TIDMTIDE

RNS Number : 4736X

Crimson Tide PLC

30 April 2019

Crimson Tide plc

Preliminary Announcement of Results to 31 December 2018

Crimson Tide plc ("Crimson Tide" or "the Company"), the provider

of the mpro5 solution, is pleased to announce its unaudited

preliminary results for the year ended 31 December 2018.

Financial Highlights

-- Profit Before Tax ahead of market expectations at GBP69k

(2017: GBP309k) after significant new investments in sales and

marketing to accelerate growth potential

-- Turnover increased to GBP2.40m (2017: GBP2.28m) reflecting

higher percentage of SaaS contracts

-- Equipment operating lease debt decreased by over 40% to

GBP376k (2017: GBP639k) with net funds doubling to GBP237k (2017:

GBP118k)

Operational Highlights

-- mpro5's Internet of Things and Time & Attendance modules

maturing and seeing first rollouts, including temperature, humidity

lux, motion sensors, NFC, fingerprint, and facial recognition

-- New solutions sales channel offering data SIM, Mobile Device

Management, and managed hardware subscription services

-- Partner network contributing maiden revenues in Rail sector

-- NHS contracts expanding

Barrie Whipp, Executive Chairman of Crimson Tide, commented:

"A year of significant investment in new Sales & Marketing

resource, whilst still producing profitability and net cash, sees

Crimson Tide well set for growth. mpro5 has evolved into a gold

standard mobility system used in over 260,000 sites and is poised

for even wider opportunities"

About the Company

Crimson Tide plc is the provider of mpro5 - #notjustanapp. mpro5

is delivered entirely cross platform (Android, IOS, Windows) on

smartphones, tablets and PDAs, and enables organisations to

transform their business and strengthen their workforce by smart

mobile working. mpro5 is a full mobility service hosted in the

cloud on Microsoft Azure. The Company's contracts are provided on a

long term, contracted subscription basis and clients can

immediately see a return on their investment.

mpro5 is used in over 260,000 sites in facilities management,

healthcare, transportation and logistics.

Enquiries:

Crimson Tide plc

Barrie Whipp / Luke Jeffrey 01892 542444

Arden Partners 020 7220 1666

John Llewellyn-Lloyd /

Dan Gee-Summons

Chairman's Statement

2018 was a year when the Board of Crimson Tide plc took the

decision to increase the Company's sales and marketing effort quite

dramatically, to allow us to create a platform for increased growth

in the future. We asked stakeholders to recognise that such

investment would be reflected in the bottom line profitability but

that it would stand us well in the future. Management expectations

were for a break even result for the year. I am very pleased that,

in the light of adding some very senior sales people and their

associated costs, as well as increasing our marketing, we were not

only profitable but exceeded market expectations.

We are very confident in our new sales team, consisting of

director level appointments in Partner sales, Enterprise sales and

Solution sales and the team has already increased our pipeline. Our

first partner sales were reflected in a new sector to Crimson Tide,

the rail industry, where we completed transactions with Northern

Rail and Chiltern Rail.

We have ambitious plans for growth with both IT channel and OEM

partners, where we are now recognised as a Solution Partner for

Samsung. In Enterprise sales, we are focused on larger

transactions, including international opportunities. We have

secured further business from existing clients and are hopeful that

our new offerings in solution sales, such as Mobile Device

Management, data SIMs and the Internet of Things (IOT) will open

opportunities with new and existing clients.

Our marketing efforts are seeing very positive results in terms

of pipeline and the gearing that these opportunities give us for

2019 and beyond are in excess of at any time in the past.

Internationally, we have restructured our Middle East efforts by

appointing a partner to manage the transactions that we have

completed and to employ our sales representative in the region. Our

partner will manage existing contracts, first line support and will

also market mpro5 for us to its own client base. We continue to see

interest in Northern Europe for mpro5 including some new interest

in Scandinavia.

