TIDMVAL

RNS Number : 6568X

ValiRx PLC

31 August 2022

VALIRX PLC

("ValiRx", "the Company" or "the Group")

HALF YEARLY REPORT FOR THE PERIODED 30 JUNE 2022

London, UK., 2022 : ValiRx Plc (AIM : VAL), a life science

company, which focuses on clinical stage cancer therapeutic

development and women's health, taking proprietary and novel

technology for precision medicines towards commercialisation and

partnering, today announces its half yearly report for the period

ended 30 June 2022 and provides an update on significant

post-period events.

HIGHLIGHTS

Operational Highlights:

-- Evaluation agreement signed with University of Barcelona

providing future licensing opportunity for peptidomimetic drug

candidate for the treatment of uterine and pancreatic cancers

-- Continued progression of Evaluation project with Hokkaido

University for a peptide drug candidate for the treatment of

endometrial, pancreatic and bile duct cancers

-- Announced equity issue raising gross proceeds of GBP2.5

million (post period end) to support continued development of its

assets, as well as strengthen its balance sheet with a view to

pursuing acquisitive tCRO strategy

-- Post period end - successful evaluation of triple negative

breast cancer programme with King's College London, now progressing

to full in-licensing

-- Progression of tCRO strategy working towards identifying a

target lab infrastructure acquisition to establish future revenue

flows into the Company

Financial Highlights

-- Research and developments costs GBP200,531 (2021: GBP166,500)

-- Administrative expenses GBP611,370 (2021: GBP618,228)

-- Share-based payment charge GBP261,052 (2021: GBPnil)

-- Total comprehensive loss for the period of GBP992,481 (2021: GBP743,178)

-- Loss before income taxation of GBP1,074,784 (2021: GBP785,434)

-- Loss per share from continuing operations of 1.53p (2021: Loss 1.14p)

-- Cash and cash equivalents at 30 June 2022 of GBP97,699 (2021:

GBP1,239,035) - GBP2.5m (gross) fundraising post period

Dr Kevin Cox, Non-Executive Chairman of ValiRx, commented :

" Despite a challenging market, I am pleased that we have been

able to complete a GBP2.5m (before expenses) equity raise at the

period end with new and existing investors. We now have sufficient

funding to continue building the collaborative development pipeline

and continue to explore options to create a translational contract

research organisation (tCRO)."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR"). The Directors of the Company take responsibility

for this announcement.

***S ***

For more information, please contact:

ValiRx plc Tel: +44 (0) 2476 796496

www.valirx.com

D r S J Dilly suzanne.dilly@valirx.com

V Formation (Public Relations) +44 (0) 115 787 0206

www.vformation.biz

Lucy Wharton - Senior PR Executive

Sue Carr - Director lucy@vformation.biz

sue@vformation.biz

Cairn Financial Advisers LLP (Nominated Tel: +44 (0) 20 7213

Adviser) 0880

Liam Murray/Jo Turner/Ludovico Lazzaretti

Cenkos Securities Limited (Joint Tel: +44 (0) 207397 8900

Broker)

Russell Kerr / Michael Johnson (Sales)

Callum Davidson / Giles Balleny (Corporate

Finance)

Turner Pope Investments (TPI) Limited Tel: +44 (0) 20 3657 0050

(Joint Broker)

James Pope / Andy Thacker

Notes for Editors

About ValiRx

ValiRx PLC accelerates the development of innovative medicines

that enhance patient experience. We do this by combining

intellectual and financial resources to select, progress and

partner a balanced portfolio of risk-reduced, early-stage

technologies for translation into clinical candidates.

The Company listed on the AIM Market of the London Stock

Exchange in October 2006 and trades under the ticker symbol:

VAL.

CHAIRMAN'S STATEMENT FOR THE HALF YEARED 30 JUNE 2022

Market conditions in the first half of 2022 have been

challenging for the majority of public companies, driven in large

part by the Russian invasion of Ukraine and the macro-economic

impacts of the Covid aftermath. While ValiRx has not been immune to

these external factors, we have continued to make significant

progress with the strategic changes initiated in 2021.

Despite these challenges, we were pleased to have been able to

complete a GBP2.5m (before expenses) equity raise at the period end

with new and existing investors which ensured that we now have a

comfortable cash position that will enable continued progression of

the collaborative development pipeline and provide ValiRx with an

opportunity to explore a range of options to build our

translational contract research organisation (tCRO) with a view to

adding further revenue streams to the business.

Understandably, our partners in the clinical development of

VAL201, TheoremRx Inc, have faced similar market challenges, with

associated delays to their financing process. Nevertheless, at this

time we have no reason to believe they will not be successful in

due course.

