TIDMSTJ

RNS Number : 3102F

St. James's Place PLC

27 July 2016

-1-

ST. JAMES'S PLACE PLC

27 St. James's Place, London SW1A 1NR

Telephone 020 7493 8111 Facsimile 020 7493 2382

27 July 2016

INTERIM STATEMENT

FOR THE SIX MONTHS TO 30 JUNE 2016

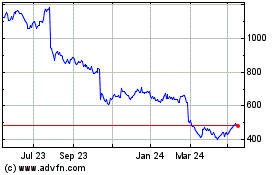

FUNDS UNDER MANAGEMENT AT GBP65.6 BILLION

FOLLOWING RECORD FUND FLOWS

New Investment and Funds under Management

-- Gross inflow of funds under management of GBP5.3 billion (2015: GBP4.4 billion)

-- Continued strong retention of client funds

-- Net inflow of funds under management of GBP3.1 billion (2015: GBP2.7 billion)

-- Group funds under management of GBP65.6 billion (2015: GBP55.5 billion)

St. James's Place Partnership

-- Partnership numbers at 2,320 up 2.5% since the start of the year

-- Total number of advisers at 3,259 up 4.7% since start of the year

Profit

- EEV basis:

-- New business profits of GBP228.9 million (2015: GBP205.9 million)

-- Operating profit at GBP284.0 million (2015: GBP265.3 million)

-- Net asset value per share 791.9 pence (2015: 683.7 pence)

- IFRS basis:

-- Underlying profit before shareholder tax of GBP73.8 million (2015: GBP72.9 million)

-- Profit before shareholder tax of GBP60.5 million (2015: GBP67.0 million)

-- Net asset value per share 201.2 pence (2015: 189.3 pence)

- Cash result:

-- Underlying post tax cash result of GBP94.4 million (2015: GBP84.9 million)

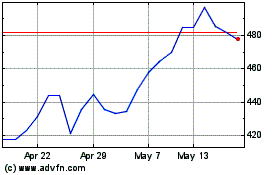

Interim Dividend

-- Interim dividend 12.33 pence per share (2015: 10.72 pence per share)

-2-

David Bellamy, Chief Executive, commented:

"Despite continued volatility in world stock markets and

political uncertainty across Europe, I am pleased to once again be

reporting a strong first half performance and continued positive

momentum in our business. Bearing testament to the reassuring

consistency and resilience of our business, I am particularly

pleased that we achieved record gross and net inflows in the second

quarter, up 23% and 25% respectively. That, together with our usual

high retention results and good performance of our client funds,

has increased our funds under management by GBP10 billion in the

last 12 months.

Whilst the UK's decision to leave the EU has created a period of

economic uncertainty in the UK, the challenges and responsibilities

that many people face when considering how to manage their wealth

and the ever changing tax considerations, remain. We believe we are

extremely well placed to meet this increasing need for advice and

remain focused on growing our number of qualified advisers and

providing them with all the tools and support to deliver high

quality outcomes for clients.

Consequently, without being complacent about the possible

consequences of Brexit, the proven strength in our business model

and ongoing momentum gives us confidence in our ability to deliver

continued growth in line with our objectives. Indeed, I can report

that new fund flows since the Referendum remain in line with those

medium term objectives.

Given the continued strong business performance, the Board has

declared a 15% increase in the interim dividend to 12.33 pence per

share. We intend to continue to grow the dividend in line with the

underlying performance of the business, as previously stated."

-3-

The details of the announcement are attached.

Enquiries:

David Bellamy, Chief Executive Tel: 020 7514 1963

Officer

Andrew Croft, Chief Financial Tel: 020 7514 1963

Officer

Tony Dunk, Investor Relations Tel: 020 7514 1963

Director

Bell Pottinger Tel: 020 3772 2566

John Sunnucks

Ben Woodford Email: Bwoodford@BellPottinger.com

An interview with David Bellamy, discussing today's results,

will be available later today on www.sjp.co.uk

Analyst presentation 11am (GMT)

Bank of America Merrill Lynch Financial Centre

2 King Edward Street

London EC1A 1HQ

To be held in King Edward Hall

Alternatively, if you are unable to attend but would like to

watch a livestream of the presentation on the day, please click on

the link below or via our website

(Live and On-demand):

http://www.investis-live.com/st-jamess-place/577f754a2a4e360b00bb41a5/dia2

There will also be a Dial in:

Conference call dial in details:

United Kingdom (Local) 020 3059 8125

All other locations + 44 20 3059 8125

Participant Password: St James's Place

Replay Dial-in details (available for 7 days)

United Kingdom 0121 260 4861

United States 1 866 268 1947

All other locations + 44 121 260 4861

Passcode: 3815352 followed by #

-4-

CONTENTS

PART ONE GROSS INFLOW FIGURES

PART TWO INTERIM MANAGEMENT STATEMENT

PART THREE EUROPEAN EMBEDDED VALUE (EEV) BASIS

PART FOUR INTERNATIONAL FINANCIAL REPORTING STANDARDS

(IFRS) BASIS

-5-

ST. JAMES'S PLACE WEALTH MANAGEMENT

GROSS INFLOWS

FOR THE SIX MONTHS TO 30 JUNE 2016

Unaudited Unaudited

3 Months to 6 Months to

30 June 30 June

2016 2015 2016 2015

------------ ------------ ------------ ------------

GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Gross inflows

Investment 0.58 0.64 1.04 1.23

Pension 1.22 0.85 2.40 1.58

Unit Trust, ISA & DFM 1.02 0.80 1.83 1.59

------------ ------------ ------------ ------------

2.82 2.29 +23% 5.27 4.40 +20%

------------ ------------ ------------ ------------

-6-

INTERIM MANAGEMENT STATEMENT

CHIEF EXECUTIVE'S REPORT

I am pleased to be reporting once again a strong first half

performance and, importantly, continued positive momentum in our

business. Bearing testament to the reassuring consistency and

resilience that is a feature of our relationship based, advice led

model, gross inflows grew by 20% in the first half to GBP5.3

billion, while the retention of our existing client funds remained

consistent with previous years such that net inflows increased by

15% to GBP3.1 billion. As a result, our client funds under

management now stand at GBP65.6 billion, up 12% since the beginning

of the year and GBP10 billion higher than at the end of June last

year.

Whilst we are mindful that the UK's decision to leave the EU

will have created economic uncertainty in the UK, the challenges

and responsibilities that many people face when considering how to

manage their wealth and their ever changing tax considerations,

remain. Through our strategy of building long-term relationships

with our clients, providing them with reliable face-to-face advice

and successfully managing their investments across well-diversified

portfolios with significant exposure to non-UK assets and different

sources of return, we continue to be very well placed to meet this

increasing need for advice and support.

Financial Performance

As reported by our Chief Financial Officer, the strong business

performance in the first half of the year is reflected in the

financial performance for the period.

The underlying strength of the financial performance is once

again impacted by a heightened levy charged by the Financial

Services Compensation Scheme (FSCS levy) of GBP17 million. This

expense impacts all profit measures, but we remain hopeful that the

elevated levy imposed over the last two years will return to a more

normalised level in future years.

Dividend

Given the continued strong business performance, the Board has

declared a 15% increase in the interim dividend to 12.33 pence per

share and we intend to continue to grow the dividend in line with

the underlying performance of the business, as previously

stated.

The interim dividend for 2016 will be paid on 30 September to

shareholders on the register at the close of business on 2

September 2016. A Dividend Reinvestment Plan ("DRP") continues to

be available for shareholders.

Clients

At the heart of our sustained growth is the importance we place

on building and maintaining long lasting relationships with our

Partners and clients and serving them well.

The financial demands on our core clients, those aged 45 and

above, are changing quite quickly. They or their parents are living

longer or expect to do so and that is changing the nature of their

financial planning for, at and in retirement. At the same time,

they increasingly want to support their children or grandchildren

in education or in purchasing a property.

