TIDMSUN

RNS Number : 5254M

Surgical Innovations Group PLC

17 September 2019

Surgical Innovations Group plc

("SI" or the "Group")

Half-year Report

Interim results for the six months ended 30 June 2019

Surgical Innovations Group plc (AIM: SUN), the designer,

manufacturer and distributor of innovative medical technology for

minimally invasive surgery, reports its unaudited financial results

for the six-month period ended 30 June 2019.

Financial highlights:

-- Revenues of GBP5.10m (2018H1: GBP5.28m)

-- Gross margin up by 4.1% to 43.1% (2018H1: 39.0%)

-- Adjusted EBITDA* of GBP0.65m (2018H1: GBP0.93m)

-- Adjusted operating profit* of GBP0.22m (2018H1: GBP0.42m)

-- Adjusted earnings per share of 0.02p (2018H1: 0.05p)

-- Net cash at end of period of GBP0.34m (31 Dec 2018: GBP0.38m)

* Adjusted EBITDA and Adjusted operating profit are stated

before deducting non-recurring exceptional costs of GBP0.18m

(2018H1: GBPnil),

amortisation of intangible acquisition costs of GBP0.18m

(2018H1: GBP0.22m) and share based payment costs of GBP0.10m

(2018H1: GBP0.06m).

The results reflect a difficult trading environment, which has

been adversely affected by constraints in UK health spending and

widespread uncertainty. We have continued to invest in people and

product development, gained in market share, and ensured that the

business is well placed to benefit from an upturn.

As explained in the 7 June 2019 trading update, the year began

positively but this momentum was not carried into the second

quarter as orders in the UK and Europe were lower than expected.

Revenues in the US and key Asian markets continued to show expected

levels of growth, as did those to our major OEM partners. Overall,

the Group has made gains in market share and generated increased

gross margins, demonstrating that our product range offers

attractive benefits to end user customers.

Following David Marsh becoming Chief Executive in March, we have

further strengthened the executive team, including the recruitment

of senior managers with functional responsibility for Operations

and Compliance. The additional investment and overhead directed

towards new product development and quality assurance will continue

to strengthen our ability to navigate the complex regulatory

environment as we move towards MDR in coming months.

Our commitment to further expanding the product portfolio, and

our close association with the surgical community and partner

organisations worldwide, will continue to provide us with

opportunities for both organic growth and further M&A

activity.

The headwinds faced since the end of the first quarter of the

year are unlikely to abate in the short term, and we anticipate

that the UK and EU markets will continue to be challenging. We

expect to deliver continuing success in the US market, working

closely with our distribution partners to further increase market

share and with the launch of YelloPort Elite(R). The Board has

reassessed its outlook for the rest of the financial year based on

the continuing challenging market conditions and reduced revenue

expectations, anticipating relatively modest growth in the second

half of 2019 compared to the first half. These trading conditions

are primarily driven by what we believe are temporary factors, and

we are more optimistic beyond the present political uncertainty

that NHS funding and activity levels will rise in response to

growing pent up demand.

As a result of the reduced revenues, the Board also anticipates

that adjusted operating profits will show an increase in the second

half of the year, albeit significantly lower than previously

expected and the business will continue to be cash generative.

Chairman of SI, Nigel Rogers, said:

"We have continued to adapt to challenging circumstances, which

are both industry-wide and transitory in nature. Whilst trading

conditions in the short term are very disappointing, the investment

made in people and products position us well to take advantage of

market opportunities. Our executive team has been strengthened, and

has the drive, expertise and experience to achieve future

success."

For further information please contact:

Surgical Innovations Group Plc www.sigroupplc.com

David Marsh, CEO Tel: +44 (0)113 230 7597

Charmaine Day, Co Sec & GFC

Walbrook PR (Financial PR & Investor Tel: +44 (0)20 7933 8780 or si@walbrookpr.com

Relations)

Paul McManus / Lianne Cawthorne Mob: +44 (0)7980 541 893 / +44 (0)7584

391 303

N+1 Singer (NOMAD &Broker) +44 (0)20 7496 3000

Richard Lindley / Rachel Hayes

About Surgical Innovations Group plc

Strategy

The Group specialises in the design, manufacture, sale and

distribution of innovative, high quality medical products,

primarily for use in minimally invasive surgery. Our product and

business development is guided and supported by a key group of

nationally and internationally renowned surgeons across the

spectrum of minimally invasive surgical activity.

We design and manufacture and source our branded port access

systems, surgical instruments and retraction devices which are sold

directly in the UK home market through our subsidiary, Elemental

Healthcare, and exported widely through a global network of trusted

distribution partners. Many of our products in this field are based

on a "resposable" concept, in which the products are part

re-usable, part disposable, offering a high quality and

environmentally responsible solution at a cost that is competitive

against fully disposable alternatives.

Elemental also has exclusive UK distribution for a select group

of specialist products employed in laparoscopy, bariatric and

metabolic surgery, hernia repair and breast reconstruction.

In addition, we design and develop medical devices for carefully

selected OEM partners, and have also collaborated with a major UK

industrial partner to provide precision engineering solutions to

complex problems outside the medical arena.