Over the last six months the Company's strategic shift towards a

tCRO business model has been further refined and the concept shared

widely with institutional investors, receiving very positive

feedback and a strong interest to support future acquisitions that

fit with the proposed buy-and-build strategy.

Success with the tCRO strategy and the conversion of assets from

our evaluation pipeline into full licencing will require ValiRx to

add additional resource and experience at all levels of the

Company. To this end, we hope to be able to strengthen the Board,

and the executive and operational teams in the near future.

Kevin Cox

30 August 2022

CHIEF EXECUTIVE OFFICER'S STATEMENT FOR THE HALF YEARED 30 JUNE

2022

The first half of 2022 has been notable within ValiRx for making

steady, sustained progress on all scientific fronts and continued

evolution of our ambitions to build a tCRO.

Our Evaluation Project brought in from Barcelona in February was

added to the two evaluation projects brought in towards the end of

2021 from Kings College London and Hokkaido Universities

respectively. These projects demonstrate the global reach of our

search capability for early-stage drug candidates and the

assessment of all three of these has actively progressed during

this period.

Post-period, we were delighted to be able to confirm successful

completion of the Evaluation stage of the triple negative breast

cancer project from Kings College London and our decision to move

forward with full in-licencing as announced 13 July 2022. As the

first successful Evaluation project within our new strategy, this

progression marks a major milestone, increasing the breadth of the

ValiRx pipeline. We continue to seek further opportunities to bring

under our Evaluation process, as well as continuing to assess the

Barcelona and Hokkaido projects for suitability for full

in-licencing.

A summary of progress of each project is provided below, forming

our quarterly project update.

Scientific Update Summary

VAL201 in prostate cancer

VAL201 is a short peptide being studied for the treatment of

prostate cancer. The peptide structure is inspired by the structure

of the naturally occurring androgen receptor and is designed to

intercept and prevent the binding of the androgen receptor to SRC

kinase; an enzyme implicated in cancerous cell growth pathways. By

preventing the androgen-mediated activation of SRC kinase, VAL201

can prevent cancerous cell proliferation (or growth) without

interfering with other functions of the androgen receptor or SRC

kinase. This precision method, mimicking a natural process,

proposes a high specificity of cancer treatment, with a lower side

effect profile.

Our Phase 1/2 clinical trial treating men with prostate cancer

with varying doses of VAL201 concluded in January 2020, with the

clinical study report submitted in January 2021.

Sub-licensing VAL201

A Letter of Intent (LOI) to sub-license VAL201 to the US biotech

company TheoremRx Inc has been in place since November 2021. On

completion of TheoremRx financing, a sub-license will be executed

between ValiRx and TheoremRx enabling TheoremRx to develop VAL201

globally in oncology in exchange for upfront, milestone and royalty

payments.

Although TheoremRx has faced challenges relating to the current

macro-economic conditions, they have demonstrated good progress

towards completion of the financing process, and we remain

confident that they have the commercial, scientific and financial

experience to honour their commitment to the project.

VAL301 in endometriosis

VAL301, the same peptide ingredient as VAL201, is being

investigated for the treatment of women with endometriosis and is

in the preclinical stage of development.

VAL301 presents an opportunity to suppress hormone-driven

cellular growth in the absence of outright hormone suppression. By

interrupting only the hormone driven cell growth while sparing the

other hormone activities, infertility and related side effects are

potentially avoided.

VAL301 is one of our preclinical pipeline products and this

potential benefit of selectivity will be investigated in future

clinical trials. The Company announced on 1 May 2020 that a

Material Transfer Agreement was signed with an undisclosed Japanese

pharmaceutical company, which enables them to carry out their own

laboratory-based evaluations.

Independently of the work being carried out in Japan, ValiRx has

commissioned further preclinical testing of the peptide to support

the mechanism of action in the treatment of endometriosis. This

additional work will provide greater insight into the interactions

of the peptide with multiple cellular proteins under differing

stimulation conditions as well as considering formulation aspects

of the project.

If successful, this new preclinical data may trigger the

positioning of VAL301 into a new ValiRx subsidiary to facilitate

further commercial development and partnering of this

programme.

VAL401 in adenocarcinoma

VAL401 was originally developed for treating lung cancer. VAL401

completed an exploratory Phase II trial in late-stage cancer

patients in 2017. The data indicated that some patients treated

with VAL401 benefited from an improvement in quality of life,

particularly in measures of pain, nausea, anxiety and insomnia; and

a statistically significant improvement in overall survival from

time of diagnosis when compared to case matched control patients

from the same clinic. Following discussions with clinical key

opinion leaders, it was suggested that patients with pancreatic

cancer could derive great benefit from a product like VAL401 due to

improvements to severe abdominal pain, lack of appetite and nausea

related to the disease.