Our business is about supporting our Partners in helping clients

with these challenges. Earlier this year, alongside the launch of a

Lasting Power of Attorney service, we introduced an

intergenerational mortgage range in association with Metro Bank,

allowing clients to use their St. James's Place investments as the

collateral for a relative's mortgage application and helping them

to access lower rates. Later this year we have further initiatives

planned including an intergenerational gifting service, family and

general insurance protection products to complete our existing

family health insurance and the development of later life planning

services including a long term care proposition and probate support

services.

-7-

We firmly believe that our highly personalised approach has a

strong place in UK financial services both today and in the future.

Indeed, at a historically significant point of economic and

political change for the UK, our advisers will play an important

role in helping clients to understand the impact of such changes

and the options that are available to them, so that clients can

make the right decisions and plan accordingly.

Investment Management

Despite the challenging market conditions, I'm pleased to report

that our investment funds and range of client portfolios have

performed in line with our expectations, benefitting from our

longer term strategy of building broadly diversified portfolios

with significant exposure to non-UK assets and different sources of

return. Less than 25% of our clients' money is invested in UK

equities and of that, 75% is in FTSE 100 companies who generally

have global businesses.

Central to our approach to investment management is the work of

our Investment Committee. They are tasked with identifying the most

talented investment managers from across the world and making

available to clients a range of investment solutions that meet

their current and future needs.

Equity income is a proven investment strategy and one which, in

an environment of low interest rates and low growth rates, remains

of great importance to clients. Whilst the UK has long been an

important market for income investors, today there is a much

broader universe of companies with a strong dividend culture. With

this in mind, alongside some changes we are making to our existing

investment strategies later this year, we are introducing a new

Worldwide Income Fund managed by Clyde Rossouw of Investec Asset

Management, based in Cape Town, South Africa. The new fund will

provide additional flexibility for clients seeking alternative

sources of income in the current environment.

Over the last ten years we have developed a truly global

approach to the management of our client funds, which I believe has

served them well and will continue to do so.

The St. James's Place Partnership

In the first half of this year, through the sustained efforts of

our business acquisition team, we continued to attract established

adviser businesses, often with more than one qualified adviser. We

also built on the success of our expanded Academy program and

increased our advisory presence in Asia. Our existing Partners too

are investing in their own practices by recruiting qualified

advisers to work for them, such that our Partner numbers increased

by 2.5% to 2,320 and our total qualified adviser capacity grew by

4.7% to 3,259.

I believe that the strong growth in Partner and total adviser

numbers bodes well for our continued growth and succession in our

Partner businesses.

As we look ahead, I'm confident that we will find additional

opportunities for growth in Asia, where our business is developing

nicely and in the Discretionary Fund Management market, through our

recent acquisition of Rowan Dartington. The range of additional

services Rowan Dartington can offer has already been very well

received by Partners and clients and since announcing the

completion of this acquisition earlier this year, the team of

client and Partner facing Investment Executives has increased.

Partners, Employees and the St. James's Place Foundation

I'd like to once again thank the entire St. James's Place

community for these results. There is no doubt in my mind that the

strength and continued growth of the business is due to their hard

work, dedication and commitment to clients and each other.

The St. James's Place Foundation has always been an important

part of the Group's culture and we aim to make a significant

difference to the lives of those less fortunate than us. Earlier

this year we passed a significant milestone as the total funds

raised, through the collective efforts of the whole of our

community, including employees, Partners, advisers, suppliers and

others connected to SJP, reached in excess of GBP50 million. All

funds raised are distributed to hundreds of charities, with grants

ranging from a few thousand pounds to more than GBP1 million.

I would like to thank everyone, including our shareholders, for

their continued support in helping to raise such impressive

sums.

-8-

Outlook

As we continue to grow our advisory presence, we look to build

strong advocacy with and through our existing clients and advisers,

in the strong belief that if we maintain our focus on doing this

well, we will continue to attract advisers, acquire new clients and

grow our client funds under management.

Without being complacent about the possible consequences of

Brexit, the proven strength in our business model and good momentum

in our business gives us confidence in our ability to deliver

continued growth in line with our objectives. Indeed, I can report

that new fund flows since the Referendum remain in line with those

medium term objectives.

David Bellamy

Chief Executive

26 July 2016

-9-

INTERIM MANAGEMENT STATEMENT

CHIEF FINANCIAL OFFICER'S REPORT

The strong business performance we have experienced in recent

years has continued in the first half of the year and this is

reflected in the financial performance for the period.

Financial results

As shareholders will be aware from previous periods, we report

our results on both IFRS and EEV bases, as well as providing

further detail on the cash emergence from the business. Detailed

explanation and analysis of the results on these measures is

provided in the Financial Review on pages 11 to 36.

The results reflect the underlying strong business performance

and the business mix in the period. There were also a number of

other drivers impacting the results (all measures impacted unless

otherwise stated):

(i) Our required contribution to the Financial Services

Compensation Scheme (FSCS) was again at an elevated level,

negatively impacting the results by GBP17.0 million pre-tax

(GBP13.6 million post-tax) compared with a pre-tax GBP20.0 million

(GBP15.9 million post-tax) for the prior year. This charge is

accounted for in full in the first half of the year. We remain

hopeful that the elevated levy we have seen over the last two years

will return to a more normal level in future.

(ii) We continue to invest in the Academy, our recent

acquisitions and other strategic initiatives, with the impact for

the current year at GBP10.0 million pre-tax (GBP8.7 million

post-tax) being higher than last year's GBP6.0 million pre-tax

(GBP5.2 million post tax).

(iii) The continuation of our back office infrastructure

investment cost GBP10.5 million pre-tax (GBP8.4 million post tax)

for the six months compared with GBP9.1 million (GBP7.3 million

post-tax) for the prior year.

(iv) As part of a review of our legacy business we are

voluntarily reviewing charges on two small cohorts of business:

waiving exit charges at the minimum retirement age where they

existed on some older pension contracts (written before July 1999);

and reassessing risk charges on a reviewable protection contract.

The combined impact of these actions is a negative one-off GBP8.2

million pre-tax (GBP6.6 million post tax) on the cash and IFRS

results, which rises to GBP13.6 million pre-tax in the EEV result

when the reduction in future charges is also fully capitalised.

(v) (EEV only) In April 2016 the CFO Forum published an amended

set of principles for calculating the EEV result following the

introduction of Solvency II at the start of 2016. The key change

impacting the result for June 2016 is a reduction in the cost of

holding a revised level of solvency capital, which has benefitted

the EEV operating profit by a one-off GBP7.5 million pre-tax.

IFRS Result

The Underlying profit before shareholder tax was GBP73.8 million

(2015: GBP72.9 million), whilst the IFRS Profit before shareholder

tax, which takes account of the amortisation of intangible assets

and liabilities, was GBP60.5 million (2015: GBP67.0 million).

The results reflect the items noted above, whilst the Profit

before shareholder tax in the current period also reflects a GBP7.4

million increase in the amortisation charge that continues a trend

we have noted previously. This amortisation charge is unrelated to

the performance of the business and we therefore present the

Underlying profit as a useful alternative measure (based upon IFRS)

for assessing operating performance.

Cash Result

The Underlying cash result for the six months was GBP94.4

million (2015: GBP84.9 million), some 11% higher, reflecting the

increased annual management fees from the higher funds under

management offset by the increase in our investment into the

strategic initiatives.

The Cash result was GBP82.5 million (30 June 2015: GBP81.8

million) reflecting the Underlying cash result adjusted for the

cost of the back office infrastructure investment and a number of

one-off items including the reviews noted in (iv) above.

-10-

Note that the Cash and Underlying cash results should not be

confused with the IFRS cash flow statement which is prepared in

accordance with IAS 7 and disclosed on page 54.

EEV Result

The EEV New Business Contribution was up 11% during the period

at GBP228.9 million (30 June 2015: GBP205.9 million). The growth

was lower than the gross inflows (+20%) due to the change in

business mix.

The Operating Profit for the period was GBP284.0 million (2015:

GBP265.3 million). The prior year benefitted from a GBP16.4 million

positive experience variance that was not repeated in the current

year.

