TIDMSTAN

RNS Number : 2064C

Standard Chartered PLC

06 February 2020

Accounting policy changes & UK bank levy guidance

Changes to selected accounting policies

Standard Chartered PLC (the Group) has reviewed its accounting

policies and is making the changes set out below. These will be

reflected in the full-year 2019 disclosures, to be published on 27

February 2020, along with prior period comparatives changed to

align with the new disclosures.

1. Net interest income and the calculation of net interest margin

The Group has changed its accounting policy for net interest

income and net trading income (a component of 'other income' in the

table below) to better reflect the underlying performance of its

banking book. There is no change in total income, only a

reclassification between net interest income and net trading income

on the face of the income statement.

The revised accounting policy will result in the Group

recognising all gains and losses from the trading book within

trading income. As before, interest income and expense from the

banking book positions will still be presented in net interest

income. The instruments moving out of average interest earning

assets include reverse repurchase agreements, bonds and loans.

These instruments are held to service client demand and

risk-managed on a mark-to-market basis.

With the reclassification of the components of gross income, it

is necessary to adjust the interest expense included in the net

interest margin calculation to remove funding costs for the trading

book. As with the change in classification of net interest income,

the new basis of preparation for the presentation of the Group's

net interest margin will better reflect the underlying performance

of the banking book.

The tables below show the Group's previously reported net

interest margin and the net interest margin under the revised

accounting policy and new basis of preparation:

As reported

On a statutory basis

$ millions FY 2018 1Q'19 2Q'19 3Q'19

Net interest income 8,793 2,256 2,362 2,369

Other income(1) 5,996 1,662 1,550 1,589

--------- -------- -------- --------

Statutory operating

income 14,789 3,918 3,912 3,958

Average interest earning

assets 558,135 585,408 584,135 602,798

Net interest margin

(%)(2) 1.58 1.56 1.62 1.56

Memorandum: on an underlying basis

$ millions FY 2018 1Q'19 2Q'19 3Q'19

Net interest income 8,840 2,272 2,371 2,385

Other income(1) 6,128 1,541 1,512 1,593

--------- ------ ------ ------

Underlying operating

income 14,968 3,813 3,883 3,978

As restated

On a statutory basis

$ millions FY2018 1Q'19 2Q'19 3Q'19

Net interest income 7,796 1,905 1,933 1,922

Other income(1) 6,993 2,013 1,979 2,036

--------- -------- --------- ---------------

Statutory operating

income 14,789 3,918 3,912 3,958

Net interest income

excluding funding costs

for FVTPL portfolio 8,033 1,993 2,011 2,025

Average interest earning

assets 476,114 487,424 484,066 499,260

Net interest margin

(%)(2) 1.69 1.66 1.67 1.61

Memorandum: on an underlying basis

$ millions FY 2018 1Q'19 2Q'19 3Q'19

Net interest income 7,840 1,920 1,942 1,937

Other income(1) 7,128 1,893 1,941 2,041

--------- -------- --------- ---------------

Underlying operating

income 14,968 3,813 3,883 3,978

1 Other income is made up of net trading income, net fees and

commissions, and other operating income. In 2018, net trading

income was c.40% of other income

2 Net interest margin is annualised net interest income (or net

interest income, excluding funding costs for the FVTPL portfolio)

divided by average interest earning assets

2. Change in recognition of interest in suspense with regard to Stage 3 assets

Historically, the Group recorded Stage 3 loans at their book

value at the time of reclassification to Stage 3. No further

interest was accrued after reclassification.

Following a clarification issued by the International Financial

Reporting Interpretations Committee in March 2019, the Group is

changing its accounting policy to report interest in suspense for

stage 3 exposures.

Under the revised policy, interest will continue to accrue on

Stage 3 loans together with an equivalent increase in impairment

provisions. This change will have no effect on total profit. The

interest income and impairment are netted together for income

statement reporting purposes. This has been the case historically

and will remain the case going forward.

However, the increase in historical impairment provisions will

result in gross stage 3 assets increasing by approximately a fifth

under the new accounting policy. Net stage 3 assets remain

unchanged as the increase in gross stage 3 assets is offset by an

increase in provisions.

If there are ultimately any recoveries on Stage 3 loans, any

recoveries will now be recognised within the credit impairment line

whereas previously the Group's approach was to recognise residual

amounts in excess of credit provisions within interest income.

There will be no material net impact on the balance sheet or

income statement.

Stage 3 cover ratios have increased as the interest in suspense

is fully provided.

The tables below show the Group's previously reported credit

risk disclosures and the effect of their restatement:

As reported

$ millions 31.12.18

------------- -----------

Gross stage 3 assets 6,924

Stage 3 provisions (4,056)

-----------

Net stage 3 assets 2,868

-----------

Cover ratio of stage 3

before collateral(3) 59%

Cover ratio of stage 3

after collateral(4) 81%

As restated

$ millions 31.12.18

---------

Gross stage 3 assets 8,454

Stage 3 provisions (5,586)

---------

Net stage 3 assets 2,868

---------

Cover ratio of stage 3

before collateral(3) 66%

Cover ratio of stage 3

after collateral(4) 85%

3 The ratio of stage 3 provisions compared to stage 3 gross assets

4 The ratio of stage 3 provisions and realisable value of

collateral held against these assets compared to stage 3 gross

assets

3. Income re-allocation due to internal reorganisation of the

Corporate Finance and Lending & Portfolio Management business

lines

The Group is also reclassifying income by product following an

internal reorganisation of the Corporate Finance and Lending &

Portfolio Management business lines. There is no change to total

income, income by region or income by segment.

All simple lending-related businesses are now managed by

coverage bankers within the Lending & Portfolio Management team

while more complex event-driven transactions and transactions

requiring specialist structuring knowledge remain managed within

the Corporate Finance team.

The tables below show what the Group's previously reported

income in these related product lines would have been on the new

organisational basis:

As reported

$ millions FY 2018 1Q'19 2Q'19 3Q'19

Corporate Finance 1,423 321 330 340

Lending 518 129 140 145

--------- -------- -------- ---------

Sub-total 1,941 450 470 485

As restated

$ millions FY 2018 1Q'19 2Q'19 3Q'19

Corporate Finance 1,186 262 272 281

Lending 755 188 198 204

--------- ------ ------ ------

Sub-total 1,941 450 470 485

4. Updated guidance on UK bank levy

The Group's current expectation is that the UK bank levy for

2019 will be around $347 million (2018: $324 million). The levy

applies to certain UK banks and the UK operations of foreign banks,

and is payable each year based on a percentage of the chargeable

equities and liabilities on the Group's consolidated balance sheet

date.

For further information, please contact:

Mark Stride

Global Head, Investor Relations

+44 (0)20 7885 8596

mark.stride@sc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCUPUUAPUPUGUQ

(END) Dow Jones Newswires

February 06, 2020 05:54 ET (10:54 GMT)

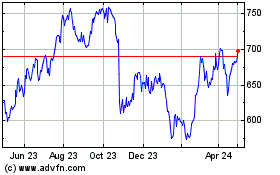

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

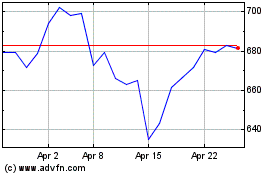

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024