ValiRx continues to seek partners to advance VAL401 into the

next stages of development and has engaged an external business

development agency to assist in identifying and approaching

potential partners.

BC201 in Covid-19

BC201 uses the peptide ingredient of VAL201 to diminish the

excessive immune response and consequently reduce severe symptoms

of Covid-19.

The theoretical action of the peptide is two-fold: by blocking

the Androgen Receptor mediated activity of SRC Kinase, the peptide

down-regulates the expression of TMPRSS2 a transmembrane protein

believed to be required for Coronavirus cell entry; and by directly

dampening the immune response. This latter mechanism has potential

for use against sepsis and autoimmune conditions in addition to the

current Covid-19 programme of work.

On 2 June 2020, the Company announced that it had entered into a

collaboration agreement with Oncolytika Limited and Black Cat Bio

Limited to consider the potential for VAL201 to develop BC201.

ValiRx provides samples of VAL201 to enable the testing

programme and access to the clinical data but has no commitment to

support the project financially. Subject to a successful outcome,

ValiRx will receive 40% of any licensing income generated by the

project.

Evaluation Projects

Kings College London, triple negative breast cancer

Successfully completing the Evaluation Stage, this peptide drug

candidate will now be licensed into a subsidiary company of ValiRx

in order to progress through preclinical development. Terms were

negotiated at the time of entering the evaluation and are now being

finalised to enable the in-license to be completed.

Hokkaido University, endometrial, pancreatic and bile duct

cancers

This peptide-based programme targets a novel mechanism of

action, binding a target that is identified as being over-expressed

in endometrial, pancreatic and bile duct cancers. A programme of

work is underway to ensure that the peptide can be synthesised to

industry standards using industry standard techniques; formulated

to access the protein target; that the biological activity is as

expected, with sufficient anti-cancer activity within the safe

dosing limits; and whether the range of cancer (or other disease)

types can be expanded.

Barcelona University, uterine and pancreatic cancers

This peptidomimetic drug candidate targets a novel binding

pocket of KRAS, a protein that is well recognised to be important

in cancer cell processes. A programme of work is underway to

confirm the lead optimisation data and mechanism of action through

a series of in silico and in vitro techniques; to synthesise and

standardise the drug candidate molecule; to confirm the anti-cancer

activity and safety profile; and to assess whether there is scope

to expand the range of diseases to be targeted for treatment by the

candidate.

Dr S J Dilly

30 August 2022

ValiRx Plc

Consolidated statement of comprehensive income

Six months Six months

ended ended Year ended

Note 30 June 30 June 31 December

------------------------ -------------------------- ------------------

2022 2021 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Continuing operations

Other operating income - 702 26,952

Research and development (200,531) (166,500) (303,789)

Administrative expenses (611,370) (618,228) (1,216,391)

Share-based payment charge (261,052) - (184,611)

Operating loss (1,072,953) (784,026) (1,677,839)

Finance costs (1,831) (1,408) (2,765)

------------------------ -------------------------- ------------------

Loss before income taxation (1,074,784) (785,434) (1,680,604)

Income tax credit 2 70,000 35,000 133,413

------------------------ -------------------------- ------------------

Loss on ordinary activities

after taxation (1,004,784) (750,434) (1,547,191)

Non-controlling interests 12,303 7,256 28,979

------------------------ -------------------------- ------------------

Loss for the period and total

comprehensive income

attributable

to owners of the parent (992,481) (743,178) (1,518,212)

======================== ========================== ==================

Loss per share - basic and

diluted

From continuing operations 3 (1.53)p (1.14)p (2.34)p

======================== ========================== ==================

ValiRx Plc

Consolidated statement of financial position

As at 30 June 31 December

---------------------------------------------------- ------------------------

2022 2021 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Goodwill 1,602,522 1,602,522 1,602,522

Intangible assets 1,007,770 1,233,184 1,108,116

Property, plant and equipment - - -

Right-of-use assets 9,278 17,136 13,278

------------------------ -------------------------- ------------------------

2,619,570 2,852,842 2,723,916

------------------------ -------------------------- ------------------------

CURRENT ASSETS

Trade and other receivables 79,291 27,414 72,925

Tax receivable 203,413 35,000 133,413

Cash and cash equivalents 97,699 1,239,035 593,672

------------------------

380,403 1,301,449 800,010

------------------------ -------------------------- ------------------------

TOTAL ASSETS 2,999,973 4,154,291 3,523,926

======================== ========================== ========================

SHAREHOLDERS' EQUITY

Share capital 9,669,995 9,669,995 9,669,995

Share premium account 24,519,456 24,401,856 24,490,618

Merger reserve 637,500 637,500 637,500

Reverse acquisition reserve 602,413 602,413 602,413

Share option reserve 723,433 484,088 491,219

Retained earnings (33,284,988) (31,606,191) (32,292,507)