Our efforts in healthcare have been part of a longer strategy

and we continue to see a wide range of opportunity. We are

currently enhancing mpro5 for people with autism and our pilots for

a global regulatory organisation have been a success, with a

substantial increase in reported cases of falsified medicines. We

have also completed further work in the reporting of clinical usage

of a drug for the treatment of high cholesterol with a large

American pharma company. Healthcare business takes some time to

come to fruition.

In terms of mpro5, our upgrade to the mobile application with

our Apollo release has seen further enhancements in terms of a Time

& Attendance module, which has already been sold to a number of

clients and a significant upgrade in the underlying codebase allows

even more features and improved performance. This has now been

followed by an upgrade to our web infrastructure with Project 13,

where we have modernised some of our core technologies on Microsoft

Azure.

mpro5 is continually improved by client feedback and our two

major investments at present are in location-based services and

facial and fingerprint recognition. We continue to increase our

development staff to ensure that we remain at the cutting edge of

both mobile and web technologies.

In many ways, the most exciting addition to mpro5 has been our

Internet of Things module and the certification of related sensors,

gateways and network technologies. IOT is now available with mpro5

with approved sensors for temperature, humidity, lux, CO2 and

motion sensors, which can trigger mpro5 Jobs and Flows

automatically. We are experiencing high levels of interest in mpro5

with IOT and now have a dedicated sales resource and presales

consultant.

Crimson Tide's organogram now shows 34 members of staff. I

recall that not more than a few years ago this figure was 14. It

shows that we have invested short term profits into growth; mpro5

has never been more widely used, with over 260,000 sites

benefitting from our technology.

Financially, we grew at the turnover level, and increased the

number of software only contracts. Additions to base subscribers

were good in the second half of 2018, a trend that has continued

into 2019. As I mentioned at the start of my statement, we took

controlled risks in terms of growth at the sales level with a view

to a breakeven result and overachieved with a small profit. Our

cash position improved even in the light of over GBP250k of device

finance repaid.

Operationally the day to day running of the business is now in

the hands of Luke Jeffrey who, with over a year in the role is now

putting his own stamp on the organisation. In 2018 we recruited

Peter Hurter as Financial Controller and Peter will succeed Steve

Goodwin as Finance Director in 2019. Steve has agreed to remain as

a Non-Executive Director.

During 2018, we recognised that we had the capacity to set a

strategy for more investments in the Company and that the

investment in increased sales and marketing resource was going to

be an investment for the future, with associated costs now. The

Board believes we took the right decision. We have an enviable

pipeline and our sales team is focused on delivery. The Company is

set well for the future.

Barrie R. J. Whipp

Executive Chairman

30 April 2019

Financial Review

I am very pleased to comment on our results for the year to 31

December 2018.

As previously communicated, the Company's strategy is one of

continuing investment in the growth of the business. In 2018 the

Company re-invested the vast majority of its profits generated from

long term subscription contracts to achieve this aim. Human

resources, focused particularly on software development and future

sales, were added throughout the year along with targeted marketing

expenditure. The Company has maintained a profit before tax for the

year of GBP69k (2017: GBP309k), better than the market's

expectation of breakeven, on turnover up 5% to GBP2.40m (2017:

GBP2.28m), reflecting more software-only contracts.

International subscribers are beginning to be added. To ensure

the Company is positioned to take full advantage of the

opportunities that are emerging, further investment in the

Company's international operations was made during 2018. This

expenditure, along with the higher other operating expenses noted

above, have added over GBP300k more costs than in 2017, excluding

amortisation and depreciation. The Company's management keep close

track on this spend to ensure these investments are wisely targeted

with the aim of achieving faster growth in future years.

Notwithstanding this expenditure, the Company has largely

maintained its cash balances, which totalled over GBP600k at the

year end, whilst continuing to repay debt used to finance mobile

devices for subscribers. Borrowings decreased by over 40% to

GBP376k (2017: GBP639k) and net funds finished the year at GBP237k

(2017: GBP118k).

