SQN Asset Finance Income Fund Ltd Monthly Net Asset Value and Dividend (4744B)

September 21 2018 - 2:00AM

UK Regulatory

TIDMSQN

RNS Number : 4744B

SQN Asset Finance Income Fund Ltd

21 September 2018

21 September 2018

SQN Asset Finance Income Fund Limited

Monthly Net Asset Value and Dividend

Net Asset Value

SQN Asset Finance Income Fund Limited (the "Company"), the

leading diversified equipment leasing fund listed in the UK, is

pleased to provide its monthly net asset value ("NAV") update.

As at 31 August 2018, the unaudited estimated NAV per ordinary

share was 97.18 pence (see below)*

As at 31 August 2018, the unaudited estimated NAV per C share

was 97.76 pence (see below).*

Dividends

The Company is pleased to announce a dividend of 0.6042 pence

per ordinary share for the month ended 31 August 2018, reflecting

an annualised dividend of 7.25 pence per share. The dividend will

be payable on 17 October 2018 to holders of ordinary shares on the

register on 4 October 2018. The ex-dividend date is 3 October

2018.

The Company is also pleased to announce a dividend on the C

Share of 0.6042 pence per C share for the month ended 31 August

2018, reflecting the first payment of the full annualised dividend

of 7.25 pence per share. The dividend will be payable on 17 October

2018 to holders of C shares on the register on 4 October 2018. The

ex-dividend date is 3 October 2018.

*NAV Footnote

The Ordinary Share NAV is net of the 0.6042 pence per ordinary

share dividend announced on 21 August 2018 that went ex-dividend on

30 August 2018 and was paid on 17 September 2018.

The C Share NAV is net of the 0.4167 pence per C share dividend

announced on 21 August 2018 that went ex-dividend on 30 August 2018

and was paid on 17 September 2018.

For further information please contact:

SQN Capital Management, LLC

Jeremiah Silkowski

Neil Roberts 01932 575 888

Winterflood Securities Limited 020 3100 0000

Neil Langford

Chris Mills

Buchanan

Charles Ryland

Henry Wilson 020 7466 5000

Notes to Editor

The Company invests in equipment lease and asset finance

arrangements across a diverse portfolio of assets and industries

predominantly in the UK, Northern Europe and US. The Company

focuses on business-essential, revenue-producing (or cost saving)

equipment and other assets with high in-place value and long

economic life relative to the investment term.

The Company's Investment Managers are SQN Capital Management,

LLC, a Registered Investment Advisor with the United States

Securities and Exchange Commission and its subsidiary, SQN Capital

Management (UK) Limited. The principals responsible for managing

the portfolio are Neil Roberts and Jeremiah Silkowski.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBLGDCUSDBGIG

(END) Dow Jones Newswires

September 21, 2018 02:00 ET (06:00 GMT)

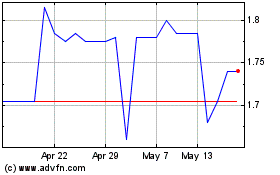

Slf Realisation (LSE:SLFR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Slf Realisation (LSE:SLFR)

Historical Stock Chart

From Apr 2023 to Apr 2024