Despite the stock market volatility our investment funds have

performed strongly and exceeded the EEV assumption by 6-7%

resulting in a positive investment variance of GBP168.8 million.

(2015: GBP24.1 million).

Total profit before tax for the period was therefore GBP442.7

million with the positive investment variance explaining most of

the increase compared with GBP289.1 million for the prior year. The

net asset value per share on an EEV basis at the end of the period

was 791.9 pence (31 December 2015: 737.3 pence).

Dividend

Given the continued strong performance of the business during

the period and continued growth in the Underlying cash result, the

Board has declared an interim dividend of 12.33p per share, an

increase of 15%. The cost of the dividend will be GBP65.0 million

(2015: GBP56.0 million). We intend to continue to grow the dividend

in line with the underlying performance of the business, as

previously stated.

Capital & Solvency II

We continue to manage the balance sheet prudently to ensure the

Group's solvency is maintained safely through the economic cycle.

This is important not only for the safeguarding of our clients'

assets, but also to ensure we can maintain returns to

shareholders.

We assess our solvency against a Management solvency buffer (see

page 29) and with solvency free assets after the dividend

considerably in excess of the buffer, our solvency position remains

strong. We also provide an estimate of our Solvency II free assets

position, which at GBP851.3 million (after deducting the interim

dividend), gives a solvency ratio of 151% and also demonstrates the

strength of our covenant.

Concluding remarks

The business, financials and lead indicators are in good

shape.

Whilst the country faces some uncertainty following the

Referendum result on 23 June, current business flows remain in line

with our medium term objectives.

As noted in the Chief Executive's Report, the proven strength of

our business model and good momentum in our business gives us

confidence in our ability to deliver continued growth in line with

our objectives.

Andrew Croft

Chief Financial Officer

26 July 2016

-11-

INTERIM MANAGEMENT STATEMENT

FINANCIAL REVIEW

The Financial Model

The Group's strategy is to attract and retain retail Funds under

Management (FUM) on which we receive an annual management fee for

as long as we retain the funds. This is the principal source of

income for the Group out of which we meet the overheads of the

business, invest in growing the Partnership and invest in acquiring

new funds under management.

The level of income is dependent on the level of client funds

and the level of asset values. In addition, since around half of

our business does not generate net income in the first six years,

the level of income will increase as a result of new business from

six years ago becoming cash generative. This deferral of cash

generation means the business always has six years' worth of funds

in the 'gestation' period. More information about our Fees on Funds

under Management can be found in Section 1 on page 13.

Group expenditure is carefully managed with clear targets set

for growth in establishment expenses in the year. Many other

expenses increase with business levels and are met from margins in

the products. The Group also invests in ensuring the quality of our

proposition for clients and Partners through investment in new

client services and existing IT systems. Finally we are also

looking to the future, with investment in strategic initiatives,

including the Academy, Asia, DFM and our Back-office infrastructure

programme. More information about our expenses can be found in

Section 2 on page 17.

A small proportion of Group expenditure is required to support

management of existing funds, but the majority of expenditure is

investment in growing the Partnership and acquiring new funds. The

resulting new business is expected to generate income for an

average of 14 years, and is expected to provide a good return on

the investment (see page 16).

As the business matures, the proportion of the cash emergence

from the existing business required to support the acquisition of

new business is reducing. This has resulted in strong growth in

Underlying cash emergence in recent years which has ultimately fed

through to growth in the dividend.

Profit Measurement

In line with statutory reporting requirements we report profits

assessed on an IFRS basis. However, given the long-term nature of

the business and the high level of investment in new business

generation each year, we believe the IFRS result does not provide

an easy guide to the cash likely to emerge in future years, nor

does it reflect the total economic value of the business.

Therefore, consistent with last year, we complement our statutory

IFRS reporting with additional analysis.

Firstly, we provide additional analysis in relation to the tax

reported under IFRS. The IFRS methodology requires that the tax

recognised in the financial statements should include the tax

incurred on behalf of policyholders in our UK life assurance

company. Since the policyholder tax charge is unrelated to the

performance of the business, we believe it is useful to separately

identify the Profit before shareholder tax. This measure reflects

the profit before tax adjusted for tax paid on behalf of

policyholders.

Secondly, the IFRS methodology promotes recognition of profits

in line with the provision of services and so, for long-term

business, some of the initial cash flows are spread over the life

of the contract through the use of intangible assets and

liabilities (known as DAC - Deferred Acquisition Costs and DIR -

Deferred Income). Due to regulation change in 2013, there was a

step change in the progression of these items, which resulted in

significant accounting presentation changes despite the

fundamentals of our vertically-integrated business remaining

unchanged. We therefore present an additional 'non-GAAP' Underlying

profit measure which is derived from the IFRS result by adjusting

for these intangibles. We believe this adjusted IFRS result

provides a useful measure of operating performance.

-12-

Thirdly, the IFRS methodology recognises other non-cash items

such as deferred tax and share options. Since a dividend can only

be paid to shareholders from appropriately fungible assets, when

determining the level of dividend the principal measures that the

Board considers are the Cash result and Underlying cash result as

they best reflect the cash generated by the business.

The Board starts by considering the Underlying cash result,

which reflects the impact of the primary drivers of the business

(being FUM and expenses as described in Sections 1 and 2). This can

be derived from the Underlying profit measure by adjusting tax to

reflect a normalised level of current tax, allowing for insurance

provisions on an IFRS basis, and allowing for share option costs.

The strategic investment in our back office infrastructure is also

excluded when considering the Underlying cash result, but is

included in the Cash result, which also reflects actual tax

settlements.

The Cash result and Underlying cash result are presented with a

breakdown explaining the sources of profit based on the key drivers

of the business, with the aim of assisting investors to understand

the development of profits. The Board also believes it is useful to

understand the contribution to profits from just the in-force

business as this reflects the value being generated by the existing

business, and so the breakdown identifies the new business impact

and makes clear the ongoing contribution from the established

business.

Finally, we also present an Embedded value result. We believe

this is useful for investors seeking to assess the full value of

the long-term emergence of shareholder cash returns, since it

includes an asset in the valuation reflecting the net present value

of the expected future cash flows from the business. This type of

presentation is commonly referred to as a 'discounted cash flow'

valuation.

Our embedded value has been determined in line with the EEV

principles, originally set out by the Chief Financial Officers

(CFO) Forum in 2004, and amended for changes to the principles

published in April 2016, following the implementation of Solvency

II in January 2016.

Many of the future cash flows derive from fund charges, which

change with movements in stock markets. Since the impact of these

changes is unrelated to the performance of the business, we believe

that the EEV operating profit (reflecting the EEV profit before

tax, adjusted to reflect only the expected investment performance

and no change in economic basis) provides the most useful measure

of embedded value performance in the year.

Given the importance of Funds under Management (FUM) to profit

generation by the business, we have provided an analysis of the FUM

make-up and development in Section 1. Section 2 covers Expenses,

which is the other significant driver of profits, with Sections 3-5

reporting on the performance of the business on the IFRS, Cash and

EEV result bases, and providing commentary on Solvency and

Liquidity.

A Glossary of terms was included in the most recent Annual

Report and Accounts, which is available on the website.

Related Party Transactions

The related party transactions during the first six month period

are set out in Note 17 to the condensed half year statements.

-13-

SECTION 1: FUNDS UNDER MANAGEMENT

During 2016 we have seen gross inflows of funds under management

of GBP5.27 billion (30 June 2015: GBP4.40 billion), up 20% and a

net inflow of GBP3.07 billion (30 June 2015: GBP2.67 billion)

growth of 15%. This result, combined with the addition of GBP1.26

billion Rowan Dartington funds under management at the date of

acquisition, together with a positive investment performance,

provided for total funds under management of GBP65.6 billion.

Analysis of the development of the funds under management is

provided in the following tables.

