Carter’s, Inc. (NYSE:CRI), the largest branded marketer in the

United States of apparel exclusively for babies and young children,

today reported its fourth quarter and fiscal 2011 results.

“In the fourth quarter, we achieved sales growth in every

segment of our business, which reflects the strength of our brands

and compelling value they provide to consumers,” said Michael D.

Casey, Chairman and Chief Executive Officer. “For the year, we

achieved a record level of sales by extending the reach of our

brands in the United States and international markets. Earnings

continue to be impacted by abnormally high cotton prices. We expect

to see the benefit of lower cotton prices in the second half of

2012, and we are forecasting good growth in sales and profitability

this year.”

Fourth Quarter of Fiscal 2011 compared to Fourth Quarter of

Fiscal 2010

Consolidated net sales increased $111.4 million, or 22.5%, to

$606.6 million. Net domestic sales of the Company’s Carter’s brands

increased $54.5 million, or 14.1%, to $442.4 million. Net domestic

sales of the Company’s OshKosh B’gosh brand increased $10.6

million, or 10.6%, to $110.0 million. Net international sales,

which are comprised of sales of Carter’s and OshKosh B’gosh branded

products to wholesale customers outside the United States and

Canadian retail store sales, increased $46.3 million to $54.3

million.

The Company’s pre-tax income in the fourth quarter of fiscal

2011 includes expenses related to the acquisition of Bonnie Togs, a

Canadian children’s apparel retailer, of approximately $3.0

million.

Operating income in the fourth quarter of fiscal 2011 was $55.0

million, a decrease of $3.7 million, or 6.4%, from $58.8 million in

the fourth quarter of fiscal 2010. Excluding the effect of the

acquisition-related expenses noted above and detailed at the end of

this release, adjusted operating income in the fourth quarter of

fiscal 2011 was $58.0 million, a decrease of $0.8 million, or 1.3%,

from the fourth quarter of fiscal 2010. The decrease primarily

reflects the net effect of higher product costs.

Net income decreased $0.1 million, or 0.3%, to $34.8 million, or

$0.59 per diluted share, compared to $34.9 million, or $0.60 per

diluted share, in the fourth quarter of fiscal 2010. Excluding the

effect of the acquisition-related expenses noted above and detailed

at the end of this release, adjusted net income in the fourth

quarter of fiscal 2011 increased $2.5 million, or 6.8%, to $37.3

million, or $0.63 per diluted share from the fourth quarter of

fiscal 2010.

A reconciliation of income as reported under accounting

principles generally accepted in the United States of America

(“GAAP”) to adjusted income is provided at the end of this

release.

Business Segment Results

In light of the acquisition of Bonnie Togs in June 2011, the

Company realigned certain of its reportable segments. Effective

October 1, 2011, the Carter’s and OshKosh wholesale segments

reflect domestic business activities formerly reported in these

brands’ wholesale and mass channel segments. In addition, the

Company added a new international segment, which includes its

Canadian retail business, international wholesale sales, and

international royalty income. Prior-year amounts have been recast

to conform to the current year presentation.

Carter’s Segments

Carter’s retail segment sales increased $42.6 million, or 26.1%,

to $206.3 million, driven by incremental sales of $19.3 million

generated by new store openings and $13.0 million generated by

eCommerce sales, and a comparable store sales increase of $11.0

million, or 7.2%, which were partially offset by the effect of

store closings of $0.7 million. In the fourth quarter of fiscal

2011, the Company opened nine Carter’s retail stores and closed

one. As of the end of the fourth quarter, the Company operated 359

Carter’s retail stores.

Carter’s wholesale segment sales increased $11.9 million, or

5.3%, to $236.1 million reflecting strong demand for the Company’s

Carter’s, Just One You, and Child of Mine brands.

