TIDMSN.

RNS Number : 7943T

Smith & Nephew Plc

25 March 2019

Re-presented Historical Quarterly Revenue Analysis

25 March 2019

Smith & Nephew plc (LSE:SN, NYSE:SNN) has updated its

revenue reporting in line with its previously announced new

commercial structure.

From 1 January 2019 the Group will report quarterly revenue for

three global franchises of Orthopaedics, Sports Medicine & ENT,

and Advanced Wound Management, replacing the previous franchise

structure. The Group's revenue reporting by geography is

unchanged.

Included within Orthopaedics are the following businesses:

-- Knee Implants

-- Hip Implants

-- Other Reconstruction, including capital sales from robotics

and cement (Other Reconstruction was previously reported within

Other Surgical Businesses)

-- Trauma (including certain extremities products)

Included within Sports Medicine & ENT are the following

businesses:

-- Sports Medicine Joint Repair (including certain extremities

products for joint repair previously reported within Trauma &

Extremities)

-- Arthroscopic Enabling Technologies

-- ENT (ENT was previously reported within Other Surgical Businesses)

Advanced Wound Management is unchanged, and includes the

following businesses:

-- Advanced Wound Care

-- Advanced Wound Bioactives

-- Advanced Wound Devices

Reporting by geography is unchanged, as follows:

-- US

-- Other Established Markets (Australia, Canada, Europe, Japan and New Zealand)

-- Emerging Markets

The updated reporting approach is in line with International

Financial Reporting Standard (IFRS) 8 Operating Segments that

require companies' segment reporting to reflect the way in which

performance is monitored, operating decisions are made and

resources are allocated.

In order to assist future comparability with historical data,

Smith & Nephew has set out below quarterly and full year

revenue under the new structure for 2018 and 2017. There has been

no change in total revenue for any period presented.

Enquiries

Investors

Andrew Swift, Smith & Nephew +44 (0) 20 7960 2285

Media

Charles Reynolds, Smith & Nephew +44 (0) 1923 477314

Ben Atwell / Andrew Ward, FTI Consulting +44 (0) 20 3727 1000

Notes

Unless otherwise specified as 'reported' all revenue growth

throughout this document is 'underlying' after adjusting for the

effects of currency translation and including the comparative

impact of acquisitions and excluding disposals. All percentages

compare to the equivalent 2017 period.

Underlying revenue growth is used to compare the revenue in a

given period to the comparative period on a like-for-like basis.

Underlying revenue growth reconciles to reported revenue growth,

the most directly comparable financial measure calculated in

accordance with IFRS, by making adjustments for the effect of

acquisitions and disposals and the impact of movements in exchange

rates (currency impact), as described below.

The effect of acquisitions and disposals measures the impact on

revenue from newly acquired business combinations and recent

business disposals. This is calculated by comparing the current

year, constant currency actual revenue (which include acquisitions

and exclude disposals from the relevant date of completion) with

prior year, constant currency actual revenue, adjusted to include

the results of acquisitions and exclude disposals for the

commensurate period in the prior year.

The 'constant currency exchange effect' is a measure of the

increase/decrease in revenue resulting from currency movements on

non-US Dollar sales and is measured as the difference between: 1)

the increase/decrease in the current year revenue translated into

US Dollars at the current year average exchange rate and the prior

revenue translated at the prior year rate; and 2) the

increase/decrease being measured by translating current and prior

year revenues into US Dollars using the prior year closing

rate.

About Smith & Nephew

Smith & Nephew is a portfolio medical technology business

with leadership positions in Orthopaedics, Advanced Wound

Management and Sports Medicine. Smith & Nephew has more than

16,000 employees and a presence in more than 100 countries. Annual

sales in 2018 were $4.9 billion. Smith & Nephew is a member of

the FTSE100 (LSE:SN, NYSE:SNN). For more information about Smith

& Nephew, please visit our corporate website

www.smith-nephew.com and follow us on Twitter, LinkedIn or

Facebook.