We aim for our brands to be recognised and respected by

healthcare professionals in all major geographical markets in which

we operate and provide by development, partnership or acquisition a

broad portfolio of cost effective, procedure specific surgical

instruments and implantable devices that offer reliable solutions

to genuine clinical needs in the operating theatre environment.

Operations

The Group currently employs approximately 100 people across two

sites in the UK. Product design, engineering and manufacturing are

carried out at the SI site in Yorkshire. Commercial activities

including marketing, UK distribution and international sales and

marketing are based at Elemental Healthcare in Berkshire.

Elemental Healthcare was acquired by the Group on 1 August 2017,

providing direct sales representation in the UK home market and a

range of distribution products.

Further information

Further details of the Group's businesses are available on

websites:

www.sigroupplc.com

www.surginno.com, and

www.elementalhealthcare.co.uk

Investors and others can register to receive regular updates by

email at si@walbrookpr.com

Surgical Innovations Group plc

Chairman's Statement

For the six-month period ended 30 June 2019

These results for the six months ended 30 June 2019 reflect a

robust response to a difficult trading environment, which has been

adversely affected by constraints in UK health spending and broader

political uncertainty. We have continued to invest in people and

product development, gained in market share, and ensured that the

business is well placed to benefit from an upturn.

Financial Overview

Revenues were marginally below the corresponding period last

year at GBP5.10m (2018H1: GBP5.28m). As explained in the 7 June

trading update, trading in the UK and European markets were

challenging, although this weakness was partially offset by growth

in the US and APAC regions.

Revenues from SI branded products were GBP2.61m (2018H1:

GBP2.81m), and UK distribution sales were GBP1.49m (2018H1:

GBP1.50m). The British Medical Association continue to report high

levels of cancellations of elective surgical procedures, and the

number of patients awaiting treatment has risen to near record

levels. This has been exacerbated by surgeons working restricted

hours due to the effect of capping tax relief on their pension

contribution, although individual NHS trusts and central government

have committed to find solutions to this issue. We continue to win

new business having converted a number of major key hospitals who

recognise both the environmental and cost benefits of our products.

This leads us to believe that our UK market share is increasing,

leaving us well positioned to benefit from a return to more normal

levels of activity.

Revenues in Europe were also slightly below the level achieved

last year at GBP0.65m (2018H1: GBP0.79m). Forward visibility of end

user demand has been somewhat obscured by the effects of inventory

management surrounding Brexit. Whilst the outcome and duration of

this uncertainty is ongoing, it is not expected to have any lasting

effect on prospects. A return to growth in European markets depends

to a greater extent on extending the product range to provide

direct alternatives to the single use plastic products which tend

to be in wider use. There are relevant products in the development

pipeline, and we are actively evaluating a broad range of

strategies to reduce the time to market of new products.

Revenues from the US in the first half increased to GBP0.85m

(2018H1: GBP0.79m) as a result of further market share gains with

surgical instruments. We anticipate that this will continue in the

second half of the year and beyond, and will be enhanced by the

launch of the YelloPort Elite(R) range of port access devices in

the fourth quarter.

The APAC region generated strong revenue growth based on the

close relationship with our key partners, especially in Japan, and

we expect this to continue in the second half of the year. The Rest

of the World (ROW) saw a reduction in revenue as a consequence of

the phasing of large tender orders and these are expected to be

secured in the next few months.

OEM revenues increased to GBP1.01m (2018H1: GBP0.98m). Within

this segment, revenues from the manufacture of Liquiband Fix-8

devices returned to growth following product design changes, and we

supplied further production units of test rigs for aero engines. We

continue to benefit from strong relationships with our key OEM

partners and anticipate continued success in this area.

Gross margins improved further to 43.1% of revenues (2018H1:

39.0%) due to manufacturing efficiencies. Other operating expenses

increased by GBP0.36m to GBP2.44m as additional resources were

deployed in operations and regulatory assurance. Adjusted operating

profit (before exceptional and acquisition related costs and share

based payment charges) for the period was GBP0.22m (2018H1:

GBP0.42m). The reported net loss before taxation amounted to

GBP0.33m against a net profit before taxation of GBP0.09m in the

corresponding period last year.

The Group reported a tax credit in the period of GBP0.03m

(2018H1: credit of GBP0.04m) which in the prior year related to

claims for enhanced Research and Development. The Group has

substantial corporation tax losses and continues to review the

extent to which a deferred tax asset should be recognized based on

the estimated future taxable profits of the Group.

Adjusted Net Earnings Per Share amounted to 0.02p (2018H1:

earnings of 0.05p). The net total comprehensive income for the

period amounted to a loss of GBP0.30m (2018H1: profit of

GBP0.13m).

Net investment in working capital increased slightly to GBP3.13m

(31 December 2018: GBP2.93m), mainly as a result of increased

inventories in relation to Brexit, and such contingency planning

remains in place. At the end of the period, the Group had available

cash at bank of GBP2.30m. Total net cash resources, taking into

account bank loans outstanding, amounted at GBP0.34m (31 December

2018: GBP0.38m).

