TIDMSUN

RNS Number : 2500J

Surgical Innovations Group PLC

21 December 2020

Surgical Innovations Group plc

("Surgical Innovations", "SI" or the "Company")

Trading update

Improvement in revenues from H1

Demand for elective surgery is building

Surgical Innovations Group plc (AIM: SUN) the designer,

manufacturer and distributor of innovative medical technology for

minimally invasive surgery ("MIS"), provides an update on current

trading for the financial year ending 31 December 2020.

Revenues in the second half of the year have recovered in line

with management expectations, with Group revenue for the full year

now expected to exceed GBP6 million. Direct gross margins (before

manufacturing volume variances) have been maintained at around 44%

of revenues. Production recommenced in October to service ongoing

customer requirements, and direct costs and overheads continue to

be managed under close control, enabling the Company to trade close

to the cash breakeven level.

The Company raised equity of GBP2.05m (net of associated costs)

in September 2020 to provide investment capital and additional

financial headroom. At 30 November 2020, net cash balances amounted

to GBP3.38m(1) , an increase of GBP2.69m since our interim report

as at 30 June 2020 (GBP0.69m).

The Global Healthcare market continues to build some resilience

to the ongoing effects of the COVID-19 pandemic, with improved

pathways for treating patients with Coronavirus enabling elective

surgery to resume to some degree in most markets in the second half

of 2020. Elective surgery in the NHS, whilst still reduced compared

to pre-COVID-19 levels, has been less impacted by the second wave

compared to the first. The USA remains strong despite the

well-documented COVID-19 situation and we continue to see sales at

levels close to those seen last year. APAC has performed well in

2020 despite COVID-19 and is on plan for the year, and the company

expect this to be another key area for us in 2021. Europe is still

slower to recover than most markets but we are seeing consistent,

albeit lower, levels of ordering by key partners.

Whilst the various COVID-19 vaccines are welcome news, it is

anticipated that roll out will take some months. Recent

developments suggest that it is reasonable to anticipate greater

seasonal pressure on beds, and further reductions in elective

surgery over the winter. The Company is well positioned to conserve

resources during this period of continued subdued demand, and then

benefit from an expected recovery, with a return to normalised

activity levels towards the end of 2021.

Since the interim results in September 2020, significant

progress has been made across various growth initiatives,

including:

-- Consolidating routes to market in the USA via:

- The new agreement announced last week with Adler Instruments

Inc. ("Adler"), our longest tenured US partner, for the

distribution of our Logicut and Eco-Cut scissor brands worth

approximately $12m over five years. Adler is a highly experienced

distribution company with access to nationwide coverage and has

already made some exciting account conversions; and

- Ongoing progress in developing a partnership with a key MIS

player to distribute our range of Elite and YP+ access devices in

the US, with a training and evaluation phase anticipated to

successfully conclude in Q1 2021. The global trocar market is

estimated to be worth $561m in sales in 2020, with the US

accounting for approximately $152m or 27%(2)

-- Further data being generated to support sustainability positioning:

- The recently announced further collaboration with the Centre

for Sustainable Healthcare ("CSH") will enable validation of the

environmental benefits messaging for our products and demonstrate

the quantifiable cost and environmental savings from a 'greener'

operating room

- Data generated will help develop information and training for

NHS hospitals and staff as they seek to fulfil their NHS 'Net Zero'

obligations on sustainability; our range of Resposable(TM) surgical

instruments reduces plastic waste by approximately 70% compared to

that generated from commonly used competing products, whilst still

providing class leading quality and functionality

- Additionally, CSH's global network will help direct the

Company's efforts to promote the green

credentials of its Resposable(TM) product portfolio to existing and new international partners

-- New product launches and new product development:

- The full launch of Cellis Breast was recently announced,

following favourable early evaluations by clinicians and positive

post-operative outcomes, providing an opportunity to capitalise on

a UK market worth approximately GBP16 million per year. The Company

expects to see strong growth through 2021 from both Cellis Breast

and Cellis AWR (Abdominal Wall Reconstruction) which addresses a

similar size UK market. These opportunities reflect the close

collaboration of the Group's subsidiary, Elemental Healthcare, with

the manufacturer, Meccellis BioTech, and key UK surgeons over a

number of years to facilitate development

- Surgical Innovations is developing a pipeline of both line

extensions and new devices to market over the next 18 months,

including larger diameter YP+ trocars to accommodate other devices

that are more routinely used in this market and the associated

introduction of an Optical 5mm trocar from H2 2021

- Collaborations on early stage projects with a number of

robotic manufacturers who have recognised the Company's expertise

in access devices and instruments; these represent exciting

opportunities over the longer term

David Marsh, CEO of Surgical Innovations, said: "We are pleased

with the work we carried out to mitigate against the challenges of

COVID-19 pandemic, taking advantage of the production hiatus to

streamline operational and regulatory processes. This has been

beneficial for the Group as we continue to be at the forefront of

the sustainability agenda with our Resposable(TM) product

portfolio. Recent progress suggests our product portfolio is well

aligned with the needs of healthcare practitioners and providers

and so, notwithstanding the ongoing effects of the pandemic, we are

optimistic for the medium to long term outlook."

The Company expects to release its audited results for the year

ended 31 December 2020 in late March 2021.

Notes:

1. Net cash equals cash less bank debt

2. Research and Markets report, Trocars - Global Market Trajectory & Analytics, Sept. 2020

For further information please contact:

Surgical Innovations Group plc www sigroupplc com

David Marsh, CEO Tel: 0113 230 7597

Charmaine Day, Co Sec & GFC

N+1 Singer (Nominated Adviser

& Broker) Tel: 020 7496 3000

Aubrey Powell (Corporate Finance)

Rachel Hayes (Corporate Broking)

Walbrook PR (Financial PR & Investor

Relations) Tel: 020 7933 8780 or si@walbrookpr.com

Mob: 07980 541 893 / 07584 391

Paul McManus / Lianne Cawthorne 303

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFLDFSLIFII

(END) Dow Jones Newswires

December 21, 2020 02:00 ET (07:00 GMT)

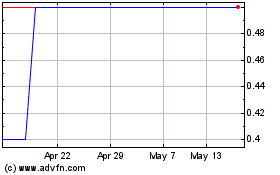

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

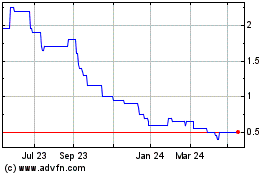

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024