Forward-looking Statements

This document may contain forward-looking statements that may or

may not prove accurate. For example, statements regarding expected

revenue growth and trading margins, market trends and our product

pipeline are forward-looking statements. Phrases such as "aim",

"plan", "intend", "anticipate", "well-placed", "believe",

"estimate", "expect", "target", "consider" and similar expressions

are generally intended to identify forward-looking statements.

Forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause actual

results to differ materially from what is expressed or implied by

the statements. For Smith & Nephew, these factors include:

economic and financial conditions in the markets we serve,

especially those affecting health care providers, payers and

customers; price levels for established and innovative medical

devices; developments in medical technology; regulatory approvals,

reimbursement decisions or other government actions; product

defects or recalls or other problems with quality management

systems or failure to comply with related regulations; litigation

relating to patent or other claims; legal compliance risks and

related investigative, remedial or enforcement actions; disruption

to our supply chain or operations or those of our suppliers;

competition for qualified personnel; strategic actions, including

acquisitions and dispositions, our success in performing due

diligence, valuing and integrating acquired businesses; disruption

that may result from transactions or other changes we make in our

business plans or organisation to adapt to market developments; and

numerous other matters that affect us or our markets, including

those of a political, economic, business, competitive or

reputational nature. Please refer to the documents that Smith &

Nephew has filed with the U.S. Securities and Exchange Commission

under the U.S. Securities Exchange Act of 1934, as amended,

including Smith & Nephew's most recent annual report on Form

20-F, for a discussion of certain of these factors. Any

forward-looking statement is based on information available to

Smith & Nephew as of the date of the statement. All written or

oral forward-looking statements attributable to Smith & Nephew

are qualified by this caution. Smith & Nephew does not

undertake any obligation to update or revise any forward-looking

statement to reflect any change in circumstances or in Smith &

Nephew's expectations.

Trademark of Smith & Nephew. Certain marks registered US

Patent and Trademark Office.

Smith & Nephew Re-presented 2018 Results

First Quarter 2018 Consolidated Re-presented Revenue

Analysis

31 March 1 April Reported Underlying Acquisitions Currency

2018 2017 growth Growth(i) /disposals impact

Consolidated revenue by franchise $m $m % % % %

------------------------------------- -------- ------- -------- ---------- ------------ --------

Orthopaedics 544 522 4 - - 4

-------------------------------------- -------- ------- -------- ---------- ------------ --------

Knee Implants 259 244 6 2 - 4

Hip Implants 155 152 2 -2 - 4

Other Reconstruction 13 10 34 30 - 4

Trauma 117 116 1 -2 - 3

Sports Medicine & ENT 362 340 6 1 1 4

-------------------------------------- -------- ------- -------- ---------- ------------ --------

Sports Medicine Joint Repair 175 155 12 5 2 5

Arthroscopic Enabling Technologies 152 153 - -5 - 5

ENT 35 32 9 6 - 3

Advanced Wound Management 290 280 4 -2 - 6

-------------------------------------- -------- ------- -------- ---------- ------------ --------

Advanced Wound Care 183 170 8 - - 8

Advanced Wound Bioactives 59 66 -11 -12 - 1

Advanced Wound Devices 48 44 10 2 - 8

Total 1,196 1,142 5 - - 5

-------------------------------------- -------- ------- -------- ---------- ------------ --------

Consolidated revenue by geography

------------------------------------- -------- ------- -------- ---------- ------------ --------

US 545 555 -2 -2 - -

Other Established Markets(ii) 446 409 9 -2 - 11

Total Established Markets 991 964 3 -2 - 5

Emerging Markets 205 178 15 9 - 6

Total 1,196 1,142 5 - - 5

-------------------------------------- -------- ------- -------- ---------- ------------ --------

(i) Underlying growth is defined in the Notes on page 2

(ii) Other Established Markets are Australia, Canada, Europe, Japan and New Zealand