Management

During the period, we have strengthened the management team and

structure. David Marsh became Chief Executive in March 2019,

supported by Adam Power (Group Development Director) and a newly

recruited Operations Director at our Leeds site, Alex Hogg. In June

2019, Charmaine Day took over full responsibility for group finance

matters on the departure of Melanie Ross.

We have recently appointed a new Compliance Director at Leeds,

Steve Seed, who will take the lead on all regulatory and quality

assurance matters reporting to David Marsh.

With this strong executive team in position, we have the right

platform of drive, expertise and experience to achieve future

success.

Regulatory activity

In May 2019, Surgical Innovations Limited underwent a

comprehensive regulatory audit resulting in recertification for

ISO13485: 2016 and ISO9001: 2015, and new certification for the

Medical Device Single Audit Program (MDSAP) streamlining access to

markets in the US, Canada, Australia, Japan and Brazil. In

addition, FDA approval was granted for the core products in the

YelloPort Elite(R) range, with further accessory products

anticipated shortly, facilitating a market launch in the final

quarter of this year.

Preparations are ongoing to transition from the European

Commission Medical Device Directive (MDD) to new Medical Device

Regulations (MDR) which has necessitated the further strengthening

of our QA/RA team, however, the additional demands on the

regulatory process resulting from the transition to MDR will

increase the barriers to entry for many of the low-cost

manufacturers, providing opportunity for those able to comply.

New products

We continue to invest in new product development. In the final

quarter of the year, we will roll out the first products in a range

of fully disposable trocars that will enable SI to compete in key

EU countries and have a broader offering for the UK private sector.

This extension of the Elite(R) range is part of an ongoing strategy

to complete the product portfolio.

Within our UK distribution business, we continue to build on our

strong reputation for quality, range and service. Cellis continues

to be a key product and during the last quarter we have regained

almost all of the previous users. Whilst the reduced number of

Abdominal Wall Reconstruction procedures has slowed sales growth,

we are well positioned to take advantage when the NHS returns to

more normal levels of activity. Cellis Breast Pocket has performed

well in the early trials and minor changes to the Acellular Dermal

Matrix will allow for launch in late Q4 2019.

We continue to work closely with Distalmotion, a Swiss-based

medical device company, towards a U.K. launch of Dexter, currently

scheduled to take place in 2020. Dexter is a surgical robot aimed

at combining the affordability of laparoscopy with the benefits of

robotic solutions for minimally invasive surgical care.

Distalmotion recently announced the successful completion of an

extensive cadaver study, receiving an enthusiastic response from

more than 40 surgeons, and gaining valuable feedback on next steps

towards commercialisation.

We have also recently launched a range of complementary products

for minimally invasive surgery, with an emphasis on gynaecology,

under an exclusive distribution agreement with The OR Company.

Headquartered in Australia and the US, The OR Company develops,

supplies and markets high quality, innovative surgical devices from

niche consumables to proprietary surgical instruments for minimally

invasive and open surgery.

The current regulatory environment provides a challenging

backdrop to the development and launch of innovative new products;

however, we have the requisite expertise and experience and are

fully committed to new product innovation as a key driver of future

growth. Whilst these regulatory constraints continue to challenge,

they do provide a barrier to entry for low-cost manufacturers who

may be unable to comply.

Brexit

Detailed preparations were made for Brexit earlier in the year,

prior to the initial March deadline, including the necessary

registrations and documentation required to provide the best

assurance possible of business continuity in the event of

disruption.

These contingency plans remain in place, as we face further

uncertainty regarding the 31 October 2019 deadline currently

envisaged.

Outlook

The headwinds faced since the end of the first quarter of the

year are unlikely to abate in the short term, and we anticipate

that the UK and EU markets will continue to be challenging. We

expect to deliver continuing success in the US market, working

closely with our distribution partners to further increase market

share and with the launch of YelloPort Elite(R). The Board has

reassessed its outlook for the rest of the financial year based on

the continuing challenging market conditions and reduced revenue

expectations, anticipating relatively modest growth in the second

half of 2019 compared to the first half. These trading conditions

are primarily driven by what we believe are temporary factors, and

we are more optimistic beyond the present political uncertainty

that NHS funding and activity levels will rise in response to

growing pent up demand.

As a result of the reduced revenues, the Board also anticipates

that adjusted operating profits will show an increase in the second

half of the year, albeit lower than previously expected and the

business will continue to be cash generative.

We have continued to adapt to challenging circumstances, which

are both industry-wide and transitory in nature. The investment

made in people and products position us well to take advantage of

market opportunities. Our executive team has been strengthened, and

has the drive, expertise and experience to achieve future

success.