OshKosh B’gosh Segments

OshKosh retail segment sales increased $9.5 million, or 11.9%,

to $89.3 million, driven by a comparable store sales increase of

$5.0 million, or 6.9%, incremental sales of $4.6 million generated

by eCommerce sales and $1.6 million generated by new store

openings, which were partially offset by the effect of store

closings of $1.9 million. In the fourth quarter of fiscal 2011, the

Company closed six OshKosh retail stores. As of the end of the

fourth quarter, the Company operated 170 OshKosh retail stores.

OshKosh wholesale segment sales increased $1.1 million, or 5.6%,

to $20.6 million.

International Segment

International segment sales increased $46.3 million to $54.3

million, reflecting the acquisition of the Canadian retailer Bonnie

Togs in fiscal 2011 and higher wholesale sales. In the fourth

quarter of fiscal 2011, the Company opened one store in Canada. As

of the end of the fourth quarter, the Company operated 65 retail

stores in Canada.

Fiscal 2011 compared to Fiscal 2010

Consolidated net sales increased $360.5 million, or 20.6%, to

$2.1 billion. Net domestic sales of the Company’s Carter’s brands

increased $236.7 million, or 17.2%, to $1.6 billion. Net domestic

sales of the Company’s OshKosh B’gosh brand increased $22.4

million, or 6.6%, to $362.8 million. Net international sales

increased $101.4 million to $136.2 million.

The Company’s pre-tax income in fiscal 2011 includes Bonnie Togs

acquisition-related charges of approximately $12.2 million.

Operating income in fiscal 2011 was $187.5 million, a decrease

of $55.8 million, or 22.9%, from $243.3 million in fiscal 2010.

Excluding the effect of the acquisition-related expenses noted

above and detailed at the end of this release, adjusted operating

income in fiscal 2011 was $199.7 million, a decrease of $43.6

million, or 17.9%, from fiscal 2010. The decrease primarily

reflects the net effect of higher product costs.

Net income decreased $32.5 million, or 22.2%, to $114.0 million,

or $1.94 per diluted share, compared to $146.5 million, or $2.46

per diluted share, in fiscal 2010. Excluding the effect of the

acquisition-related expenses noted above and detailed at the end of

this release, adjusted net income in fiscal 2011 decreased $23.2

million, or 15.9%, to $123.2 million, or $2.09 per diluted share

from fiscal 2010.

A reconciliation of income as reported under GAAP to income

adjusted for expenses related to the Company’s acquisition of the

Bonnie Togs business is provided at the end of this release.

Cash flow from operations in fiscal 2011 was $81.1 million

compared to $85.8 million in fiscal 2010, reflecting decreased

earnings in fiscal 2011, partially offset by lower net working

capital requirements.

Carter’s Segments

Carter’s retail segment sales increased $125.4 million, or

22.9%, to $671.6 million, driven by incremental sales of $57.0

million generated by new store openings and $40.8 million generated

by eCommerce sales, and a comparable store sales increase of $29.1

million, or 5.6%, which were partially offset by the effect of

store closings of $1.5 million. In fiscal 2011, the Company opened

56 Carter’s retail stores and closed three stores.

Carter’s wholesale segment sales increased $111.3 million, or

13.4%, to $939.1 million, driven by growth in the Company’s

Carter’s, Child of Mine, and Just One You brands.

OshKosh B’gosh Segments

OshKosh retail segment sales increased $16.0 million, or 6.0%,

to $280.9 million, driven by incremental sales of $12.9 million

generated by eCommerce sales and $8.9 million generated by new

store openings, which were partially offset by a comparable store

sales decrease of $0.7 million, or 0.3%, and the effect of store

closings of $5.0 million. In fiscal 2011, the Company opened three

OshKosh retail stores and closed thirteen stores.

OshKosh wholesale segment sales increased $6.4 million, or 8.5%,

to $81.9 million driven by higher off-price channel sales.

International Segment

International segment sales increased $101.4 million to $136.2

million, reflecting the acquisition of Bonnie Togs in fiscal 2011

and higher wholesale sales.