Second Quarter 2018 Consolidated Re-presented Revenue

Analysis

30 June 1 July Reported Underlying Acquisitions Currency

2018 2017 growth Growth(i) /disposals impact

Consolidated revenue by franchise $m $m % % % %

------------------------------------- ------- ------ -------- ---------- ------------ --------

Orthopaedics 548 531 3 1 - 2

-------------------------------------- ------- ------ -------- ---------- ------------ --------

Knee Implants 258 246 5 3 - 2

Hip Implants 156 150 4 1 - 3

Other Reconstruction 16 13 28 27 - 1

Trauma 118 122 -4 -5 - 1

Sports Medicine & ENT 368 345 7 3 2 2

-------------------------------------- ------- ------ -------- ---------- ------------ --------

Sports Medicine Joint Repair 177 159 12 7 3 2

Arthroscopic Enabling Technologies 153 151 1 -1 - 2

ENT 38 35 7 5 - 2

Advanced Wound Management 329 318 4 1 - 3

-------------------------------------- ------- ------ -------- ---------- ------------ --------

Advanced Wound Care 187 177 6 2 - 4

Advanced Wound Bioactives 87 92 -5 -6 - 1

Advanced Wound Devices 55 49 12 9 - 3

Total 1,245 1,194 4 2 - 2

-------------------------------------- ------- ------ -------- ---------- ------------ --------

Consolidated revenue by geography

------------------------------------- ------- ------ -------- ---------- ------------ --------

US 590 582 1 1 - -

Other Established Markets(ii) 429 403 6 1 - 5

Total Established Markets 1,019 985 3 1 - 2

Emerging Markets 226 209 8 6 - 2

Total 1,245 1,194 4 2 - 2

-------------------------------------- ------- ------ -------- ---------- ------------ --------

(i) Underlying growth is defined in the Notes on page 2

(ii) Other Established Markets are Australia, Canada, Europe, Japan and New Zealand

Third Quarter 2018 Consolidated Re-presented Revenue

Analysis

29 September 30 September Reported Underlying Acquisitions Currency

2018 2017 growth Growth(i) /disposals impact

Consolidated revenue by

franchise $m $m % % % %

----------------------------- ------------ ------------ -------- ---------- ------------ --------

Orthopaedics 505 494 2 5 - -3

------------------------------ ------------ ------------ -------- ---------- ------------ --------

Knee Implants 232 228 1 4 - -3

Hip Implants 142 140 2 4 - -2

Other Reconstruction 13 10 37 43 - -6

Trauma 118 116 2 3 - -1

Sports Medicine & ENT 345 336 3 3 2 -2

------------------------------ ------------ ------------ -------- ---------- ------------ --------

Sports Medicine Joint Repair 171 157 9 8 3 -2

Arthroscopic Enabling

Technologies 138 144 -4 -2 - -2

ENT 36 35 3 5 - -2

Advanced Wound Management 319 322 -1 1 - -2

------------------------------ ------------ ------------ -------- ---------- ------------ --------

Advanced Wound Care 184 186 -1 1 - -2

Advanced Wound Bioactives 81 86 -7 -7 - -

Advanced Wound Devices 54 50 9 11 - -2

Total 1,169 1,152 2 3 - -1

------------------------------ ------------ ------------ -------- ---------- ------------ --------

Consolidated revenue by

geography

------------------------------ ------------ ------------ -------- ---------- ------------ --------

US 569 545 4 4 - -

Other Established

Markets(ii) 393 407 -3 -1 - -2

Total Established Markets 962 952 1 2 - -1

Emerging Markets 207 200 4 10 - -6

Total 1,169 1,152 2 3 - -1

------------------------------ ------------ ------------ -------- ---------- ------------ --------

(i) Underlying growth is defined in the Notes on page 2

(ii) Other Established Markets are Australia, Canada, Europe, Japan and New Zealand