Nigel Rogers

Chairman

17 September 2019

Unaudited consolidated income statement

for the six months ended 30 June 2019

Unaudited Unaudited Audited

six months six months Year

ended ended Ended

30 June 30 June 31 December

2019 2018 2018

Notes GBP'000 GBP'000 GBP'000

------------------------------------------- ------ ----------- ----------- ------------

Revenue 2 5,103 5,284 10,969

Cost of sales (2,904) (3,217) (6,297)

------------------------------------------- ------ ----------- ----------- ------------

Gross profit 2,199 2,067 4,672

Other operating expenses (2,434) (2,079) (4,327)

Other income - 150 275

------------------------------------------- ------ ----------- ----------- ------------

Adjusted EBITDA * 649 938 2,364

Amortisation and impairment of intangible

R&D costs (130) (269) (355)

Amortisation of intangible acquisition

costs (176) (224) (788)

Amortisation of Right of Use assets 1 (87) - -

Depreciation of tangible assets (214) (247) (481)

Exceptional items 5 (184) - -

Share based payments (93) (60) (120)

Operating (loss)/profit (235) 138 620

Finance costs 1 (91) (44) (105)

Finance income - - -

------------------------------------------- ------ ----------- ----------- ------------

(Loss)/profit before taxation (326) 94 515

Taxation credit 3 31 36 210

------------------------------------------- ------ ----------- ----------- ------------

(Loss)/profit and total comprehensive

income (295) 130 725

------------------------------------------- ------ ----------- ----------- ------------

Earnings per share

Basic 4 (0.04p) 0.02p 0.09p

Diluted 4 (0.04p) 0.02p 0.09p

------------------------------------------- ------ ----------- ----------- ------------

* EBITDA is earnings before interest, depreciation, amortisation

and exceptional items.

Unaudited consolidated statement of changes in equity

for the six months ended 30 June 2019

Share Share Capital Merger Retained

Notes capital premium reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- ------ -------- -------- -------- -------- --------- --------

Balance as at 1 January 2019 7,826 5,831 329 1,250 (813) 14,423

Recognition of right of use

assets and lease liabilities

on adoption of IFRS16 1 - - - - (63) (63)

Issue of share capital 80 46 - - - 126

Employee share-based payment

charge - - - - 93 93

-------------------------------- ------ -------- -------- -------- -------- --------- --------

Total - Transaction with

owners 7,906 5,877 329 1,250 (783) 14,579

-------------------------------- ------ -------- -------- -------- -------- --------- --------

Profit and total comprehensive

income for the period - - - - (295) (295)

-------------------------------- ------ -------- -------- -------- -------- --------- --------

Unaudited balance as at 30

June 2019 7,906 5,877 329 1,250 (1,078) 14,284

-------------------------------- ------ -------- -------- -------- -------- --------- --------

Unaudited consolidated balance sheet

as at 30 June 2019

Unaudited Unaudited Audited

30 June 30 June 31 December

2019 2018 2018

Notes GBP'000 GBP'000 GBP'000

--------------------------------------- ------ ---------- ---------- ------------

Assets

Non-current assets

Property, plant and equipment 814 1,139 934

Right of Use Assets 1 1,263 - -

Intangible assets 10,045 10,717 10,191

Deferred tax asset 91 62 91

12,213 11,918 11,216

--------------------------------------- ------ ---------- ---------- ------------

Current assets

Inventories 2,661 1,969 2,083

Trade and other receivables 2,454 2,132 2,961

Amount due from associate 146 - 79

Cash at bank and in hand 2,301 2,300 2,491

--------------------------------------- ------ ---------- ---------- ------------

7,562 6,401 7,614

--------------------------------------- ------ ---------- ---------- ------------

Total assets 19,775 18,319 18,830

--------------------------------------- ------ ---------- ---------- ------------

Equity and liabilities

Equity attributable to equity holders

of the parent company

Share capital 7,906 7,826 7,826

Share premium account 5,877 5,831 5,831

Capital reserve 329 329 329

Merger reserve 1,250 1,250 1,250

Retained earnings (1,078) (1,330) (813)

--------------------------------------- ------ ---------- ---------- ------------

Total equity 14,284 13,906 14,423

--------------------------------------- ------ ---------- ---------- ------------

Non-current liabilities

Borrowings 1,676 1,975 1,820

Deferred tax liabilities 65 141 98

Dilapidation provision 165 165 165

Right of Use lease liability 1 1,183 - -

--------------------------------------- ------ ---------- ---------- ------------

3,089 2,281 2,083

--------------------------------------- ------ ---------- ---------- ------------

Current liabilities

Trade and other payables 1,435 1,132 1,556

Obligations under finance leases - 3 -

Accruals 524 697 481

Right of Use lease liability 1 155 - -

Borrowings 288 300 287

--------------------------------------- ------ ---------- ---------- ------------

2,402 2,132 2,324

--------------------------------------- ------ ---------- ---------- ------------

Total liabilities 5,491 4,413 4,407

--------------------------------------- ------ ---------- ---------- ------------

Total equity and liabilities 19,775 18,319 18,830

--------------------------------------- ------ ---------- ---------- ------------

Unaudited consolidated cash flow statement

for the six months ended 30 June 2019

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

Notes 2019 2018 2018

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------ ----------- ----------- ----------------

Cash flows from operating activities

Profit after tax for the year (295) 130 725

Adjustments for:

Taxation (31) (36) (210)

Finance Costs 1 91 44 89

Depreciation of property, plant and

equipment 214 247 481

Amortisation and impairment of intangible

assets 305 493 1,143

Amortisation of right of use assets 1 87 - -

Share-based payment charge 93 60 120

Other Income - 300 -

Loss on disposal of fixed assets - 1 6

Foreign Exchange 24 6 48

(Increase) /decrease in inventories (578) 505 384

Decrease/(increase) in current receivables 444 (167) (1,027)