2012 Business Outlook

The Company anticipates that product costs for its Spring 2012

merchandise assortments will increase approximately 15% compared to

its Spring 2011 assortments, due to continued elevated cotton,

labor, and other product-related costs. Product costs for the

Company’s Fall 2012 merchandise assortment are expected to decline

approximately 10% compared to its Fall 2011 assortments,

principally due to lower cotton costs.

For fiscal 2012, the Company projects net sales will increase

approximately 8% to 10% over fiscal 2011. The Company expects

adjusted diluted earnings per share, excluding approximately $5

million to $7 million in charges related to the Bonnie Togs

acquisition or other unusual items, to be approximately $2.40 to

$2.50 compared to $2.09 in fiscal 2011.

For the first quarter of fiscal 2012, the Company expects net

sales to increase approximately 11% to 13% over the first quarter

of fiscal 2011. The Company expects adjusted diluted earnings per

share, excluding approximately $1 million to $2 million in charges

related to the Bonnie Togs acquisition or other unusual items, to

be approximately $0.38 to $0.43, compared to $0.56 in the first

quarter of fiscal 2011.

Conference Call

The Company will hold a conference call with investors to

discuss fiscal 2011 results and its business outlook on February

29, 2012 at 8:30 a.m. Eastern Time. To participate in the call,

please dial 913-981-5519. To listen to a live broadcast of the call

on the internet, please log on to www.carters.com and select the

“Q4 2011 Earnings Conference Call” link under the “Investor

Relations” tab. Presentation materials for the call can be accessed

at www.carters.com by selecting the “Conference Calls &

Webcasts” link under the “Investor Relations” tab. A replay of the

call will be available shortly after the broadcast through March 9,

2012, at 719-457-0820, passcode 8641534. The replay will also be

archived on the Company’s website.

For more information on Carter’s, Inc., please visit

www.carters.com.

Cautionary Language

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 relating to the Company’s future

performance, including, without limitation, statements with respect

to the Company’s anticipated financial results for the first

quarter of fiscal 2012 and fiscal 2012, or any other future period,

assessment of the Company’s performance and financial position, and

drivers of the Company’s sales and earnings growth. Such statements

are based on current expectations only, and are subject to certain

risks, uncertainties, and assumptions. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those anticipated, estimated, or projected. Factors that could

cause actual results to materially differ include: the acceptance

of the Company's products in the marketplace; changes in consumer

preference and fashion trends; seasonal fluctuations in the

children's apparel business; negative publicity; the breach of the

Company's consumer databases; increased production costs;

deflationary pricing pressures and customer acceptance of higher

selling prices; a continued decrease in the overall level of

consumer spending; the Company's dependence on its foreign supply

sources; failure of its foreign supply sources to meet the

Company's quality standards or regulatory requirements; the impact

of governmental regulations and environmental risks applicable to

the Company's business; disruption to our eCommerce business; the

loss of a product sourcing agent; increased competition in the baby

and young children's apparel market; the ability of the Company to

identify new retail store locations, and negotiate appropriate

lease terms for the retail stores; the ability of the Company to

adequately forecast demand, which could create significant levels

of excess inventory; failure to successfully integrate Bonnie Togs

into our existing business and realize growth opportunities and

other benefits from the acquisition; failure to achieve sales

growth plans, cost savings, and other assumptions that support the

carrying value of the Company's intangible assets; and the ability

to attract and retain key individuals within the organization. Many

of these risks are further described in the most recently filed

Quarterly Report on Form 10-Q and other reports filed with the

Securities and Exchange Commission under the headings "Risk

Factors" and "Forward-Looking Statements." The Company undertakes

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise.