------------------------ -------------------------- ------------------------

2,867,809 4,189,661 3,599,238

Non-controlling interest (197,170) (163,144) (184,867)

------------------------ -------------------------- ------------------------

TOTAL EQUITY 2,670,639 4,026,517 3,414,371

------------------------ -------------------------- ------------------------

LIABILITIES

NON-CURRENT LIABILITIES

Borrowings 28,056 40,473 35,654

Lease liabilities 2,486 9,576 5,681

------------------------ -------------------------- ------------------------

30,542 50,049 41,335

------------------------ -------------------------- ------------------------

CURRENT LIABILITIES

Trade and other payables 281,955 60,506 50,835

Borrowings 9,747 9,527 9,627

Lease liabilities 7,090 7,692 7,758

------------------------ -------------------------- ------------------------

298,792 77,725 68,220

------------------------ -------------------------- ------------------------

TOTAL LIABILITIES 329,334 127,774 109,555

------------------------ -------------------------- ------------------------

TOTAL EQUITY AND LIABILITIES 2,999,973 4,154,291 3,523,926

======================== ========================== ========================

ValiRx Plc

Consolidated statement of changes in shareholders' equity

Share-based Reverse

Share Share Retained Merger payment acquisition Non-controlling

capital premium earnings reserve reserve reserve interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Unaudited

Balance at 1

January

2022 9,669,995 24,490,618 (32,292,507) 637,500 491,219 602,413 (184,867) 3,414,371

Loss for the

period - - (992,481) - - - (12,303) (1,004,784)

Lapse of

share

warrants - 28,838 - - (28,838) - - -

Share-based

payment

movement - - - - 261,052 - - 261,052

Balance at

30

June 2022 9,669,995 24,519,456 (33,284,988) 637,500 723,433 602,413 (197,170) 2,670,639

===================== ========================== ======================== ======================= ==================== ====================== ====================== ===================

Unaudited

Balance at 1

January

2021 9,669,828 24,380,356 (30,919,728) 637,500 540,803 602,413 (155,888) 4,755,284

Loss for the

period - - (743,178) - - - (7,256) (750,434)

Issue of

shares 167 21,500 - - - - - 21,667

Lapse of

share

options - - 56,715 - (56,715) - - -

Balance at

30

June 2021 9,669,995 24,401,856 (31,606,191) 637,500 484,088 602,413 (163,144) 4,026,517

===================== ========================== ======================== ======================= ==================== ====================== ====================== ===================

Audited

Balance at 1

January

2021 9,669,828 24,380,356 (30,919,728) 637,500 540,803 602,413 (155,888) 4,755,284

Loss for the

year - - (1,518,212) - - - (28,979) (1,547,191)

Issue of

shares 167 21,500 - - - - - 21,667

Lapse of

share

options - 88,762 145,433 - (234,195) - -

Share-based

payment

movement - - - - 184,611 - - 184,611

Balance at

31

December

2021 9,669,995 24,490,618 (32,292,507) 637,500 491,219 602,413 (184,867) 3,414,371

===================== ========================== ======================== ======================= ==================== ====================== ====================== ===================

ValiRx Plc

Consolidated cash flow statement

Year ended

Six months ended 30 June 31 December

------------------------------------------- ---------------------

2022 2021 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash flows from operating

activities

Operating loss (1,072,953) (784,026) (1,677,839)

Amortisation of intangible fixed

assets 102,850 104,843 221,072

Depreciation of right-of-use assets 4,000 3,859 7,717

(Increase)/decrease in receivables (6,366) 39,321 (6,190)

Increase/(decrease) in payables

within one year 231,120 (50,836) (60,507)

Share option charge 261,052 - 184,611

------------------- ---------------------- ---------------------

Net cash outflows from operations (480,297) (686,839) (1,331,136)

Tax credit received - 71,346 71,346

Interest paid (1,702) (701) (782)

------------------- ---------------------- ---------------------

Net cash outflow from operating

activities (481,999) (616,194) (1,260,572)