(Decrease)/increase in trade and other

payables (84) (555) 48

---------------------------------------------- ------ ----------- ----------- ----------------

Cash generated from operations 270 1,028 1,807

Taxation received/(paid) 1 36 (68)

Interest paid (42) (44) (89)

---------------------------------------------- ------ ----------- ----------- ----------------

Net cash generated from operating activities 229 1,020 1,650

---------------------------------------------- ------ ----------- ----------- ----------------

Payments to acquire property, plant

and equipment (94) (60) (88)

Acquisition of intangible assets (160) (200) (398)

Net cash used in investment activities (254) (260) (486)

---------------------------------------------- ------ ----------- ----------- ----------------

Repayment of bank loan (150) (150) (318)

Net proceeds from issue of share capital 126 - -

Repayment of obligations under finance

leases - (13) (16)

Payments to Right of Use lease liabilities 1 (117) - -

---------------------------------------------- ------ ----------- ----------- ----------------

Net cash used in financing activities (141) (163) (334)

---------------------------------------------- ------ ----------- ----------- ----------------

Net increase in cash and cash equivalents (166) 597 830

Cash and cash equivalents at beginning

of period 2,491 1,709 1,709

Effective exchange rate fluctuations

on cash held (24) (6) (48)

---------------------------------------------- ------ ----------- ----------- ----------------

Net cash and cash equivalents at end

of period 2,301 2,300 2,491

---------------------------------------------- ------ ----------- ----------- ----------------

Analysis of net borrowings:

Cash at bank and in hand 2,301 2,300 2,491

Bank loan (1,964) (2,275) (2,107)

Obligations under finance leases - (3) -

Obligations under right of use lease

liabilities 1 (1,338) - -

Net cash/(debt) at end of period (1,001) 22 384

---------------------------------------------- ------ ----------- ----------- ----------------

Notes to the Interim Financial Information

1. Basis of preparation of interim financial information

The interim financial information was approved by the Board of

Directors on 18 September 2019. The financial information set out

in the interim report is unaudited.

The interim financial information has been prepared in

accordance with the AIM Rules for Companies and on a basis

consistent with the accounting policies and methods of computation

as published by the Group in its annual report for the year ended

31 December 2018, which is available on the Group's website.

The Group has chosen not to adopt IAS 34 Interim Financial

Statements in preparing these interim financial statements and

therefore the interim financial information is not in full

compliance with International Financial Reporting Standards as

adopted for use in the European Union.

The group has considered the new standard IFRS 16 'Leases'

effective from 01 January 2019 and is EU endorsed.

IFRS 16 'Leases' has been adopted by the Group for the financial

year starting on 1 January 2019. For leases previously classi ed as

operating leases, the Group did not recognise assets or

liabilities, and instead spread the lease payments on a

straight-line basis over the lease term, disclosing in its annual

nancial statements the total commitment. The impact of the new

standard has brought these operating lease arrangements onto the

balance sheet, with a right of use asset and corresponding

financial liability recognised on transition.

The Group has material operating lease commitment and therefore

the adoption of the standard has had a material impact on the

Financial Statements of the Group. The Board has applied the modi

ed retrospective approach and therefore at the date of initial

application an amount equal to the lease liability, using

appropriate incremental borrowing rates, has been recognised as a

right of use asset. The portfolio of leases mainly consists of

property along with vehicle leases and IT equipment. For low value

and short-term leases, the Group decided to apply the recognition

exemptions to short term leases of vehicles and low value IT

equipment. This ensures that there is no immediate impact to net

assets on that date.

The Group's lease commitments have remained at a similar level

to those at 31 December 2018 and the incremental borrowing rate is

6%, the e ect of adopting IFRS 16 has resulted in the recognition

of right-of-use assets and lease liabilities of approximately

GBP1.5 million at 1 January 2019.

Instead of recognising an operating expense for its operating

lease payments, the Group has instead recognised interest on its

lease liabilities and amortisation on its right-of-use assets. The

overall nancial results in the period ending 30 June 2019 has

adversely impacted by GBP75,000 due to the front-end loading of

interest compared to smooth operating lease rental expenses.

The financial impacts of IFRS 16 on H1 2019 are set out in the

table below.

Adjustments to the opening balance sheet:

Initial 30 June

recognition 2019

IFRS 16 IFRS 16

(GBP'000) (GBP'000)

--------------------------------- ------------ -----------

Right of use asset 1,350 1,263

--------------------------------- ------------ -----------

ROU lease liability-Non-Current (1,262) (1,183)

--------------------------------- ------------ -----------

ROU lease liability -Current (151) (155)

--------------------------------- ------------ -----------

Impact on Equity (63) (75)

--------------------------------- ------------ -----------

Impact on current year Income:

Impact of

IFRS 16

(GBP'000)

------------------------------ -----------

Operating lease rentals 117

------------------------------ -----------

Amortisation of ROU asset (87)

------------------------------ -----------

Underlying operating profit 30

------------------------------ -----------

Net finance costs (42)

------------------------------ -----------

Underlying profit before tax (12)

------------------------------ -----------

The financial information set out in this interim report does

not constitute statutory financial statements as defined in section

434 of the Companies Act 2006. The figures for the year ended 31

December 2018 have been extracted from the statutory financial

statements which have been filed with the Registrar of Companies.

