Tetragon Financial Group Ltd Statement re: TCIP Expands CLO Team

September 19 2018 - 2:00AM

UK Regulatory

TIDMTFG

Tetragon Credit Income Partners - TCIP

TCIP Expands CLO Team

LONDON, Sept. 19, 2018 /PRNewswire/ -- Tetragon Credit Income Partners today

announces that Scott Snell has joined its CLO business. Snell, the former

Co-Head of BlackRock's US CLO business, brings nearly 16 years of experience

within the US CLO industry and structured credit markets.

"The CLO market continues to be a dynamic space presenting many interesting

investment opportunities, both near and long-term, making it an exciting time

to add an asset like Scott to our team," said Dagmara Michalczuk, Portfolio

Manager in the TCIP team. "As we look to continue to grow in this space,

Scott's nearly two decades of experience navigating this sector will be crucial

to our expansion and continued success."

Snell added: "Since inception, Tetragon has been a leader in taking majority

equity stakes in CLO transactions and forging deep relationships with CLO

managers to deliver strong risk-adjusted returns for its investors. I am

excited to become a part of this leading credit player and look forward to

helping the firm succeed and grow, especially at this moment in the CLO

industry."

As a Managing Director and Co-Head of Blackrock's US CLO business, Snell was

responsible for asset selection, trading and positioning decisions within

certain mutual funds and dedicated CLO separate accounts. Prior to joining

BlackRock, Snell was a trader and portfolio manager at Oak Hill Advisors,

specializing in structured credit investments. He began his career in

financial services as a structured product research analyst at Lehman Brothers

following his completion of his MBA program at the University of Michigan.

TCIP is owned by Tetragon Financial Group Limited and is one of the asset

managers that comprise TFG Asset Management. Tetragon invests in both

externally-managed CLOs and in CLOs managed by TFG Asset Management's LCM and

TCIP businesses. A cornerstone of TCIP's approach has been to buy and hold a

majority of the residual or "equity" tranches of CLOs which provide exposure to

senior secured loans on a levered basis.

Tetragon, directly and through private equity vehicles managed by TCIP, has

invested over $2.2 billion in CLO equity, across 97 CLOs managed by 32 managers

since inception.

About Tetragon:

Tetragon is a closed-ended investment company that invests in a broad range of

assets, including bank loans, real estate, equities, credit, convertible bonds,

private equity, infrastructure and TFG Asset Management, a diversified

alternative asset management business. Where appropriate, through TFG Asset

Management, Tetragon seeks to own all, or a portion, of asset management

companies with which it invests in order to enhance the returns achieved on its

capital. Tetragon's investment objective is to generate distributable income

and capital appreciation. It aims to provide stable returns to investors across

various credit, equity, interest rate, inflation and real estate cycles. The

company is traded on Euronext in Amsterdam N.V. and on the Specialist Fund

Segment of the main market of the London Stock Exchange. For more information

please visit the company's website at www.tetragoninv.com.

Tetragon: Press Inquiries:

Yuko Thomas Prosek Partners

Investor Relations Andy Merrill and Ciara Brinkmann

ir@tetragoninv.com Pro-tetragon@prosek.com

This release does not contain or constitute an offer to sell or a solicitation

of an offer to purchase securities in the United States or any other

jurisdiction. The securities of Tetragon have not been and will not be

registered under the U.S. Securities Act of 1933 and may not be offered or sold

in the United States or to U.S. persons unless they are registered under

applicable law or exempt from registration. Tetragon does not intend to

register any portion of its securities in the United States or to conduct a

public offer of securities in the United States. In addition, Tetragon has not

been and will not be registered under the U.S. Investment Company Act of 1940,

and investors will not be entitled to the benefits of such Act. Tetragon is

registered in the public register of the Netherlands Authority for the

Financial Markets under Section 1:107 of the Financial Markets Supervision Act

as a collective investment scheme from a designated country.

END

(END) Dow Jones Newswires

September 19, 2018 02:00 ET (06:00 GMT)

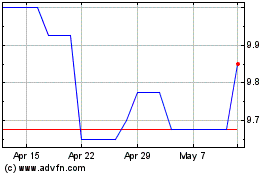

Tetragon Financial (LSE:TFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

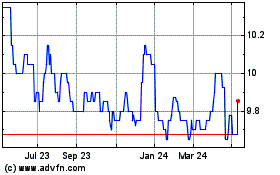

Tetragon Financial (LSE:TFG)

Historical Stock Chart

From Apr 2023 to Apr 2024