------------------- ---------------------- ---------------------

Cash flows from investing

activities

Purchase of intangible fixed assets (2,504) (8,839) -

------------------- ---------------------- ---------------------

Net cash outflow from investing

activities (2,504) (8,839) -

------------------- ---------------------- ---------------------

Cash flows from financing

activities

Share issue - 21,667 21,667

Repayment of lease liabilities (4,500) (4,500) (9,000)

Bank loan (6,970) - (5,324)

------------------- ---------------------- ---------------------

Net cash (used in)/generated from

financing activities (11,470) 17,167 7,343

------------------- ---------------------- ---------------------

Net decrease in cash and cash

equivalents (495,973) (607,866) (1,253,229)

Cash and cash equivalents at start of

period 593,672 1,846,901 1,846,901

------------------- ---------------------- ---------------------

Cash and cash equivalents at end of

period 97,699 1,239,035 593,672

=================== ====================== =====================

ValiRx Plc

Notes to the interim financial statements

1 General information

Valirx Plc is a company incorporated in the United Kingdom,

which is listed on the Alternative Investment Market of the London

Stock Exchange Plc. The address of its registered office is

Stonebridge House, Chelmsford Road, Hatfield Heath, Essex CM22

7BD.

Financial information

The interim financial information for the six months ended 30

June 2022 and 2021 have not been audited or reviewed and do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. The comparative financial information for

the year ended 31 December 2021 has been derived from the audited

financial statements for that period. A copy of those statutory

financial statements for the year ended 31 December 2021 has been

delivered to the Registrar of Companies. The report of the

independent auditors on those financial statements was unqualified,

drew attention to a material uncertainty relating to going concern

and did not contain a statement under Sections 498 (2) or (3) of

the Companies Act 2006.

The interim financial statements have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 as they apply to

the financial statements of the Company for the six months ended 30

June 2022 and as applied in accordance with the provisions of the

Companies Act 2006 and under the historical cost convention or fair

value where appropriate. They have also been prepared on a basis

consistent with the accounting policies expected to be applied for

the year ending 31 December 2022 and which are also consistent with

those set out in the statutory accounts of the Group for the year

ended 31 December 2021.

The interim consolidated financial statements are presented in

pounds sterling which is the currency of the primary economic

environment in which the Group operates.

2 Taxation

Six months ended Six months ended Year ended

30 June 30 June 31 December

------------------ ------------------ ------------

2022 2021 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

United Kingdom corporation tax at 20%

Current period - R & D Tax credit (70,000) (35,000) (133,413)

------------------ ------------------ ------------

Income tax credit (70,000) (35,000) (133,413)

================== ================== ============

3 Loss per ordinary share

The loss and number of shares used in the calculation of loss

per share are as follows:

Six months ended Six months ended Year ended

30 June 30 June 31 December

-------------------- ----------------------- --------------------

2022 2021 2021

(unaudited) (unaudited) (audited)

Basic: GBP GBP GBP

Loss for the financial period (1,004,784) (750,434) (1,547,191)

Non-controlling interest 12,303 7,256 28,979

-------------------- ----------------------- --------------------

(992,481) (743,178) (1,518,212)

==================== ======================= ====================

Weighted average number of shares 65,049,156 65,004,957 65,004,957

Loss per share (1.53)p (1.14)p (2.34)p

==================== ======================= ====================

The loss and the weighted average number of shares used for

calculating the diluted loss per share are identical to those for

the basic loss per share. The exercise prices of the outstanding

share options and share warrants are above the average market price

of the shares and would therefore not be dilutive under IAS 33

'Earnings per Share.

4 Dividends

The Directors do not propose to declare a dividend in respect of

the period.

5 Copies of interim results

Copies of the interim results can be obtained from the website

www.valirx.com . From this site you may access our financial

reports and presentations, recent press releases and details about

the Company and its operations.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

Such statements are based on current expectations and

assumptions and are subject to a number of risks and uncertainties

that could cause actual events or results to differ materially from

any expected future events or results expressed or implied in these

forward-looking statements. Persons receiving and reading this

announcement should not place undue reliance on forward-looking

statements. Unless otherwise required by applicable law, regulation

or accounting standard, the Company does not undertake to update or

revise any forward-looking statements, whether as a result of new

information, future developments or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDIBXXDGDG

(END) Dow Jones Newswires

August 31, 2022 02:00 ET (06:00 GMT)

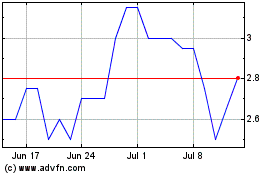

Valirx (LSE:VAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Valirx (LSE:VAL)

Historical Stock Chart

From Apr 2023 to Apr 2024