The auditor's report on those financial statements was unqualified

and did not contain a statement under sections 498(2) and 498(3) of

the Companies Act 2006.

2. Segmental reporting

Information reported to the Board, as Chief Operating Decision

Makers, and for the purpose of assessing performance and making

investment decisions is organised into three operating segments.

The Group's operating segments under IFRS 8 are as follows:

-- SI Brand - the research, development, manufacture and

distribution of SI branded minimally invasive devices.

-- OEM - the research, development, manufacture and distribution

of minimally invasive devices for third party medical device

companies through either own label or co-branding. This now

incorporates Precision Engineering, the research, development,

manufacture and sale of minimally invasive technology products for

precision engineering applications

-- Distribution -the distribution of specialist medical products

sold through Elemental Healthcare Ltd.

The measure of profit or loss for each reportable segment is

gross margin less attributable amortisation of product development

costs.

Assets and working capital are monitored on a Group basis, with

no separate disclosure of asset by segment made in the management

accounts, and hence no separate asset disclosure is provided here.

The following segmental analysis has been produced to provide

reconciliation between the information used by the chief operating

decision maker within the business and the information as it is

presented under IFRS.

Six months ended 30 June 2019 (unaudited) SI Brand Distribution OEM Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------- ------------ ------- -------

Revenue 2,609 1,489 1,005 5,103

------------------------------------------ -------- ------------ ------- -------

Result

Segment result 1,115 367 358 1,840

Unallocated expenses (2,106)

------------------------------------------ -------- ------------ ------- -------

Profit from operations (266)

Finance costs (48)

Finance income -

------------------------------------------ -------- ------------ ------- -------

Profit before taxation (314)

Tax 31

------------------------------------------ -------- ------------ ------- -------

Profit for the period (283)

------------------------------------------ -------- ------------ ------- -------

Included within the segment/operating results are the following

significant non-cash items:

SI Brand Distribution OEM Total

Six months ended 30 June 2019 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------- ------------ ------- -------

Amortisation of intangible assets 67 176 62 305

Additions to intangibles 160 - - 160

Additions to tangibles 86 8 - 94

------------------------------------------ -------- ------------ ------- -------

Six months ended 30 June 2018 (unaudited) SI Brand Distribution OEM Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------- ------------ ------- -------

Revenue 2,805 1,504 975 5,284

------------------------------------------- -------- ------------ ------- -------

Result

Segment result 497 700 378 1,575

Unallocated expenses (1,437)

------------------------------------------- -------- ------------ ------- -------

Profit from operations 138

Finance costs (44)

Finance income -

------------------------------------------ -------- ------------ ------- -------

Profit before taxation 94

Tax 36

------------------------------------------- -------- ------------ ------- -------

Profit for the period 130

------------------------------------------- -------- ------------ ------- -------

Included within the segment/operating results are the following

significant non-cash items:

SI Brand Distribution OEM Total

Six months ended 30 June 2018 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------- ------------ ------- -------

Amortisation of intangible assets 206 224 63 493

Additions to intangibles 200 - - 200

Additions to tangibles 54 6 - 60

------------------------------------------- -------- ------------ ------- -------

SI Brand Distribution OEM Total

Year ended 31 December 2018 (audited)

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ------------ ------------ ------------ -------------

Revenue 6,088 3,037 1,844 10,969

---------------------------------------- ------------ ------------ ------------ -------------

Result

Segment result 1,733 1,059 737 3,529

Unallocated expenses (2,909)

---------------------------------------- ------------ ------------ ------------ -------------

Profit from operations 620

Finance income -

Finance costs (105)

---------------------------------------- ------------ ------------ ------------ -------------

Profit before taxation 515

Tax credit 210

---------------------------------------- ------------ ------------ ------------ -------------

Profit for the period 725

---------------------------------------- ------------ ------------ ------------ -------------

Included within the segment/operating results are the following

significant non-cash items:

SI Brand Distribution OEM Total

Year ended 31 December 2018 (audited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ ---------- ------------ ------- -------------

Amortisation and impairment of intangible

assets 230 788 125 1,143

Additions to intangibles 398 - - 398

Additions to tangibles 65 23 - 88

------------------------------------------ ---------- ------------ ------- -------------

Unallocated expenses include those costs that cannot be split

between segments and which are not separately analysed in the

management accounts including research and development costs, sales

and marketing, and head office overheads.