CARTER’S, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(dollars in thousands, except for share

data)

(unaudited)

For the three-month periods ended For the

twelve-month periods ended December 31,

2011

January 1,

2011

December 31,

2011

January 1,

2011

Net sales $ 606,629 $ 495,270 $ 2,109,734 $ 1,749,256 Cost

of goods sold

399,894

311,262 1,418,582

1,075,384 Gross profit 206,735 184,008

691,152 673,872 Selling, general, and administrative expenses

160,872 135,108 540,960 468,192 Royalty income

(9,182 ) (9,886 )

(37,274 )

(37,576 ) Operating income 55,045 58,786 187,466

243,256 Interest expense, net 1,843 3,196 7,148 9,870 Foreign

currency gain

(251 )

-- (570 )

-- Income before income taxes 53,453

55,590 180,888 233,386 Provision for income taxes

18,668 20,696

66,872 86,914 Net

income

$ 34,785 $

34,894 $ 114,016

$ 146,472 Basic net

income per common share $ 0.59 $ 0.61 $ 1.96 $ 2.50 Diluted

net income per common share $ 0.59 $ 0.60 $ 1.94 $ 2.46

CARTER’S, INC.

BUSINESS SEGMENT RESULTS

(unaudited)

For the three-month periods ended For the

twelve-month periods ended (dollars in thousands)

December

31,

2011

% of

Total

January 1,

2011

% of

Total

December 31,

2011

% of

Total

January 1,

2011

% of

Total

Net sales: Carter’s Wholesale $

236,087 38.9 % $ 224,216 45.3 % $ 939,115 44.5 % $ 827,815 47.3 %

Carter’s Retail (a)

206,309

34.0 % 163,663

33.0 % 671,590

31.8 % 546,233

31.2 % Total Carter’s

442,396 72.9 %

387,879 78.3 %

1,610,705 76.3 %

1,374,048 78.5

% OshKosh Retail (a) 89,322 14.7 % 79,837 16.2

% 280,900 13.3 % 264,887 15.2 % OshKosh Wholesale

20,640 3.4 %

19,549 3.9 %

81,888 3.9 %

75,484 4.3 % Total

OshKosh

109,962 18.1

% 99,386 20.1

% 362,788 17.2

% 340,371 19.5

% International (b)

54,271

9.0 % 8,005

1.6 % 136,241

6.5 % 34,837

2.0 % Total net sales

$ 606,629 100.0

% $ 495,270

100.0 % $

2,109,734 100.0 %

$ 1,749,256 100.0

% Operating income

(loss): % of

segment

net sales

% of

segment

net sales

% of

segment

net sales

% of

segment

net sales

Carter’s Wholesale $ 29,080 12.3 % $ 29,875 13.3 % $ 119,682

12.7 % $ 152,281 18.4 % Carter’s Retail (a)

33,672 16.3 %

38,132

23.3 %

105,818 15.8 %

113,277 20.7 % Total Carter’s

62,752 14.2 %

68,007

17.5 %

225,500 14.0 %

265,558 19.3 % OshKosh Retail (a) (140 )

(0.2 %) 7,622 9.5 % (9,469 ) (3.4 %) 19,356 7.3 % OshKosh Wholesale

(1,232 ) (6.0 %)

(613 ) (3.1 %)

(1,490

) (1.8 %)

3,863 5.1 %

Total OshKosh

(1,372 ) (1.2

%)

7,009 7.1 %

(10,959 ) (3.0 %)

23,219 6.8 % International (b)

10,743 (c) 19.8 %

4,131

51.6 %

27,251 (c) 20.0 %

16,925 48.6 % Segment operating income

72,123 11.9 % 79,147 16.0 % 241,792 11.5 % 305,702 17.5 %

Corporate expenses (d)

(17,078 )

(e) (2.8 %)

(20,361 ) (4.1 %)

(54,326 ) (e) (2.6 %)

(62,446 ) (3.6 %) Total operating income

$ 55,045 9.1 %

$

58,786 11.9 %

$

187,466 8.9 %

$

243,256 13.9 %

(a) Includes eCommerce results.

(b) Net sales include international retail and wholesale sales.

Operating income includes international licensing income.