Six Months Ended 30 June 2016 Investment Pension UT/ISA Total

& DFM

Note GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Opening funds under management 22.52 20.86 15.23 58.61

Rowan Dartington acquisition - - 1.26 1.26

Gross inflows 1.04 2.40 1.83 5.27

Net investment return 0.70 1.39 0.53 2.62

Regular income withdrawals and maturities 1,2 (0.26) (0.40) (0.04) (0.70)

Surrenders and part surrenders 3 (0.41) (0.46) (0.63) (1.50)

------------ ------------ ------------ ------------

Closing funds under management 23.59 23.79 18.18 65.56

============ ============ ============ ============

Net inflows 0.37 1.54 1.16 3.07

============ ============ ============ ============

Implied surrender rate as a percentage of

average funds under management 3.6% 3.9% 7.4% 4.7%

============ ============ ============ ============

Included within "UT/ISA & DFM" are gross inflows of GBP0.17

billion and outflows from regular income withdrawals and maturities

of GBP0.07 billion in relation to the Rowan Dartington Group funds

under management.

In addition, there is a further GBP434 million of funds under

management in third party funds within our Asia business.

Six Months Ended 30 June 2015 Investment Pension UT/ISA Total

Note GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Opening funds under management 21.14 18.08 12.79 52.01

Gross inflows 1.23 1.58 1.59 4.40

Net investment return 0.23 0.32 0.23 0.78

Regular income withdrawals and maturities 1,2 (0.24) (0.29) - (0.53)

Surrenders and part surrenders 3 (0.43) (0.30) (0.47) (1.20)

------------ ------------ ------------ ------------

Closing funds under management 21.93 19.39 14.14 55.46

============ ============ ============ ============

Net inflows 0.56 0.99 1.12 2.67

============ ============ ============ ============

Implied surrender rate as a percentage of

average funds under management 4.0% 3.2% 6.9% 4.4%

============ ============ ============ ============

In addition, there was a further GBP473 million of funds under

management in third party funds within our Asia business.

-14-

Twelve Months Ended 31 December 2015 Investment Pension UT/ISA Total

Note GBP'Billion GBP'Billion GBP'Billion GBP'Billion

Opening funds under management 21.14 18.08 12.79 52.01

Gross inflows 2.45 3.66 3.13 9.24

Net investment return 0.19 0.38 0.25 0.82

Regular income withdrawals and maturities 1,2 (0.48) (0.62) - (1.10)

Surrenders and part surrenders 3 (0.78) (0.64) (0.94) (2.36)

------------ ------------ ------------ ------------

Closing funds under management 22.52 20.86 15.23 58.61

============ ============ ============ ============

Net inflows 1.19 2.40 2.19 5.78

============ ============ ============ ============

Implied surrender rate as a percentage of

average funds under management 3.6% 3.3% 6.7% 4.3%

============ ============ ============ ============

In addition, there was a further GBP430 million of funds under

management in third party funds within our Asia business.

Notes:

1. Regular income withdrawals represent those amounts selected

by clients which are paid out by way of periodic income. The

withdrawals are anticipated in the calculation of EEV New Business

Profit.

2. Maturities are those sums paid out where the plan has reached

the selected maturity date (e.g. retirement date). The expected

maturity date is anticipated in the calculation of EEV New Business

Profit.

3. Surrenders and part surrenders are those amounts where

clients have chosen to withdraw money from their plan. Surrenders

are assumed in the calculation of the EEV New Business Profit and

the level is based on analysis of actual experience taking into

account plan duration and the age of the client. The implied

surrender rate shown in the table above is very much a simple

average and reflects only recent experience. Whilst it could be

compared with the long-term assumptions underlying the calculation

of the embedded value, it should not be assumed that small

movements in this rate will result in a change to the long term EEV

assumptions.

-15-

Fees on Funds Under Management

As noted at the start of this Financial Review, our financial

model is to attract and retain retail funds under management on

which we receive an annual management fee.

The net annual management fee retained by the Group is c.0.77%

post tax. However, due to our product structure, investment and

pension business does not generate net cash in the first six years.

Consequently, the level of income we are receiving today is not

fully representative of the expected earnings from the funds we are

managing, and these earnings will increase as a result of the new

business from six years ago becoming cash generative. This deferral

of cash generation means there is always six years' worth of

business in the 'gestation' period.

The table below provides an estimated current value of the funds

under management in the gestation period.

30 June 2016 30 June 2015 31 December 2015

Year Total Total Total

GBP'Billion GBP'Billion GBP'Billion

2009 - 1.1 -

2010 1.2 2.2 2.0

2011 2.4 2.4 2.4

2012 2.7 2.8 2.7

2013 3.8 3.4 3.7

2014 4.0 3.5 3.9

2015 4.8 1.7 4.5

2016 Half year 2.5 - -

------------- ------------- -----------------

Total 21.4 17.1 19.2

============= ============= =================

This GBP21.4 billion of funds under management in the gestation

period represents approximately a third of the total funds under

management which, if all the business reached the end of the

gestation period, would contribute some GBP165 million to the

annual post-tax cash result.

-16-

The Business Case for new Funds Under Management

The Group incurs costs associated with attracting new funds. We

believe it is useful to provide details of the economic return we

expect will be generated from the new business; in other words, the

business case for the investment in attracting new clients and

funds under management.

As detailed later in this review on page 25, a net cost of

GBP59.0 million (2015: GBP52.7 million) has been incurred to

attract the GBP5.27 billion of gross new funds (2015: GBP4.40

billion).

We regard this as an investment in new business which we expect

to generate income in the future significantly exceeding this cost

and therefore provide positive returns for shareholders. The table

below provides details of the new business added during the

reporting periods and different measures of valuing the

investment:

6 Months 6 Months 12 Months

Ended Ended Ended

30 June 2016 30 June 2015 31 December 2015

Gross inflows (GBP'billion) 5.27 4.40 9.24

Post-tax investment in new business (GBP'million) (59.0) (52.7) (84.2)

Post-tax present value of expected profit from investment

(GBP'million) 186.7 165.3 358.9

Cost of new business (% of new money invested)* 1.1% 1.2% 0.9%

New business margin (% of new money invested) 4.5% 4.7% 4.8%

Cash payback period (years) 5 5 5

Internal rate of return (net of tax) 21.2% 23.8% 22.1%

* The investment as a percentage of net inflow of funds under

management was 1.9% compared with 2.0% for June 2015. The full year

cost is expected to be lower at 1.5% (2015: 1.5%), because the FSCS

levy is fully expensed in the first half of the year.

Geographical and segmental analysis

30 June 2016 30 June 2015 31 December 2015

------------- ------------- -----------------

GBP'Billion GBP'Billion GBP'Billion

UK Equities 15.8 15.7 15.6

North American Equities 14.0 11.2 13.1

Fixed Interest 10.7 8.1 8.8

European Equities 7.0 6.1 6.2

Asia & Pacific Equities 5.5 5.1 4.9

Cash 5.4 4.5 4.6

Property 2.3 1.9 2.2

Alternative Investments 1.5 1.1 1.3

Other* 3.4 1.8 1.9

Total 65.6 55.5 58.6

============= ============= =================

*Included within "Other" is GBP1.35 billion (2015: GBPnil) in

relation to Rowan Dartington Group funds under management.

-17-

SECTION 2: EXPENSES

Management Expenses

The table below provides a breakdown of the management

expenditure (before tax):

6 Months 6 Months 12 Months

Ended Ended Ended

Note 30 June 2016 30 June 2015 31 December 2015

------- -------------- -------------- ------------------

GBP'Million GBP'Million GBP'Million

Establishment costs 1 75.1 68.6 139.4

Other performance related costs 2 43.5 45.3 94.3

Operational development costs 3 7.0 7.2 17.3

Strategic development costs 4 1.9 1.2 1.9

Academy costs 5 3.5 2.5 5.5

Asia costs 6 3.6 3.3 7.9

DFM costs 7 3.7 - 1.6

Back-office infrastructure development 8 10.5 9.1 18.1

Regulatory fees 9 3.9 3.4 7.5

FSCS levy 9 17.0 20.0 20.1

-------------- -------------- ------------------

169.7 160.6 313.6

============== ============== ==================

Notes

1. Establishment costs are the running costs of the Group's

infrastructure and are relatively fixed in nature in the short

term, although they are subject to inflationary increases. These

costs will increase as the infrastructure expands to manage the

higher number of existing clients, the growing number of advisers

and increasing business volumes.