Disaggregation of revenue

The Group has disaggregated revenues in SI Brand Distribution OEM Total

the following table:

Six months ended 30 June 2019 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ ------------ ------------ ------- -------------

United Kingdom 754 1,489 923 3,166

Europe 648 - - 648

US 769 - 82 851

APAC 160 - - 160

Rest of World 278 - - 278

------------------------------------------ ------------ ------------ ------- -------------

2,609 1,489 1,005 5,103

------------------------------------------ ------------ ------------ ------- -------------

SI Brand Distribution OEM Total

Six months ended 30 June 2018 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ ------------ ------------ ------- -------------

United Kingdom 825 1,504 767 3,096

Europe 731 - - 731

US 582 - 208 790

APAC 23 - - 23

Rest of World 644 - - 644

------------------------------------------ ------------ ------------ ------- -------------

2,805 1,504 975 5,284

------------------------------------------ ------------ ------------ ------- -------------

SI Brand Distribution OEM Total

Year ended 31 December 2018 (audited) GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- ------------ ------------ ------- --------------

United Kingdom 1,692 3,037 1,426 6,155

Europe 1,347 - - 1,347

US 1,704 - 418 2,122

APAC 317 - - 317

Rest of World 1,028 - - 1,028

-------------------------------------- ------------ ------------ ------- --------------

6,088 3,037 1,844 10,969

-------------------------------------- ------------ ------------ ------- --------------

Revenues are allocated geographically on the basis of where

revenues were received from and not from the ultimate final

destination of use.

3. Taxation

Current Tax

The Group reported a current tax credit in the period of GBPnil

(2018 FY: credit of GBP0.04m) which relates to claims for enhanced

Research and Development in respect of 2017.The Group are in the

process of preparing an enhanced Research and Development claim for

2018, this will depend on the amount of current year tax losses

that can be elected to exchange for cash, if any.

Deferred Tax

The Group reported a deferred tax asset in the period of

GBP0.03m in respect of the acquisition of the intangible. At the

balance sheet date, the Group has unused tax losses of GBP21.1

million (FY 2018: GBP21.1 million) available for offset against

certain future profits. This represents an unrecognized deferred

tax asset of GBP3.4m (2018: GBP3.4m). The timing differences has

given rise to a deferred tax liability of GBP127,000 (FY 2018 DTL:

GBP197,000).

4. Earnings per share

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

-------------------- ----------- ----------- ------------

Earnings per share

Basic (0.04p) 0.01p 0.09p

Diluted (0.04p) 0.01p 0.09p

Adjusted 0.02p 0.05p 0.21p

-------------------- ----------- ----------- ------------

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of shares in issue. Diluted earnings per share is calculated

by dividing the earnings attributable to ordinary shareholders by

the diluted weighted average number of shares in issue. Adjusted

Earnings per share is calculated by dividing the adjusted earnings

attributable to ordinary shareholders (profit before exceptional

and amortisation costs relating to the acquisition of Elemental

Healthcare and share based payments) by the weighted average number

of shares in issue.

The Group has one category of dilutive potential ordinary shares

being share options issued to Directors and employees. The impact

of dilutive potential ordinary shares on the calculation of

weighted average number of shares is set out below.

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

'000s '000s '000s

-------------------------------------- ----------- ----------- ------------

Basic earnings per share 782,566 782,566 782,566

Dilutive effect of unexercised share

options 42,004 16,327 47,012

-------------------------------------- ----------- ----------- ------------

Diluted earnings per share 824,570 798,893 829,578

-------------------------------------- ----------- ----------- ------------

5. Exceptional Items

Exceptional items in the period ending 30 June 2019 related to

termination payments made to a former director of GBP162,000 and

abortive acquisition costs of GBP22,000.

6. Interim Report

This interim report is available at www.sigroupplc.com.

Surgical Innovations Group plc

Statement of compliance with QCA code on Corporate

Governance

Principle Extent of Commentary Further disclosure(s)

current compliance

Establish a strategy Fully compliant Group business strategy Go to www.sigroupplc.com

and business is summarised in the and follow About Us then

model which promote Mission Statement Our Business Activities

long term value approved by the board

for shareholders. in February 2018,

entitled "Inspired Strategic Report section

by surgeons for the of the Annual Report

benefit of patients".

Strategic issues,

and the appropriate

business model to

exploit opportunities

and mitigate risks,

are under continuous

review by the board,

and reported periodically.

Key risks and mitigating

actions are detailed

in the Principal risks

and uncertainties

section of the Annual

Report.

-------------------- ------------------------------- -------------------------------

Seek to understand Fully compliant Regular meetings are Go to www.sigroupplc.com

and meet shareholder held with institutional and follow Investor Centre

needs and expectations and private shareholders, then Meetings & Voting

during which structured

feedback is sought

and, where considered

appropriate, acted

upon.

Shareholder liaison

is principally undertaken

by the Non-Executive

Chairman and the Chief

Executive Officer.

-------------------- ------------------------------- -------------------------------

Take into account Fully compliant Directors and employees Go to www.sigroupplc.com

wider stakeholder adopt a broad view and follow About Us then

and social responsibilities during decision making Corporate Social

and their implications to take meaningful Responsibility

for long term account of the impact

success of our business on

all key stakeholder

groups.

The Board recognises

that the Company's

long-term success

is reliant on the

efforts of its employees,

customers and suppliers

and through maintaining

relationships with

its regulators.

Feedback from employees,

customer groups, suppliers

and others is actively

encouraged.

-------------------- ------------------------------- -------------------------------

Embed effective Fully compliant The group operates Principal Risks and

risk management, a system of internal Uncertainties

considering both controls designed section of Annual Report

opportunities (to the extent considered

and threats, appropriate) to safeguard

throughout the group assets and protect

organisation the business from

identified risks,

including risk to

reputation. Financial

risks, including adequacy

of funding and exposure

to foreign currencies,

are identified and

subject to examination

during the annual

external audit process.

