IDE Group Holdings PLC Trading Update (3851S)

March 11 2019 - 3:01AM

UK Regulatory

TIDMIDE

RNS Number : 3851S

IDE Group Holdings PLC

11 March 2019

IDE Group Holdings Plc

("IDE", the "Group" or the "Company")

Trading Update

IDE, the mid-market network, cloud and IT Managed Services

provider, is pleased to provide an update on the Group's trading

performance for the year to 31 December 2018.

As announced on 10 January 2019, GBP7.2 million of annualised

staff cost reductions were implemented in 2018, with further

reductions identified since the year end bringing the total to

GBP7.8 million. Various operational cost savings have also been

realised including a reduction in software licencing costs and

property costs.

The Board is pleased to report that as a result of these cost

savings the trading performance of the Group improved in the second

half of the year. Furthermore, the Company reached a settlement in

relation to an outsourced service contract which will result in a

saving of c.GBP3 million over the next three years, therefore the

provision made at the time of the interim results has now been

reversed. Consequently, the Group now expects to report a

significantly reduced loss at Adjusted EBITDA* level for the full

year compared to that reported in the interim results for the six

months to 30 June 2018. Following the rationalisation of the cost

base, the Group expects to report a much improved trading

performance in 2019.

In addition to the progress having been made in relation to the

Group's cost base, several of the Group's material customers

renewed their contracts with IDE towards the end of the year, some

on a multi-year basis; these contracts have a total contract value

of c.GBP3.6 million.

In January 2019 IDE announced a GBP10 million loan note issue,

supported by the Company's largest shareholders, the proceeds of

which would be used to repay the Group's outstanding debt

facilities with National Westminster Bank plc and provide

additional working capital. The loan notes provide long term

funding for the Group, thereby affording security for all the

Group's stakeholders and providing a secure financial platform on

which IDE can build.

* before net finance costs, tax, depreciation, impairment

charges, amortisation, exceptional items and share based payment

charges

IDE Group Holdings Plc Tel: +44 (0)344

Andy Parker, Executive Chairman 874 1000

finnCap Limited Tel: +44 (0)20 7220

Nominated Adviser and Broker 0500

Corporate finance: Jonny Franklin-Adams/

Scott Mathieson/ Hannah Boros

ECM: Tim Redfern/ Richard Chambers

MXC Capital Markets LLP Tel: +44 (0)20 7965

Financial Adviser 8149

Charlotte Stranner

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTCKKDNBBKBDND

(END) Dow Jones Newswires

March 11, 2019 03:01 ET (07:01 GMT)

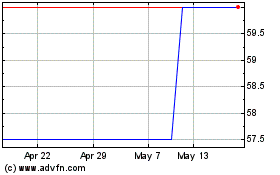

Tialis Essential It (LSE:TIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

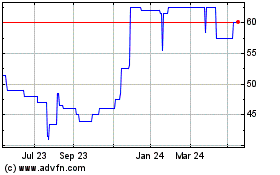

Tialis Essential It (LSE:TIA)

Historical Stock Chart

From Apr 2023 to Apr 2024