(c) Includes $0.7 million and $6.7 million of expense related to

the amortization of the fair value step-up for Bonnie Togs

inventory acquired for the three and twelve-month periods ended

December 31, 2011, respectively, and a $1.5 million and $2.5

million charge associated with the revaluation of the Company’s

contingent consideration for the three and twelve-month periods

ended December 31, 2011, respectively.

(d) Corporate expenses generally include expenses related to

incentive compensation, stock-based compensation, executive

management, severance and relocation, finance, building occupancy,

information technology, certain legal fees, consulting, and audit

fees.

(e) Includes $0.8 million and $3.0 million of professional

service fees associated with the acquisition of Bonnie Togs for the

three and twelve-month periods ended December 31, 2011,

respectively.

CARTER’S, INC.

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except for share

data)

(unaudited)

December 31,

2011

January 1, 2011 ASSETS Current assets: Cash and cash

equivalents $ 233,494 $ 247,382 Accounts receivable, net 157,754

121,453 Finished goods inventories, net 347,215 298,509 Prepaid

expenses and other current assets 18,519 17,372 Deferred income

taxes

25,165 31,547

Total current assets 782,147 716,263 Property, plant,

and equipment, net 122,346 94,968 Tradenames 306,176 305,733

Goodwill 188,679 136,570 Deferred debt issuance costs, net 2,624

3,332 Other intangible assets, net 258 -- Other assets

479 316 Total assets

$ 1,402,709 $

1,257,182 LIABILITIES AND STOCKHOLDERS’

EQUITY Current liabilities: Current maturities of long-term

debt $ -- $ -- Accounts payable 102,804 116,481 Other current

liabilities

49,949

66,891 Total current liabilities 152,753

183,372 Long-term debt 236,000 236,000 Deferred income taxes

114,421 113,817 Other long-term liabilities

93,826 44,057 Total

liabilities

597,000

577,246 Commitments and contingencies

Stockholders’ equity: Preferred stock; par value $.01 per share;

100,000 shares authorized; none issued or outstanding at December

31, 2011 and January 1, 2011 -- -- Common stock, voting; par value

$.01 per share; 150,000,000 shares authorized, 58,595,421 and

57,493,567 shares issued and outstanding at December 31, 2011 and

January 1, 2011, respectively 586 575 Additional paid-in capital

231,738 210,600 Accumulated other comprehensive loss (11,282 )

(1,890 ) Retained earnings

584,667

470,651 Total stockholders’

equity

805,709

679,936 Total liabilities and

stockholders’ equity

$ 1,402,709

$ 1,257,182

CARTER’S, INC.

CONSOLIDATED STATEMENTS OF CASH

FLOW

(dollars in thousands)

(unaudited)

For the fiscal years ended December 31,

2011

January 1,

2011

Cash flows from operating activities: Net income $ 114,016 $

146,472 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 32,548 31,727

Amortization of Bonnie Togs inventory step-up 6,672 -- Non-cash

revaluation of contingent consideration 2,484 -- Amortization of

Bonnie Togs tradename and non-compete agreements 187 --

Amortization of debt issuance costs 708 2,616 Non-cash stock-based

compensation expense 9,644 7,303 Income tax benefit from

stock-based compensation (6,900 ) (9,249 ) Loss (gain) on disposal

/ sale of property, plant, and equipment 139 (118 ) Deferred income

taxes 9,128 4,370 Effect of changes in operating assets and

liabilities: Accounts receivable (33,222 ) (39,359 ) Inventories

(20,571 ) (84,509 ) Prepaid expenses and other assets (948 ) (6,269

) Accounts payable and other liabilities

(32,811 ) 32,837

Net cash provided by operating activities

81,074 85,821

Cash flows from investing activities: Capital expenditures (45,495

) (39,782 ) Acquisition of Bonnie Togs, net of cash acquired

(61,207 ) -- Proceeds from sale of property, plant, and equipment

10 286 Net

cash used in investing activities

(106,692

) (39,496 ) Cash flows from

financing activities: Payments on term loan -- (334,523 ) Proceeds

from revolving credit facility -- 236,000 Payments of debt issuance

costs -- (3,479 ) Repurchases of common stock -- (50,000 ) Income

tax benefit from stock-based compensation 6,900 9,249 Withholdings

from vesting of restricted stock (2,181 ) (927 ) Proceeds from

exercise of stock options

6,786

9,696 Net cash provided by (used in) financing

activities

11,505

(133,984 ) Effect of exchange rate changes on

cash 225 -- Net decrease in cash and cash equivalents (13,888 )