-------------------- ------------------------------- -------------------------------

Maintain the Fully compliant The board comprises Board section of Annual

board as a well-functioning, six directors; three Report

balanced team non-executive directors,

led by the chair two full time executive

directors, and the

Non-Executive Chairman.

The Chairman and two

of the non-executive

directors are considered

to be fully independent

(Alistair Taylor and

Paul Hardy).

The board is supported

by appropriate board

committees which are

each chaired by one

of the independent

non-executive directors.

An annual record of

attendance at board

meetings will be included Corporate Governance section

in the Annual Report of Annual Report

at the conclusion

of each year.

The Non-Executive

Chairman's responsibilities

approximate to one

day per week, other

Executive Directors

are expected to work

full time. Non-executive

directors are expected

to commit sufficient

time to fulfill their

role - this approximates

to 2 days per month.

The attendance by

the members of the

Board at the meetings

is recorded and reviewed

annually.

-------------------- ------------------------------- -------------------------------

Ensure that between Fully compliant The board is satisfied Board section of Annual

them the directors that the current composition Report

have the necessary provides the required

up-to-date experience, degree of skills,

skills and capabilities experience, diversity

and capabilities appropriate

to the needs of the

business. Steps are

taken to challenge

the status quo, and

encourage proper consideration

of any dissenting

opinion. Board composition

and succession planning

are subject to continuous

review taking account

of the potential future

needs of the business.

The Board has not

taken any specific

external advice on

a specific matter,

other than in the

normal course of business

as an AIM quoted company.

The Directors rely

on the Company's advisory

team to keep their

skills up to date

and through attending

market updates and

other seminars provided

by the advisory team,

the London Stock Exchange

plc and other intermediaries.

-------------------- ------------------------------- -------------------------------

Evaluate board Partially Board evaluation has Management section of

performance based compliant not been carried out Chairman's Statement

on clear and as part of a formal

relevant objectives, process, although

seeking continuous the Chairman has actively

improvement encouraged self-evaluation

by all board members,

and feedback on the

conduct and content

of board meetings.

The board will consider

whether a more structured

approach is required

in future.

-------------------- ------------------------------- -------------------------------

Promote a corporate Fully compliant The board promotes Go to www.sigroupplc.com

culture that high ethical and moral and follow About Us then

is based on ethical standards which are Our Business Activities

values and behaviours set out in the Mission

Statement. The board

and all employees

expect to be judged

by, and accountable

for, their actions.

The business operates

in a highly regulated

environment, which

promotes the benefits

of high moral standards

and rewards good behaviour

over the long term.

-------------------- ------------------------------- -------------------------------

Maintain governance Fully compliant The board as a whole Board section of Annual

structures and share responsibility Report

processes that for sound governance

are fit for purpose practices. Corporate Governance Section

and support good The Chief Executive of Annual Report

decision-making Officer reports to

by the board the board. In addition

to his collective

responsibilities as

a director, he is

responsible for the

oversight of the strategic

and operating performance

of the group

The Group Financial

Controller/Company

Secretary reports

to the Chief Executive

Officer. In addition

to her collective

responsibilities as

a director to the

subsidiaries, she

is primarily responsible

for all aspects of

financial reporting

to the board and key

stakeholders, as well

as maintaining communication

with investors and

other key stakeholders.

Details of the audit,

remuneration and nomination

committees are set

out in the Corporate

Governance section

of the website. The

Non-Executive Directors

comprise the membership

of each of the committees.

-------------------- ------------------------------- -------------------------------

Communicate how Fully compliant The Board attaches Go to www.sigroupplc.com

the company is great importance to and follow Investor Centre

governed and providing shareholders then Meetings & Voting

is performing with clear and transparent

by maintaining information on the

a dialogue with Group's activities

shareholders and strategy. Details

and other relevant of all shareholder

stakeholders communications are

provided on the Company's

website, including

historical annual

reports and governance

related material together

with notices of all

general meetings for

the last five years.

The Company discloses

outcomes of all general

meeting votes.

The Company has appointed

a professional Financial

Public Relations firm

with an office in

London to advise on

its communications

strategy and to assist

in the drafting and

distribution of regular

news and regulatory

announcements. Regular

announcements are

made regarding the

Company's investment

portfolio as well

as other relevant

market and regional

news.

The Company lists

contact details on

its website and on

all announcements

released via RNS,

should shareholders

wish to communicate

with the Board.

-------------------- ------------------------------- -------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DBGDCXGBBGCL

(END) Dow Jones Newswires

September 17, 2019 02:01 ET (06:01 GMT)

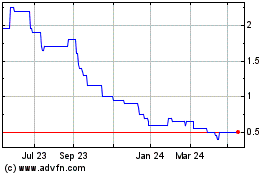

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

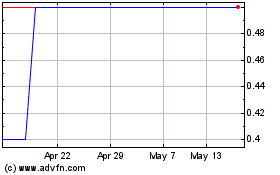

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024