As indicated at the time of our 2015 results, we anticipate the

full year growth in these expenses will be some 11% as we are

expanding our presence in London during 2016.

2. Other performance related costs, for both Partners and

employees, vary with the level of new business and operating profit

performance of the business.

3. Operational development costs represent business as usual

expenditure to support the business, such as the on-going

development of our investment proposition and our technology,

including focus on cyber security.

4. As a growth business we are constantly looking to new

opportunities and expect to incur a small level of ongoing expense

associated with pursuing other strategic developments.

5. The Academy is an important strategic investment for the

future and we are continuing to grow our investment in this

programme. Costs have increased in recent years as we have

increased the number of students within the programme and launched

more regional academies. Full year costs are expected to be some

GBP7.5 million.

6. Our expansion into Asia through operations in Singapore, Hong

Kong and Shanghai is intended to provide diversification of our

growth model through exporting our successful wealth management

proposition to new markets, starting with the UK ex-pat market.

Costs reflect both the ongoing operational costs, but also the

development costs associated with growing these businesses to

achieve sustainable scale.

7. Completion of the purchase of Rowan Dartington in March 2016

facilitated a new DFM operation within the SJP proposition. We

expect this business will grow quickly, requiring investment to

support these ambitions.

-18-

8. Our back-office infrastructure programme is a multi-year

initiative to upgrade our administration so it can support our

future business goals. Having achieved the migration of our ISA and

Unit Trust proposition to our new Bluedoor system in 2015, the

focus in 2016 is the launch of a new retirement account with the

eventual aim being to migrate pension and drawdown business onto

the new system. We anticipate a similar level of costs for the

remainder of the year.

9. The costs of operating in a regulated sector include fees

charged by the regulators and our contribution to the Financial

Services Compensation Scheme. Our position as a market-leading

provider of advice, means we make a very substantial contribution

to supporting the industry compensation scheme, the FSCS, thereby

providing protection for clients of other sector businesses that

fail. In the last couple of years, the levy has been at an elevated

level and we remain hopeful that it will return to a more

normalised level in future.

Group Expenses

The table below provides a reconciliation from the management

expenses above to the total Group expenses included in the

Consolidated Statement of Comprehensive Income on page 50.

6 Months 6 Months 12 Months

Ended Ended Ended

Note 30 June 2016 30 June 2015 31 December 2015

------- -------------- -------------- ------------------

GBP'Million GBP'Million GBP'Million

Expenses per table above 169.7 160.6 313.6

Partner remuneration 10 276.6 250.5 518.5

Investment expenses 10, 11 30.2 76.5 143.5

Third party administration 10, 12 34.8 25.9 56.6

Acquired IFA operating costs 1.5 1.5 3.0

Amortisation and revaluation of DAC, PVIF and

Renewal Income Assets 35.5 39.4 76.0

Share option costs 7.5 5.6 15.7

Share option NI - 2.0 3.4

Interest expense and bank charges 3.9 1.8 6.0

Charitable donations 1.9 1.2 3.5

Other 6.7 3.1 10.3

-------------- -------------- ------------------

398.6 407.5 836.5

Total expenses 568.3 568.1 1,150.1

============== ============== ==================

Notes

10. These costs are met from corresponding policy margins and

any variation in them from changes in the volumes of new business

or the level of the stock markets does not directly impact the

profitability of the Group.

11. In October 2015 in preparation for migration of business to

the Bluedoor platform we rationalised our funds so that Investment

expenses of all unit trusts are charged directly to the trust

rather than some being settled by the manager or life company. As a

result, the Investment expenses for most funds are no longer

consolidated in the accounts, but neither is the equal and

offsetting fee, resulting in a neutral profit impact overall (and a

neutral impact on clients).

12. In November 2015, as a result of the migration of business

to the Bluedoor platform and as noted last time, the business moved

to a new administration tariff with IFDS. The ultimate impact of

this change will be a significant reduction in the cost of

administration, but some administration costs which were previously

charged to the trusts are now being treated as expenses, with a

corresponding offsetting increase in fee income; again a neutral

impact overall. As a result, the Third Party Administration costs

reported in 2016 will increase by c.10% in addition to the growth

in business. The rate of growth in costs in future years will then

be slower than business growth, allowing the expected future saving

to emerge.

-19-

SECTION 3: INTERNATIONAL FINANCIAL REPORTING STANDARDS

(IFRS)

As noted at the start of this review, two key measures based on

IFRS are Profit before shareholder tax, which removes the impact of

policyholder tax, and Underlying profit, which removes the impact

of changes in certain intangibles (DAC/DIR/PVIF). We believe

Underlying profit provides a useful measure, based on IFRS, for

assessing operating performance.

As noted in the CFO's report, the results reflect the underlying

strong business performance and the business mix in the period, but

also a number of other drivers including: the FSCS levy; continued

investment in the Academy, recent acquisitions and other strategic

initiatives, as well as our back-office infrastructure; and costs

of reviewing charges in two small cohorts of legacy business.

6 Months Ended 6 Months Ended 12 Months Ended

30 June 2016 30 June 2015 31 December 2015

Before After tax Before After tax Before After tax

shareholder shareholder shareholder

tax tax tax

------------- ------------ ------------- ------------ ------------- ------------

GBP'Million GBP'Million GBP'Million GBP'Million GBP'Million GBP'Million

Underlying cash 105.4 94.4 89.8 84.9 197.0 182.1

Share options (7.5) (7.5) (5.6) (5.6) (15.7) (15.0)

Deferred tax impacts - (12.4) - (18.5) - 52.1

Insurance reserves (1.3) (1.0) 1.5 1.5 (1.8) (1.8)

Back-office infrastructure

development (10.5) (8.4) (9.1) (7.3) (18.1) (14.4)

Variance (12.3) (6.0) (3.7) 4.2 2.3 3.8

Underlying profit 73.8 59.1 72.9 59.2 163.7 206.8

DAC/DIR/PVIF (13.3) (10.7) (5.9) (5.1) (12.4) (4.8)

------------- ------------ ------------- ------------ ------------- ------------

IFRS profit 60.5 48.4 67.0 54.1 151.3 202.0

============= ============ ============= ============ ============= ============

6 Months 6 Months 12 Months

Ended Ended Ended

30 June 2016 30 June 2015 31 December 2015

-------------- -------------- ------------------

Pence Pence Pence

IFRS basic earnings per share 9.3 10.4 38.9

============== ============== ==================

IFRS diluted earnings per share 9.2 10.3 38.5

============== ============== ==================

Underlying basic earnings per share 11.3 11.5 39.8

============== ============== ==================

Underlying diluted earnings per share 11.2 11.3 39.4

============== ============== ==================

Underlying cash basic earnings per share 18.1 16.5 34.6

============== ============== ==================

Underlying cash diluted earnings per share 17.9 16.3 34.2

============== ============== ==================

-20-

Underlying Profit before Shareholder Tax

The result for the six months was GBP73.8 million (30 June 2015:

GBP72.9 million). A breakdown by segment of the Underlying profit

is provided in the following table:

6 Months 6 Months 12 Months

Ended Ended Ended

30 June 2016 30 June 2015 31 December 2015

-------------- -------------- ------------------

GBP'Million GBP'Million GBP'Million

Life business 72.9 87.3 174.2

Unit Trust business 49.2 30.9 70.7

-------------- -------------- ------------------

Funds Management business 122.1 118.2 244.9

Distribution business (19.2) (23.5) (21.2)

Back-office infrastructure development (10.5) (9.1) (18.1)

Other (18.6) (12.7) (41.9)

-------------- -------------- ------------------

Underlying profit before shareholder tax 73.8 72.9 163.7

============== ============== ==================

Funds Management

The increase in profit in the period by 3% to GBP122.1 million

(30 June 2015: GBP118.2 million) principally reflects higher income

from funds under management, albeit offset by costs of reviewing

charges in two small cohorts of legacy business. The change in

split of the profit between Life and Unit Trust business reflects

an internal reallocation of overhead expenses.