Crimson Tide's balance sheet remains healthy. Intangible fixed

assets includes goodwill of GBP0.8m (2017: GBP0.8m) and the cost of

our mpro5 software, GBP1.1m at the 2018 year end (2017: GBP0.9m),

During the year, the underlying platform on which our mpro5

software operates was upgraded and "Internet of Things" technology

incorporated to further add to users' capabilities. The Company

believes this additional investment has already created new

opportunities including the ability to utilise sensor-based

functionality.

The Group has previously not made fair value adjustments to

intra-group loans denominated in currencies other than Sterling as

the amounts were considered immaterial. Due to the decline in the

value of Sterling to Euro in 2016, an adjustment to the fair value

of intra-group loans denominated in Euro has become necessary. The

adjustment did not impact Earnings per Share or Diluted Earnings

per Share as reported in the prior year.

Future Prospects

Cash generation from organic business continues to be strong.

Additional functionality and international expansion is expected to

accelerate long term contracted revenue growth. Margins close to

90% and high operational gearing leads the Directors to believe

that the majority of these increased revenues will positively

impact profit before tax. The market for cloud, mobility and

Internet of Things is undoubted and mpro5 provides clients with

these fully inclusive services on a subscription basis. With the

planned addition of a new biometric time and attendance module to

mpro5 and an opportunity pipeline higher than ever before, the

Board is excited about the continuing development of the Company

and its future prospects.

Stephen Goodwin

Finance Director

30 April 2019

Crimson Tide plc

Unaudited Consolidated Income Statement

Group

Year ended Year ended

December December

2018 2017

GBP000 GBP000

As restated

- Note E

Revenue 2,398 2,275

Cost of Sales (324) (231)

----------- ------------

Gross Profit 2,074 2,044

Administration expenses (1,581) (1,246)

) )

Exceptional item (note B) - (44)

----------- ------------

Earnings before interest, tax, depreciation

& amortisation 493 754

Depreciation & amortisation (384) (394)

----------- ------------

Profit from operations 109 360

Finance costs (40) (51)

----------- ------------

Profit before taxation 69 309

Tax (note C) - (5)

Profit for the year attributable to equity

holders of the parent 69 304

=========== ============

Earnings per share (note D)

Basic earnings per Ordinary share (pence) 0.02 0.07

Diluted earnings per Ordinary share (pence) 0.01 0.07

Unaudited Consolidated Statement of Comprehensive Income

Group

Year ended Year ended

December December

2018 2017

GBP000 GBP000

As restated

- Note E

Profit for the year 69 304

Other comprehensive income/(loss) for the

year:

Exchange differences on translating foreign

operations - 5

----------- ------------

Total comprehensive profit for the year 69 309

=========== ============

Crimson Tide plc

Unaudited Statement of Financial Position

Group

As at 31 As at 31 As at 1

December December January

2018 2017 2017

GBP000 GBP000 GBP000

As restated As restated

- Note E - Note E

Fixed Assets

Intangible assets 1,904 1,698 1,522

Equipment, fixtures & fittings 401 611 750

----------

2,305 2,309 2,272

---------- ------------ ------------

Current Assets

Inventories 15 8 7

Trade and other receivables 935 974 636

Cash and cash equivalents 613 757 878

---------- ------------ ------------

1,563 1,739 1,521

---------- ------------ ------------

Total Assets 3,868 4,048 3,793

========== ============

Equity and liabilities

Equity attributable to equity

holders of the parent

Share capital 457 454 453

Share premium 148 121 112

Other reserves 478 478 473

Reverse acquisition reserve (5,244) (5,244) (5,244)

