect of EKF Germany, the

warranty claim, and release of accruals no longer required.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFEFUDFASELD

(END) Dow Jones Newswires

March 14, 2018 03:01 ET (07:01 GMT)

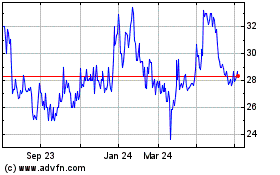

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Aug 2024 to Sep 2024

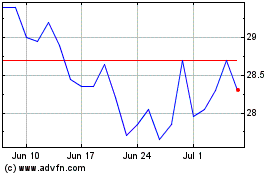

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Sep 2023 to Sep 2024