Distribution Business

St. James's Place is a vertically integrated firm, allowing it

to benefit from the synergies of combining funds management with

distribution. Therefore, as well as the income generated on the

funds under management, there is a further margin from the

distribution activity, which depends principally upon the levels of

new business and expenses.

The result reflects the increase in new business, but offset by

continued investment in our recent Asia acquisition, as well as

another elevated FSCS levy of GBP17.0 million (30 June 2015:

GBP20.0 million). Excluding these effects the core Distribution

activity would have made a small loss of GBP0.5 million (30 June

2015: GBP1.6 million loss).

Back-Office Infrastructure Development

As noted on page 17, the investment during the period in the

back office development project (known as Bluedoor) was GBP10.5

million (2015: GBP9.1 million).

Other

Other operations made a negative contribution of GBP18.6 million

(30 June 2015: loss of GBP12.7 million).

The result reflects our continued investment in the business,

including the Academy costs of GBP3.5 million (30 June 2015: GBP2.5

million) and other investments in developments of GBP5.2 million

(30 June 2015: GBP3.7 million) (see Section 2 on page 17 for more

detail on these expenses).

Also reflected is the cost of expensing share options of GBP7.5

million (30 June 2015: GBP5.6 million), which includes the cost of

the new Partner share scheme launched in 2015.

-21-

DAC/DIR/PVIF

The net movement in the DAC, DIR and PVIF intangibles has a

negative contribution to profit as summarised in the table below. A

more detailed analysis is included in Notes 10 and 14 on pages 70

and 71.

6 Months Ended 6 Months Ended 12 Months Ended

30 June 2016 30 June 2015 31 December

2015

Before After Before After Before After

shareholder tax shareholder tax shareholder tax

tax tax tax

------------- ------------

GBP'Million GBP'Million GBP'Million GBP'Million GBP'Million GBP'Million

Amortisation (3.4) (2.6) 6.2 5.0 12.4 15.8

Arising on

new business (9.9) (8.1) (12.1) (10.1) (24.8) (20.6)

Movement in

year (13.3) (10.7) (5.9) (5.1) (12.4) (4.8)

============= ============ ============= ============ ============= ============

The change, year on year, in the amortisation charge stems from

the changes in adviser charging rules in 2013, which changed the

nature of certain cash flows in the Group, moving them from long

term manufacturing margins to short term advice margins.

The net impact of amortisation of the accumulated balances of

DAC and PVIF assets, and DIR liability, reduced again during the

period, turning negative for the first time. We expect it will

become more negative over the next few years before levelling out

and eventually reversing. By contrast, the new business addition

amount is expected to move in line with new business growth.

It is important to note the intangible and deferred nature of

these items, meaning that they do not reflect the operating

performance of the business. This is why we believe the Underlying

profit measure, which is adjusted from IFRS to remove these

impacts, provides a useful measure of operating performance.

Shareholder Tax

The actual tax rate in each of the periods may be impacted by

significant one-off items and events such as a change in

corporation tax rate. The table below provides a high level

analysis of shareholder tax, and a more detailed analysis is

included in Note 5 to the condensed half year financial

statements.

6 Months 6 Months 12 Months

Ended Ended Ended

30 June 2016 30 June 2015 31 December 2015

-------------- -------------- ------------------

GBP'Million GBP'Million GBP'Million

Expected shareholder tax (11.7) (12.7) (29.2)

Recognition of capital losses 1.5 - 74.8

Other tax adjustments (1.9) (0.2) 0.6

Corporation tax rate change - - 4.5

Actual shareholder tax (12.1) (12.9) 50.7

============== ============== ==================

Expected shareholder tax rate 19.3% 19.0% 19.3%

-------------- -------------- ------------------

Actual shareholder tax rate 20.0% 19.3% (33.5%)

-------------- -------------- ------------------

-22-

The expected shareholder tax principally reflects the current UK

corporation tax and overseas rates applicable and will vary from

year to year depending upon the emergence of profit between the

different tax regimes which apply to the St. James's Place Group

companies.

There has been a small reassessment in the value of capital

losses of GBP1.5 million in the period (30 June 2015: GBPnil) and

the combined negative impact of a number of other small tax

adjustments was GBP1.9 million (30 June 2015: GBP0.2 million).

The overall impact of these effects was to decrease the tax

charge on an IFRS basis to GBP12.1 million at 30 June 2016 (30 June

2015: GBP12.9 million).

In the Budget of 18 March 2016, the Chancellor announced a

future tax reduction to 17% from 18% effective from 1 April 2020.

We estimate that this reduction in rate will reduce our net

deferred tax asset by around GBP1 million. This will be recognised

when the change in rate is substantively enacted.

IFRS Profit

Analysis of the IFRS profit before tax, Profit before

shareholder tax and IFRS profit after tax is presented in the table

below, which also shows the impact of the tax incurred on behalf of

policyholders:

6 Months 6 Months 12 Months

Ended Ended Ended

30 June 2016 30 June 2015 31 December 2015

-------------- -------------- ------------------

GBP'Million GBP'Million GBP'Million

IFRS profit before tax 97.0 103.7 174.1

Policyholder tax (36.5) (36.7) (22.8)

--------------

Profit before shareholder tax 60.5 67.0 151.3

Shareholder tax (12.1) (12.9) 50.7

-------------- -------------- ------------------

IFRS profit after tax 48.4 54.1 202.0

============== ============== ==================

The Profit before shareholder tax for the six months was GBP60.5

million (30 June 2015: GBP67.0 million). The impact of the negative

contribution from the net movement in DAC/DIR/PVIF intangibles was

a major contributor to the lower Profit before shareholder tax

result in the current period.

Both the IFRS profit before tax and the IFRS profit after tax

results reduced between the two periods, reflecting the same

drivers underlying the reduction in Profit before shareholder tax.

The lower level of profit also resulted in a small reduction in the

level of Shareholder tax. As noted elsewhere, the level of

Policyholder tax is unrelated to the performance of the business

and more related to investment performance, but nevertheless the

charges were also similar in each year.

-23-

Analysis of IFRS Assets and Net Assets per Share

The table below provides a summarised breakdown of the IFRS

position at the reporting dates:

6 Months 6 Months 12 Months

Ended Ended Ended

30 June 2016 30 June 2015 31 December 2015

-------------- -------------- ------------------

GBP'Million GBP'Million GBP'Million

Purchased value of in-force* 26.1 28.2 27.4

Deferred acquisition costs* 603.3 643.4 627.2

Deferred income* (353.0) (383.6) (368.3)

Other IFRS net assets 11.8 2.7 7.7

Solvency II net assets 772.3 700.1 801.1

-------------- -------------- ------------------

Total IFRS net assets 1,060.5 990.8 1,095.1

============== ============== ==================

* net of deferred tax

6 Months 6 Months 12 Months

Ended Ended Ended

30 June 2016 30 June 2015 31 December 2015

-------------- -------------- ------------------

Pence Pence Pence

Net asset value per share 201.2 189.3 208.7

============== ============== ==================

-24-

SECTION 4: CASH RESULT, SOLVENCY AND LIQUIDITY

The Cash and Underlying cash results should not be confused with

the IFRS cash flow statement which is prepared in accordance with

IAS 7 and disclosed on page 54.

This section now brings together our reporting on the Cash

result, Solvency II net assets, and our solvency in line with the

approach we outlined at the year end. Following the introduction of

Solvency II at the start of 2016, the Cash result has been adjusted

to remove the impact of Solvency I reserves, and now reflects the

movement in the Solvency II net assets during the period adjusted

for movements in non-cash items (see page 31). The Cash result for

the prior year reflected the Solvency I reserves as that was the

regulatory regime at the time.

The Cash result and Underlying cash result are the principal

measures the Board considers when determining the dividend payment

to shareholders. The Board starts by considering the Underlying

cash result, which reflects the impact of the primary drivers of

the business (being FUM and expenses as described in Sections 1 and

2). This can be derived from the Underlying profit measure by

adjusting tax to reflect a normalised level of current tax,

allowing for insurance provisions on an IFRS basis, and allowing

for share option costs. The strategic investment in our back office

infrastructure is also excluded when considering the Underlying

cash result, but is included in the Cash result, which also

reflects actual tax settlements.