Retained earnings 7,081 7,012 6,708

---------- ------------ ------------

2,920 2,821 2,502

---------- ------------ ------------

Liabilities

Amounts falling due within

one year 723 868 769

Amounts falling due after more

than one year 225 359 522

---------- ------------ ------------

Total liabilities 948 1,227 1,291

---------- ------------ ------------

Total equity and liabilities 3,868 4,048 3,793

Crimson Tide plc

Unaudited Statement Of Changes In Equity

Group Share Share Other Reverse Retained Total

capital premium reserves acquisition earnings

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance as at

1 January 2017

as previously

stated 453 112 422 (5,244) 6,759 2,502

Prior year adjustment

- Note E 51 (51) -

--------- --------- ---------- ------------- ---------- --------

Balance as at

1 January 2017

as restated 453 112 473 (5,244) 6,708 2,502

Retained profit

for the year 310 310

Share options

exercised 1 9 10

Translation movement (1) (1)

Prior year adjustment

- Note E 6 (6) -

--------- --------- ---------- ------------- ---------- --------

Balance as at

31 December 2017

as restated 454 121 478 (5,244) 7,012 2,821

Retained profit

for the year 69 69

Share options

exercised 3 27 30

Balance as at

31 December 2018 457 148 478 (5,244) 7,081 2,920

========= ========= ========== ============= ========== ========

Crimson Tide plc

Unaudited Consolidated Cash Flow Statement

Group

--------------------------

Year ended Year ended

31 December 31 December

2018 2017

GBP000 GBP000

As restated

- Note E

Cash flows from operating activities

Profit before taxation 69 309

Add back:

Amortisation of intangible assets 141 120

Depreciation of equipment, fixtures and

fittings 243 274

Interest expense 40 51

Unrealised currency translation losses - 6

Operating cash flows before movements in

working capital 493 760

Increase in inventories (7) (1)

Decrease/(increase) in trade and other receivables 70 (338)

(Decrease)/increase in trade and other payables (15) 143

Cash generated from operating activities 541 564

Taxes paid (32) (5)

Net cash generated from operating activities 509 559

------------ ------------

Cash flows used in investing activities

Purchases of fixed assets (380) (431)

Sales of fixed assets - -

Net cash used in investing activities (380) (431)

------------ ------------

Cash flows from financing activities

Net proceeds from share issues 30 10

Interest paid (40) (51)

Net decrease in borrowings (263) (189)

Net cash from financing activities (273) (230)

------------ ------------

Net (decrease)/increase in cash and cash

equivalents (144) (102)

Net cash and cash equivalents at beginning

of period 757 859

Net cash and cash equivalents at end of

period 613 757

Crimson Tide plc

Group

--------------------------

Year ended Year ended

31 December 31 December

2018 2017

GBP000 GBP000

Analysis of net funds:

Cash and cash equivalents 613 757

Bank overdraft - -

613 757

Other borrowing due within one year (151) (280)

Borrowings due after one year (225) (359)

Net funds 237 118

Notes to the Consolidated Financial Statements for the year

ended 31 December 2018

A) Significant accounting policies

a. Basis of preparation

The preliminary results for the period to 31 December 2018 are

unaudited. The consolidated financial statements of Crimson Tide

plc will be prepared and approved by the Directors in accordance

with applicable law and International Financial Reporting

Standards, incorporating International Accounting Standards (IAS)

and Interpretations (collectively IFRSs) as endorsed by the

European Union.

b. Basis of consolidation

The Group financial statements consolidate the financial

statements of the Company and all of its subsidiaries.

On an acquisition, fair values are attributed to the Group's

share of net assets. Where the cost of acquisition exceeds the

values attributable to such net assets, the difference is treated

as purchased goodwill, which is capitalised and subjected to annual

impairment reviews. The results of acquired companies are brought

in from the date of their acquisition.

c. Changes in accounting policy

No changes in accounting policies, including new or amended

IFRSs, are expected to have an impact on the Company's financial

results.

d. Revenue recognition

Subscription income and support income is credited to turnover

in equal monthly instalments over the period of the agreement.

There is no recognition in the Consolidated Income Statement of the

contracted value of future revenues.

B) Exceptional item

The Company incurred one-off legal fees of GBP37k and accounting

due diligence costs of GBP7k in preparation of an acquisition that

was subsequently aborted by the Company.