(87,659 ) Cash and cash equivalents, beginning of period

247,382 335,041

Cash and cash equivalents, end of period

$

233,494 $ 247,382

CARTER’S, INC.

RECONCILIATION OF GAAP TO ADJUSTED

RESULTS

Three-month

period ended December 31, 2011

Gross Margin SG&A

Operating

Income

Net

Income

Diluted

EPS

(dollars in millions, except earnings per share)

As

reported (GAAP) $ 206.7 $ 160.9 $55.0 $ 34.8 $ 0.59

Acquisition-related expenses:

Amortization of fair value step-up of

inventory (a)

0.7 -- 0.7 0.5 0.01 Revaluation of contingent consideration -- (1.5

) 1.5 1.5 0.02 Professional fees / other expenses (b)

-- (0.8 )

0.8 0.5 0.01

Total acquisition-related expenses

0.7

(2.2 ) 3.0

2.5 0.04 As adjusted

(c)

$ 207.5 $

158.6 $58.0 $

37.3 $ 0.63

Twelve-month

period ended December 31, 2011

Gross Margin SG&A Operating

Income

Net

Income

Diluted

EPS

(dollars in millions, except earnings per share)

As

reported (GAAP) $ 691.2 $ 541.0 $187.5 $ 114.0 $ 1.94

Acquisition-related expenses:

Amortization of fair value step-up of

inventory (a)

6.7 -- 6.7 4.8 0.08 Revaluation of contingent consideration -- (2.5

) 2.5 2.5 0.04 Professional fees / other expenses (b)

-- (3.0 )

3.0 1.9 0.03

Total acquisition-related expenses

6.7

(5.5 ) 12.2

9.2 0.15 As adjusted

(c)

$ 697.8 $

535.4 $199.7 $

123.2 $ 2.09

(a) Expense related to the amortization of the fair value

step-up for Bonnie Togs inventory acquired.

(b) Professional service fees associated with the acquisition of

Bonnie Togs.

(c) In addition to the results provided in this earnings release

in accordance with GAAP, the Company has provided adjusted,

non-GAAP financial measurements that present gross margin,

SG&A, operating income, net income, and net income on a diluted

share basis excluding the adjustments discussed above. The Company

has excluded $3.0 million and $12.2 million in acquisition-related

expenses from these results for the three and twelve-month periods

ended December 31, 2011, respectively. The Company believes these

adjustments provide a meaningful comparison of the Company’s

results. The adjusted, non-GAAP financial measurements included in

this earnings release should not be considered as an alternative to

net income or as any other measurement of performance derived in

accordance with GAAP. The adjusted, non-GAAP financial measurements

are presented for informational purposes only and are not

necessarily indicative of the Company’s future condition or results

of operations.

CARTER’S INC.

RECONCILIATION OF GAAP TO ADJUSTED

RESULTS

Three-month

period ended April 2, 2011

(dollars in millions, except earnings per share)

SG&A

Operating

Income

Net

Income

Diluted

EPS

As reported (GAAP) $ 113.5 $ 53.6 $ 32.1 $ 0.55

Professional fees / other expenses (a)

(1.0 ) 1.0

0.7 0.01 As adjusted

(b)

$ 112.5 $

54.7 $ 32.8 $

0.56

(a) Professional service fees associated with the acquisition of

Bonnie Togs.