The Cash result and Underlying cash result, which are presented

after tax, are a combination of the cash emerging from the business

in force at the start of the year, less the investment made to

acquire new business during the year. The tables and commentary

below provide an indicative analysis of the Cash result into these

two elements.

-25-

Six Months Ended 30 June 2016

Note In-Force New Business Total

------- ------------ ------------- ------------

GBP'Million GBP'Million GBP'Million

Operational

Net annual management fee 1 226.1 9.6 235.7

Reduction in fees in gestation period 1 (81.2) (5.7) (86.9)

------------ ------------- ------------

Net income from funds under management 1 144.9 3.9 148.8

Margin arising from new business 2 - 20.5 20.5

Establishment expenses 3 (6.0) (54.1) (60.1)

Operational development expenses 3 - (5.6) (5.6)

Regulatory fees 3 (0.3) (2.7) (3.0)

FSCS levy 3 (1.3) (12.3) (13.6)

Shareholder interest 4 4.7 - 4.7

Tax relief from capital losses 5 7.0 - 7.0

Miscellaneous 6 4.4 - 4.4

------------ ------------- ------------

Operating cash result 153.4 (50.3) 103.1

Investment

Academy 7 - (2.8) (2.8)

Asia 7 - (3.2) (3.2)

DFM 7 - (1.2) (1.2)

Strategic development costs 7 - (1.5) (1.5)

Underlying cash result 153.4 (59.0) 94.4

Back-office infrastructure development 8 (8.4)

Variance 9 (3.5)

Cash result 82.5

============

-26-

Six Months Ended 30 June 2015

Note In-Force New Business Total

------- ------------ ------------- ------------

GBP'Million GBP'Million GBP'Million

Operational

Net annual management fee 1 206.6 8.6 215.2

Reduction in fees in gestation period 1 (75.4) (4.8) (80.2)

------------ ------------- ------------

Net income from funds under management 1 131.2 3.8 135.0

Margin arising from new business 2 - 20.5 20.5

Establishment expenses 3 (5.4) (49.3) (54.7)

Operational development expenses 3 - (5.8) (5.8)

Regulatory fees 3 (0.2) (2.4) (2.6)

FSCS levy 3 (1.6) (14.3) (15.9)

Shareholder interest 4 3.7 - 3.7

Tax relief from capital losses 5 8.3 - 8.3

Miscellaneous 6 1.6 - 1.6

------------ ------------- ------------

Operating cash result 137.6 (47.5) 90.1

Investment

Academy 7 - (2.0) (2.0)

Asia 7 - (2.3) (2.3)

Strategic development costs 7 - (0.9) (0.9)

Underlying cash result 137.6 (52.7) 84.9

Back-office infrastructure development 8 (7.3)

Variance 9 4.2

Cash result 81.8

============

-27-

Year Ended 31 December 2015 Note In-Force New Business Total

----- ------------ ------------- ------------

GBP'Million GBP'Million GBP'Million

Operational

Net annual management fee 1 406.7 33.5 440.2

Reduction in fees in gestation period 1 (143.1) (18.5) (161.6)

------------ ------------- ------------

Net income from funds under management 1 263.6 15.0 278.6

Margin arising from new business 2 - 47.8 47.8

Establishment expenses 3 (11.1) (100.2) (111.3)

Operational development expenses 3 - (13.8) (13.8)

Regulatory fees 3 (0.6) (5.2) (5.8)

FSCS levy 3 (1.6) (14.3) (15.9)

Shareholder interest 4 8.6 - 8.6

Tax relief from capital losses 5 12.1 - 12.1

Miscellaneous 6 (4.7) - (4.7)

------------ ------------- ------------

Operating cash result 266.3 (70.7) 195.6

Investment

Academy 7 - (4.4) (4.4)

Asia 7 - (6.3) (6.3)

DFM 7 - (1.3) (1.3)

Strategic development costs 7 - (1.5) (1.5)

Underlying cash result 266.3 (84.2) 182.1

Back-office infrastructure development 8 (14.4)

Variance 9 3.8

Cash result 171.5

============

-28-

Notes

All numbers are expressed after tax at the prevailing tax rate

for each year.

1. The Net annual management fee is the manufacturing margin the

Group retains from the funds under management after payment of the

associated costs (e.g. investment advisory fees and Partner

remuneration). Broadly speaking the Group receives an average Net

annual management fee rate of 0.77% (post tax) of funds under

management (2015: 0.77% (post tax)).

However, as noted in Section 1 on page 15, due to our product

structure, investment and pension business does not generate cash

in the first six years (known as the 'gestation' period). This is

reflected in an adjustment which is the Reduction in fees in

gestation period.

The overall result is the Net income from funds under

management, which was some 10% higher than the same period in 2015,

reflecting the higher average funds under management in the

period.

2. Margin arising from new business: This is the cash impact of

new business in the year, reflecting growth in new business,

production related expenses and mix of business. The movement year

on year will reflect growth in gross inflows, but also mix of

business.

3. Expenses: These reflect the expenses of running the Group and

more detail is provided in the table on page 17. In line with the

rest of this table they are presented after allowance for tax.

4. Shareholder interest arising from regulated and non-regulated

business: This is the assumed income accruing on the investments

and cash held for regulatory purposes together with the interest

received on the surplus capital held by the Group.

5. Utilisation of capital losses: In recent years, a deferred

tax asset has been established for historic capital losses which

are now regarded as being capable of utilisation over the medium

term.

Utilisation in the period was slightly ahead of our expected

level of GBP4-5 million for a six month period.

6. Miscellaneous: This represents the cash flow of the business

not covered in any of the other categories, including ongoing

administration expenses and the associated policy charges, together

with utilisation of the deferred tax asset in respect of prior

year's unrelieved expenses (due to structural timing differences in

the life company tax computation).

7. Investment: The result for each of these initiatives reflects

the operational expenses to support growth, but offset by any

non-SJP fees not reflected elsewhere in the analysis, and is

presented after allowance for tax.

8. Back-office infrastructure development: These costs relate to

a major project seeking to combine our back offices under one

management team and to put in place one unified, client centric

administration system, enabling them to deliver improved service

and improved efficiency for the business.

9. Variance: This reflects variances in the settlement of tax

related liabilities between the policyholders (unit-linked funds),

the shareholder and HMRC; the GBP6.6 million negative one-off cost

of reviewing charges in two small cohorts of legacy business; and a

number of other small positive and negative one-off items.

-29-

Solvency

St. James's Place is a relatively simple Wealth Management group

offering mainly investment products. Our strategy is to attract and

administer retail funds under management, from which we receive an

annual management fee; we are a fee-based business. Our clients can

access their investments on demand but, because we match the

encashment value on the unit-linked business, movements in equity

markets, interest rates, mortality, morbidity, longevity and

currency rates have little impact on our ability to meet

liabilities (although they can affect emergence of profit). We also

have a prudent capital management approach and invest surplus

assets in cash, AAA rated money-market funds and UK government

securities. The overall effect is assurance that we can meet

liabilities, and a resilient solvency position that is dependable

even through adverse market conditions.

We manage solvency of our business on the basis of holding

assets in excess of the client unit-linked liabilities. This

ensures we are able to meet client liabilities at all times, but

also allows for a prudent Management solvency buffer (MSB) as

protection against other risks. We have assessed the MSB for our

Life business as GBP150 million, having taking into account a wide

range of factors and information, not least the results from stress

and scenario testing carried out as part of our annual ORSA (Own

Risk and Solvency Assessment). We will also continue to hold

capital within the Group in respect of the other regulated (but

non-insurance) companies, based on at least 150% of the regulatory

requirement.