C) Taxation

A reduced corporation tax charge of GBPnil (2017: GBP5,000) has

been included in the consolidated accounts for the period ended 31

December 2018 due to the availability of tax losses.

D) Earnings per share

The basic earnings per share has been calculated by dividing the

profit attributable to ordinary shareholders by the weighted

average number of shares in issue during the period.

The diluted earnings per share has been calculated by dividing

the profit attributable to ordinary shareholders by the weighted

average number of shares that would be in issue, assuming

conversion of all dilutive potential ordinary shares into ordinary

shares.

Reconciliation of the weighted average number of shares used in

the calculations are set out below.

Group

Year ended Year ended

31 December 2018 31 December

2017

Earnings per share

Reported profit for the year

(GBP000) 69 309

Reported basic earnings per share

(pence) 0.02 0.07

Reported diluted earnings per

share (pence) 0.01 0.07

Year ended Year ended

31 December 31 December

2018 2017

No. No.

Weighted average number of ordinary

shares:

Opening balance 454,486,234 453,486,234

Effect of 3m share options issued 493,151 -

during the year

Effect of 1m share options issued

during the year - 52,055

-------------- --------------

Weighted average number of ordinary

shares for basic EPS 454,979,385 453,538,289

Effect of options outstanding 8,580,357 11,282,258

-------------- --------------

Weighted average number of ordinary

shares for basic EPS 463,559,742 464,820,547

============== ==============

E) Prior year adjustment

Group Share Share Other Reverse Retained Total

capital premium reserves acquisition earnings

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance as at

1 January 2017

as previously

stated 453 112 422 (5,244) 6,759 2,502

Effect of intra-group

foreign currency

fair value adjustment 51 (51) -

--------- --------- ---------- ------------- ---------- --------

Balance as at

1 January 2017

as restated 453 112 473 (5,244) 6,708 2,502

The Group has previously not made fair value adjustments to

intra-group loans denominated in currencies other than Sterling as

the amounts were considered immaterial. Due to the decline in the

value of Sterling to Euro in 2016, an adjustment to the fair value

of intra-group loans denominated in Euro has become necessary.

This adjustment has the effect of reducing the Group's profit

for the prior year, while increasing the value of the Group's Irish

subsidiary. The Irish subsidiary's value is increased by means of

the Cumulative Translation Adjustment, which forms part of "Other

Reserves" on the Consolidated Statement of Financial Position. The

increase in the Cumulative Translation Adjustment is reported in

the Consolidated Statement of Comprehensive Income.

The adjustment did not impact Earnings per Share or Diluted

Earnings per Share as reported in the prior year.

Year ended

December

2017

GBP000

Administration expenses

Decrease in profit for the financial year (6)

-----------

The following table summarises the impact of the prior period

error on the financial statements of the Group.

Consolidated Income Statement

Consolidated Statement of Other Comprehensive Income

Year ended

December

2017

GBP000

Other comprehensive income/(loss) for

the year:

Increase in exchange differences on translating

foreign operations 6

-----------

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2018

or 31 December 2017. Statutory accounts for 2017, which were

prepared under IFRS, have been delivered to the Registrar of

Companies. The auditors have reported on the 2017 accounts; their

report was unqualified and did not contain a statement under

section 498(2) or (3) of the Companies Act 2006. The statutory

accounts for 2018 which are prepared under accounting standards

adopted by the EU will be finalised on the basis of the financial

information presented by the directors in this preliminary

announcement and will be delivered to the Registrar of Companies

following the Company's annual general meeting. The audited

statutory accounts will be published on the Company's website

www.crimsontide.co.uk in May 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SEFFUUFUSEEL

(END) Dow Jones Newswires

April 30, 2019 02:01 ET (06:01 GMT)

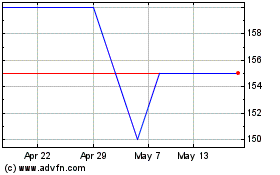

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Apr 2023 to Apr 2024