(b) In addition to the results provided in this earnings release

in accordance with GAAP, the Company has provided adjusted,

non-GAAP financial measurements that present SG&A, operating

income, net income, and net income on a diluted share basis

excluding the adjustments discussed above. The Company has excluded

$1.0 million in acquisition-related expenses from these results for

the three month period ended April 2, 2011. The Company believes

these adjustments provide a meaningful comparison of the Company’s

results. The adjusted, non-GAAP financial measurements included in

this earnings release should not be considered as an alternative to

net income or as any other measurement of performance derived in

accordance with GAAP. The adjusted, non-GAAP financial measurements

are presented for informational purposes only and are not

necessarily indicative of the Company’s future condition or results

of operations.

CARTER’S, INC.

RECONCILIATION OF NET INCOME ALLOCABLE

TO COMMON SHAREHOLDERS

For the fourth quarter ended For fiscal

years ended December 31,

2011

January 1,

2011

December 31,

2011

January 1,

2011

Weighted-average number of common and common equivalent shares

outstanding: Basic number of common shares outstanding 57,955,394

57,003,785 57,513,748 58,135,868 Dilutive effect of unvested

restricted stock 180,569 134,533 129,262 117,708 Dilutive effect of

stock options

486,570

696,635 571,907

762,473 Diluted number of common and

common equivalent shares outstanding

58,622,533

57,834,953

58,214,917 59,016,049

As reported on a GAAP Basis:

Basic net income per common share: Net income $ 34,785,000 $

34,894,000 $ 114,016,000 $ 146,472,000 Income allocated to

participating securities

(366,660 )

(292,222 )

(1,210,944 )

(1,202,948 ) Net income available to common

shareholders

$ 34,418,340

$ 34,601,778 $

112,805,056 $

145,269,052 Basic net income per common

share $ 0.59 $ 0.61 $ 1.96 $ 2.50 Diluted net income per

common share: Net income $ 34,785,000 $ 34,894,000 $ 114,016,000 $

146,472,000 Income allocated to participating securities

(363,639 )

(288,723 )

(1,199,147 )

(1,187,501 ) Net

income available to common shareholders

$

34,421,361 $

34,605,277 $

112,816,853 $

145,284,499 Diluted net income per

common share $ 0.59 $ 0.60 $ 1.94 $ 2.46

As

adjusted (a): Basic net income per common share: Net

income $ 37,257,000 $ 34,894,000 $ 123,229,000 $ 146,472,000 Income

allocated to participating securities

(392,717

)

(292,222 )

(1,308,794 )

(1,202,948 ) Net income available to common

shareholders

$ 36,864,283

$ 34,601,778 $

121,920,206 $

145,269,052 Basic net income per common

share $ 0.64 $ 0.61 $ 2.12 $ 2.50 Diluted net income per

common share: Net income $ 37,257,000 $ 34,894,000 $ 123,229,000 $

146,472,000 Income allocated to participating securities

(389,481 )

(288,723 )

(1,296,043 )

(1,187,501 ) Net

income available to common shareholders

$

36,867,519 $

34,605,277 $

121,932,957 $

145,284,499 Diluted net income per

common share $ 0.63 $ 0.60 $ 2.09 $ 2.46

(a) In addition to the results provided in this earnings release

in accordance with GAAP, the Company has provided adjusted,

non-GAAP financial measurements that present per share data

excluding the adjustments discussed above. The Company has excluded

$3.0 million and $12.2 million in acquisition-related expenses from

these results for the three and twelve-month periods ended December

31, 2011, respectively.

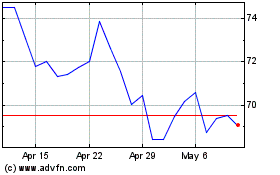

Carters (NYSE:CRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

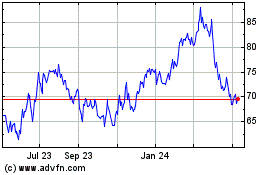

Carters (NYSE:CRI)

Historical Stock Chart

From Apr 2023 to Apr 2024