30 June 2016 Other

Life Regulated Other Total

------------ ------------ ------------ ------------

GBP'Million GBP'Million GBP'Million GBP'Million

Solvency II net assets 466.4 106.1 199.8 772.3

Proposed interim 2016 dividend (65.0) (65.0)

Solvency II net assets after dividend 466.4 106.1 134.8 707.3

------------ ------------ ------------ ------------

Management Solvency Buffer (MSB) 150.0 64.6 214.6

Management solvency ratio 311% 164% 330%

Solvency II net assets reflects the assets of the Group in

excess of those assets matching the client's (unit--linked)

liabilities. It includes a GBP168.3 million deferred tax asset

which is not immediately fungible, although we expect it will be

utilised over the next ten years. The actual rate of utilisation

will depend on business growth and external factors, particularly

investment market conditions.

-30-

Solvency II Net Assets

In addition to presenting an IFRS balance sheet (on page 53) and

an EEV balance sheet (on page 41), we believe it is beneficial to

provide a balance sheet reflecting our approach to managing

solvency based on Solvency II net assets. This is based on the IFRS

balance sheet, but with adjustments made to accounting assets and

liabilities to reflect the Solvency II regulations. Provision for

insurance liabilities is set equal to the associated unit

liabilities. The following table presents the balance sheet netting

out the policyholder interest in unit-linked assets and liabilities

and adjusting for changes required by the Solvency II valuation

regulations.

Solvency II Net Assets

Balance Sheet

30 June 2016 Solvency II

IFRS Net Assets 30 June 31 December

Balance Sheet Adj 1 Adj 2 Balance Sheet 2015 2015

-------------------------- --------------- ------------ ------------ --------------- ------------ ------------

GBP'Million GBP'Million GBP'Million GBP'Million GBP'Million GBP'Million

Assets

Goodwill 21.2 (21.2) - - -

Deferred acquisition

costs 713.2 (713.2) - - -

Acquired value of

in-force business 32.0 (32.0) - - -

Developments 3.1 (3.1) - - -

Property and equipment 8.9 8.9 6.4 8.0

Deferred tax assets 212.7 (44.4) 168.3 112.1 179.2

Investment property 1,345.9 (1,345.9) - - -

Equities 40,747.1 (40,747.1) - - -

Fixed income securities 10,558.1 (10,501.2) 56.9 82.5 83.1

Investment in Collective

Investment Schemes 3,520.9 (2,997.6) 523.3 603.3 531.0

Derivative financial

instruments 706.1 (706.1) - - -

Reinsurance assets 93.5 (84.8) 8.7 8.5 8.6

Insurance & investment

contract receivables 74.9 74.9 92.9 76.2

Other receivables 1,453.5 (935.1) (0.8) 517.6 380.1 415.3

Cash & cash equivalents 6,412.1 (6,150.1) 262.0 315.1 233.5

--------------- ------------ ------------ --------------- ------------ ------------

Total assets 65,903.2 (63,383.1) (899.5) 1,620.6 1,600.9 1,534.9

--------------- ------------ ------------ --------------- ------------ ------------

Liabilities

Insurance contract

liabilities 488.1 (384.3) (86.5) 17.3 16.7 10.0

Other provisions 16.4 16.4 11.9 15.4

Investment contracts 46,605.2 (46,547.8) 57.4 57.3 44.3

Borrowings 181.8 181.8 82.1 181.8

Derivative financial

instruments 847.7 (847.7) - - -

Deferred tax liabilities 407.5 (66.1) (128.7) 212.7 227.1 206.2

Insurance & investment

contract payables 65.5 65.5 50.3 45.9

Deferred income 396.1 (396.1) - - -

Income tax liabilities 50.4 50.4 69.5 29.6

Other payables 1,040.4 (793.7) 246.7 385.8 200.5

NAV attributable to unit

holders 14,743.5 (14,743.5) - - -

Preference shares 0.1 0.1 0.1 0.1

--------------- ------------ ------------ --------------- ------------ ------------

Total liabilities 64,842.7 (63,383.1) (611.3) 848.3 900.8 733.8

Net assets 1,060.5 - (288.2) 772.3 700.1 801.1

=============== ============ ============ =============== ============ ============

Adjustments

1. Nets out the policyholder interest in unit-linked assets and liabilities

2. Adjustments to the IFRS balance sheet in line with Solvency

II requirements, including removal of DAC, DIR, PVIF and deferred

tax

-31-

The movement in the Solvency II net assets is equal to the Cash

result adjusted for changes in non-cash items such as deferred tax

assets and goodwill as well as changes in equity such as dividends

paid in the year (see page 52 - Consolidated Statement of Changes

in Equity).

6 Months 6 Months 12 Months

Ended Ended Ended

30 June 2016 30 June 2015 31 December 2015*

-------------- -------------- -------------------

GBP'Million GBP'Million GBP'Million

Opening Solvency II Net Assets 801.1 708.7 708.7

Dividend paid in period (90.4) (74.8) (130.8)

Issue of share capital and exercise of options 5.4 6.4 11.8

Consideration paid for own shares (5.5) (10.0) (12.8)

Change in deferred tax (10.9) (15.3) 52.7

Change in goodwill, and other Solvency II adjustments (9.9) 3.3 -

Cash result 82.5 81.8 171.5

-------------- -------------- -------------------

Closing Solvency II Net Assets 772.3 700.1 801.1

============== ============== ===================

* The Solvency II net assets disclosed at 31 December 2015 were

adjusted for submission to the regulator.

Solvency II Balance Sheet

Whilst we focus on Solvency II net assets and the MSB to manage

solvency, we provide additional information about the Solvency II

free asset position for information. The presentation starts from

the same Solvency II net assets, but includes recognition of an

asset in respect of the expected Value of In-Force cashflows (VIF)

and a Risk Margin (RM) reflecting the cost to secure the transfer

of the business to a third party, if required. The Solvency II net

assets, VIF and RM comprise the 'Own Funds', which is assessed

against a Solvency Capital Requirement (SCR), reflecting the

capital required to protect against a range of 1 in 200 stresses.

The SCR is calculated on the Standard Formula approach. No

allowance has been made for Transitional Provisions in the

calculation of Technical provisions or SCR.

An analysis of the Solvency II position for our Group, split by

regulated and non-regulated entities at the period end is presented

in the table below:

Other

30 June 2016 Life Regulated Other Total

------------ ------------ ------------ ------------

GBP'Million GBP'Million GBP'Million GBP'Million

Solvency II net assets after dividend 466.4 106.1 134.8 707.3

Value of in-force (VIF) (estimated) 2,499.3 - - 2,499.3

Risk Margin (estimated) (679.2) - - (679.2)

Own Funds (A) (estimated) 2,286.5 106.1 134.8 2,527.4

------------ ------------ ------------ ------------

Solvency capital requirement (B) (estimated) (1,643.8) (32.3) (1,676.1)

Solvency II free assets (estimated) 642.7 73.8 134.8 851.3

------------ ------------ ------------ ------------

Solvency ratio (A/B) (estimated) 151%

------------

The solvency ratio before taking account of the final dividend

is 155% at the period end.

-32-

Liquidity

As noted above, our investment policy is always to hold assets

to match unit-linked liabilities, and to hold any excess in assets

that are liquid and high credit quality. An analysis of the liquid

asset holdings is provided below:

Holding Name GBP'Million GBP'Million

Government bonds

5.8% UK Treasury 26/07/2016 11.3

4% UK Treasury 07/09/2016 41.4

3.75% Singapore Government Bonds 01/09/2016 4.2 56.9

------------

AAA rated money market funds

BlackRock 94.4

Goldman Sachs 74.6

HSBC 74.1

Insight 80.5

JP Morgan 62.6

Legal & General 70.8

Royal Bank of Scotland 5.0

Scottish Widows 61.3 523.3

Bank balances

Bank of Scotland 29.6

Barclays 80.8

HSBC 48.8

Lloyds TSB 38.1

NatWest 3.9

RBS 2.4

Santander 25.9

Metro 23.5

Others 9.0 262.0

------------

Total 842.2

============

In the normal course of business, the Company is expected to

generate regular, positive cashflow from annual management income

exceeding expenses. As noted previously, future growth in cashflow

is driven by new business, but in the short term growth will