Fourth Quarter 2018 Consolidated Re-presented Revenue

Analysis

31 December 31 December Reported Underlying Acquisitions Currency

2018 2017 growth Growth(i) /disposals impact

Consolidated revenue by

franchise $m $m % % % %

--------------------------------- ----------- ----------- -------- ---------- ------------ --------

Orthopaedics 571 560 2 4 - -2

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

Knee Implants 269 266 1 3 - -2

Hip Implants 160 157 2 4 - -2

Other Reconstruction 19 13 43 45 - -2

Trauma 123 124 -1 1 - -2

Sports Medicine & ENT 386 382 1 2 1 -2

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

Sports Medicine Joint Repair 193 179 8 8 2 -2

Arthroscopic Enabling

Technologies 157 167 -6 -4 - -2

ENT 36 36 1 3 - -2

Advanced Wound Management 337 336 - 2 - -2

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

Advanced Wound Care 185 187 -1 2 - -3

Advanced Wound Bioactives 94 97 -3 -3 - -

Advanced Wound Devices 58 52 11 14 - -3

Total 1,294 1,278 1 3 - -2

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

Consolidated revenue by geography

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

US 649 624 4 3 1 -

Other Established Markets(ii) 427 439 -3 - - -3

Total Established Markets 1,076 1,063 1 2 - -1

Emerging Markets 218 215 2 8 - -6

Total 1,294 1,278 1 3 - -2

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

(i) Underlying growth is defined in the Notes on page 2

(ii) Other Established Markets are Australia, Canada, Europe, Japan and New Zealand

Full Year 2018 Consolidated Re-presented Revenue Analysis

31 December 31 December Reported Underlying Acquisitions Currency

2018 2017 growth Growth(i) /disposals impact

Consolidated revenue by

franchise $m $m % % % %

--------------------------------- ----------- ----------- -------- ---------- ------------ --------

Orthopaedics 2,168 2,107 3 3 - -

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

Knee Implants 1,017 984 3 3 - -

Hip Implants 613 599 2 2 - -

Other Reconstruction 62 45 36 36 - -

Trauma 476 479 - -1 - 1

Sports Medicine & ENT 1,461 1,402 4 2 2 -

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

Sports Medicine Joint Repair 717 650 10 7 2 1

Arthroscopic Enabling

Technologies 600 615 -2 -3 - 1

ENT 144 137 5 5 - -

Advanced Wound Management 1,275 1,256 2 - - 2

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

Advanced Wound Care 740 720 3 1 - 2

Advanced Wound Bioactives 320 342 -6 -6 - -

Advanced Wound Devices 215 194 10 9 - 1

Total 4,904 4,765 3 2 - 1

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

Consolidated revenue by geography

----------------------------------------------- ----------- -------- ---------- ------------ --------

US 2,354 2,306 2 1 1 -

Other Established Markets(ii) 1,693 1,658 2 - - 2

Total Established Markets 4,047 3,964 2 1 - 1

Emerging Markets 857 801 7 8 - -1

Total 4,904 4,765 3 2 - 1

---------------------------------- ----------- ----------- -------- ---------- ------------ --------

(i) Underlying growth is defined in the Notes on page 2

(ii) Other Established Markets are Australia, Canada, Europe, Japan and New Zealand

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCPGUUPWUPBGMP

(END) Dow Jones Newswires

March 25, 2019 05:00 ET (09:00 GMT)

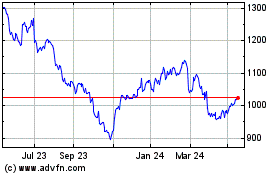

Smith & Nephew (LSE:SN.)

Historical Stock Chart

From Mar 2024 to Apr 2024

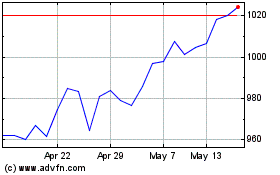

Smith & Nephew (LSE:SN.)

Historical Stock Chart

From Apr 2023 to Apr 2024