Tern PLC: Portfolio Update (686377)

May 16 2018 - 2:01AM

UK Regulatory

Dow Jones received a payment from EQS/DGAP to publish this press

release.

Tern PLC (TERN)

Tern PLC: Portfolio Update

16-May-2018 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

16 May 2018

Tern Plc (AIM: TERN)

Portfolio Update

Tern Plc (AIM:TERN), the investment company specialising in the Internet of

Things ("IoT"), is pleased to provide an update on the activities of its

seven portfolio companies as it progresses its objective of having twelve

active portfolio investments. This includes Tern's latest investment,

FundamentalVR.

The valuations of all portfolio company, save for FundamentalVR, were last

assessed as at Tern's last reported balance sheet date of 31 December 2017.

They will next be reviewed at Tern's interim date, being 30 June 2018.

Device Authority Limited ("DA") - 56.8% holding and latest balance sheet

valuation GBP9.7m

DA continues to make progress in 2018 and to generate revenues with new

partners and customers. Since the last portfolio update on 24 January 2018

it has:

· Confirmed that Larsen & Toubro Infotech Limited ("LTI") is the party

which it entered into a strategic partnership, announced in the portfolio

update;

· Entered into a technology partnership with Gemalto N.V. ("Gemalto"), a

world leader in digital security;

· Launched the Enterprise IoT Security Blueprint [1] - a framework for

organisations implementing strong IoT identity and data security

operations in any environment, detailing key requirements, components and

guidelines to be considered;

· Supported Microsoft Azure IoT Hub following the recent release of

KeyScaler 5.8, a global leader in Identity and Access Management for IoT;

and

· In tandem with InVMA, DA announced the availability of InVMA's

AssetMinder secured by KeyScaler and in use with GCE Healthcare.

FVRVS Limited ("FundamentalVR") - acquired an 18.3% holding for GBP798,309 as

announced on 14 May 2018.

· FundamentalVR is focused on the emerging approach called mixed reality

(MR) combining virtual and augmented reality technologies with data

collected from the internet of things (IoT) devices to create new

environments in which both digital and physical objects -- and their data

-- integrate with each other (as discussed in Deloitte's Tech Trends 2017:

The Kinetic Enterprise);

· Fundamental Surgery is a VR and haptic surgical simulation platform,

providing a revolutionary and affordable way for surgeons to safely

practice and refine skills;

· FundamentalVR are working with hospitals and leading surgical

specialists of the development of its platform and working with a number

of industry pharmaceutical and equipment manufacturing brands; and

· FundamentalVT is also a global development partner to Microsoft for

HoloLens Mixed Reality.

InVMA Limited ("InVMA") - 50% holding and latest balance sheet valuation of

GBP375,000

InVMA has had a positive start to the year:

· Committed sales orders of GBP1m taken in 2017 as announced on 24 January

2018;

· The ClarityTM platform, developed by InVMA on behalf of GCE Healthcare,

has been launched to the market;

· InVMA built the initial release for Howden following a PTC and Microsoft

partnership announcement to provide an industry leading AR and IoT

solution to Colfax and its subsidiaries, Howden and ESAB. InVMA are also

supporting Howden with the continued development and architecture;

· AssetMinder(R) has been successfully implemented by customers and a

reseller channel has been secured to increase their reach;

· Other wins have included paid proof of values for a UK based lift

manufacturer and a UK energy management company; and

· Tern has invested a further GBP250,000 since 1 January 2018 to maintain

its current holding.

flexiOPS Limited ("flexiOPS") - 100% holding and latest balance sheet

valuation of GBP78,000,

· Revenue generative flexiOPS continues to work across a portfolio of

research and development projects;

· flexiOPS' majority owned subsidiary, Wyld Technologies Limited ("Wyld")

has been actively developing business traction and a product roadmap in

line with current market trends and positive market feedback; and

· Wyld has designed and is prototyping a new emergency and mass

communication platform that promises to deliver a new level of automation

and intelligence while respecting and protecting users' privacy.

Seal Software Group Limited ("Seal Software") - <1% holding and latest

balance sheet valuation of GBP62,714

· Seal Software was named a 2018 Cool Vendor in Content Services by

Gartner;

· 8.6m preference shares were issued in March 2018 at $1.7/share, up from

$0.8/share at the previous issue in October 2017; and

· New revenue generating contracts announced in 2018.

Push Technology Limited ("Push") - <1% holding and latest balance sheet

valuation of GBP11,326

Al Sisto, CEO of Tern, said:

"Our portfolio companies continue to win contracts and secure partnerships

with major companies, which is testament to the strength of their offering.

They are gaining market share and a positive reputation in a range of

rapidly growing market and I look forward to reporting in the interim

results for the six months ending 30 June 2018 on how this progress has

impacted their valuations."

Enquiries

Tern Plc via Redleaf

Al Sisto/Sarah Payne

WH Ireland Limited Tel: 0117 945 3470

(NOMAD and joint broker)

Mike Coe/Ed Allsopp

Whitman Howard Tel: 020 7659 1234

(Joint broker)

Nick Lovering/Francis North

Redleaf Communications Tel: 020 3757 6880

Elisabeth Cowell/Fiona Norman

ISIN: GB00BFPMV798

Category Code: MSCH

TIDM: TERN

LEI Code: 2138005F87SODHL9CQ36

Sequence No.: 5550

EQS News ID: 686377

End of Announcement EQS News Service

1: http://public-cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=153d2570e4777b1faff698a6cf5cf09c&application_id=686377&site_id=vwd_london&application_name=news

(END) Dow Jones Newswires

May 16, 2018 02:01 ET (06:01 GMT)

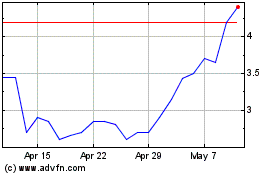

Tern (LSE:TERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tern (LSE:TERN)

Historical Stock Chart

From Apr 2023 to Apr 2024